[ad_1]

Pierre Crom/Getty Images News

Author’s note: This article was released to CEF/ETF Income Laboratory members on October 24th.

Inflation has raged all year, reaching 8.2% this past September. Due to elevated inflation and reader interest, I’ve covered several inflation-hedge ETFs in the recent past, including those focused on equities, commodities, and TIPs, amongst others. ETFs covered are all reasonably effective inflation hedges, with individual ETFs having other specific benefits as well. Few of these funds offer strong, reasonably sustainable dividends, which are key for many investors. The First Trust Indxx Global Natural Resources Income ETF (NASDAQ:FTRI) is one of the few exceptions.

FTRI is a global natural resources / commodity equity income ETF. FTRI’s effectiveness as an inflation-hedge, strong 9.9% dividend yield, and cheap valuation, make the fund a buy. On the other hand, the fund’s holdings and dividends are significantly riskier than average. As such, the fund is only appropriate for the most aggressive investors, in my opinion at least.

FTRI – Basics

- Investment Manager: First Trust

- Underlying Index: Indxx Global Natural Resources Income Index

- Expense Ratio: 0.40%

- Dividend Yield: 9.89%

- Total Returns CAGR 10Y: -4.16%

FTRI – Overview

FTRI is an equity index ETF, tracking the Indxx Global Natural Resources Income Index. Said index includes the 50 highest-yielding natural resources equity companies, defined as those focusing on energy, materials, agriculture, water, and timber. Securities must also meet inclusion criteria centered on liquidity, trading, profitability, and dividend sustainability. Unprofitable companies are excluded from the index, as are companies without at least three consecutive years of stable or growing dividends. It is market-cap weighted index. As with most indexes, there are security and industry caps meant to ensure diversification.

In general terms, FTRI’s underlying index seems reasonable enough, but there is one important downside or risk. Excluding companies without at least three years of stable or growing dividends means divesting from companies which cut their dividends, which I don’t believe is an appropriate course of action for global commodity companies.

Commodity companies have incredibly volatile revenues and earnings, so ensuring stable dividends is sometimes difficult. Global companies sometimes put less importance on dividend stability than U.S. companies, although this does vary by country. Some companies pay special, outsized dividends when commodity prices are high, and these then return to normal when prices normalize. Dividend stability is important, but I don’t believe that a blanket rule against dividend cuts makes sense in this particular market niche.

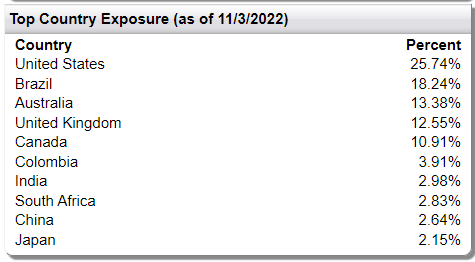

Going back to the fund and its holdings, FTRI seems to be about as diversified as a global commodities fund can realistically be. The fund invests in 50 stocks from about a dozen countries, and three industries. FTRI is overweight the United States, Brazil, and Australia, three countries with many natural resources, and commodity companies.

FTRI

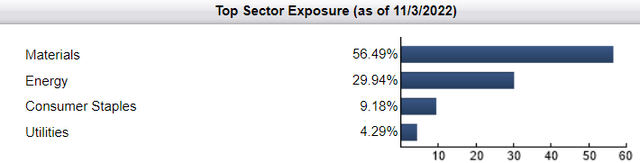

The fund focuses on materials and energy companies, for obvious reasons, with smaller investments in consumer staples (agriculture), and utilities.

FTRI

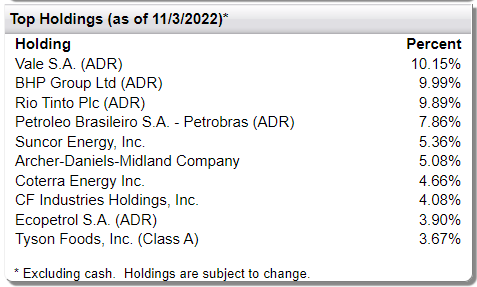

FTRI is a relatively concentrated fund, with its top ten holdings accounting for slightly over 65% of its value. Concentration increases risk, volatility, and means that fund performance is strongly dependent on the performance of a very small number of stocks. Expect significant underperformance if the fund’s larger holdings, especially Vale (VALE), BHP (BHP), Rio Tinto (RIO), and Petrobras (PBR), underperform, and vice versa.

