[ad_1]

I always enjoy learning from my readers.

One such reader responded to an article I recently wrote on my personal blog (more on that later). In the course of developing a related topic, I made reference to REITS, and specifically the Vanguard Real Estate ETF (VNQ).

I referenced VNQ for the simple reason that I have written about it for years. All the way back in 2015, I discussed the benefits of REITS and included VNQ in one of my model portfolios. In late-2018, I briefly alluded to some changes in the structure of VNQ in an article entitled 3 Vanguard ETFs To Consider Right Now.

In brief, Vanguard substantially expanded the index tracked by VNQ, from one that tracked a fairly limited set of REITs to a more comprehensive index that included real estate development companies as well as specialty REITs, such as American Tower Corporation (AMT), which owns and/or operates over 40,000 cellular towers in the United States.

After reading the article on my blog referenced above, my reader posed this question via my Twitter feed.

Is there a reason you like VNQ over FREL or is FREL not on your radar?

FREL refers to the Fidelity MSCI Real Estate Index ETF (FREL). And, to be honest, I had never so much as looked at this ETF. Interestingly, FREL was in existence when I compared those 3 REIT ETFs back in 2015, but it was extremely new and very small. So, it didn’t make the cut. But that was then, and this is now. Since my reader had asked such a specific question, I thought I owed it to him to at least take a look. Further, since I myself am a Fidelity Brokerage client, my curiosity was piqued from that standpoint as well.

As it turns out, I found myself quite surprised by what I learned. Join me, and you’ll soon see why.

Introducing: Fidelity MSCI Real Estate Index ETF

First, some high-level information concerning this ETF. With an inception date of February 2, 2015, FREL has been around for well over 4 years. It carries a very low expense ratio of .084%. According to its product page, as of August 21, 2019 FREL had AUM of $887.9 million. It has average daily trading volume of $6.5 million, with an average spread of .05%.

According to the fund’s summary prospectus, here are details about the fund’s index and tracking methodology:

The fund’s underlying index is the MSCI USA IMI Real Estate Index, which represents the performance of the real estate sector in the U.S. equity market.

Using a representative sampling indexing strategy to manage the fund. “Representative sampling” is an indexing strategy that involves investing in a representative sample of securities that collectively has an investment profile similar to the index. The securities selected are expected to have, in the aggregate, investment characteristics (based on factors such as market capitalization and industry weightings), fundamental characteristics (such as return variability and yield) and liquidity measures similar to those of the index. The fund may or may not hold all of the securities in the MSCI USA IMI Real Estate Index.

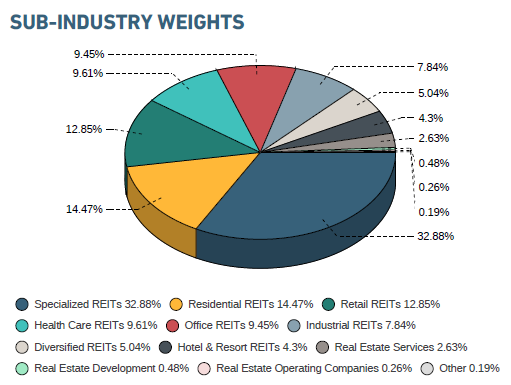

Here is how that index breaks down, by sub-industry.

Source: MSCI USA IMI Real Estate Index Fact Sheet

Source: MSCI USA IMI Real Estate Index Fact Sheet

Clearly, this index covers the spectrum quite nicely. The largest sub-industry by far is specialized REITs, at 32.88%. However, there are also nice allocations to residential, retail, health care, and office REITS, each running between approximately 10-15% of the total.

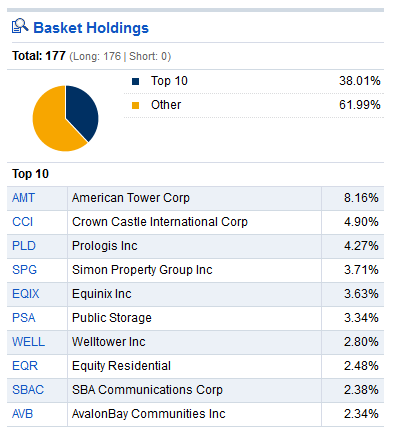

As far as the Top 10 holdings, and their relative overall weighting, here is the detail.

Source: Fidelity FREL Website (Previously Linked)

I referenced FREL’s top holding, American Tower Corporation, above. To give you just some idea of the diversity represented, let’s discuss very briefly 3 other companies included in FREL’s Top 10.

