[ad_1]

Khoa Nguyen

iShares MSCI Frontier and Select EM (NYSEARCA:FM) is an exchange-traded fund that provides investors with exposure to so-called frontier market equities, including smaller-sized emerging market stocks. The fund attempts to focus on investing in markets with greater liquidity/investability. However, the fund’s expense ratio is still high, presumably due to a combination of low assets under management and the difficulty associated with managing a portfolio of equities in relatively undeveloped equity markets.

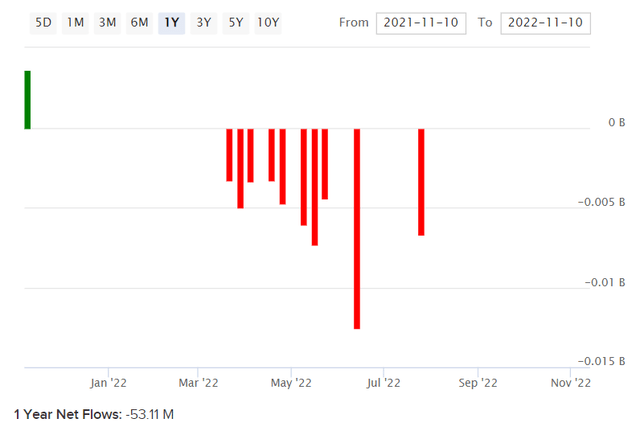

FM’s expense ratio is 0.79%, with net assets under management of $310 million as of November 11, 2022. That follows negative net fund flows of circa -$53 million over the past year.

ETFDB.com

My last article covering FM was posted on December 13, 2021, when I took a neutral view given what I perceived was modest over-valuation. That was in spite of high implied returns; I thought that the risk/reward was not satisfactory, especially in light of poor historical performance. Since then, FM has fallen by -29.15% on a price-only basis, versus the S&P 500 U.S. equity index’s fall of -15.23%. In a sense, you could argue that FM has moved, therefore, with a “beta” of circa 1.91x. The historical five-year beta of FM is estimated at 0.84x, however this is not so useful given the clearly higher risk of the fund; also, less liquid instruments (and/or instruments whose prices are derived from less liquid portfolios) can often trade less, and therefore result in lesser volatility over certain time periods in spite of higher actual risk.

It is worth revisiting given the larger fall in FM vs. the U.S. equity market. It may be possible that FM was over-valued before, but is now either fairly valued or even under-valued. For one, it is interesting to note that FM seems to follow an up-and-down cycle (since the fund’s inception in late 2012).

TradingView.com

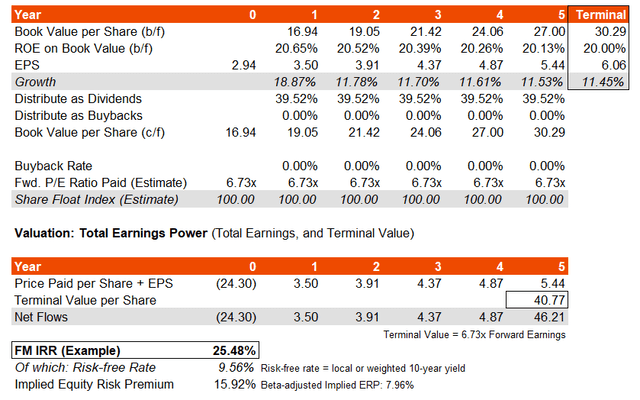

The fund seeks to replicate the performance of its chosen benchmark index, the MSCI Frontier and Emerging Markets Select Index. The most recent factsheet for the index, as of October 31, 2022, provides us with trailing and forward price/earnings ratios of 8.00x and 6.73x, respectively. The price/book ratio was 1.39x, and the indicative dividend yield was 4.94%. These figures imply a forward return on equity and forward earnings yield of 20.65% and 14.86%, respectively. Already, that would suggest a longer-term return potential of 15-20% per annum over the medium- to long-term, in my view, but we would also need to consider actual valuation. A high underlying IRR potential is not enough, as we have already seen with FM’s recent declines, to justify investing.

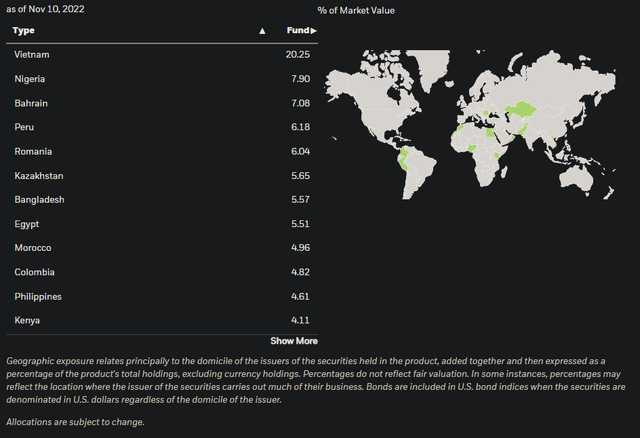

FM is exposed to various geographies (see below). These include Vietnam (20%), Nigeria (8%), Bahrain (7%), Peru (6%), Romania (6%), and various others. These are all difficult equity markets to get access to for most retail investors, so FM definitely serves a purpose. That does not make it an attractive investment, however, we will continue with the valuation process.

