[ad_1]

syahrir maulana/iStock via Getty Images

Investment Thesis

Anyone who has invested in small-caps over the past year has experienced a rough ride with nothing to show for it. At one point in January, the Russell 2000 (IWM) was down more than 20% from its November 2021 peak and is underperforming the S&P 500 (SPY) by 23% over the past year. Despite optimism over a growing economic recovery throughout 2021, investors have consistently preferred large-caps to small-caps. Even when cyclicals took over leadership for a short while, small-caps still struggled to gain any footing. As we move through 2022, where the Fed is expected to raise rates aggressively into a slowing economy, it doesn’t look like the environment for small-caps will get significantly better.

That doesn’t mean all small-cap ETFs have suffered. Covered call ETFs, which write option contracts on top of the underlying index, have actually done quite well. These strategies haven’t been able to eliminate all or even most downside risk, but the high yields generated by these products has been able to significantly soften the blow of the recent correction.

Today, I want to examine the Global X Russell 2000 Covered Call ETF (RYLD). It buys the stocks in the Russell 2000 index and writes corresponding call options on 100% of the portfolio. Is it a great option to own in rising markets? Probably not, since the 100% call option coverage pretty much requires forgoing most of the potential capital appreciation upside. During markets where equities are losing value and volatility is elevated, however, covered call ETFs, such as RYLD, can and have done quite well.

Background

RYLD holds a long position in the Vanguard Russell 2000 ETF (VTWO), while concurrently writing at-the-money call options on the index. Each calendar month, the fund will write a succession of one-month call options and hold them until expiration. RYLD (and all of the Global X Covered Call ETFs) make distributions on a monthly basis.

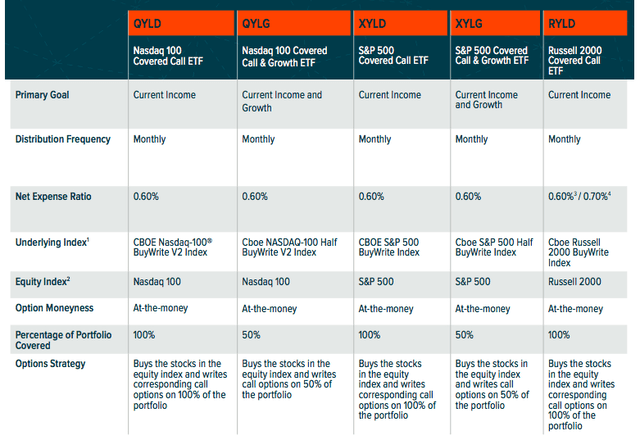

Global X Covered Call ETFs (www.globalxetfs.com)

RYLD is the 3rd fund in Global X’s covered call ETF lineup following the Global X Nasdaq 100 Covered Call ETF (QYLD) and the Global X S&P 500 Covered Call ETF (XYLD), both of which debuted in 2013. RYLD came along much later in 2019. Late last year, it added the Global X Nasdaq 100 Covered Call & Growth ETF (QYLG) and the Global X S&P 500 Covered Call & Growth ETF (XYLG). Since these two funds only use a 50% coverage ratio, they come with lower yields, but also offer more upside potential in case the equity markets continue rising.

One of the major advantages of covered call ETFs is the high yields they generate. Depending on the options coverage the fund utilizes, it can add a couple of percentage points of extra yield (like the FT Cboe Vest S&P 500 Dividend Aristocrats Target Income ETF (KNG) that I covered here recently) or it can produce a yield well into the double digits. RYLD falls into the latter category and has consistently generated a trailing 12-month yield of more than 10% throughout its three-year life. Today, that yield has pushed north of 12%.

