[ad_1]

JamesBrey/E+ via Getty Images

Investors today are clamoring over the few reasonably priced inflation hedges left on the market. When considering an inflation hedge, it is of chief importance to look for those companies with minimal variable input costs and highly variable selling prices to maximize positive exposure to inflation. These include mining stocks, energy producers, transportation firms, and agriculture businesses (notably timber, fertilizer, and land). In general, all firms within these industries have been net inflationary benefactors as commodity prices have risen far faster than input costs.

Notably, there has recently been a critical shift in how rising inflation impacts business fundamentals. The economy is transitioning from a “high inflation, high economic growth” phase to a “high inflation, low-to-negative economic growth” one. In a typical economic cycle, aggregate supply (total goods and services produced) is generally assumed to be rising at a slow but constant pace. In contrast, demand fluctuates cyclically – primarily driven by monetary policies. When demand grows faster than supply, inflation rises until prices are high enough (and rates rise) that demand reverses lower, often just below supply levels.

However, today, the economy is in a far-from-typical cycle due to extreme monetary policies and various governments’ economically questionable choices. Generally speaking, the total global economic supply has not risen since 2019 due to the long-term impacts of lockdown measures. Notably, global crude oil production is back at ~2016 levels, as are most key commodities. The total supply trend may have turned negative recently due to the consequences of Russia’s invasion of Ukraine and the related sanction measures, and the recent extreme lockdown measures in key production areas of China.

Problematically, with interest rates skyrocketing (and the bond market collapsing), demand for goods and services is now likely falling. Still, supply may be falling at an even faster pace due to those exogenous factors. The net result is a continued increase in inflation with low-to-negative real economic growth, a problematic situation known as “stagflation.” In this situation, equities, even commodity producers, are not necessarily an inflation hedge since operating costs may begin to rise faster than selling prices, resulting in a drop in profit margins. In my view, this is likely the case in the future for many mining stocks, as recently detailed in my recent article, “Freeport-McMoRan: Operational Difficulties And Copper Demand Destruction Threaten Rally.”

Overall, for investors to find the best inflation hedge today, they must look to equities in economic segments that drive inflation due to factors unrelated to changes in economic demand. This generally excludes base metal miners, timber, and some energy stocks (particularly gasoline refiners), which have greater exposure to changes in economic demand, making energy producers (XOP) and fertilizer makers such as (UAN) more suitable.

At this point, I believe the best results may be found directly in commodities since rising operating costs will not negatively affect them as with equities. So, what good is driving inflation and is unlikely to see demand destruction? Considering everyone needs food, regardless of their income, I believe that agricultural commodities such as the ETF (NYSEARCA:DBA) are the best bet today.

The World’s Coming Food Crisis

While it is not my intention to stoke fear, I believe the best antidote to fear is an honest and sober look at the facts. Those facts point to a very high probability of a formidable food shortage by late 2022, stemming from the fertilizer shortage. The U.N’s Food and Agriculture Organization recently estimated that one-third of Ukraine’s crops and agricultural land might not be harvested in 2022 due to the war (fleeing citizens, conscription, land devastation, lack of access to fertilizer, and black-sea port instabilities). This is a key issue as Ukraine produces nearly half of the world’s sunflower oil and 10-15% of global wheat, barley, and corn. The Middle East depends on Ukraine for half of its cereal grain needs, and the country is also an essential food supplier to the E.U and China.

This issue extends far beyond Ukraine’s borders. From a big-picture perspective, it should be noted that the mass industrialization of agriculture over recent decades has stripped soil nutrients to a point where nearly all crops are dependent on fertilizer. The fertilizer production is highly reliant on natural gas as input, and, since 2020’s lockdowns, global natural gas production has been weak. Even before the war, the E.U’s natural gas supply became so low that prices rose to a point where many E.U fertilizer producers were forced to halt production.

Considering the E.U is highly dependent on Russian natural gas, the potential boycott would likely exacerbate that issue. Hence, it remains unclear whether or not the E.U will pursue such measures. It should also be noted that Russia’s current account has risen to a record level, implying its economy has benefited more from higher commodity prices than it has lost from trade sanctions. Problematically, this gives Russia some ability to restrict exports for geopolitical purposes. Overall, that situation does not bode well for countries dependent on Russia’s agricultural commodities, given it is also the most significant global fertilizer exporter and a key food producer.