FTRI

Besides the above, not much else stands out about the fund or its holdings.

FTRI – Investment Thesis

FTRI’s investment thesis is quite simple, and rests on the fund’s effectiveness as an inflation hedge, strong 9.9% dividend yield, and cheap valuation. These combine to create a strong fund and investment opportunity, and one which seems particularly appropriate for income investors concerned about inflation.

Let’s have a look at each of the points above.

Effectiveness as an Inflation Hedge

FTRI invests in global natural resources or commodity companies. These companies derive the majority of their revenues and earnings from the production of relatively simple commodity products, and so tend to perform extremely well when commodity prices / inflation are high and rising.

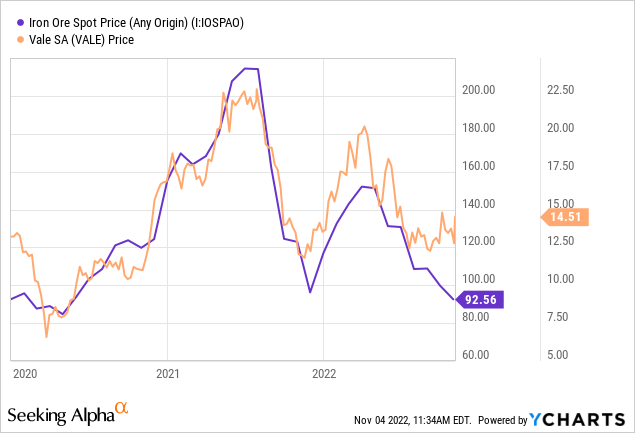

Vale, the fund’s largest holding, is a representative example. Vale focuses on iron ore, and so its revenues and earnings are strongly impacted by iron ore prices. Investors are fully aware of this, and so Vale’s share price tends to closely track that of iron ore. The correlation is, I think, very easy to spot.

Considering the above, Vale can be said to be a reasonably effective hedge against iron ore prices. Investors concerned about rising iron ore prices can invest in Vale, and realize strong returns if iron ore prices increase. That was the case from mid-2020 to mid-2021, as can be seen above.

