[ad_1]

Scott Olson/Getty Images News

Inflation has been an issue across the globe for months, and sees no signs of abating. Inflation reached 8.3% this past August, significantly higher than average, and higher than the Federal Reserve’s long-term 2.0% target. Increased inflation has led to rising cost of living and expenses for most investors, and declining prices for most asset classes, a dreadful combination. Investors are pivoting towards inflation-protected investments, hedges, and funds, to protect their portfolios and retirements in these tough times.

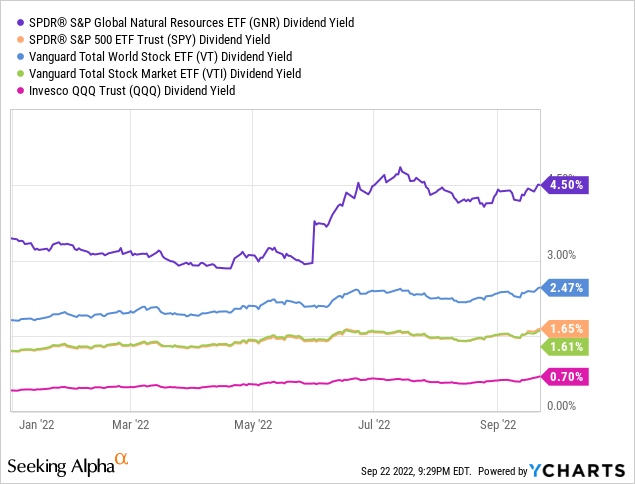

The SPDR S&P Global Natural Resources ETF (NYSEARCA:GNR), an equity index ETF investing in global energy, agriculture, and metals and mining companies, is one such fund. GNR’s underlying holdings have above-average exposure to inflation, and so see strong growth and market-beating performance when inflation is high, as it currently is. GNR is a moderately effective inflation hedge, yields 4.5%, and is a buy.

GNR – Basics

- Investment Manager: BlackRock

- Dividend Yield: 4.5%

- Expense Ratio: 0.15%

- Total Returns CAGR 10Y: 4.1%

GNR – Overview and Holdings Analysis

GNR is an equity index ETF, investing in global energy, agriculture, and metals and mining companies. It tracks the S&P Global Natural Resources Index, an index of these same securities. It is an incredibly simple index, investing in the 90 largest companies in the aforementioned industries, subject to a basic set of inclusion criteria. It is a market-cap weighted index.

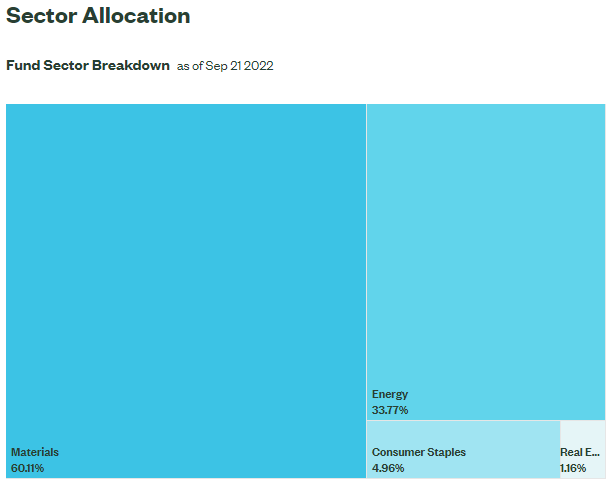

Currently, the fund focuses on metals and mining companies, with significant energy investments, and smaller agricultural investments. These asset allocations simply reflect current market conditions, including industry / company market-caps. Industry exposures are as follows.

GNR

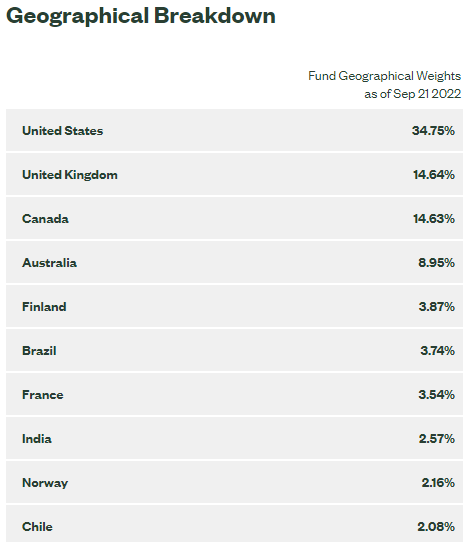

GNR is a global equity fund, with investments in dozens of countries, and most relevant regions. The fund currently focuses on the Anglosphere, with significant investments in the United States, United Kingdom, Canada and Australia. These countries have significant energy, agricultural, and mineral resources, and very developed equity markets, so it is only natural for the fund to focus on them. Country exposures are as follows.

GNR

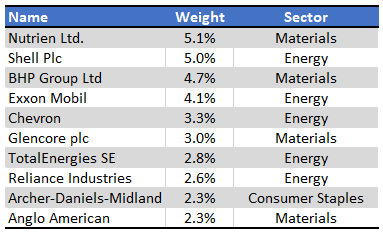

Finally, the fund currently invests in 102 securities, above its 90 holdings target. The difference is due to nominal investments in around a dozen securities, most of which are inconsequential to the fund or its investors. GNR’s largest holdings are as follows.

GNR

GNR – Inflation Exposure

GNR focuses on industries whose revenues and earnings are strongly dependent on the prices of basic materials and inputs. Energy companies, for instance, are strongly dependent on energy prices for their revenues, earnings, and overall shareholder returns. Companies like Exxon (XOM) and Chevron (CVX) perform well when oil prices are high, less well when oil prices are low. The same is true for agricultural companies and agricultural prices, and for mining companies and mineral prices.

