[ad_1]

da-kuk/E+ via Getty Images

The SPDR EURO STOXX 50 ETF (NYSEARCA:FEZ) is supposed to be a broad European exposure, but it isn’t really. While an important economy, France is not the majority of European enterprise at all. Also, France typically conducts itself more independently than others in Europe in some key areas, including energy policy. Nevertheless, the FEZ exposures end up not being very representative of a European bet, and they lean heavily on consumer discretionary exposures which are going to retreat hard in a more serious recession. Trading only at a modest discount from the iShares Core MSCI Europe ETF (IEUR), we do not feel they are a compelling buy.

FEZ Breakdown

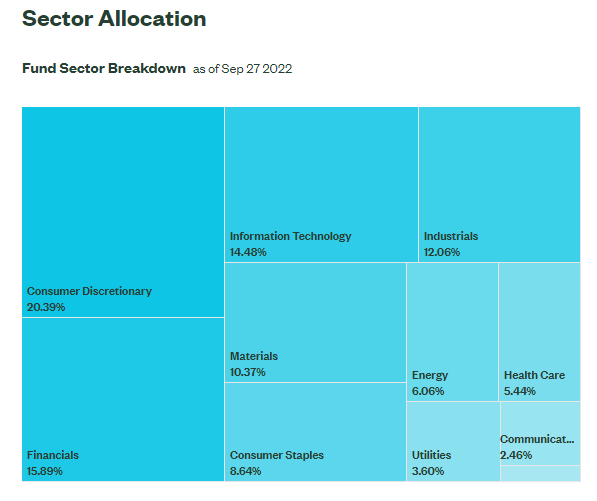

Let’s break down FEZ beginning with sectors.

Sectors (SSGA.com)

There is a heavy lean towards consumer discretionary exposures. Many of these are fashion but also cars and appliances. The latter in particular are likely to suffer as they are not only discretionary but consumer durables, often financed by consumer finance programs. When we are looking at a rate hiking environment any activity that relies on leverage is liable to decline. Even fashion merely on the basis that it is discretionary is likely to produce earnings declines, also because they would be exposed to inflation, much like cosmetics.

Financials feature quite heavily, at a 16% exposure to the 20% of consumer discretionary. This has some offsetting effects since financial exposures are likely to be well positioned on both the insurance and banking side. Rate hikes will produce greater net interest margins in banking, and they will also improve better rolling over yields in substantially short-duration fixed-income insurance reserve portfolios. Nonetheless, their positioning to increase earnings is stymied by savings rates, which while trailing lending rates, must eventually rise.

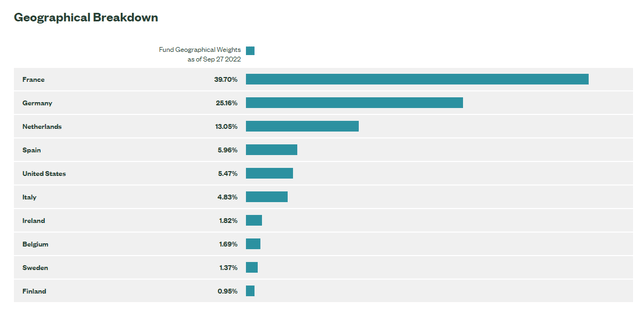

Geographies (SSGA.com)

On a geographic basis, while not particularly impeaching as France is a well-run and relatively independent economy, independent of Russian energy supply, a fair representation of Europe is not achieved by FEZ, although that may not be the goal.

Conclusions

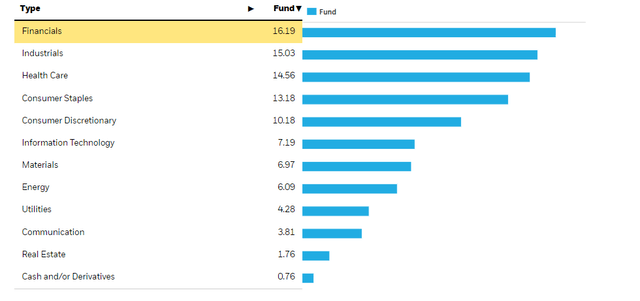

The issue then comes to valuation. The IEUR which has an 11% PE, and therefore 9% earnings yield with a higher potential of earnings growth due to larger financial exposures trades only at a 12% premium to the FEZ, which lies just under 10x in PE implying an earnings rate marginally higher than 10% with substantial consumer discretionary exposures which are weak. IEUR appears to be the better deal. Moreover, the IEUR has an expense ratio of only 0.1% to the FEZ’s 0.3%.

IEUR Sectors (iShares.com)

It appears a better option and a more representative bet on Europe’s markets, which while heavily beleaguered still have at least come down in a manner more realistic of the current macroeconomic climate as opposed to other market indices. If I were to hazard cash in an equity ETF, IEUR appears the sturdier bet.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Source links Google News