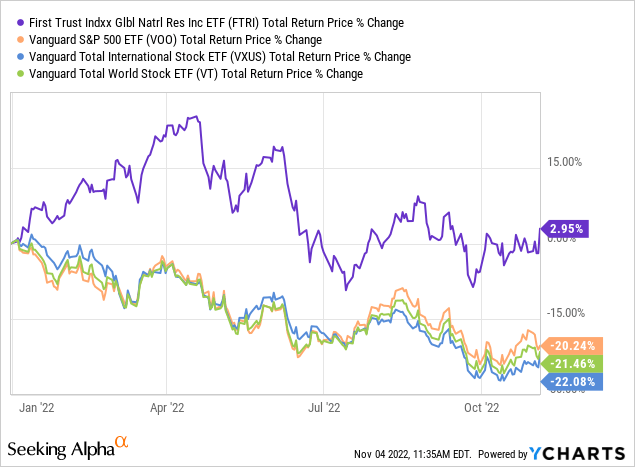

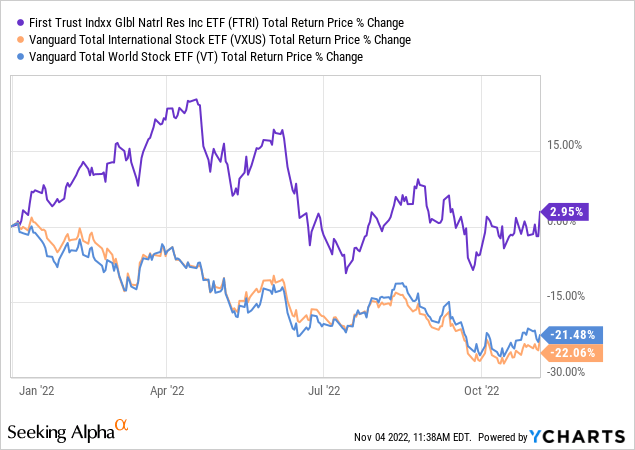

Vale is a reasonably effective hedge against iron ore prices. FTRI invests in dozens of natural resources / commodity companies focusing on many different products, from a few different industries. This makes FTRI a reasonably effective hedge against inflation, broadly construed. Expect the fund to outperform when inflation is high and rising, as has been the case YTD.

FTRI is a moderately effective inflation hedge, a positive for the fund and its shareholders, and one which is particularly important during a period of heightened inflation.

On a more negative note, as FTRI is an equity fund, share prices and total returns are somewhat dependent on investor sentiment, which might not necessarily track inflation or commodity prices. FTRI’s returns have barely been positive YTD, even as prices skyrocket, as rising interest rates and worsening economic fundamentals have turned sentiment bearish. As such, the fund could, possibly, underperform or post losses during a future inflationary environment, if sentiment were sufficiently bearish. Although this does not seem all that likely to me, the market is rarely that irrational, it is a distinct possibility, and an important fact for investors to consider.

Investors wishing to avoid the issues described above should consider investing in commodity futures funds. These provide straight, direct exposure to commodity prices, ignoring issues of market sentiment and the like. The Invesco DB Commodity Index Tracking ETF (DBC), and the Invesco DB Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC) are two such funds, previously covered here.

Strong 9.9% Dividend Yield

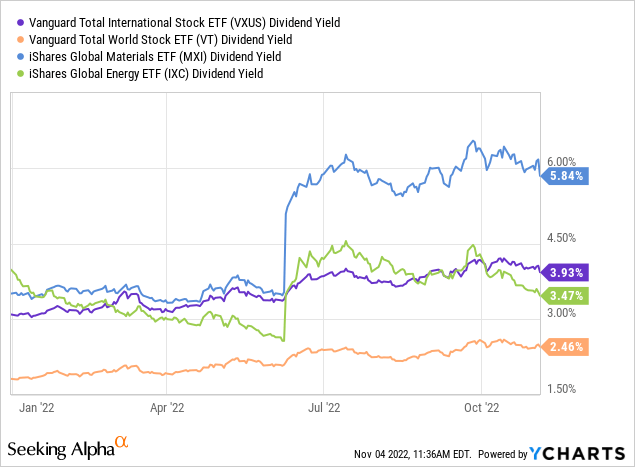

FTRI invests in the 50 highest-yielding global natural resource companies. Focusing on companies with comparatively strong yields results in a lot of income for the fund, and strong dividends for its shareholders. FTRI itself currently yields 9.9%, an incredibly strong yield on an absolute basis, higher than most broad-based equity index funds, and higher than narrower materials and energy index funds too.

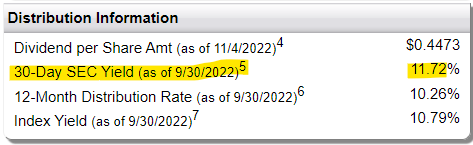

FTRI’s current dividends are also more than covered by underlying generation of income, as evidenced by the fund’s 11.7% SEC yield. SEC yields are a standardized measure of short-term generation of income, and reflective of the actual income generated by a fund’s underlying holdings. FTRI generates 11.7% in income, which more than covers its 9.9% in dividends.

FTRI

ETFs tend to distribute any and all income to investors as dividends. As FTRI currently generates more in income than it distributes to shareholders, dividends should see some growth in the coming months. In practice, future dividends are dependent on future income, which is strongly sensitive to commodity prices. As such, even though present conditions point towards dividend growth moving forward, the situation is incredibly uncertain, and ultimately dependent on future, not present, conditions.

