[ad_1]

Evgenii Mitroshin

Adding More Crude Oil Exposure

I have a broad range of energy exposure via crude oil futures, oil producers and some oil service stocks. I wanted to increase my exposure to the energy sector without taking any more equity risk. However, I did not want to buy more crude oil futures as energy would then become too large as a percentage of my portfolio. I did a deep dive comparing the main crude oil ETFs including the ProShares K-1 Free Crude Oil Strategy ETF (BATS:OILK), United States Oil Fund, LP (USO), and the Invesco DB Oil Fund (DBO) to see if any of these funds fulfilled my needs.

ProShares K-1 Free Crude Oil Strategy ETF

K-Form Free

One of the main features of the OILK fund is that it is K-1 form free.

A K-1 tax form simply moves the tax liability from the exchange traded product entity to the limited partners who own shares. Since OILK is buying and selling crude oil contracts, there are capital gains and losses. The K-1 form is simply a way to make sure those gains and losses flow directly to you. This tax filing is a pain and most investors prefer an ETF that is K-1 free. OILK is advantageous in that you do not have to fill out the tax form.

Size And Liquidity

OILK is only an $80 million fund. It trades over 60,000 shares per day. The liquidity is sufficient for small retail investors. However, I generally avoid funds that are less than $100 million. By comparison, the United States Oil Fund (USO) is a $2 billion fund and Invesco DB Oil Fund (DBO) is a $335 million fund.

Composition And Expense Ratio

OILK has an expense ratio of 0.71%. Most oil fund peers have an expense ratio between 0.7% and 0.8%. There are no low-cost ETF’s in this field.

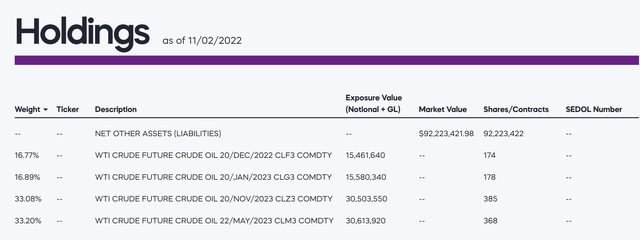

Most crude oil ETFs are a combination of crude oil futures contracts and some treasury bills. The interest from the treasury bills give you monthly distributions of income. OILK currently holds four crude oil futures contracts that expire within 12 months.

OILK Factsheet

One third of the index follows a monthly roll schedule, the second third of the index follows a June annual roll schedule, while the remaining third follows a December annual roll schedule.

The Index weights are equally reset semi-annually in the months of March and September. I am fairly comfortable with this roll schedule as I think that the supply demand dynamics will cause higher prices in 2023.

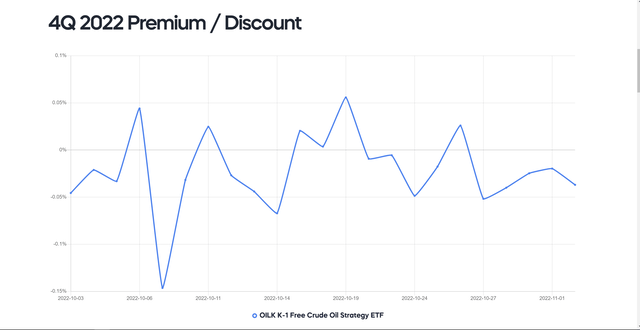

The fund rarely trades at much of a premium or a discount to NAV.

OILK Factsheet

Windfall Profits Tax

One of the reasons that I am adding to more crude oil exposure but not necessarily investing in more oil company shares is that the political climate appears to have turned for the worse. Oil companies have been vilified for record profits, despite the fact that the industry was in the doldrums from 2014-2020. President Joe Biden has repeatedly slammed oil and gas companies for “war-profiteering” for reaping bumper profits after Russia’s invasion of Ukraine. Just yesterday, Biden said companies should instead lower fuel costs for Americans or invest some of the profits in boosting domestic production. “If they don’t, they’re going to pay a higher tax on their excess profits, and face other restrictions,” Biden said.

The European Union has already announced windfall profits tax in late September. EU countries agreed to a “temporary” windfall profit levy for oil, gas, coal and refining companies. Under the scheme, energy companies would pay an extra tax for some surplus profits, defined as those 20% above a company’s average taxable profits in the last four years.

Although I am sure that a lot of the rhetoric towards the oil industry is nothing more than political grandstanding, I have learned to be careful with natural resource companies when the political winds change. Anyone who held mining shares operating in some Latin American countries can probably remember royalty agreements being renegotiated as the price of gold or copper rose. Sometimes it is less risky to simply own the underlying commodity.

Near Term Catalysts

I will not go in to the long term structural reasons why the oil markets have a supply deficit. Instead, I will focus on two near term catalysts that should help to propel prices higher in the next 12-18 months.

Firstly, there are strong signals that China is going to alter their zero Covid policy. It is estimated that Chinese demand has fallen by 350,000-500,000 bpd this year. Historically, Chinese demand increases by ~500,000 bpd. In essence, the crude oil markets have dealt with closer to 1 mil bpd of reduced demand as a direct result of China’s zero Covid policy. However, there are indications that the government is prepared to loosen restrictions. Firstly, China has approved the BioNtech vaccine for foreigners. This could be a precursor to the vaccine being approved for the local Chinese population. Secondly, China is planning to relax travel restrictions. These are all early indications that Chinese crude oil demand should be normalizing in the coming months.

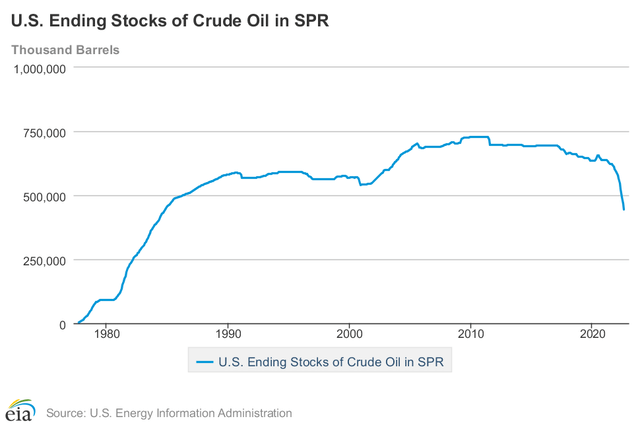

On the supply side, the Biden administration is expected to curtail the draining of the Strategic Petroleum Reserve after the election next week. Over the past year, 180 mil barrels have been released in an effort to tame the oil price appreciation. However, it is expected that there will not be any more SPR releases after December 2022. The Biden administration has signalled an intention to refill the reserves at prices below $70/barrel.

EIA

Final Thoughts

With near term supply and demand catalysts on the horizon, I wanted to increase my energy exposure. However, I was hesitant to add to more energy stocks as I am weary that oil companies could be hit with a windfall profits tax.

The OILK is a decent financial instrument for speculators looking for a favorable roll schedule, reasonable fees and decent daily volume. Personally, I will not use the OILK to increase my energy exposure because the fund is simply too small at $80 million. Instead, I will most likely use USO or DBO.

[ad_2]

Source links Google News