[ad_1]

Oat_Phawat/iStock via Getty Images

The price of gold has surged back over $1,900/oz on the back of heightened geopolitical, economic, and social tensions. Understandably, many analysts point to the Ukraine-Russia conflict as a critical factor pushing gold higher. Most large geopolitical conflicts exacerbate inflationary pressures and promote widespread uncertainty. These pressures include the Ukraine-Russia conflict and social issues such as bank freezes in Canada, which have promoted immense banking stability concerns among many. Of course, there are also growing widespread concerns regarding inflation and economic volatility in general. Gold is one of the few assets that loves uncertainty, making it an excellent target for investors looking to hedge against today’s many uncertainties.

Investors have many ways to gain exposure to the precious metal, including buying physical metal with a high premium, buying a gold ETF like (GLD) with some counterparty risks, and gold mining stocks like those in the ETF (GDX). To me, gold miners are one of the better options today since they allow for indirect exposure to the physical metal. Many are seeing solid profits today, which creates potential dividend benefits. I generally have a bullish view of GDX, but some significant risk factors have arisen in recent months that investors should keep in mind.

Gold Detaching From Its “Monetary Value”

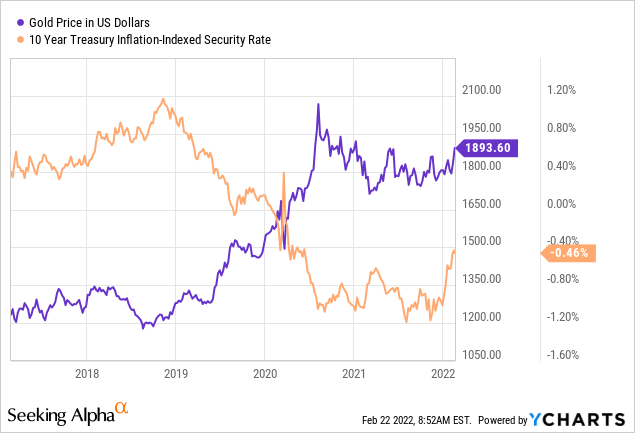

Interestingly, we’re seeing a trend in gold which is very uncommon; the price of gold is rising with real interest rates. While this could seem like a moot point, it should be noted that gold is almost always priced in direct inverse proportion to real interest rates. Real interest rates are rates minus expected inflation and can be directly measured using inflation-indexed Treasury bonds. Since the year has begun, gold has seemingly lost its negative correlation to real interest rates. See below:

As you can see, there has been a sharp rise in real interest rates over the three months, but no decline in the price of gold. The two are usually in near-lockstep inverse correlation since gold’s hypothetical “real yield” is always zero. Gold is expected to keep up precisely with inflation over the long run, so it is essentially “competing” with inflation-indexed bonds. When inflation-indexed bonds yields (real rates) decline, gold’s discounted value rises and vice versa. However, for roughly three months, the value of gold has risen as its “fair value” based on real rates has technically declined. This is seen more clearly in the scatter chart below of gold vs. real rates:

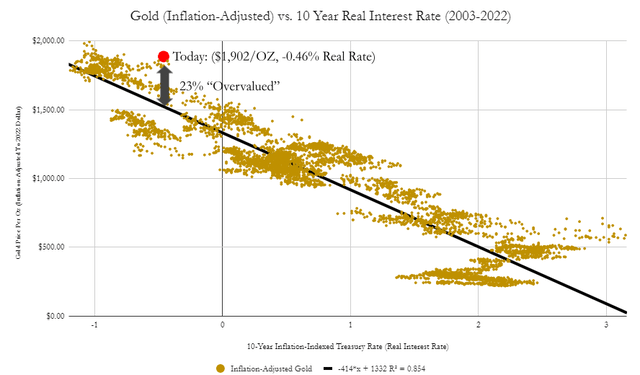

Inflation-Adjusted Price of Gold Vs. 10-Year Real Interest Rates (Data Source: LBMA, Federal Reserve. Chart Is Self-Made)

Historically, the inflation-adjusted price of gold (based on today’s dollar) is equal to $1,332/oz – 414 X 10-Year Real Rate. Today, with the real rate at -0.46%, gold is “expected” to be at $1,552/oz but is instead at $1,905/oz, ~23% higher. This could mean that gold is relatively overvalued today or potentially that inflation-indexed bonds are undervalued (i.e., real rates are too high). In my view, the latter is unlikely as the Federal Reserve’s Q.E. program likely pushed real rates to unreasonably low levels, and they are closer to reasonable levels now that they spiked.

