[ad_1]

Since January 2015, the Invesco CurrencyShares Swiss Franc Trust (NYSEARCA:FXF) has lost 19.07% of its value in moves tied to important central bank activities and substantial changes in the economic outlook for the region. The fund tracks the value of the Swiss currency against a broad range of important assets, which is significant because foreign exchange trades utilizing the Swiss franc as a funding instrument have the capability of generating some of the best income opportunities in the category sector. Recent slowdowns in economic growth projections have led to downside revisions in consumer price inflation for the domestic economy in Switzerland, and these increasingly uncertain economic environments have the potential to force the Swiss National Bank to intervene once again in the currency markets. If this occurs, the result will likely be extended downside in the value of FXF.

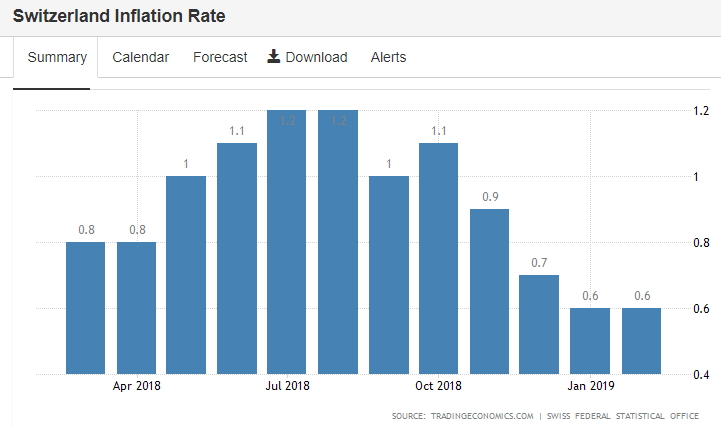

(Source: Swiss Federal Statistical Office/Trading Economics)

At its most recent monetary policy meeting, the Swiss National Bank lowered its domestic inflation projection for the fourth time in a row and kept deposit rates at negative 0.75% (the lowest interest rates in the world). The central bank’s statement showed rising concerns that slower global growth will produce a reduction in long-term inflation forecasts for many of the world’s largest economies. The SNB now expects domestic price pressures to expand at a rate of 0.3% in 2019, which is half of the annual increase that was expected in December and just one-third the rate of expansion that was projected at the same time last year. Recently, similar comments have been made by the European Central Bank and the Federal Reserve, so it would seem that there is a mounting consensus amongst the world’s central bankers, which indicates a continued need for accommodative policy measures.

Unfortunately, weaknesses in global pricing pressures could continue to complicate matters for the Swiss National Bank. Thus far, their attempts to limit gains in the franc have required extraordinary efforts, but the level of progress has come as a result of these efforts has been disappointing. In 2016, the SNB spent 67.1 billion francs on currency intervention. This was followed by interventions valued at 48 billion francs in 2017 and 2.3 billion francs in 2018.

(Source: Author)

Clearly, the level of aggressiveness that has been displayed by the SNB has been waning. But these actions have had little effect on the market values of EURCHF and USDCHF, and the SNB still considers the franc to be “highly valued.” Ultimately, these increasingly uncertain economic environments could force the hand of the SNB once again and continued interventions in the currency markets will likely place extended pressure on FXF.

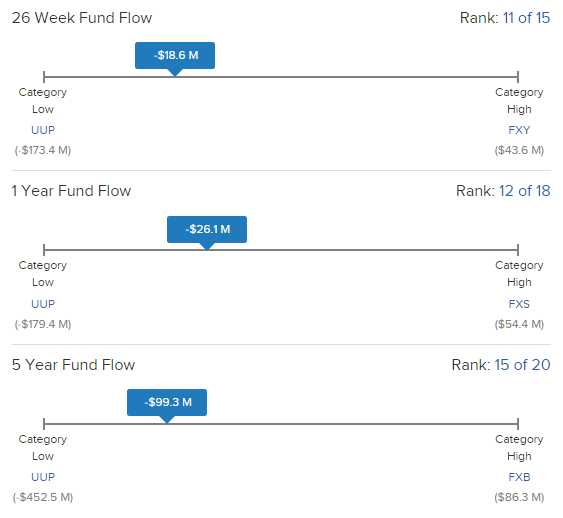

(Source: ETFdb.com)

Over the last 5-year period, FXF has been impacted by significant outflows equal to $99.3 million. This puts the ETF in the bottom-quarter of its category averages, but the pace of the outflow activity has actually increased in the following periods. In the last 52-week period, FXF has been negatively impacted by outflows of $26.1 million, and in the last 26-week period, the market’s outflow activity has totalled $18.6 million. During these more recent periods, FXF has fared a bit better when compared to the other ETFs in the category. But the pace of the outflows has accelerated, and this could help FXF break critical price support levels if these trends continue.

(Source: Author)

For the last seven months, EURCHF has mostly traded inside a range bounded by the 1.1180 and 1.1480 price levels. Volatility in this instrument has started to move higher once again as investors have become increasingly anxious about the possibility of a finalized Brexit outcome. But that trading range is starting to break to the downside, and these market events are likely causing added stress for members of the Swiss National Bank. Unfortunately, the intensity of these moves could actually accelerate if the European Central Bank signals an intention to restart its programs of quantitative easing.

(Source: Author)

Changes in volatility have been less apparent in USDCHF, but it is still clear that currency intervention measures by the SNB have had little impact on its valuation. Since underlying strength in the franc can increase deflationary pressures and weigh substantially on Switzerland’s export economy, the SNB is unlikely to begin raising interest rates before the start of 2021. This means that the central bank has limited means to slow the progression of the franc against its major peers in foreign exchange markets (especially the euro). In practical terms, the SNB’s path to rate normalization does not appear to be anywhere in sight. As a result, potential for further intervention in currency markets and continued weakness in the world’s economic framework should prevent FXF from moving much higher in 2019.

Thank you for reading.

Now, it’s time to make your voice heard. Reader interaction is the most important part of the investment learning process! Comments are highly encouraged. We look forward to reading your viewpoints.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News