[ad_1]

designer491/iStock via Getty Images

Strategy and portfolio

The Global X SuperIncome Preferred ETF (NYSEARCA:SPFF) is a high yield fund paying monthly distributions with an annual distribution yield of 6.42% and a total expense ratio of 0.58%. It was launched on 07/16/2012 and tracks the S&P Enhanced Yield North American Preferred Stock Index.

According to Global X ETFs website, eligible securities are U.S. and Canada traded preferred stocks with at least US$ 250 million in total market capitalization and US$ 1 million in average daily volume. The top 25 highest yielding securities are included in the index. Current index constituents ranked within the top 75 remain in the index until the count reaches 50. The index uses a capped market cap weighting methodology. The maximum number of securities per issuer is 3 and the maximum weight per issuer is 5% at every semi-annual reconstitution.

However, there is no limit in sector weight. As much as 66.6% of total asset value is in financial companies. The next table lists the top 10 issuers with their weights and some ratios. The portfolio is quite concentrated: these top 10 names represent about 48% of asset value (the fund doesn’t hold the tickers below, but preferred stocks issued by these companies).

|

Ticker |

Name |

% of Net Assets |

EPS growth% TTM |

P/E TTM |

P/E fwd |

|

JPM |

JPMorgan Chase & Co |

5.25 |

6.96 |

9.79 |

11.57 |

|

BAC |

Bank of America Corp |

5.22 |

50.13 |

10.46 |

11.01 |

|

C |

Citigroup Inc |

5.2 |

11.64 |

6.18 |

7.76 |

|

MS |

Morgan Stanley |

5.18 |

3.17 |

10.84 |

11.39 |

|

BDX |

Becton, Dickinson and Co |

5.1 |

12.87 |

39.99 |

22.23 |

|

NLY |

Annaly Capital Management Inc |

5.07 |

-43.90 |

3.82 |

6.67 |

|

WFC |

Wells Fargo & Co |

5.05 |

233.39 |

9.43 |

10.83 |

|

PNC |

The PNC Financial Services Group Inc |

5.04 |

-38.39 |

14.84 |

12.20 |

|

ET |

Energy Transfer LP |

3.84 |

-14.72 |

11.34 |

8.24 |

|

DUK |

Duke Energy Corp |

3.36 |

173.19 |

23.45 |

20.49 |

Performance

Since inception in 2012, SPFF with dividends reinvested has lagged the S&P 500 by 10 percentage points in annualized return (see next table). Risk metrics are mixed: volatility is lower than for the broad index, but the maximum drawdown is deeper. Anyway, the risk-adjusted performance is much lower (Sharpe ratio). This period doesn’t include a bear market cycle and this underperformance may not be representative of long-term behavior.

|

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

SPFF |

37.06% |

3.25% |

-40.19% |

0.37 |

8.02% |

|

SPY |

273.51% |

14.30% |

-32.05% |

0.98 |

13.59% |

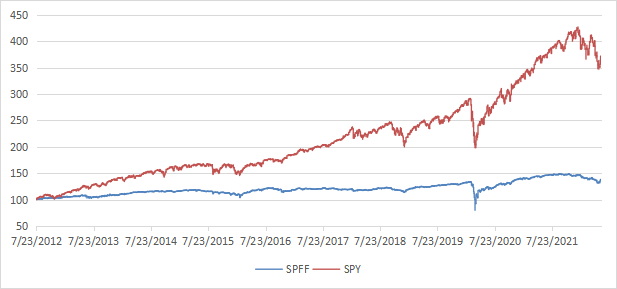

The next chart plots the equity value of $100 invested in SPFF and SPY since SPFF inception.

SPFF vs. SPY (chart: author; data: portfolio123)

The previous table is a clue of capital decay: the annualized return reinvesting all distributions, without paying any tax on them, is about half of the distribution rate. It is confirmed by SPFF share price history (without dividend): it has lost almost 30% since inception.

SPFF share price – without dividends (TradingView on Seeking Alpha)

Capital decay also means income stream decay: the yield cannot go up continuously to offset the loss in asset value. The full picture for an income-seeking investor is not pretty, considering the current inflation rate and tax paid on distributions. The average monthly distribution went down from about $0.09 in 2013 to $0.057 in 2022. The loss in income stream since inception is over 30%.

This issue is not specific to SPFF: securities with yields above 6% suffer from capital decay, on average (there are rare exceptions). The 10-year average annualized return including dividends of all ETFs with a yield superior to 6% is 4.5%… for an average yield of 8.8%! The 10-year average annualized return including dividends of all Russell 1000 stocks with a dividend yield superior to 6% is 5.9%, for an average yield of 8% (data calculated with Portfolio123).

SPFF might be used as an instrument for trading or tactical allocation, but I don’t recommend it as part of a sustainable retirement plan. This is true for a number of high-yield instruments, not only this one.

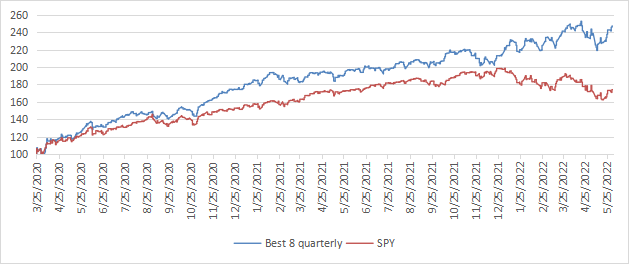

How to manage capital decay in high yield securities

Capital and income decay is a structural issue in many closed-end funds, like in most high-yield instruments. However, it is not inexorable if one knows how to trade CEFs instead of using them as buy-and-hold instruments. I designed a 5-factor ranking system statistically related to forward returns across the full CEF universe, and started publishing the 8 best ranked liquid CEFs in Quantitative Risk & Value (QRV) after the March 2020 market meltdown. The list is updated every week. Its average dividend yield varies around 7-8%. It is not a model portfolio: trading the list every week is too costly in spreads and slippage. Its purpose is helping income investors find funds with a good entry point. In the table and chart below I give the hypothetical example of starting a portfolio on 3/25/2020 with my initial “Best 8 Ranked CEFs” list and updating it every 3 months since then, ignoring intermediate updates to limit transaction costs. Returns are calculated with holdings initially in equal weights without rebalancing until the next 3-month update. Dividends are reinvested at the beginning of every 3-month period.

|

since 3/25/2020 |

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

Best 8 CEFs quarterly |

147.32% |

51.20% |

-13.33% |

2.38 |

16.80% |

|

SPY |

74.10% |

28.81% |

-18.22% |

1.43 |

17.13% |

This simulation is not a real portfolio and not a guarantee of future return (chart: author; data: portfolio123)

The usual disclaimer says that past performance (real or simulated) is not representative of future return. I go farther: the “Best 8” list has very little chance to perform as well in a future 2-year period as in the past 2 years. The March 2020 meltdown resulted in price dislocation and exceptional opportunities in the CEF universe. The 2022 downturn was also a source of opportunities in energy and infrastructure funds. This is unlikely to be reproducible in the future. However, I think a discount-driven rotational strategy in CEFs has a much better chance to protect both capital and income stream against erosion and inflation than any high-yield passive investment like SPFF. Dates and lists can be checked in QRV post history.

[ad_2]

Source links Google News