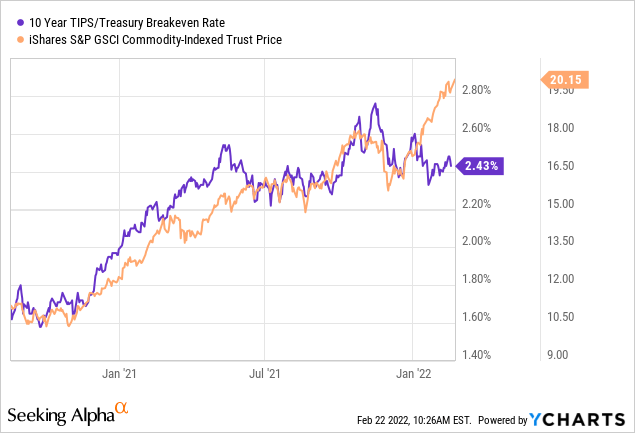

So, what does the gold market know that the bond market doesn’t? While gold may have risen a bit over its “monetary fair value,” I would hardly say it’s overvalued because it is genuinely the only time-proven hedge against the risk factors facing the market today. Inflation-indexed Treasury bonds like (TIP) are a great hedge against CPI inflation. Still, they technically carry default risk (since the government likely can’t print its way out of a consumer-price indexed debt). Of course, the Treasury bond market may simply be underpricing inflation risk, perhaps due to the bearish impact of tapering on Treasury bond prices. This is evidenced by the fact that the Treasury 10-year inflation-breakeven rate (inflation-expectation rate) is falling while commodities (GSG) are rising:

The iShares commodity basket ETF used above is predominantly energy commodities (60%), with the rest mixed between agriculture, metals, and precious metals. Historically, it is closely correlated to the long-term expected inflation rate (purple line above), but the two have become disconnected like gold and real rates. Commodities prices are surging at a record pace across the board (energy, metals, and agriculture) while the inflation outlook has declined slightly. Typically, higher commodity prices push inflation up, but the bond market’s inflation gauge no longer responds to commodities.

Looking at the market today, I believe the commodity market is more trustworthy as a signal than the bond market since it is likely that the Fed’s trillions in Q.E. and the ongoing “Q.E. wind-down” are artificially impacting bond prices. In other words, I expect real inflation to be above the “inflation breakeven rate” due to the impact of surging commodity prices which does not appear to be accounted for in bond yields. If correct, gold is not overvalued and correctly accounts for surging inflationary pressures.

Gold Miner Profits May Surge

The “disconnect” between rates and commodities is crucial for investors to understand because it implies inflation may continue to rise instead of falling, as most economists (and the bond market) seem to believe. As most commodities surge, producers and consumers will pay much more for goods over the coming months. Thus, gold remains a great asset to own since it is one of the few proven hedges against inflation. Still, I would exercise some caution since gold is “expensive” compared to real interest rates, which could still create some bearish short-term pressure.

Generally speaking, gold miners usually see their profits rise asymmetrically with the price of gold. It currently costs most miners around $1,070 to mine an ounce of gold, everything included. For example, a 1% rise in the price of gold from, say, $1900 to $1919 would cause a 2.2% profit margin increase of $830/oz to $849/oz (subtracting the $1070 cost). As such, the gold miner ETF GDX typically carries a beta to the price of gold of around 2X. Since GDX is technically an equity fund, it also has a higher correlation to the S&P 500 of 0.22, while gold’s correlation to the S&P 500 is 0.06 (essentially nothing). Thus, a crash in the stock market could be bearish for GDX, but its 0.22 correlation is still so low that its exposure is still relatively low.

Today, I see no strong reasons to be bullish on stocks and many on gold. However, better results are likely to be found with a gold miner ETF basket-like (GDX). The fund still has a forward “P/E” valuation of 15.5X, below most other equities (the S&P 500’s is currently 21X). Commodity producers often have lower “P/E” valuations because their earnings often decline over time without new investment as reserves deplete. From an earnings standpoint (based on today’s gold price), I would say GDX is reasonably valued.

The Bottom Line

Over the next few weeks, I would only expect gold to rise if there is a continued increase in geopolitical or domestic/social uncertainty and unease. Other bullish factors behind gold could be a continued rise in oil over $100 per barrel (which I strongly suspect) or a sharp increase in inflation expectations. The chief risk facing gold is that the bond market’s “view” that inflation will fall and real rates will rise is correct as that could cause a relatively significant decline in gold to perhaps $1,500-$1,600/oz. In my view, this is unlikely as it appears the bond market is not appropriately pricing in for the inflationary impact of surging commodity (particularly oil & gas) prices.

Overall, to me, GDX and miners, in general, are preferable to gold since GDX owners technically own physical metal in the dirt. GDX also has roughly 2X the upside (and downside) potential as gold, allowing investors to use a smaller amount of money to hedge with gold. Of course, gold miners’ expenses also rise with inflation and commodities (transportation, mining, labor, etc.), and all-in-sustained costs are growing quickly. Thus far, gold has risen far more than AISCs for most miners, so this has not harmed profits, but if gold fails to rise while oil continues to increase, then miner profits could fall. Risks aside, I still expect GDX to be one of the best assets to own over the next twelve months.

[ad_2]

Source links Google News