[ad_1]

Leestat/iStock via Getty Images

Introduction

The other day, I went through my energy-related articles. All of them had one thing in common, they all covered one or more ways to gain long-term exposure in the industry. That makes sense as I’m income-focused and because energy has become a go-to place for high (in some cases sky-high) shareholder returns. In this article, I will give you a way to actively trade natural gas. The ProShares Ultra Bloomberg Natural Gas ETF (NYSEARCA:NYSEARCA:BOIL) is a leveraged ETF allowing investors to gain relatively high exposure to natural gas with a limited investment. Given the pullback in natural gas and energy prices in general, this trade opportunity is getting close to a very attractive risk/reward as we’re about to go into a winter that could see even lower supply than previously expected.

So, let’s look at the details!

What’s BOIL?

I usually start my articles with my macro view. In this case, I’m starting with the ETF as there are a few things we need to discuss.

First of all, I’m somewhat breaking a few rules of mine. One of these rules is to avoid ETFs with a high expense ratio. That’s because I don’t like to get people into any investment that provides a large financial benefit to a third party – in this case, the provider of the ETF. BOIL has a 0.95% expense ratio, which is rather high.

However, in this case, this is somewhat neglectable as we’re dealing with a leveraged ETF that I believe should be used for short- and mid-term trading instead of long-term investing as I will show you in this article. In other words, if investors hold this ETF for just a few days, these expenses can almost be ignored.

This brings me to the second rule: leverage. I try to avoid high-volatility investments or to get traders involved with high leverage. More often than not, readers overestimate the (destructive) power of leverage.

I also don’t really like ETFs in general as it gives the asset managers so much power. For example, companies like Blackrock and Vanguard own large parts of most publicly traded companies. Yet, as BOIL is a commodity-focused ETF, that doesn’t really apply here.

With all of this said, BOIL isn’t half bad. It’s a perfect tool for the task it was designed to accomplish, which is to allow investors to get magnified exposure to natural gas.

To quote ProShares:

This leveraged ProShares ETF seeks a return that is 2x the return of its underlying benchmark (target) for a single day, as measured from one NAV calculation to the next.

The ETF does NOT follow the spot price of Henry Hub natural gas futures. It tracks the Bloomberg Natural Gas Subindex. This index contains multiple natural gas futures.

According to Bloomberg:

[…] the index is a single commodity subindex of the Bloomberg CI composed of futures contracts on Natural Gas.

ProShares adds:

The index is valued using the settlement prices for the underlying futures contracts. The index rolls its contracts over the course of 5 consecutive business days, starting on the 6th business day of the month. Each day, approximately 20% of each futures position that is included in the month’s roll is rolled.

In other words, BOIL is still tied to Henry Hub, yet it covers futures beyond the closest expiration date.

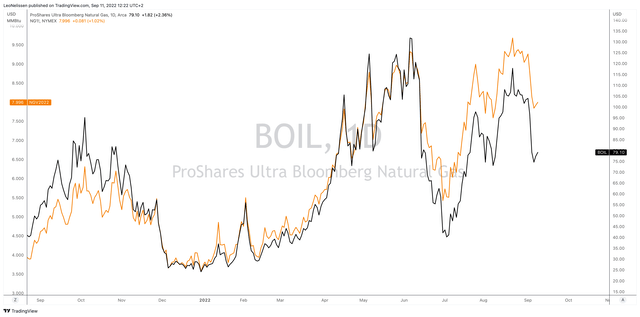

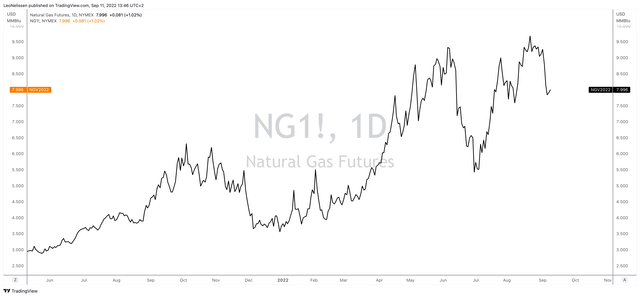

The chart below shows the price of BOIL (black) and Henry Hub (orange) – in this case, I did use the spot price, which shows that the correlation is almost perfect. It means investors don’t need to be energy experts as following the spot price gets the job done, although it’s note entirely “scientifically” correct.

