[ad_1]

The Global X Cloud Computing ETF (NYSE:CLOU) is an exchange-traded fund offering investors exposure to companies that are involved in broadly defined “cloud computing technologies”. According to the fund sponsor Global X, this includes Software-as-a-Service “SaaS”, Platform-as-a-Service “PaaS”, Infrastructure-as-a-Service “IaaS”, managed server storage space and data center real estate investment trusts, and related hardware and infrastructure. The fund just started trading on April 12, 2019, and is up 1% during that time with a wide range of volatility, although some of the underlying holdings have been exceptionally strong year to date.

CLOU Price Chart

(Source: Finviz.com)

The general idea of cloud computing is based on the utilization of remote servers to store, manage, and process data over the internet versus requiring similar, locally-based hardware. The various “as-a-service” terms extends the cloud computing concept by offering on-demand software, platforms, and infrastructure (among other services) over the internet typically licensed to users via a subscription model. The benefit is that the centrally hosted applications can share computing resources facilitating the sharing of information among users, while the actual applications are kept up to date by the provider.

The trend in recent years that continues to be a major growth driver for the group is an ongoing “transition to the cloud” as businesses large and small move information technology infrastructure and applications into these services. Companies adopting cloud-based solutions typically benefit from economies of scale, which oftentimes represent a cost savings compared to legacy models.

CLOU is currently comprised of 36 companies based on an underlying index known as the INDXX Global Cloud Computing Index, which features the following inclusion methodology:

Companies as those companies that 1) license and deliver software over the internet on a subscription basis “SAAS”, 2) provide a platform for creating software applications which are delivered via the internet “PAAS”, 3) provide virtualized computing infrastructure over the internet ‘IaaS”, 4) own and manage facilities customers use to store data and servers, including data center REITs, and/or 5) manufacture or distribute infrastructure and/or hardware components used in cloud and edge computing activities. In addition, companies that generate at least $500 million of revenue from providing public cloud infrastructure (but less than 50% of their overall revenues), are eligible for inclusion.

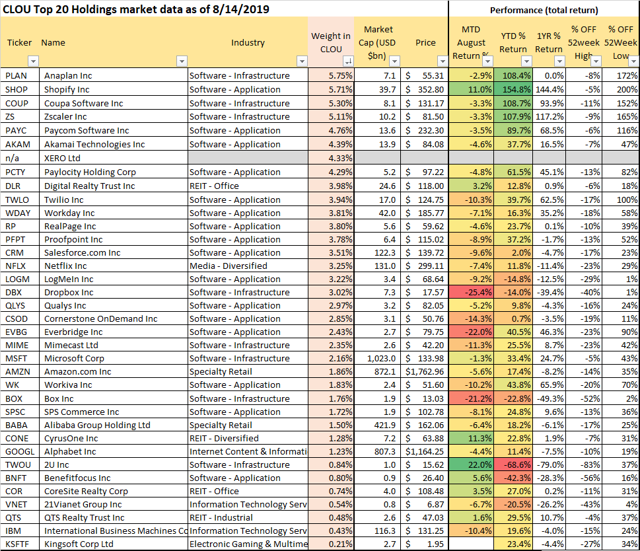

CLOU underlying holdings

As mentioned the broadly defined cloud computing theme based on the above criteria includes such mega-cap stocks as Microsoft Corp. (MSFT), Amazon.com (AMZN), Alphabet (GOOGL), Alibaba Group Holdings (BABA), Netflix (NFLX), Salesforce.com (CRM), and International Business Machines (IBM), which as a group currently represent a relatively modest 14% weighting in the ETF. These companies are, in fact, relevant to cloud computing, but we see the real attraction of CLOU as a collection of smaller companies that are likely less widely held by individual investors.

Anaplan (PLAN) is the largest holding with a 5.75% weight, followed closely by Shopify (SHOP) at 5.71%, Coupa Software (COUP) at 5.3%, Zscaler (ZS) at 5.11%, and Paycom Software (PAYC) at 4.76%. The top five here have a 27% weighting in CLOU and are more directly defined by cloud computing services in the traditional sense, as opposed to the mega-caps listed above that have more unrelated business lines.

The performance of the underlying holdings has been exceptionally strong this year prior to the creation of the fund, with the average stock up 28% year-to-date 2019. Shopify, the Canadian based e-commerce platform (among many services provides tools and solutions for merchants), is the biggest winner, up 155% YTD. The data for the month of August shows these names have pulled back along with higher market volatility. Dropbox (DBX) is down 25% in August as the biggest loser.

CLOU holdings performance metrics

Source: Data by YCharts / Table by author

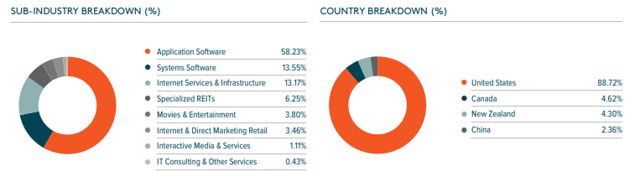

The theme among the group is generally business management and productivity tools for various industries and types of organizations. Briefly summarizing the main concept of a few companies, the application software sub-industry designation is the most well-represented among the group at 58%.

CLOU industry and country exposure

(Source: Global X)

Salesforce.com, with a market cap of $122.3 billion, is one of the largest pure-plays on “software as a service” with its industry-leading customer relationship management suite. In some ways, CRM was a pioneer of the business model that has become the standard in the industry. The subscription-based sales model is a defining theme in cloud computing, but there are exceptions.

Companies like Paycom Software and Paylocity Holding Corp. (PCTY) focus on human resources solutions like tools for talent acquisition and payroll. Zscaler and Proofpoint (PFPT) commercialize on demand data security and user protection type of applications. Xero Ltd., a New Zealand company not actively traded in a U.S. exchange, sells accounting software for small and medium-sized business. Twilio (TWLO) focuses on integration of messaging and communications tools for software development.