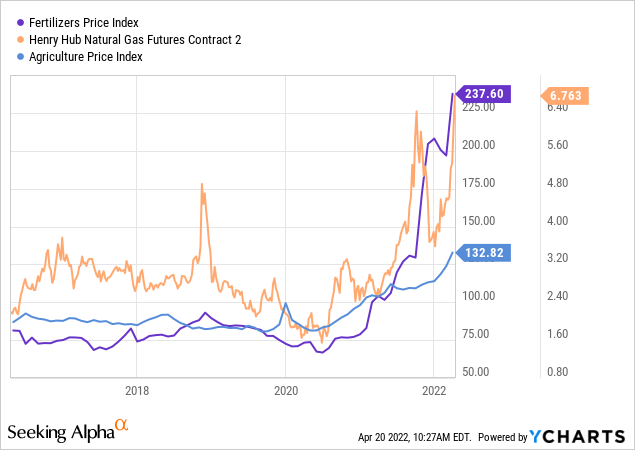

Thus far, the U.S has boosted LNG and fertilizer exports to the E.U and South America to offset losses from Russia. This effort has resulted in a decline in domestic supplies and increased prices for both essential commodities. See below:

Fertilizer, natural gas, and food prices were moderated and generally low during the four years before 2020 but have skyrocketed higher since the end of that year. As a result of extreme fertilizer prices, rising energy and transportation costs, and labor shortages, global rice production is expected to decline by ~10%. While the North American planting season is only now beginning, it is generally expected that corn and grain production will fall while bean output will rise since legumes require far less fertilizer. Of course, there are other non-fertilizer issues promoting global food inflation, such as the severe African, North American, and Australian droughts (and floods) and the growing avian flu epidemic in the U.S (resulting in significant chicken-culling).

Significant Continued Upside Potential in DBA

Overall, it appears likely that the global supply of agricultural commodities will decline by record levels this year. Ultimately, this stems from many factors that began well-before Russia’s invasion. However, the war seems to be the “straw that breaks the camel’s back” regarding the global food market. I first wrote about the potential for significant food shortages and the bullish potential for the agriculture ETF DBA in 2019 and again related to impacts from COVID lockdowns in 2020. Today, the factors suggested years ago are still pushing agricultural prices higher, while a multitude of new factors may soon cause yet another substantial upward move.

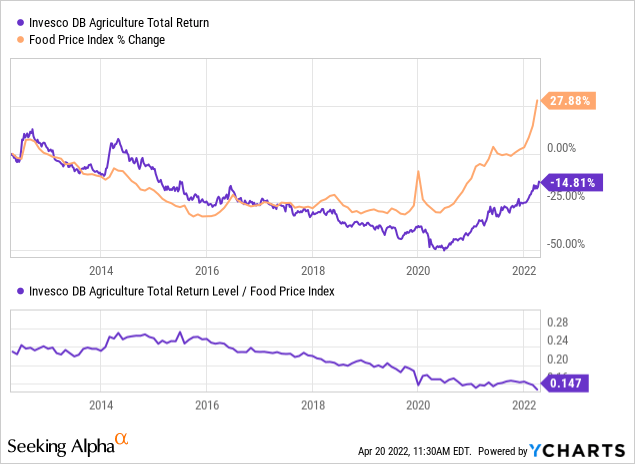

Invesco’s DBA owns a variety of futures contracts in agricultural commodities, including wheat, corn, soybeans, sugar, and animals. Generally speaking, all of these commodities are facing growing shortages besides perhaps soybeans since its planted acreage may rise in the face of fertilizer shortages. DBA tends to closely track the Food Price Index, with some drag since investors in futures contracts indirectly pay storage costs via ‘contango.’ See below:

