[ad_1]

shih-wei/E+ via Getty Images

Investment thesis

FinTech is a global theme, poised to benefit as expanding broadband and mobile internet penetration coincide with a rising middle class in developing markets, historically under-served by traditional financial services. While FinTech companies have historically catered to the digital preferences of younger consumers, they are increasingly competing on cost and convenience across a range of more established industries like lending and insurance. In 2020, the number of active online banking users was approaching 1.9bn worldwide. Forecasts suggest that number could reach 2.5bn by 2024, highlighting the vast reach in just one segment of this theme. In this article, I will review the Global X FinTech Thematic ETF (NYSEARCA:FINX) which provides exposure to a basket of international FinTech stocks.

Strategy Details

The Global X FinTech Thematic ETF tracks the performance of the Indxx Global Fintech Thematic Index. The index invests in companies on the leading edge of the emerging financial technology sector, which encompasses a range of innovations helping to transform established industries like insurance, investing, fundraising, and third-party lending through unique mobile and digital solutions.

If you want to learn more about the strategy, please click here.

Portfolio Composition

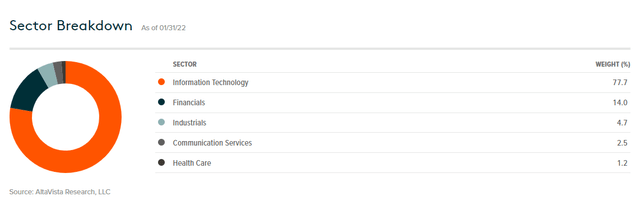

From the sector allocation chart below, we can see the index places a high weight on the information technology sector (representing around 77.7% of the index), followed by Financials (representing around 14% of the ETF) and Industrials (accounting for 4.7% of the portfolio). The largest three sectors have a combined allocation of approximately 96.4%. Unsurprisingly, FINX is highly concentrated in sectors related to the financial sector. I think it is important to see how that fits your investment goals and if you’re comfortable with higher exposure to tech stocks and financials.

Global X ETFs

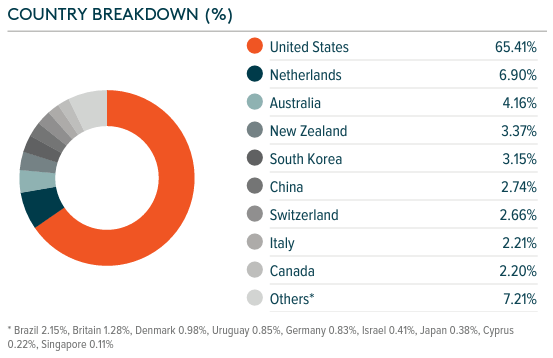

The top 3 countries represented approximately 76% of the portfolio. The US has the largest allocation (~65% of the fund), followed by the Netherlands at ~7% and Australia at ~4%.

Global X ETFs

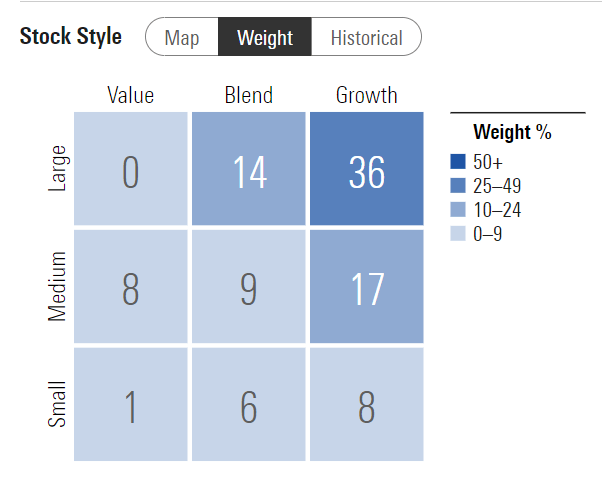

FINX invests over 36% of the funds into large-cap growth, characterized as large-sized companies where growth characteristics predominate. Large-cap issuers are generally defined as companies with a market capitalization exceeding $8 billion. The second-largest allocation is in mid-cap growth issuers, accounting for ~17% of the portfolio. It is interesting to see that FINX allocates more than 60% of the funds to growth stocks that generally re-invest all available cash flow into growth opportunities. These companies tend to have on average a higher beta. Therefore, I think it is important to determine if you are comfortable with a higher level of volatility.

Morningstar

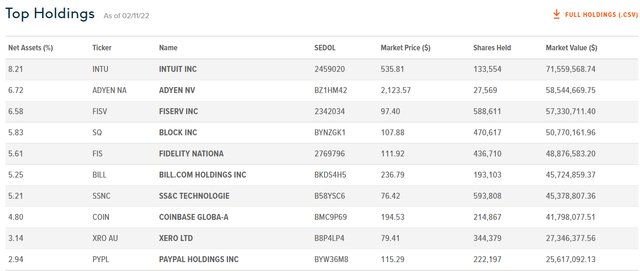

The fund is currently invested in 65 different stocks. The top ten holdings account for 52.01% of the portfolio, with no single stock weighting more than 9%. All in all, I would say that FINX is well-diversified.

Global X ETFs

Since we are dealing with equities, one important characteristic is the valuation of the portfolio. According to data from Global X ETFs, the fund currently trades at an average price-to-book ratio of 3.72 and at an average forward price-to-earnings ratio of ~22.5. In addition to that, the portfolio has a return on equity of 15.4%. Even if I don’t consider the current valuation to be cheap, I think it is pretty obvious that FINX is now much cheaper than it used to be 4 months ago. In my opinion, this eliminates a lot of valuation risk. Moreover, these companies are able to generate a very good return on equity and have high growth opportunities, thus it is fair to assume that their valuation should command a premium. Overall, I think FINX is fairly valued at the moment. However, it is impossible to predict if the pullback in tech stocks will continue over the next month or not, which adds a lot of uncertainty to the bullish thesis.

Is This ETF Right for Me?

I have compared below the price performance of FINX against the performance of the Invesco QQQ ETF (NYSEARCA:QQQ) over 5 years to assess which one was a better investment. Over that period, FINX has underperformed QQQ but did better than the S&P 500. Compared to FINX, QQQ rose by more than 64 percentage points. To put FINX’s performance into perspective, a $100 investment in FINX five years ago would now be worth $205.49 after accounting for the recent sell-off. This represents a compound annual growth rate of more than 15%, which is a very good absolute return.

However, this chart clearly shows how volatile this strategy can be. In all the major pullbacks of the past five years, FINX had a higher drawdown than QQQ, which definitely makes it much more volatile. If you plan on buying this ETF for a long period of time without selling anything in between, I think you will end up with a good result. However, in the short term, I do not think FINX is suitable for an investor, but rather for a trader looking to benefit from FINX’s volatility.

Refinitiv Eikon

Key Takeaways

Fintech is an exciting industry as the returns are high and the future perspectives are appealing. That said, I think it is hard to pick tomorrow’s winners as the industry is driven by continuous innovation. This is definitely a factor that could explain why this strategy is so volatile. For the abovementioned reasons, I don’t think FINX is suitable for investors with low-risk tolerance. However, if you have the stomach to hold through some brutal drawdowns and if you approach this investment from a long-term perspective, I think FINX could deliver a fair return after all at the current valuation.

[ad_2]

Source links Google News