[ad_1]

imaginima

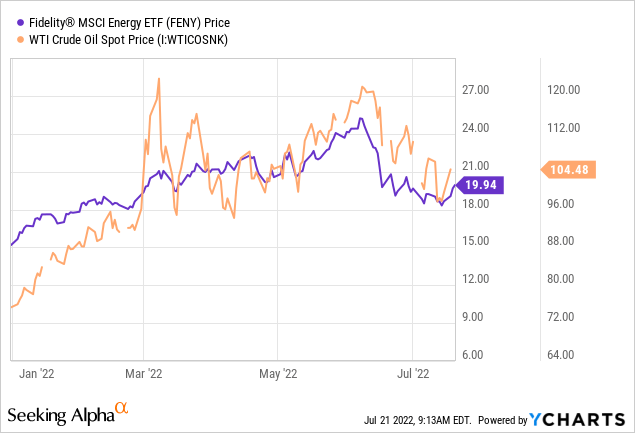

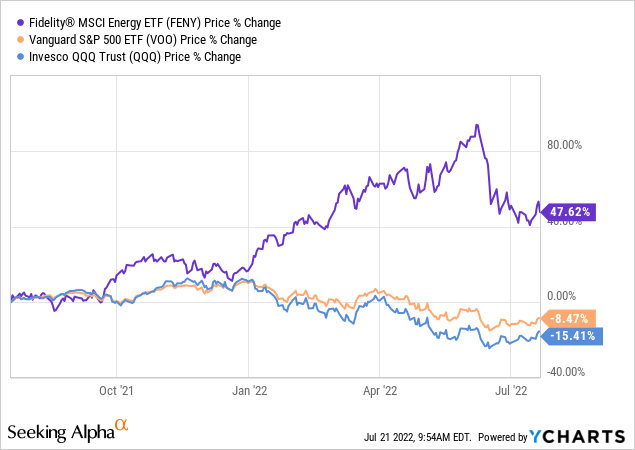

Due to the pullback in the price of oil, the Fidelity MSCI Energy ETF (NYSEARCA:FENY) is down ~20% since its June high (see graphic below). That decline took place despite the fact that the macro-environment for the energy sector – specifically for refiners and LNG suppliers – is still very bullish. Indeed, the refining sector is set to report record profits in Q2. Meantime, global LNG prices – due to Putin’s horrific war on Ukraine and the resulting sanctions placed on Russia by the U.S. and its Democratic and NATO allies – are still very strong. And despite the pullback in WTI, note it still remains significantly over 2x the generally considered breakeven point for the majority of large-scale US shale companies (estimated ~$40/bbl). Combined with the fact that, as compared to the overall market, the energy sector remains an extreme value in the challenging bear market of 2022, I rate FENY a BUY.

Investment Thesis

First off, and despite the recent pullback in the price of oil, note that WTI is currently trading at $96/bbl. That is more than 2x the breakeven price of most large-scale U.S. shale operators, which is generally considered to be in the neighborhood of ~$40/bbl.

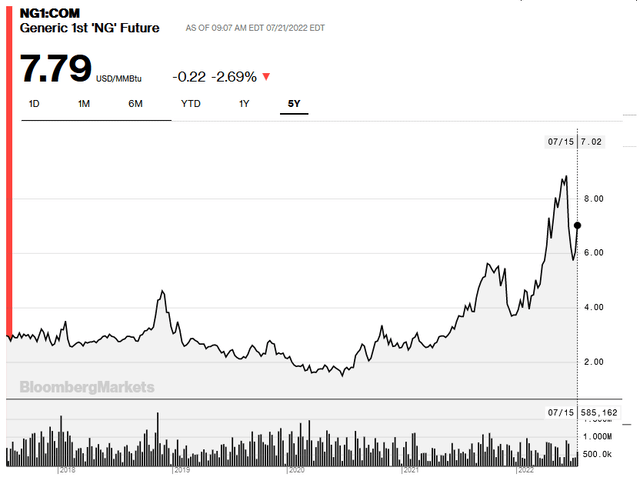

Secondly, and despite selling at a huge discount to global natural gas prices, NYMEX gas is currently trading at $7.82/MMBtu. Once again, that is extremely elevated in comparison to the recent past and a very positive catalyst for the associated nat gas production of the major U.S. shale companies.