There is also Digital Realty Trust (DLR), CyrusOne (CONE), CoreSite Realty Corp. (COR), and QTS Realty Trust Inc. (VNET), which are REITs specializing in data storage centers.

Indeed, it’s a diverse group, and we think investors should familiarize themselves with the products and services of these companies that are using cloud infrastructure as part of their business.

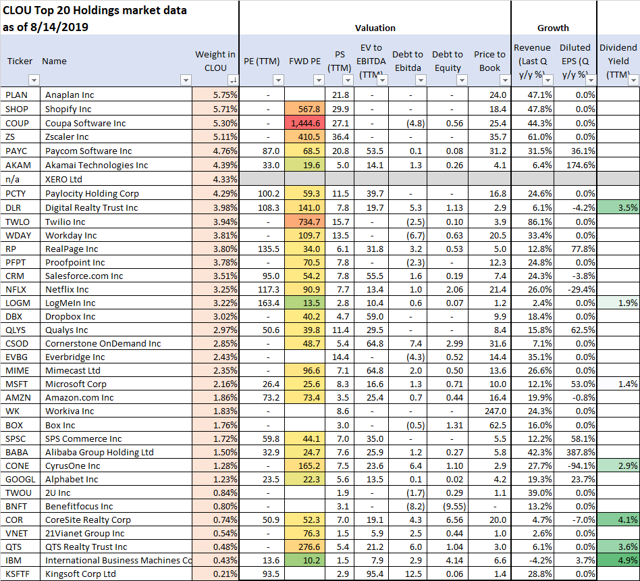

Valuation

CLOU holdings valuation metrics

Source: Data by YCharts / Table by author

From the table above, only 19 of the 36 companies, or 52%, have reported positive earnings over the last twelve months, represented by a missing P/E ratio. Together, the companies that are unprofitable represent 56% of the ETF weighting, highlighting the speculative nature, which adds risk considering generally expensive valuations. Among the stocks that do have some positive EPS, the average P/E ratio is 66.5x.

With sales as the only comparable metric, we note that the average P/S for the group is 9.7x. Objectively, we can say that a couple of stocks, including Zscaler, Shopify, and Coupa Software, with a P/S ratio of 36.4x, 29.9x, and 27.1x each respectively, are commanding lofty valuations. Indeed, the drivers here are growth, and in these cases, the companies have delivered thus far.

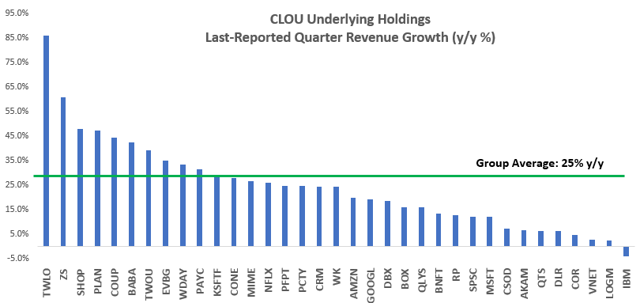

High growth in these tech stocks is to be expected, and the data shows the companies in the group reported revenues in the last reported quarter up 25% year over year on average. This ranges from Twilio, which reported revenues up 86% in its Q2, down to the “grandfather” of the group, International Business Machines Company, which is the only company with negative revenue growth in the last quarter, with revenues down 4.2%.

CLOU holdings quarterly revenue growth

Source: Data YCharts / Table by author

Analysis

It’s easy to gawk at some of these valuation multiples and impressive performance of the underlying stocks in the group. We recognize that indeed some of these companies are not only disrupting legacy industries, but at the same time, are creating a new market that may drive growth for many years forward. With that said, investors should recognize the high risk of the Global X Cloud Computing ETF, which includes a number of stocks with very high expectations. Oftentimes, the only way to justify current prices for these high-growth and unprofitable companies is to project continued momentum and market trends out many years forward. This introduces a number of risks that could ultimately lead to the companies falling short of expectations requiring a reset of the stock price much lower.

CLOU balances these early-stage, high-growth newcomers by more established mega-cap tech names like Google and Microsoft, for example. While this adds a component of diversification and lowers the overall risk level of the fund, we criticize the concept of drawing a thematic factor connection between various stock that may otherwise have little in common, like Netflix with a 3.25% weighting in the fund and Dropbox with a 3.02% weighting in the fund, for example. The fundamental drivers and company-specific factors are unrelated in most cases.

We note that there are a number of companies in the software application space that are not included in the ETF, like Veeva Systems (VEEV), Wix.com (WIX), and even a company like Spotify Technologies (SPOT), with its music subscription services, which we could make a case belongs in this group as is. The First Trust Cloud Computing ETF (SKYY) and the Invesco Dynamic Software ETF (NYSE:PSJ) are other funds with similar concepts but also have their faults in terms of composition. We would like to see in the future a more specialized ETF concept to only include the universe of SaaS companies, for example.

Takeaway

CLOU is a new ETF with a limited history that makes it difficult to draw conclusions on how well the cloud computing theme and, more important, the index methodology will perform over the long term. We view this fund as a high-beta version of the broader tech sector and expect it to present higher volatility overall given the number of early-stage, high-growth companies. Considering the overall aggressive valuation premium in many of the smaller firms, this is a highly speculative exchange-traded fund that we believe will underperform the broader market to the downside should cyclical conditions deteriorate. Take a look at the fund prospectus for a full list of risks and disclosures.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Author may be long or short various securities via the underlying or options at anytime. The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Investing includes risks, including loss of principal.

[ad_2]

Source link Google News