TradingView (Black = BOIL, Orange = Henry Hub)

Essentially, it’s fair to say that if natural gas rises by 2%, this ETF will return close to 4% (2x leverage factor). However, if natural gas falls by 2%, this ETF loses 4%. On a long-term basis, this is very destructive. For example, a 10% natural gas decline erases 20% of the BOIL value. Recovering from that takes a lot of time.

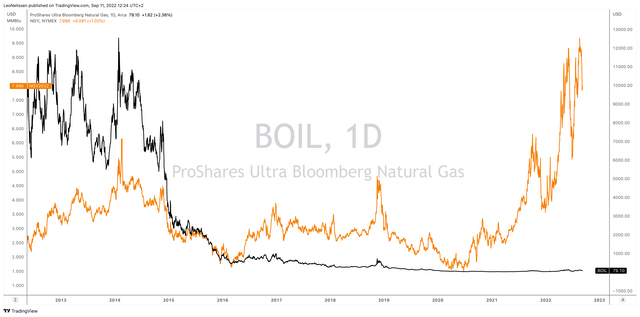

Hence, this is what the long-term performance of BOIL looks like:

TradingView (Black = BOIL, Orange = Henry Hub)

What we’re seeing above is total value destruction.

Hence, ProShares advises people to monitor their holdings on a daily basis given the risks associated with this financial product.

Nonetheless, while BOIL is the worst possible way to gain long-term natural gas exposure, it does have benefits. These benefits outweigh the risks as the fund has net assets of almost $190 million. That’s a lot for a leveraged commodity ETF.

By buying a 2x leveraged natural gas ETF, investors gain two major benefits.

- Investors can get access to natural gas without having to buy commodity futures or options, which are usually tools that are more common among professional investors.

- Investors do not have to invest a lot of cash to get the exposure they desire thanks to the leverage this fund brings to the table. For example, if you’re looking to buy $4,000 worth of natural gas, a $2,000 investment in BOIL gets the job done.