Bloomberg

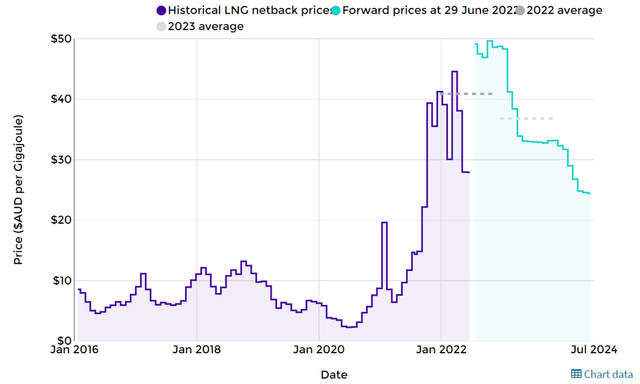

Thirdly, and despite demand destruction by recent COVID-19 related lockdowns in China, Australian LNG prices remained significantly elevated during Q2 at more than double the price of the past few years:

GlobalLNGHub.com

Lastly, refining margins, especially for US refiners that have much lower nat gas feedstock costs as compared to the rest-of-world, are extremely strong. Indeed, Exxon (XOM) recently reported that Q2 refining margins were so strong that they could add as much as $5.5 billion to Q2 refining profits. That’s obviously a huge number.

So let’s take a closer look at the FENY ETF to see how it has positioned investors to benefit from the bullish macro environment for energy.

Top 10 Holdings

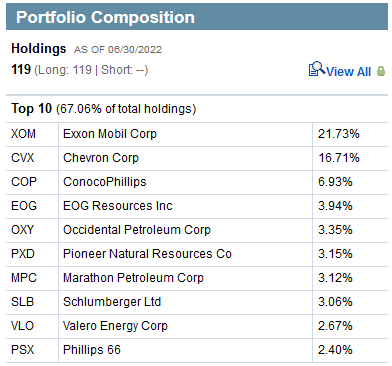

The top-10 holdings in the FENY ETF are shown below and equate to what I consider to be an overly concentrated 67% of the entire portfolio. That is especially the case given the fund’s 38.4% weighting in its top-2 holdings alone: Exxon and Chevron (CVX):

Fidelity

However, I am fine with the fund’s allocation to these two energy heavyweights for two reasons. First, Exxon’s Q2 pre-announcement was a very bullish indicator going forward. And, second, Chevron has excellent exposure to Australian LNG – which, as previously mentioned, is currently a very bullish market.

The #3 holding is ConocoPhillips (COP) with a 6.9% weight. COP, as I have reported, is generating massive free-cash-flow due to two very well-timed acquisitions in the Permian Basin at the bottom of COVID-19 market cycle: Concho Resources and the subsequent purchase of the majority of Shell’s Permian assets (see ConocoPhillips: A Lot To Like).

ConocoPhillips finally instituted a variable dividend policy ($0.70/share in Q1), but its variable dividend severely lags that of peers EOG Resources (EOG), the fund’s #4 holding, and Pioneer Natural Resources (PXD), the fund’s #6 holding, at $1.80 and $6.60 in Q1, respectively. All of these top U.S. shale producers are just killing it with WTI at significantly more than 2x their breakeven price.

The fund has an aggregate 8.2% allocation to refiners Marathon Petroleum Corp (MPC), Valero (VLO), and Phillips 66 (PSX). Based on strong crack margins, I expect all of these refiners to report record or near-record refining profits in Q2. That is especially the case for PSX, which has excellent exposure to diesel, considered it has a leading global position in coking capacity. That said, my major criticism of this fund is that it is a bit underweight the refiners given the very bullish backdrop of strong crack margins.