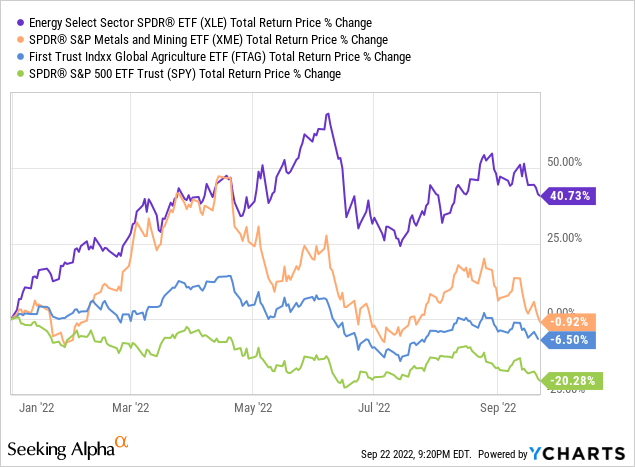

These three industries and prices tend to be key drivers of inflation. Energy, basic materials, and metals, are input goods for most consumer and industrial goods, so when their prices increase, the price of basically everything increases too. Agricultural products and prices are important for all consumers, we all have to eat, so rising prices in this sector tend to be acutely felt by everyone. As such, energy, agriculture, metals and mining, companies all tend to outperform when inflation is high, as has been the case YTD, especially for energy companies.

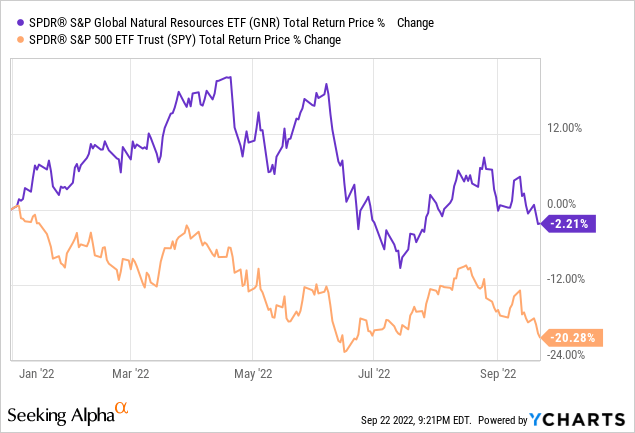

GNR focuses on industries and companies which outperform when inflation is high, so the fund, naturally, outperforms under said conditions as well.

GNR’s underlying holdings are dependent on prices for their revenues and earnings, so these should remain strong even if inflation normalizes somewhat. Shareholder returns would follow. As an example, GNR’s underlying holdings currently sport an earnings yield of 16.0%. Assuming no further price increases, equivalent to saying inflation plummets to zero, long-term shareholder returns should roughly equal 16.0%, a bit higher once you account for organic growth. Point being, GNR’s underlying holdings are incredibly profitable right now, with current prices. Further price hikes / inflation would almost certainly benefit the fund, but conditions are quite strong right now regardless.

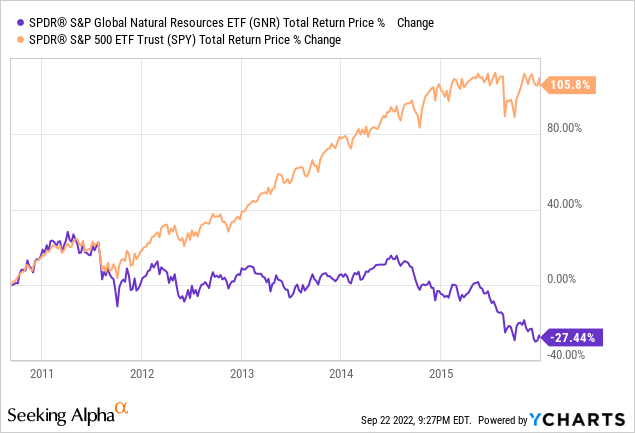

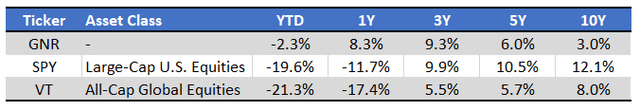

On a more negative note, GNR’s strong inflation exposure cuts both ways: the fund outperforms when prices are high and rising, underperforms when prices are low and decreasing. Expect significant losses and underperformance during commodity price crunches, as was the case during the early 2010s. GNR was down by more than 27% from inception to early 2016, while the S&P 500 was up by more than 100% for the same. These were disastrous results for the fund, and would almost certainly happen during any future commodity price crunch as well.

GNR – Dividend Analysis

GNR currently sports an above-average 4.5% dividend yield, as rising commodity prices boost the revenues, earnings, and obviously dividends, of its underlying holdings. The fund’s yield is good, if not fantastic, on an absolute basis, and quite a bit higher than the equity market average.

GNR – Performance Analysis

GNR’s performance is strongly dependent on commodity prices, and its performance track-record reflects that. The fund tends to outperform when commodity prices are high, as has been the case these past twelve months. The fund tends to underperform when commodity prices are low, as was the case in the first half of the 2010s. As commodity prices have mostly declined / been low during the past decade, the fund has underperformed since the same.

GNR’s long-term underperformance is a negative for the fund and its shareholders, but I do believe that future performance will be materially stronger. Economic conditions and industry valuations are very different today than in the past, so performance should be very different as well.

ETF.com – Chart by Author

Conclusion – Buy

GNR’s underlying holdings have above-average exposure to inflation, and so see strong growth and market-beating performance when inflation is high. GNR is an effective inflation hedge, yields 4.5%, and is a buy.

[ad_2]

Source links Google News