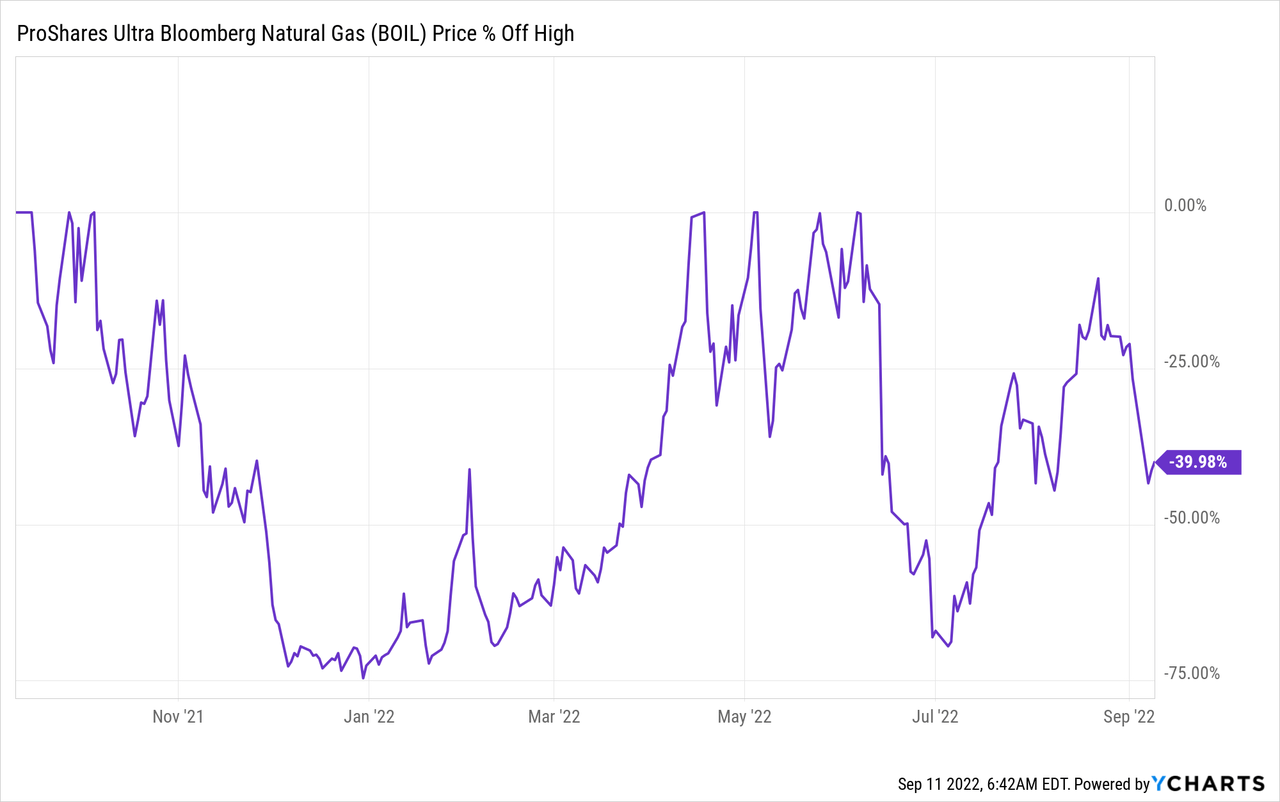

That said, this year, the ETF had two major upswings. One returning more than 400% between January and June, and one of 190% between July and August.

Now, the ETF is 40% below its 52-week high. That’s a lot, but it’s better than the starting points of the aforementioned rallies when the ETF was close to 75% below its high. So once again, this is the kind of volatility we’re dealing with here.

Given the current sell-off, I got interested in the ETF.

A Short-Term Opportunity In Natural Gas

If you want my long-term view on natural gas and an ETF that goes with it, I highly recommend you to read this article as it shows my view on long-term commodity fundamentals and an ETF that goes with it.

When it comes to actively trading natural gas, we’re dealing with a headline-driven market. While the long-term thesis remains bullish – I think – natural gas can decline quite substantially on a short-term basis. This can be caused by demand destruction due to slower economic growth, or headlines related to the war in Ukraine.

Right now, I believe the short-term outlook is rather bullish for a number of reasons.

