[ad_1]

Let’s start with the idea that every asset is perfectly priced, and thus, it is impossible to generate alpha. Let the scenario soak in: every asset’s price, in every part of the world, perfectly reflects all available information. It then becomes obvious that we won’t be able to generate higher risk-adjusted returns. Choosing a company over another would be out of pure preference, and by no means a “better” investment. The same applies to investing in equities in specific countries. Choosing the US over the UK, or vice versa, would not in any way improve returns. That’s the magic of efficient markets.

However, the sole act of making a decision of where to invest in the “perfectly efficient” world is suboptimal. No stock, or country, will outperform in terms of risk-adjusted returns, so we cannot improve returns. Nevertheless, through diversification, we can easily reduce the overall risk of the portfolio. This happens as long as all assets are not perfectly correlated to each other. Moreover, as in this world we know that other investors have perfectly priced every asset in the market, the optimal solution would be to allocate exactly the same proportion of our portfolio to each security as the rest of the market.

Evidently, as the site’s name suggests, neither of us believe that the markets are “perfectly efficient”. I do believe, however, that markets are highly efficient and that it is almost impossible for the retail investor to find any “alpha” opportunities. Many professional investors struggle to do this. This article is mainly aimed toward investors who do not want to actively manage their portfolios and are better off just choosing the right allocation between different asset classes.

To all of the investors for whom the above description applies, and even to those that it doesn’t, I strongly recommend investing in a “Global Equity” Index, such as Vanguard’s Total World Stock ETF (VT). It is an ETF that invests in both foreign and US stocks and seeks to track the FTSE Global All Cap Index, which covers both well-established and still-developing markets.

More precisely, I believe that there are two main reasons why an ETF that aims to track the “global stock market” is particularly relevant: portfolio diversification and income diversification. The first one relates to the opportunities that global equity allocation provides to reduce portfolio risk, even in a world with increasing correlations. The second one is focused on diversifying investors both sources of income, labor and capital.

Portfolio Diversification

I already stated that through diversification, in a world where every asset is “perfectly” priced, we can achieve a reduction in portfolio risk as long as all assets are not perfectly correlated. But I think that this Vanguard report puts it perfectly:

The rationale for diversification is clear—domestic equities tend to be more exposed to the narrower economic and market forces of their home market while stocks outside an investor’s home market tend to offer exposure to a wider array of economic and market forces. These differing economies and markets produce returns that can vary from those of an investor’s home market.

Simply put: there are other equity markets, that are exposed to other economies, that don’t behave exactly as your local economy. Therefore, other markets won’t behave exactly like your domestic one. Because of this reason, adding exposure to other markets would invariably reduce your portfolio’s risk.

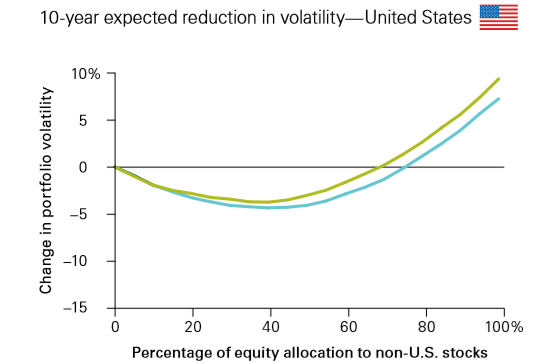

(Vanguard)

The chart above shows the expected reduction in volatility of US-International equity portfolios (green) and 60% stocks-40% bonds portfolios (blue) depending on the allocation to international and American markets. As you can see, the greatest reduction in volatility comes somewhere around a 40% allocation to international stocks. Not coincidentally, the weight of non-US in the “global equities portfolios” by capitalization has historically fluctuated around that number.

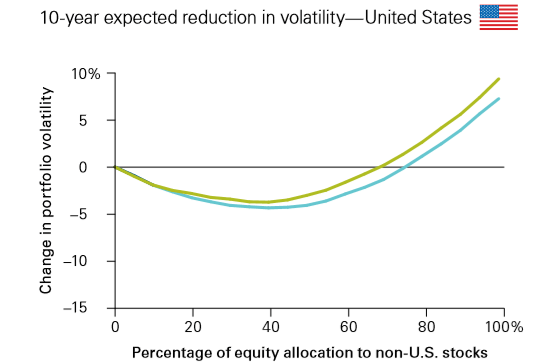

(Vanguard)

This chart is even more telling, as it provides proof of the global portfolio superior risk-adjusted returns of the past 48 years. Although at first glance the global portfolio does not seem to outperform the US portfolio by that much, we have to keep in mind that the chart is probably greatly skewed by the last decade of marked US outperformance (that in a world of efficient markets we should not expect to continue).

