[ad_1]

Vadzim Kushniarou/iStock via Getty Images

Over the last decade, Global X SuperDividend ETF (NYSEARCA:SDIV) has paid dividends every year, but the recent surge in its yield appears unsustainable, and the fund may soon slash its payouts. Moreover, gloomy prospects for SDIV’s price appreciation may continue to impact its overall returns. The fund has a high-risk profile because it invests heavily in real estate and mortgage services businesses. The current market trends do not support an ETF such as SDIV, and investors should seek alternatives that can profit from rising rates and inflationary pressure.

How Does SDIV Carry High Risk?

As of April 30, 43.7% of the fund’s portfolio weighting was allocated to the real estate sector, with a significant focus on geographics such as China, Hong Kong, and the United States. In addition, 13.2% of the portfolio was allocated to companies that offer mortgages and related financial services in these regions.

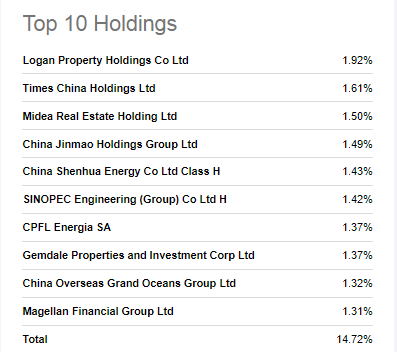

Top 10 stock holdings (Seeking Alpha)

Global X SuperDividend ETF’s top four stock holdings are China-based property developers and all of these companies have lost significant stock price value in the last twelve months. For instance, shares of Logan Property Holdings Co Ltd are down 80% in the past twelve months while shares of Times China Holdings Ltd plunged 76%. In addition to these four companies, SDIV’s portfolio includes several other struggling companies operating in China’s real estate or mortgage markets.

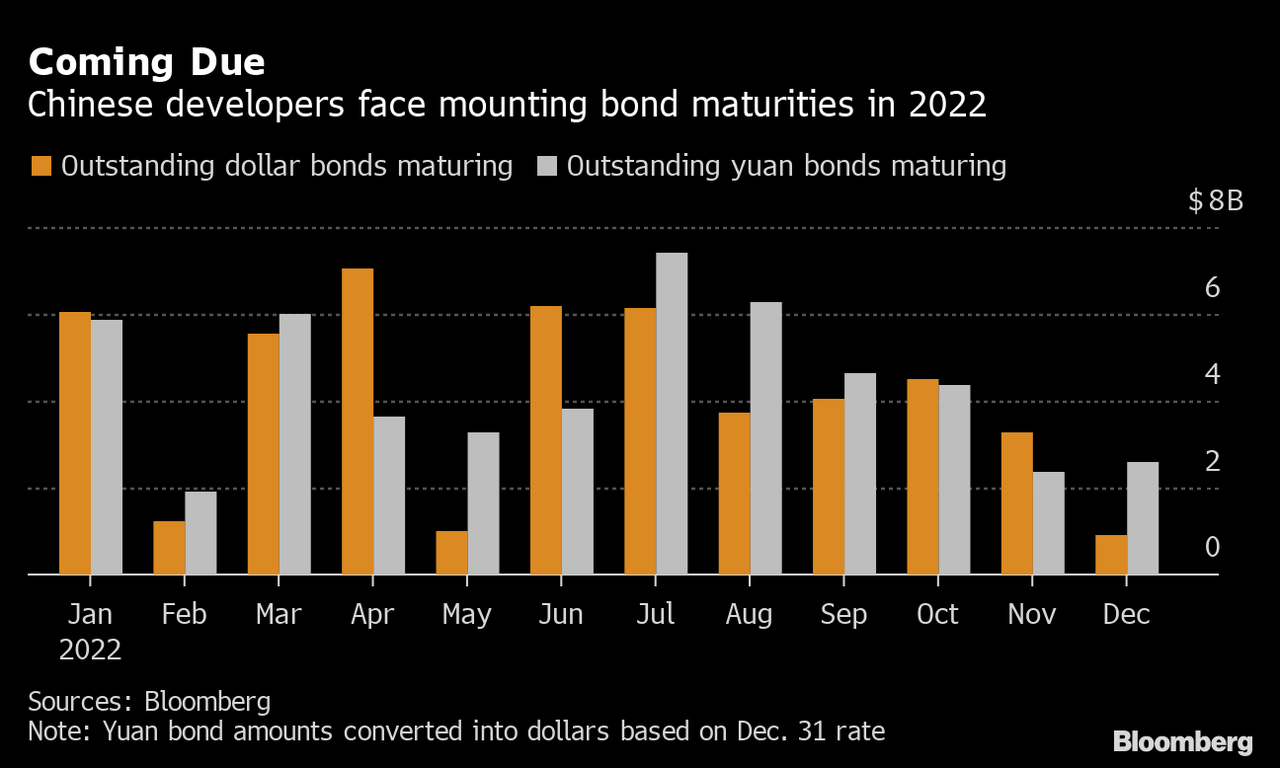

The market dynamics for Chinese property developers look worse than the US players. Last year, China’s property market debt squeeze triggered the first in a series of debt defaults by developers like China Evergrande Group, which is also a member of SDIV’s portfolio. Furthermore, sales from the top 50 developers slid 50% in the first quarter of 2022 from a year-ago period. At the same time, default risk has been increasing with billions of dollars in bonds maturing in 2022.