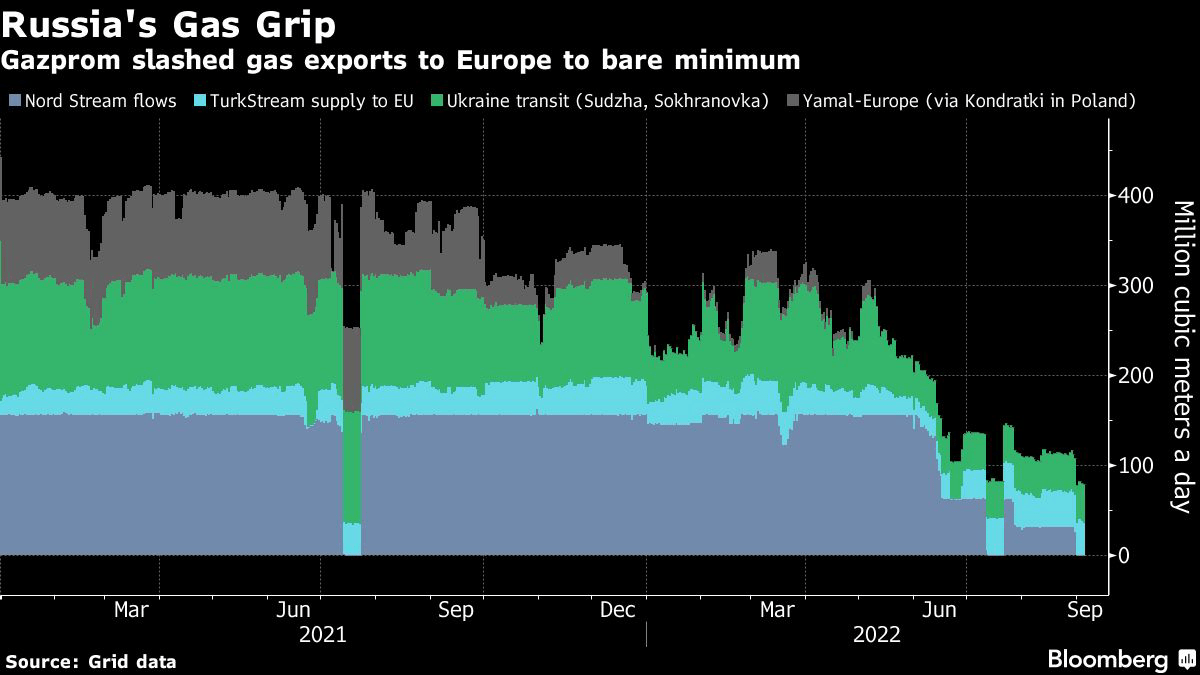

The first reason is the fact that supply is extremely low already. Russia’s exports to Europe have hit the bare minimum after falling gradually since 2021. This includes Gazprom cutting off gas flows through Nord Stream 1 indefinitely.

Bloomberg

Russia is playing economic warfare with the European Union as its decision to completely halt gas flows through Nord Stream 1 will raise the Euro Area’s gas bill by an additional EUR 50 billion. That’s on top of EUR 460 billion from earlier price increases.

A recession is now the base case in Europe as there is absolutely no way to find alternatives for Russian gas in the short term. Prior to the invasion, Europe relied on Russia for 40% of its gas imports. As pipeline flows now only account for 9%, one can imagine that stimulus cannot replace natural gas to keep supply chains intact.

One of the reasons why energy prices have come down (European TTF, USA Henry Hub) is because of intervention.

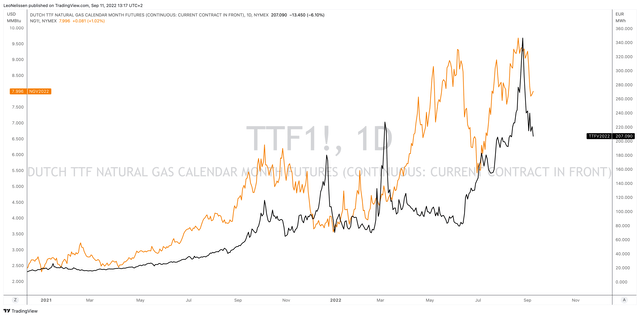

TradingView (Black = Dutch TTF, Orange = Henry Hub)

According to Bloomberg:

Ministers called for initiatives to skim off energy companies’ windfall profits so the funds can be redirected to struggling consumers. Some officials had pushed to impose price caps on all imported gas as the bloc grows increasingly desperate to prevent price surges from hammering the economy. In the end, they agreed that proposal needed more work.

On the one hand, energy prices – especially in Europe – rose too fast too quickly. It was time for a pullback and headlines provided the opportunity. On the other hand, we’re dealing with new developments and the fact that these windfall taxes in Europe are not bringing back supply. If anything, it frees up funds to increase demand from consumers. That’s obviously a good thing for struggling households, but you get my point. Demand will remain high, yet supply won’t increase.

I believe we’re nearing a scenario where Russian gas flows will fall even further, erasing all hopes that gas flows will increase anytime soon.