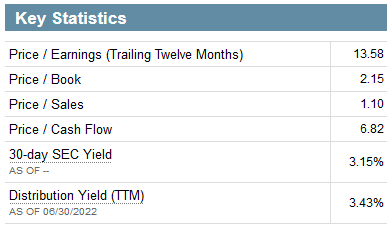

Market Metrics

As mentioned in the article’s bullets, the FENY ETF represents extreme value in my opinion. This is easily demonstrated from some common market valuation metrics:

Fidelity

The 30-day and TTM yields are relatively attractive in comparison to the current S&P 500 yield of 1.7%. That is especially the case given that the outlook for dividend growth from FENY’s energy holdings is excellent going forward.

Performance

Despite the recent pullback, the FENY ETF has significantly outperformed the S&P500 and Nasdaq-100, as represented by the (VOO) and (QQQ) ETFs, respectively, over the past year:

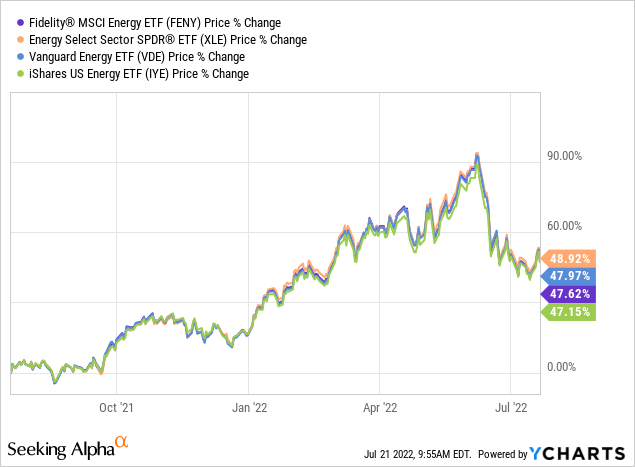

The graphic below compares the FENY ETF with several of its competitors over the past year: the Energy Select Spider ETF (XLE), the Vanguard Energy ETF (VDE), and the iShares US Energy ETF (IYE):

As you can see, there is not much difference in these funds’ relative performance. That being the case, it isn’t as important as which energy fund investors choose, but that they establish a position in the sector.

Risks

As always, the risks of investing in a cyclical commodity sector like energy are significant. Higher inflation and the resulting higher interest rates will likely cause global economic contraction at best, and a global economic recession at worst. That could cause various levels of energy demand destruction. However, at the present time, the supply/demand fundamentals remain quite strong in my opinion.

A settlement of Putin’s war-of-choice in Ukraine and the resulting sanctions placed on Russia could exert downward pressure on oil & gas prices. However, a settlement would likely also lead to economic rebounds in various countries that are currently suffering high energy & food prices as a result of Putin arguably breaking the global energy & food supply chains.

US shale producers could decide to produce more – and they very easily could do so considering the billions of bbls of proven shale reserves (at $40/bbl, let alone $100/bbl), have the pipelines to get that product to market, and could easily bring new shale wells onto market in a matter of weeks (not a year as some CEOs are saying). After all, U.S. remains exactly what these same CEOs have been saying for years: short-cycle assets that can be easily and economically scaled-up (or down).

Longer term, one reason the energy sector is trading at such “value” (at least in terms of the metrics listed above) is because of the threat that EVs and renewable energy adoption pose in the long-run. Indeed, most analysts expect EVs to account for 50% of new vehicle sales by 2030. My opinion is that estimate – given the current very high price of gasoline and the number of lower cost EV options hitting the market – is likely to be on the low side.

Summary & Conclusion

Fidelity’s FENY ETF is, at the current time, as good as any other energy ETF available to investors. It has a reasonable expense fee (0.08%) and a relatively strong yield (3.2%). The fund is overweight the biggest two American O&G companies (Exxon & Chevron), but the fundamentals of both these companies are very strong at the moment and the outlook for dividend growth is excellent. My only criticism is that the fund could have a higher allocation to the refining sector, but the refiners are traditionally quite cyclical and perhaps, in the long run, the FENY’s positioning is less risky for investors that want to buy-and-hold this ETF. The bottom line here is that oil, natural gas, refined products like diesel & gasoline, and LNG prices all remain elevated. That means these energy companies are likely going to shock investors with their upcoming Q2 EPS reports, which I expect to be spectacular. And those earnings and massive FCF will likely lead to excellent dividend growth.

FENY is a BUY.

[ad_2]

Source links Google News