iShares.com

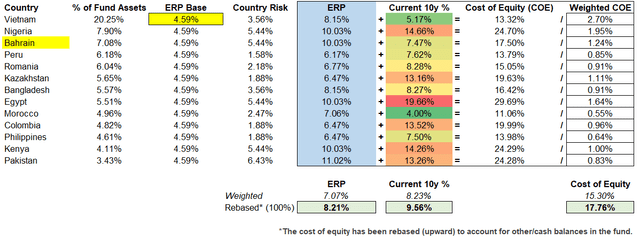

The geographic exposures are relevant to estimating the fair cost of equity for the portfolio. I have generated an estimate below using equity risk premium and country risk premium estimates for 2022 from Professor Damodaran, coupled with risk-free rates taken from recent 10-year bond yields of each FM country exposure. Given the lack of data for Bahrain, the 10-year yield is estimated based on yields of other available durations.

Author’s Calculations

The cost of equity comes to 17.76%. This would imply that we should be demanding a return of at least 17.76% from FM, and if the forward earnings power of FM’s portfolio is not high enough (relative to the prevailing share price) then we should not invest.

If we give FM’s portfolio the benefit of the doubt that it can maintain a return on equity of at least 20% over the next few years, and keep most other factors constant, my IRR gauge would imply a potential annual return of circa 25.5% over the next five years. This is based on the most recent portfolio composition (at October 2022 month-end) and associated underlying earnings power. The three- to five-year average earnings growth rate per my inputs comes to 13.06-14.07%, which is just below the consensus offered by Morningstar for FM’s portfolio of 15.09%.

Author’s Calculations

Our cost of equity since my last article covering FM has risen, including both equity risk premia, and risk-free rates (with interest rates rising dramatically this year on average). Nevertheless, in spite of a hefty almost-18% cost of equity, the forward IRR potential is perhaps as high as 25% for FM per the above data. This also assumes a constant price/earnings multiple and constant FX rates.

The earnings multiple is probably fine, although it is not “cheap” in spite of the earnings multiple of just 6.73x (currently) being perceivably very low. Frontier markets are presumably better positioned than the developed world on average to endure higher-than-average earnings growth rates until they achieve greater economic maturity. Assuming a 2-4% perpetual growth rate, and an equity risk premium of at least 11% in the long run (twice the upper bound of the 4.2-5.5% ERP range I typically suggest for mature equity markets), and an average risk-free rate of say 10% (to be conservative), the fair forward earnings multiple would be circa 5.26-5.88x. Reducing the expected risk-free rate over time and/or equity risk premia would help, but basically my idea is that the earnings multiple is fairly low, and we should not expect an expansion of the multiple over time.

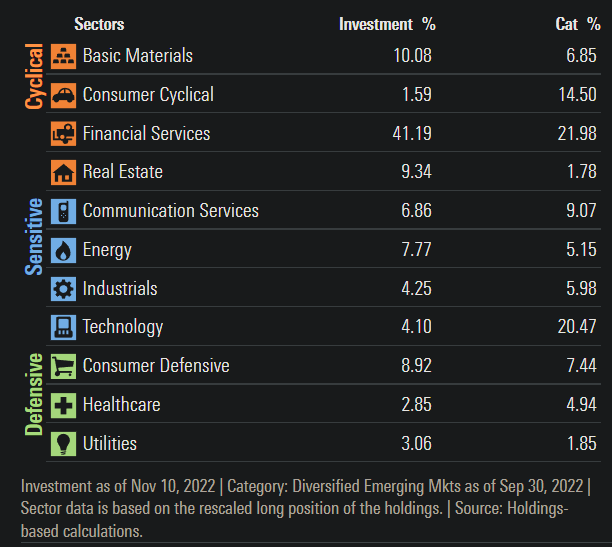

FM is probably undervalued at this juncture. Further, its sectors are largely cyclical (financials and materials). As the world economy heads into a new economic cycle, with markets leading the real economy by 6-12 months, it is possible that FM will rally into the next business cycle (especially given both its under-valuation, cyclical characteristics, and the tendency for the U.S. dollar to soften when markets become more bullish).

Morningstar.com

Therefore, I would take a bullish view on FM from November 2022. I think there is potential for FM to see another “up-cycle” in line with its past price action as illustrated earlier.

[ad_2]

Source links Google News