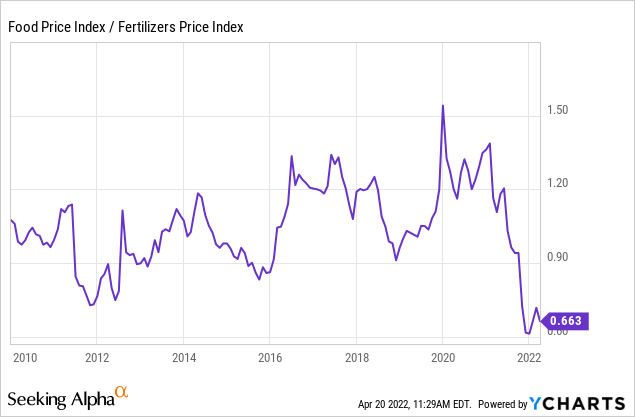

Both DBA and food prices have risen substantially since 2020, but not by nearly as much as fertilizers, implying farmers will not be boosting output in response to higher prices as recently suggested by White House economists. The ratio of the food price index to the fertilizer prices index (both arbitrary) has generally held between 0.9 to 1.2 over the past decade but is currently at 0.66. See below:

When this ratio slips, farmers’ margins may be under pressure as fertilizer costs rise faster than sales prices. Of course, other essential farm costs such as labor, energy, water (see California), and machine parts have also been rising dramatically, weighing on farmers’ ability to plant, harvest, and sell sufficient acreage. These issues are substantial in developing nations that lack domestic fertilizer and machine part production. If the ratio were to normalize without a decline in fertilizer prices, food prices would need to rise by at least 35%.

To some extent, the U.S is a net benefactor of the situation as North America has ample domestic resources that are lacking in Eurasia, so export demand is skyrocketing. Still, U.S food prices will undoubtedly rise as more food is sent abroad. Most likely, meat prices will continue to increase faster as livestock feed becomes scarcer as human demand outcompetes animal farmers. Regardless, food prices are incredibly inelastic as demand hardly declines as prices rise. Next to water, I would bet raw agricultural commodities are the most inelastic goods. Thus, even a “small” shortage can result in immense price increases as people will buy food before anything else. German grocer Aldi has already hiked prices by 20-50% in response to shortages. Considering the global agricultural deficit is expected to widen dramatically this year, we may soon see similar, if not larger, price hikes in the U.S.

The Bottom Line

Overall, I believe that raw agricultural commodities such as DBA are the best investment and inflation hedge today. While many companies in the commodity production sectors have been great inflation hedges, rising prices will soon negatively impact profit margins as transportation, labor, and debt financing costs soar. With this in mind, raw commodities that benefit from increasing production costs seem like a better hedge in a stagflationary environment. Obviously, gold (GLD) and silver (SLV) are decent options, but rising real interest rates tend to weigh on precious metals. Natural gas (UNG) and oil (USO) are likely better, but those commodities still face more price elasticity than food.

In my view, DBA has few significant downside risks compared to its upside potential. Considering the ongoing planting season is depressed, it is virtually certain the food shortage will worsen dramatically by year-end unless demand for food declines substantially. Of course, this would require either population decline or, more likely, a global effort to reduce excessive food waste. Also, an immediate end to global droughts or the war in Ukraine could stop food prices, but considering the planting season has already begun, that may be too little too late. A significant increase in the U.S dollar exchange rate (UUP) value due to rate hikes and external debt demands (see dollar shortage) could negatively impact U.S-dollar-based commodity prices. That said, it seems export demand for agricultural commodities from the U.S will remain high enough to offset the potential impact of the strong dollar.

Considering the world is likely facing the most significant agricultural shortage ever since agricultural industrialization and globalization began, I am not sure there is a limit on how high DBA can rise. Looking at the differential with fertilizer costs, it seems a 30-40% rise is likely around the corner, but I would not be surprised to see much more significant gains by the Northern harvest season. Importantly, DBA does have a roughly 3-8% annual drag due to contango (storage costs), but this may decline and become backwardation as storage is depleted. The fund also carries a higher expense ratio of 93 bps, but this is very little compared to its potential upside. From a technical standpoint, DBA may soon see a minor pullback as it has risen a lot recently, but overall, I believe it is, by far, the best inflation hedge on the market today.

[ad_2]

Source links Google News