[ad_1]

lechatnoir

This monthly article series shows a dashboard with aggregate industry metrics in consumer staples. It is also a review of sector ETFs like the Consumer Staples Select Sector SPDR ETF (XLP) and the First Trust Consumer Staples AlphaDEX Fund (NYSEARCA:FXG), whose holdings are used to calculate these metrics.

Shortcut

The next two paragraphs in italic describe the dashboard methodology. They are necessary for new readers to understand the metrics. If you are used to this series or if you are short of time, you can skip them and go to the charts.

Base Metrics

I calculate the median value of five fundamental ratios for each industry: Earnings Yield (“EY”), Sales Yield (“SY”), Free Cash Flow Yield (“FY”), Return on Equity (“ROE”), Gross Margin (“GM”). The reference universe includes large companies in the U.S. stock market. The five base metrics are calculated on trailing 12 months. For all of them, higher is better. EY, SY and FY are medians of the inverse of Price/Earnings, Price/Sales and Price/Free Cash Flow. They are better for statistical studies than price-to-something ratios, which are unusable or non available when the “something” is close to zero or negative (for example, companies with negative earnings). I also look at two momentum metrics for each group: the median monthly return (RetM) and the median annual return (RetY).

I prefer medians to averages because a median splits a set in a good half and a bad half. A capital-weighted average is skewed by extreme values and the largest companies. My metrics are designed for stock-picking rather than index investing.

Value and Quality Scores

I calculate historical baselines for all metrics. They are noted respectively EYh, SYh, FYh, ROEh, GMh, and they are calculated as the averages on a look-back period of 11 years. For example, the value of EYh for food in the table below is the 11-year average of the median Earnings Yield in food companies.

The Value Score (“VS”) is defined as the average difference in % between the three valuation ratios (EY, SY, FY) and their baselines (EYh, SYh, FYh). The same way, the Quality Score (“QS”) is the average difference between the two quality ratios (ROE, GM) and their baselines (ROEh, GMh).

The scores are in percentage points. VS may be interpreted as the percentage of undervaluation or overvaluation relative to the baseline (positive is good, negative is bad). This interpretation must be taken with caution: the baseline is an arbitrary reference, not a supposed fair value. The formula assumes that the three valuation metrics are of equal importance.

Current data

The next table shows the metrics and scores as of last week’s closing. Columns stand for all the data named and defined above.

|

VS |

QS |

EY |

SY |

FY |

ROE |

GM |

EYh |

SYh |

FYh |

ROEh |

GMh |

RetM |

RetY |

|

|

Staple/Food Retail |

-28.51 |

-3.73 |

0.0334 |

1.7527 |

0.0142 |

17.81 |

19.09 |

0.0429 |

1.9180 |

0.0314 |

16.67 |

22.28 |

9.63% |

1.92% |

|

Food |

-8.13 |

5.16 |

0.0511 |

0.5789 |

0.0190 |

19.29 |

28.34 |

0.0459 |

0.6724 |

0.0243 |

15.38 |

33.37 |

2.99% |

4.61% |

|

Beverage |

-8.82 |

-21.06 |

0.0307 |

0.2560 |

0.0164 |

18.06 |

44.41 |

0.0367 |

0.2677 |

0.0174 |

24.39 |

52.97 |

6.10% |

-3.66% |

|

Household prod. |

-2.33 |

4.37 |

0.0785 |

1.2504 |

-0.0087 |

19.76 |

38.33 |

0.0451 |

0.8826 |

0.0383 |

17.19 |

40.88 |

12.50% |

-38.08% |

|

Personal care |

-22.28 |

3.12 |

0.0339 |

0.3775 |

0.0124 |

19.72 |

63.05 |

0.0384 |

0.4555 |

0.0200 |

21.34 |

55.39 |

8.89% |

-10.72% |

|

Tobacco |

18.76 |

-42.43 |

0.0619 |

0.5623 |

0.0195 |

6.82 |

50.20 |

0.0588 |

0.4681 |

0.0149 |

34.75 |

52.56 |

8.30% |

5.95% |

Value And Quality chart

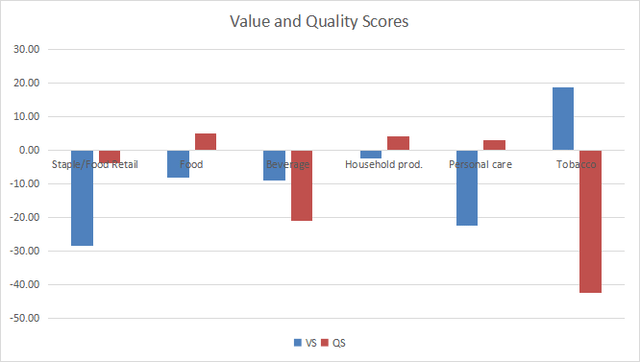

The next chart plots the Value and Quality Scores by industry (higher is better).

Value and quality in consumer staples (Chart: author; data: Portfolio123)

Momentum

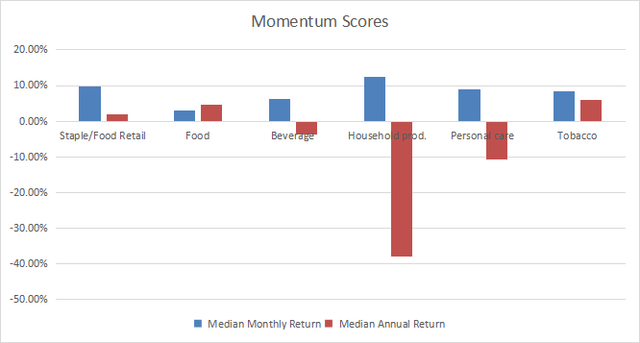

The next chart plots momentum data.