Diversifying income

I already showed you how buying foreign stocks can greatly reduce your portfolio risk. But it doesn’t stop there, as global equities can also diversify your sources of income.

Let’s start with an affirmation that should not be that much controversial: if your present and future labor income is tied to a specific economy, your savings should be underweight to that economy. What this means is that because both your salary and your country’s equity market can be influenced by the same economy, you should allocate less of your savings to that equity market than what would be optimal without considering your present and future labor income.

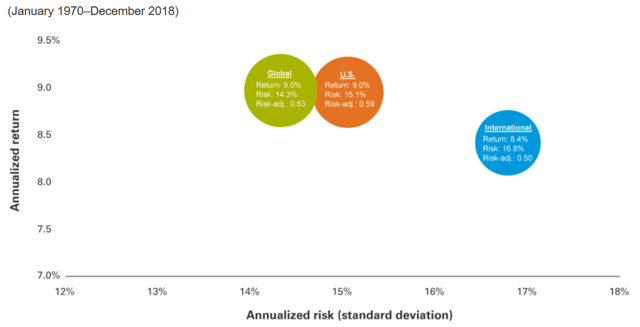

To put it more bluntly: recessions may or may not affect your income (see chart below), so when one comes, you’ll be better off having more of your savings somewhere else.

(Federal Reserve Economic Database, Federal Reserve Economic Database)

Vanguard Total World Stock ETF (VT) and its close brother (VXUS)

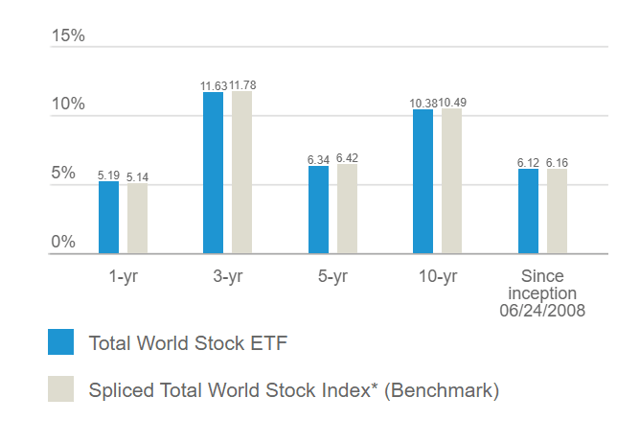

For investors that are convinced that it is optimal to allocate to the “global stock market”, the Vanguard Total World Stock ETF (VT) is a good way to go. The chart below shows how closely it has historically tracked its underlying index (basically, the “global stock universe”). It does so by holding 8,192 different stocks worldwide. Moreover, its expense ratio is just 0.09%, in comparison to the 0.30% of its closest competitor, the Shares MSCI ACWI ETF (ACWI).

(Vanguard ETF Profile | Vanguard)

Some investors might consider holding their US equities and their global equity exposure separate for tax and accounting reasons. For them, I believe that the Vanguard Total International Stock ETF (VXUS) is a great option. It is basically the same as the (VI) ETF, but it excludes the US exposure. It also closely tracks its index and has the same expense ratio.

Conclusion

For investors who believe that the market’s behavior is mostly efficient, and who do not believe that they can generate alpha, a global equity ETF is an optimal way to allocate to stocks. The main reason is that in such a world where markets are efficient and assets (and equity markets) risk-adjusted returns are the same, the best way to improve the risk-adjusted returns of our portfolios is through diversification. Given that different markets respond to different economies and are not perfectly correlated, diversifying through them ought to reduce volatility and increase risk-adjusted returns. Allocating to foreign markets may also protect an investor’s savings from being correlated to the same investor’s salary.

A great way to allocate to a “global equity portfolio” is through Vanguard’s Total World Stock ETF (VT). It closely tracks its underlying index by holding over 8,000 different stocks and is as cheap as an ETF may come. Investors that prefer to keep their US equities and their global equity exposure separate, might consider instead the Vanguard Total International Stock ETF (VXUS).

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investing is inherently risky. Some strategies, particularly those including the use of derivatives or leverage are even more so. The purpose of this article is to provide investors and general readers with ideas that they can implement. However, the author stops short of providing investment advice and the reader is fully responsible for his or her investments. Careful consideration of the risks involved in any investment is recommended, as no investor should participate in investments whose risks he or she does not completely understand.

Additionally, past results are not a guarantee of future performance and should be used only as a tool for analysis.

[ad_2]

Source link Google News