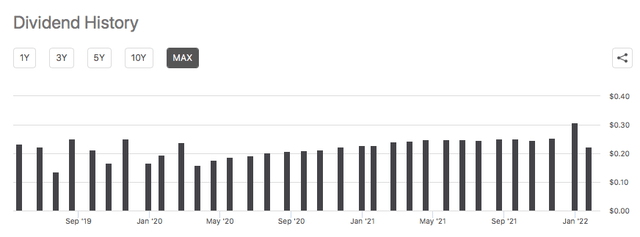

The dividend distributions in the months immediately following the launch were a bit choppy, but you can see that since the middle of 2020 those payments have steadied considerably.

RYLD Distribution History (Seeking Alpha)

Of course, there’s a downside that comes with those high yields. In a fund that utilizes a 100% options overlay, as RYLD does, you give up most, if not all, share price appreciation potential. When the fund writes an option contract, it pockets the premium for selling it and pays those premiums out in the form of dividends. When the value of the Russell 2000 rises, those call options are very likely to be exercised by the holder. Since RYLD’s call options are written at-the-money, they’re forced to sell at below market prices. That helps lower the fund’s volatility quite a bit, but it also means that the dividend yield is essentially the only source of positive returns.

In a perfect world, covered call strategies perform best in sideways moving markets with low volatility. A sideways market means the options are more likely to expire at- or out-of-the-money. A low volatility market means that there are fewer opportunities for the option buyer to exercise in-the-money. In down markets, like the one we’ve experienced recently, covered call ETFs are likely to outperform their underlying index, but they can still lose money due to owning the underlying index.

RYLD vs. Russell 2000

RYLD’s life could be split into three periods…

- Pre-COVID (04/2019 – 03/2020)

- Post-COVID Recovery (04/2020 – 11/2021)

- Fed Pivot (12/2021 – present)

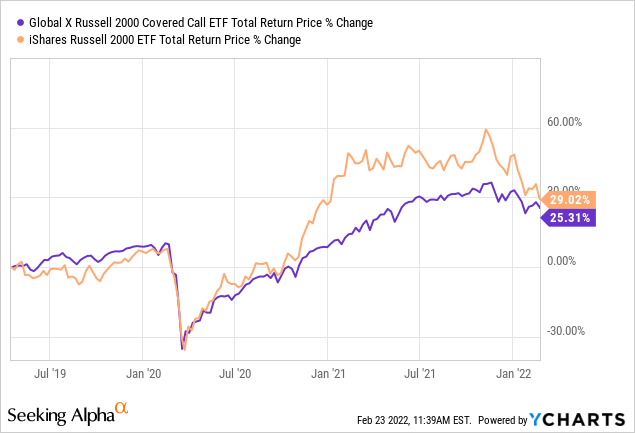

The chart below lays out the performance of RYLD against the iShares Russell 2000 ETF (IWM).

In the pre-COVID period, you can see RYLD outperforming IWM by a modest amount. Throughout much of that first year, small-caps trended sideways without a great deal of volatility, exactly the kind of window where covered call ETFs tend to perform best. RYLD outperformed for a while up until the point where small-caps rallied again in the lead-up to the COVID shutdown. During this time, IWM caught up with RYLD and both funds produced virtually identical returns (although RYLD did it with much less volatility).

During the COVID bear market, both funds crashed in value. All risk assets did.

During the recovery, the government dumped trillions of dollars of stimulus into the economy and risk asset prices were off to the races. During that early bounce off the bottom, RYLD was able to generate some share price gains, but a lot of the total return was due to the yield. The Russell 2000, on the other hand, rose quickly and far outpaced the return of RYLD. This is exactly what we’d expect to see during bull markets.

Most of 2021 was marked by the return of the sideways market for small-caps. RYLD was able to play some catch-up, but posted its best performance once small-caps started outright correcting.