Momentum in consumer staples (Chart: author; data: Portfolio123)

Interpretation

The tobacco industry is undervalued by about 19% relative to 11-year averages. However, quality has deteriorated and is now far below the historical baseline. A note of caution about statistics and sample size in this industry: there are only five tobacco companies in my reference universe. Food, beverage and household products are undervalued by less than 10% regarding the same metrics. Quality is close above the baseline for food and household products, but it looks bad for beverage. Personal care and staple/food retail are overvalued by 20% to 30%, and their quality scores don’t justify it.

FXG: a “value or growth” ETF in consumer staples

The First Trust Consumer Staples AlphaDEX Fund has been tracking the StrataQuant® Consumer Staples Index since 5/8/2007. It has a total expense ratio of 0.64%, which is much more expensive than XLP (0.10%).

As described by First Trust, the underlying index is constructed by ranking the stocks in the Russell 1000 Index on growth factors, and, separately, on value factors. Each stock is ranked by its growth or value score based on its style classification by Russell. Stocks classified in both growth and value styles receive the better of their growth or value score. The greater of the top 75% of the sector or 40 stocks is selected for the underlying index (if the number of eligible stocks is below 40, all stocks are included). Then, selected stocks are weighted based on their rank quintiles, with an equal weight within each quintile. The index is reconstituted quarterly.

Since inception, FXG has lagged XLP by a short margin of 23 bps in annualized return. Moreover, risk measured in drawdown and volatility is higher than the sector benchmark.

|

Total Return |

Annual.Return |

Max Drawdown |

Sharpe |

StdDev |

|

|

FXG |

297.35% |

9.31% |

-38.54% |

0.63 |

14.59% |

|

XLP |

310.37% |

9.54% |

-33.45% |

0.75 |

11.98% |

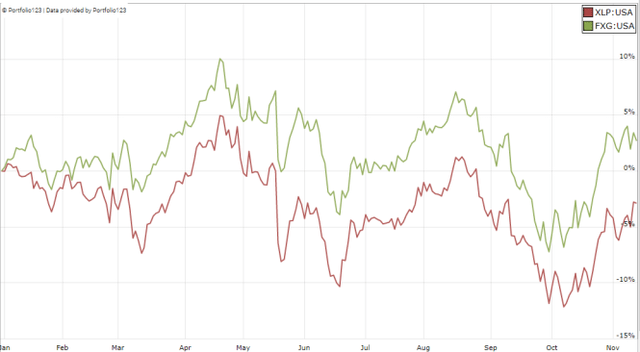

However, FXG beats XLP in 2022 to date:

FXG vs. XLP in 2022 (Portfolio123)

As of writing, the fund has 40 holdings. The next table shows the top 10 names with fundamental ratios and dividend yields. Their aggregate weight is 41.5%.

|

Ticker |

Name |

Weight |

EPS growth %TTM |

P/E TTM |

P/E fwd |

Yield% |

|

PFGC |

Performance Food Group |

4.93% |

282.85 |

43.08 |

15.26 |

0 |

|

WBA |

Walgreens Boots Alliance |

4.93% |

70.57 |

8.25 |

9.21 |

4.65 |

|

BG |

Bunge Ltd. |

4.61% |

-38.03 |

10.33 |

7.34 |

2.46 |

|

ABC |

AmerisourceBergen Corp. |

4.24% |

8.76 |

19.05 |

13.32 |

1.27 |

|

LW |

Lamb Weston Holdings, Inc. |

3.97% |

58.28 |

29.45 |

27.28 |

1.20 |

|

POST |

Post Holdings, Inc. |

3.95% |

289.66 |

7.67 |

40.09 |

0 |

|

MCK |

McKesson Corp. |

3.93% |

146.88 |

25.24 |

14.40 |

0.61 |

|

TSN |

Tyson Foods, Inc. |

3.84% |

75.90 |

5.94 |

7.65 |

2.73 |

|

SYY |

Sysco Corp. |

3.58% |

112.31 |

29.92 |

20.33 |

2.32 |

|

ADM |

Archer-Daniels-Midland Co. |

3.47% |

56.50 |

12.85 |

12.40 |

1.72 |

Ratios: Portfolio123

In summary, FXG is a “smart beta” ETF selecting stocks separately on value and growth criteria. The strategy looks great in theory, but the fund failed to outperform the sector benchmark since its inception in 2007. This doesn’t justify a high management fee. Moreover, XLP is much more liquid. It is also quite concentrated in the top holdings. Investors who want to limit the risks related to individual companies may prefer the Invesco S&P 500 Equal Weight Consumer Staples ETF (RHS).

Dashboard List

I use the first table to calculate value and quality scores. It may also be used in a stock-picking process to check how companies stand among their peers. For example, the EY column tells us that a food company with an earnings yield above 0.0511 (or price/earnings below 19.57) is in the better half of the industry regarding this metric. A Dashboard List is sent every month to Quantitative Risk & Value subscribers with the most profitable companies standing in the better half among their peers regarding the three valuation metrics at the same time. The list below was sent to subscribers several weeks ago based on data available at this time.

|

USNA |

USANA Health Sciences, Inc. |

|

COKE |

Coca-Cola Consolidated, Inc. |

|

PPC |

Pilgrim’s Pride Corp. |

|

KR |

The Kroger Co. |

|

TSN |

Tyson Foods, Inc. |

|

POST |

Post Holdings, Inc. |

|

NUS |

Nu Skin Enterprises, Inc. |

|

EPC |

Edgewell Personal Care Co. |

|

TAP |

Molson Coors Beverage Co. |

|

VGR |

Vector Group Ltd. |

It is a rotating list with a statistical bias toward excess returns on the long term, not the result of an analysis of each stock.

[ad_2]

Source links Google News