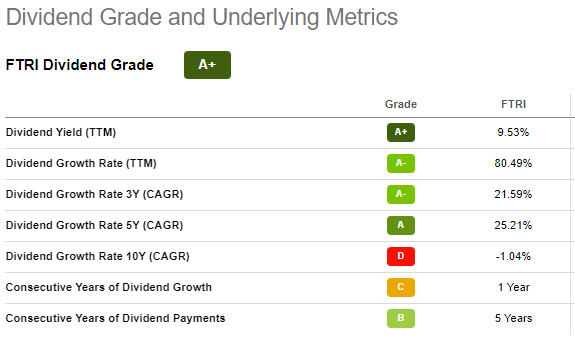

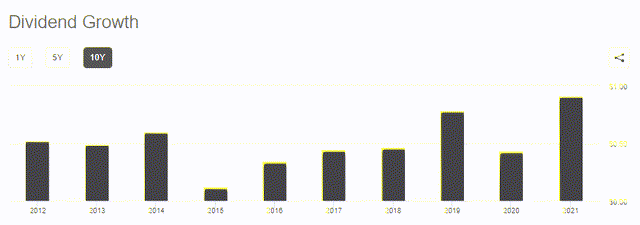

FTRI’s dividend growth track-record is, well, complicated. The fund’s dividends have seen incredibly strong growth since inception, and for most relevant time periods too. Growth for the past 10 years has technically been negative, but only because there was an uncharacteristically large dividend in 2011, almost certainly due to special distributions from the fund’s underlying holdings.

SeekingAlpha

On the other hand, and as can be seen above, growth is concentrated in the recent past, with fund dividends almost doubling in size these past twelve months. Growth was much slower, and volatile, in prior years. Excluding 2022, due to uncharacteristically high dividends, and 2021, due to uncharacteristically low dividends, I arrive at a dividend growth rate of 8.5% for the past ten years. I think this figure is much more reflective of the actual dividend growth experienced by the fund, after accounting for dividend volatility.

FTRI’s strong, growing 9.9% dividend yield is a significant benefit for the fund and its shareholders, and particularly beneficial for income investors and retirees.

On a more negative note the fund’s dividends are incredibly volatile, and quite risky. Large dividend cuts are common, and tend to occur during downturns, recessions, and commodity price crunches. FTRI’s dividends were cut 45% in 2020, during which the coronavirus pandemic was in full swing. The fund’s dividends were cut by a whopping 80% in 2014, during which energy and commodity prices plummeted. Looking at annual fund dividends, the volatility and cuts are evident.

SeekingAlpha

Fund dividends will very likely be cut during any future downturn, recession, or commodity price crunch. These are relatively common occurrences, so fund dividends will almost certainly be cut sometime in the future. I do believe that the long-term trend should be towards growth, as has been the case since inception, but significant volatility and large dividend cuts are to be expected as well.

Volatile, risky dividends are a significant negative for the fund and its shareholders, and particularly detrimental for risk-averse investors and retirees. FTRI does not seem like an appropriate investment for investors looking for safe, dependable dividends, in my opinion at least.

Cheap Valuation

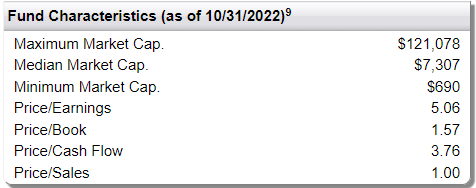

International equities are currently undervalued relative to U.S. equities, due to investor sentiment, lower growth prospects, and greater risk.

Natural resource and commodity companies are also undervalued, due to investor sentiment, weakening economic fundamentals, and significantly greater risk.

Higher-yielding companies tend to be somewhat undervalued, as yields are a common valuation metrics. Lots of exception here, but the broader point stands.

FTRI invests in the highest-yielding natural resource and commodity companies, and is significantly overweight international equities. The combination results in an incredibly cheap fund, with a PE ratio of 5.1x and a PB ratio of 1.6x. For reference, the S&P 500 sports a PE ratio of 18.1x, and a PB ratio of 3.4x.