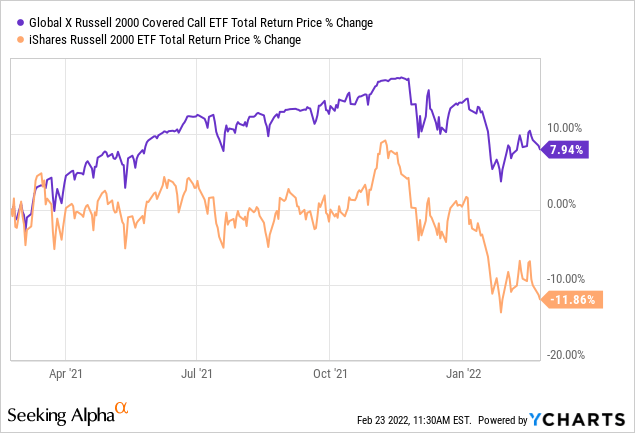

The difference in returns between RYLD and IWM over the past year has been huge.

As market volatility increases, the premiums on options contracts tend to rise. This is likely something that benefited RYLD even further, although the distributions made on average haven’t increased significantly over the correction period. The share price of RYLD has predictably declined along with the decline in the Russell 2000 due to its long position in the underlying index, but overall risk has been lower and the double digit yield from the options premiums has allowed the fund to outperform significantly. It hasn’t been the perfect market for covered call ETFs in 2022, but it’s been enough to push RYLD to a 6% total return advantage year-to-date.

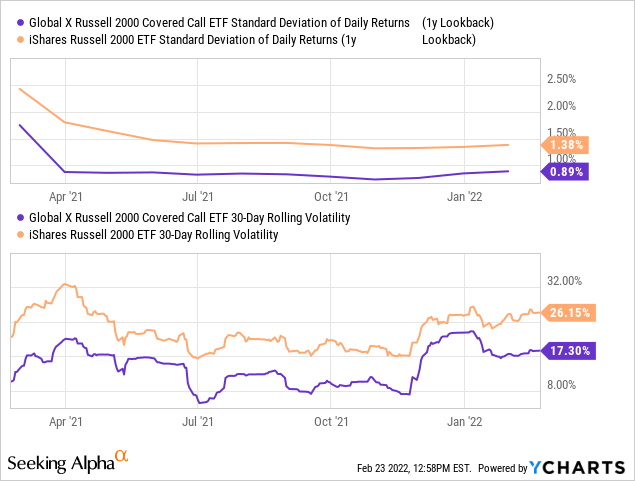

How much less volatile has RYLD been when compared to the Russell 2000? Both short-term and longer-term measures suggest it’s about 35% less volatile.

Many investors assume that since the Russell 2000 is the fund’s underlying index, it will carry the same degree of volatility but just add the high yield on top of the index’s performance. In reality, that’s not at all the case. The two will, of course, be correlated with each other, but the covered call strategy makes the two funds pretty unique products.

The high dividend yield along with the significant reduction in volatility makes RYLD at least a consideration for many income-focused portfolios. This could especially be the case for those in retirement, who are no doubt having difficulty generating a livable yield with traditional stocks and bonds. I’m not saying that these folks should over-allocate to funds, such as RYLD, in a yield-chasing expedition, but allocating at least a small percentage of a portfolio to something like this in order to provide a yield boost isn’t as risky an idea as it might seem considering it’s invested in the Russell 2000. An allocation to IWM should probably be kept to very low percentages in retirement or income-focused portfolios, but a slightly higher allocation to RYLD may still be appropriate.

Conclusion

Income seekers shouldn’t shy away from covered call ETFs. Double digit yields should always be approached with some degree of skepticism, but RYLD isn’t one of those funds that appears excessively risky. Its monthly dividend distribution schedule has been incredibly consistent over the past year or so and can be a great option for those looking for steady and predictable income streams.

Investors should, however, be aware of the different performance profile of covered call ETFs compared to owning the index outright. The yields are attractive, but the tradeoff is giving up most share price appreciation potential. In bull markets, expect RYLD to underperform. In bear markets, expect it to outperform its underlying index, but still capture most losses. A sideways or slightly declining market with low volatility is the sweet spot in terms of total return.

With 2022 and 2023 looking like they could come with a wide range of potential outcomes, RYLD could be an ETF that actually helps steady your portfolio and deliver the income you seek.

[ad_2]

Source links Google News