Bloomberg (Bond maturities in 2022 )

Due to pandemic-related restrictions, Hong Kong’s property developers have also been experiencing losses, with house prices forecasted to drop by 10% in 2022. Hong Kong’s home prices fell for the third straight month in March, hitting a 14-month low as many homeowners sold their units at heavily discounted prices. Goldman Sachs recently predicted that home prices in the territory will decline by 20% by 2025.

Global X SuperDividend ETF also held many positions in US-based real estate and mortgage firms including Starwood Property Trust (STWD), Two Harbors Investment Corp (TWO), and Arbor Realty Trust (ABR). After two years of robust performance, their stocks started falling amid concerns about rate hikes and slowing demand. The downtrend is likely to gain momentum ahead as Fed is expected to speed up monetary tightening in the months ahead.

Several signs have already been reflecting slowing real estate markets in the United States. For instance, the average 30-year fixed mortgage rate is currently hovering around its highest level since 2009. It was at around 3% in December 2021. With rising mortgage rates, the number of new home buyers is declining. Over the last two months, mortgage purchase applications have been declining at a mid-single to double-digit rate from a year earlier while The Mortgage Banker Association expects total mortgage originations to decline by 35.5% compared to 2021. Another sign of slowing growth is employees’ layoffs from mortgage firms. Recently, Wells Fargo and several other firms announced to lay off home-lending employees amid a drop in the mortgage business.

Poor Returns Performance Likely to Accelerate in 2022

Despite SDIV’s history of paying dividends every year over the past ten years, its dividend growth remained unsustainable with a five-year CAGR of negative 4%. It has a history of adjusting dividend returns, and it might be forced to do that again in the months ahead. This is because of its portfolio exposure to struggling property development markets.

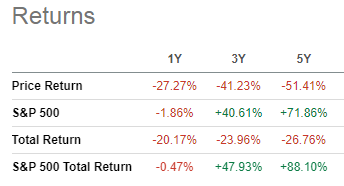

Total returns (Seeking Alpha)

In addition to dividend instability, capital appreciation is the major risk when considering SDIV for a dividend or defensive portfolio. The fund’s total returns have underperformed substantially over the years compared to the broader market. The underperformance is mostly attributed to the steep drop in its ETF price. Due to exposure to the property development markets in China and Hong Kong, I believe the ETF’s price will remain under pressure in the quarters ahead. In addition, an interest rate hike in the US would further bolster bearish sentiment.

Alternative Options

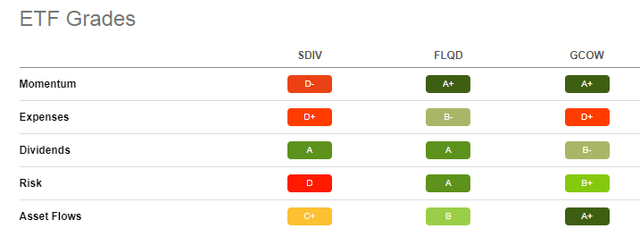

Quant Grades (Seeking Alpha)

There is a strong sell signal for SDIV based on Seeking Alpha’s Quant score of 1.4. Apart from dividends, SDIV received poor ratings on momentum, expenses, risk, and asset flows. Since SDIV seems like a risky option, there are several options that may be worth considering, including Franklin LibertyQ Global Dividend ETF (FLQD) and Pacer Global Cash Cows Dividend ETF (GCOW). On the basis of Seeking Alpha quant scores, both ETFs gained Strong Buy ratings. These ETFs look less risky because of their lower exposure to risky sectors like real estate. As of April, FLQD held a large stake in banking, health care, and consumer defensive stocks, while GCOW invested heavily in energy, basic materials, and health care stocks.

In Conclusion

Dividend investors obviously want higher yields. However, not every high-yielding dividend security is a wise investment. Many high-yielding securities are quite risky, such as SDIV. Although SDIV paid high dividends over the years, its total returns remained in the negative double-digit range. For me, it is more important to have a sustainable dividend payout combined with a steady price appreciation than a risky high-yielding dividend. Therefore, instead of chasing high-yielding SDIV ETF, investors should look for alternatives that offer better risk-reward.

[ad_2]

Source links Google News