- Public Storage (PSA) is a 2nd example of a company in the Specialized REITS sub-industry. Public Storage is the world’s largest owner, operator and developer of self-storage facilities, with nearly 2,500 facilities across the United States. The motto of one of its subsidiaries is “store your stuff for less.” Whether on a temporary basis, perhaps while moving, or on a more permanent basis because they simply have too much “stuff,” more than one million U.S. customers take advantage of their services.

- Simon Property Group (SPG) is an example of a company in the Retail REITS sub-industry. Simon is a global leader in the ownership of premier shopping, dining, entertainment and mixed-use destinations and an S&P 100 company. From The Forum Shops at Caesar’s Palace in Las Vegas to its 69 Premium Outlets locations across the country, Simon is a leader in this segment.

- AvalonBay Communities (AVB) is an example of a company in the Residential REITS sub-industry. As of June 30, 2019, AvalonBay owned or held a direct or indirect ownership interest in 294 apartment communities containing 86,148 apartment homes in 12 states and the District of Columbia.

In summary, then, FREL is a very balanced, diversified offering for investors desirous of including exposure to REITS in their portfolios.

Great, But What’s That Little Secret You Mentioned In The Title?

That’s right, I did mention that, didn’t I?

You see, my whole purpose in digging into FREL was to find out how it differed from VNQ, and then share my opinion of those differences.

Instead, to my surprise, I discovered something quite different.

For all practical purposes, FREL is VNQ!

I wasn’t ready for that. After all, the two indexes are named slightly differently. The index into which VNQ transitioned is the MSCI US IMI Real Estate 25/50 Index while, as featured above, FREL tracks the MSCI USA IMI Real Estate Index. I expected to find some differences, perhaps even fairly substantial ones.

However, follow me through the next few pictures and see what you think.

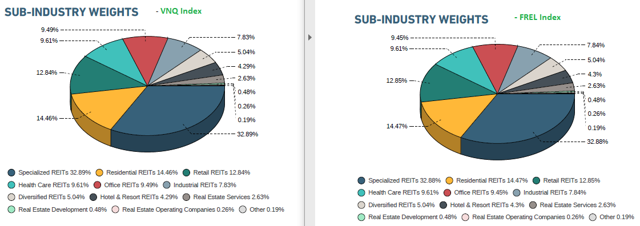

I already produced the sub-industry graphic for FREL above. I repeat it below, on the right-hand side. On the left hand side is the equivalent graphic for the index used by VNQ.

Source: Fact Sheet for MSCI US IMI Real Estate 25/50 Index

Source: Fact Sheet for MSCI US IMI Real Estate 25/50 Index

If you expand that picture and check it carefully, you will find both are virtually identical. The biggest variance I can find is a .04% difference in office REITS (9.49% vs. 9.45%) and most others are either identical or have a difference of .01%.

“Surely, that can’t be right,” I thought. So, I checked the index characteristics section.

First, here it is for VNQ’s index.

Source: Fact Sheet for MSCI US IMI Real Estate 25/50 Index

Source: Fact Sheet for MSCI US IMI Real Estate 25/50 Index

Next, for FREL’s index.

Source: Fact Sheet for MSCI US IMI Real Estate Index

Source: Fact Sheet for MSCI US IMI Real Estate Index

Again, virtually no difference. VNQ’s index has exactly two more constituents. However, as can be seen, not only are the Top 10 holdings in both indexes exactly the same, but their overall weighting is only .03% different!

Summary and Conclusion

I undertook the research for this article hoping to illuminate the differences between FREL and VNQ. To my surprise, I found that, for all practical purposes, they are exactly the same!

Perhaps this is of greatest interest to Fidelity Brokerage clients. In FREL, such investors would have essentially the equivalent of VNQ, but both at a slightly lower expense ratio and with the benefit of commission-free trading. As one caveat, FREL’s trading spread is slightly higher so, if you are anything but a steady long-term holder, you would need to be careful not to eat up any advantage you gained.

Bonus Article Link

Careful readers might have caught a subtle detail mentioned at the outset, namely that my reader was responding to a post on my personal blog.

As it happens, that article featured a relatively new ETF developed by none other than fellow Seeking Alpha contributor Hoya Capital Real Estate.

If you haven’t yet been exposed to this ETF, you might be interested in checking out my review. You’ll find that it starts from a similar concept to a pure REIT ETF, such as VNQ or FREL, but takes it in a direction that offers effectively a “one stop” vehicle for investing in the entire U.S. housing market. If nothing else, it’s worth a look.

As always, until next time, I wish you … happy investing!

Disclosure: I am/we are long VNQ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult with their personal tax or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal.

[ad_2]

Source link Google News