FTRI

FTRI’s cheap valuation could lead to significant capital gains, contingent on valuations normalizing, which could happen if either economic conditions or investor sentiment were to improve. Sentiment has improved all year, at least relative to other equity segments, and FTRI has significantly outperformed for the same period, as expected.

Cheap valuations also serve to somewhat reduce risk, insofar as they serve to limit losses during bear markets. Companies with PE ratios of 5.1x, average for FTRI, can easily finance significant dividend and buyback programs, which can serve to minimize reductions in share prices, putting something of a floor on the same. Companies with PE ratios of 18.1x, average for the S&P 500, usually can’t finance significant dividends or share buybacks, so have less tools available to limit losses or reductions in their share prices.

FTRI’s cheap valuation is a significant benefit for the fund and its shareholders.

FTRI – Risks and Negatives

FTRI has many benefits, but also many risks and negatives. I’ve covered most of these already, but thought to take a closer look at the most important of these.

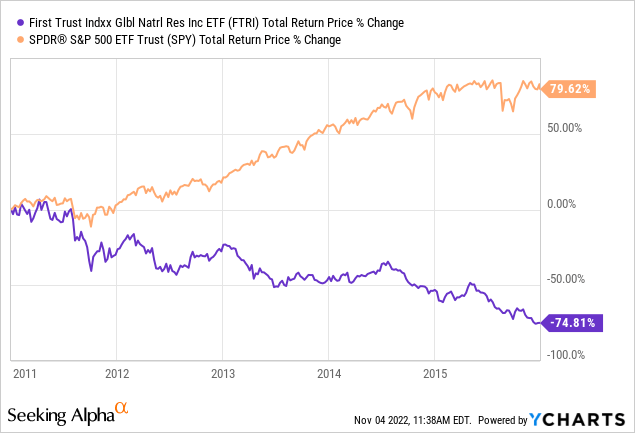

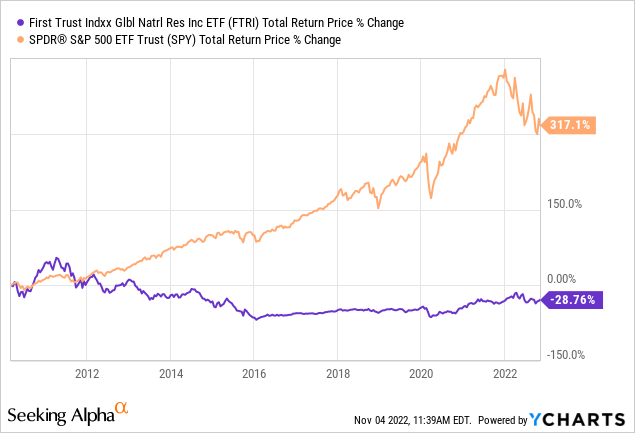

FTRI focuses on natural resources or commodity companies. These companies perform quite well when commodity prices increase, but perform quite badly when these decrease. Losses could mount during particularly severe commodity price crunches, as was the case from 2011 to 2016. FTRI was down by almost 75% during said time period, significantly underperforming relative to the S&P 500.

The fund has yet to recover from the losses above, and is down since inception, and by quite a bit.

FTRI’s underperformance during commodity price crunches and disastrous performance track-record are its two most significant negatives. In my opinion, these negatives are significant enough that the fund is an inappropriate investment for all but the most aggressive, risk-seeking investors.

On a slightly more positive note, the fund’s performance looks worse than expected, due to terrible timing. FTRI was created in the tail end of a massive commodities rally / bull market, so saw few gains before plummeting after commodity prices went down. Performance would look materially stronger if the fund were older, and saw greater gains before the crash, or younger, and saw fewer losses from the crash. Terrible timing makes FTRI’s returns look worse than expected, in my opinion at least.

Conclusion

FTRI’s effectiveness as an inflation-hedge, strong 9.9% dividend yield, and cheap valuation, make the fund a buy. The fund is incredibly risky, and so only appropriate for the most risk-seeking investors, in my opinion at least.

[ad_2]

Source links Google News