[ad_1]

onurdongel

Introduction

We often forget about the Global X MLP ETF (NYSEARCA:MLPA) as pipelines are just not as much fun to write about as are upstream companies. That’s a shame and something I’ve tried to improve upon as they are delivering a lot of cash every quarter and have an unbroken history of so doing for the life of the fund.

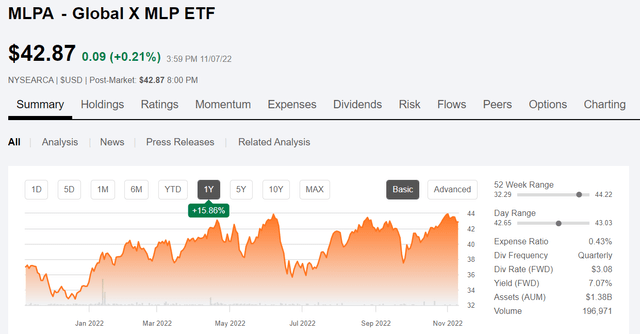

MLPA price chart (Seeking Alpha)

As you can see, we are still about 5% off recent highs, well above what I would call an optimum entry point in the middle $30s. If you are a yield seeker, I don’t know that would keep me from layering into a starter position. A call only you can make obviously, but patience might or might not pay off in terms of waiting for a lower price. The stock dipped to $36 in the past couple of weeks, when the current softness in energy prices first manifested itself. It has popped back nicely along with many other companies since. I’ll leave it to you to guess about the timing of market jitters.

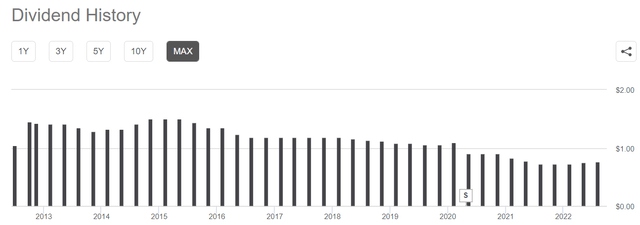

The current payout is the result of a 2020 1:6 reverse split that was maintained as the industry came roaring back in Q-3 of that year. I wouldn’t be put off by the reverse split.

- Many funds in this space did them then.

- It was necessary as many large investors can’t hold funds below a certain price per share.

- We are unlikely to see an “end of the world” scenario that March of 2020 presented for a good long while.

As you can see in the chart below, the quarterly payout has been on the decline for a while, but 7.84% is just that and nothing to sneeze at as a YOC.

MLPA Dividend history (Seeking Alpha)

The top ten holdings of the MLPA ETF, which comprise ~72% of the funds holding, include companies that we have discussed many a time here in Seeking Alpha. These companies are mainstays of the energy distribution network upon which we depend for energy security in this country.

MLPA holdings (Seeking Alpha)

The thesis for the MLPA

I know I can’t talk about pipelines without launching into the sermon about how valuable installed infrastructure is, but there you have it. The sixty thousand-odd miles of pipeline held by Enterprise Products Partners (EPD), or the 110 thousand miles held by Energy Transfer (ET) could not be built for many multiples of the value of these two companies. I will go out on a limb and say that they couldn’t be built at all in the current regulatory morass.

It’s an odd point we have arrived at where the “vehicles” that deliver trillions of dollars – the extension of energy into goods and services, of economic well-being are so widely held in disrepute. This sentiment certainly weighs on the valuation of these companies. Any sort of upward reappraisal by large investors looking for yield might send prices of the constituent companies higher and by extension, push the MLPA shares higher as well. This is something I wouldn’t count on though, your primary reason for investing in this ETF should yield.

It should also be noted that past decade has seen a significant decline in the valuation of these funds even as other more diversified ETFs have risen with the general market. An example would be the Invesco QQQ, which over a 10-year period ending in January of this year quadrupled. But as we’ve noted above, have ETFs like MLPA begun ticking up as this year has progressed? Perhaps QQQ performance awaits?

MLPA tracks the Solactive Infrastructure Index, which has the following criteria for inclusion –

- Listing on a regulated stock exchange in the United States

- Structured as an MLP, taxed as a partnership, or an MLP that is taxed as a corporation

- Business focus on owning and operating assets used in energy logistics

- Free float market capitalization of at least $2 billion

- Average daily trading volume in the last 3 months of at least $2.5 million

- Maintained or grown its distribution quarter-over-quarter for at least one of the trailing 2 quarters

- General Partners (“GPs”) are not eligible for inclusion

I am not sure if these requirements add anything to the security of an MLP ETF or not. I will leave that to you to decide.

Risks

The key risk for an ETF is in its market concentration. If, for example, the energy sector sees adverse times, the ETFs that reflect it will also. This has certainly been the case for a number of years.

Comparisons

There are a bunch of similar ETFs out there that have similar holdings to MLPA, and pay similar dividends with similar expense ratios. AMLP, the Alerian MLP ETF, is another well-known pipeline ETF. AMZA is another. Both of these have slightly higher dividend payouts, but also carry higher expense ratios. Without doing a lot of digging, one is probably as good as another!

Your takeaway

I think MLP ETFs are ideal ways for IRA or 401K investors to participate in the pipeline space. Among the key reasons are avoiding the IRS K-1 filing requirements. This is a major inconvenience, that horribly complicates tax filing and, in the case of tax-sheltered retirement accounts, can lead to all kinds of problems. I suggest you contact your tax advisor for further information in this regard.

I am long MLPA and would like to acquire more. My target for adding is middle $30s which may or may not come around this cycle. I will be patient. My recommendation is that you put this one on your watch list for a slightly better entry point.

[ad_2]

Source links Google News