That’s based on Ukraine’s efforts to quickly retake lost ground. The Ukrainian armed forces have pushed Russia back more than 70 kilometers, which means Russia lost more ground in 1-2 weeks than it was able to capture in the six months prior to the counter-offensive.

While it needs to be seen how things develop, it is highly likely that Russia will become more aggressive, which means pressuring countries backing Ukraine to refrain from sending more support. The best way to achieve this is by hurting Europe where it hurts most: cutting off gas, oil, and coal exports.

Hence, Ukraine’s President Zelenskiy came warned that things could get worse:

“It is the most difficult winter for the whole world,” Volodymyr Zelenskiy said at the Yalta European Strategy Conference in Kyiv organized by Ukrainian businessman Victor Pinchuk. He termed choking off energy to Europe Putin’s “last argument.”

Zelenskiy urged Ukraine’s allies to expand offers of anti-missile systems to protect the country’s energy infrastructure, which he predicted would be a target for Russian troops, and acknowledged the risk of foreign aid to Ukraine fading over time.

This means that all eyes are on the US, which needs to supply much-needed LNG. Yet, that’s unlikely to happen until at least 2026 when export capacity is high enough to truly make a difference in both Europe and Asia.

EIA

This explains why European natural gas futures and Henry Hub are correlated as tight supplies in Europe have a ripple effect throughout the entire world.

On top of that, Europe is considering putting a price cap on Russian gas, which would basically mean paying less for gas than Russia is asking for it. While Russia does not have the infrastructure to re-direct natural gas to willing buyers in i.e., Asia (at least not all of it), it did trigger Putin to threaten to cut off all supplies as The Guardian reported:

Vladimir Putin has dismissed the idea as “stupid” and threatened to make Europe “freeze” this winter, if a cap is agreed. Russia has already slashed supplies to Europe and said it will not resume flows at previous volumes until the EU lifts sanctions. Russian supply makes up only 9% of EU gas imports, down from 40% before the invasion of Ukraine.

Takeaway

I am a long-term energy bull. However, the short-term outlook isn’t bad either, to put it mildly. Russia is likely to further reduce natural gas exports while the recent pullback was mainly based on investors selling their profitable positions and headlines that are unlikely to result in higher supply. If anything, current developments point to higher demand and lower supply. Add to this the increasingly unfavorable position of Russia in Ukraine, and we get a situation where natural gas will be even more important as a weapon of war for Putin’s efforts to retake lost positions.

Given these circumstances, I believe that Henry Hub is bottoming. I expect the uptrend to remain strong with the first target of $10 (per MMBtu) before the end of the year.

TradingView (Henry Hub)

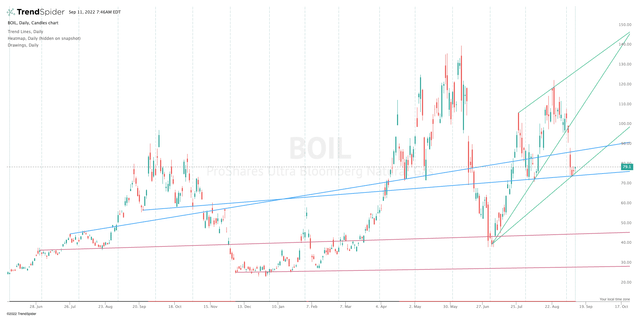

Needless to say, BOIL also looks like it’s bottoming according to the TrendSpider chart below, which is based on automatic trend detection.

TrendSpider

In other words, I think the risk/reward for a long position in BOIL is attractive.

However, and I cannot stress this enough, please be aware that BOIL is highly volatile. If you decide that BOIL is right for you, keep your position very small. I believe long-term investing in the industry is much more attractive than short-term trading with leveraged products.

Other than that, I think the risk/reward for natural gas is quite good at this point, which will have implications on other assets as well as I will discuss in the weeks ahead.

(Dis)agree? Let me know in the comments!

[ad_2]

Source links Google News