[ad_1]

Ayman-Alakhras/iStock via Getty Images

Investment Thesis

This year, the Fidelity High Dividend ETF (NYSEARCA:FDVV) was a safe haven for dividend investors, offering a solid 3% yield and a price-performance 11% better than the S&P 500 Index. However, its Index rebalanced in February, so I always encourage investors to do at least an annual checkup to ensure the product continues to meet their objectives.

This article will evaluate these Index changes and FDVV’s latest fundamentals compared with two Russell 1000 ETFs. I’ve determined that FDVV is less volatile than previously, has more substantial dividend growth potential, and yields approximately 3.28% at current prices. While it doesn’t appear to hold any advantage over low-cost value ETFs from a fundamentals perspective, FDVV’s strong dividend characteristics are enough to tip the scales in its favor. Therefore, I’m maintaining my buy rating on FDVV, and I’m excited to take you through my reasons.

ETF Overview

Strategy and Fund Basics

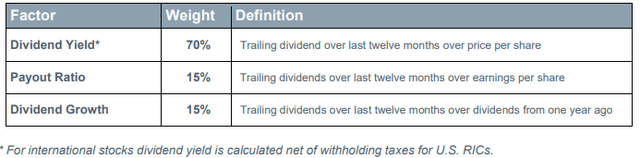

FDVV tracks the Fidelity High Dividend Index, a proprietary strategy focusing on three factors:

Fidelity

Fidelity uses these factors to calculate a composite score for each Russell 1000 security. However, scores are calculated separately for each sector. Quant investors should favor this method since dividend and value ETFs are often light on richly-valued stocks in the Technology sector. As for the actual criteria themselves, they seem reasonable, but I do have some criticisms:

1. Trailing ratios may be problematic after significant market events. I prefer forward-looking metrics, and it’s unclear if protections exist against yield traps.

2. The one-year measurement period for the dividend growth criteria is too short. Dividend investors typically look for consistent growth over the last three and five years, supported by solid revenue and earnings growth.

3. More emphasis should be on ensuring dividend growth will continue. I would assign a weight of 25% to the payout ratio and dividend growth factors and drop the dividend yield weight to 50%.

That’s just me, but at least FDVV accomplishes its key objective of delivering a relatively high yield. Currently, it’s 2.91%, and I’ve listed some other descriptive statistics below that you might find helpful.

- Current Price: $39.46

- Assets Under Management: $1.11 billion

- Expense Ratio: 0.29%

- Launch Date: September 12, 2016

- Trailing Dividend Yield: 2.91%

- Three-Year Dividend CAGR: -2.01%

- Five-Year Beta: 1.05

- Number of Securities: 102

- Portfolio Turnover: 32%

- Assets in Top Ten: 28.75%

- 30-Day Median Bid-Ask Spread: 0.10%

- Tracked Index: Fidelity High Dividend Index

The expense ratio of 0.29% is slightly elevated, but I don’t think it should be a deal-breaker for dividend investors. However, the 0.10% median bid-ask spread is high, so the costs will increase if you plan to trade FDVV frequently. That is not my recommendation.

The three-year annualized dividend growth of -2.01% is disheartening due to that factor not being prominent in the screening process. Four-year annualized dividend growth is better at 2.52%, but FDVV seems better suited for those desiring a high yield today than in ten years.

Sector Exposures and Top Holdings

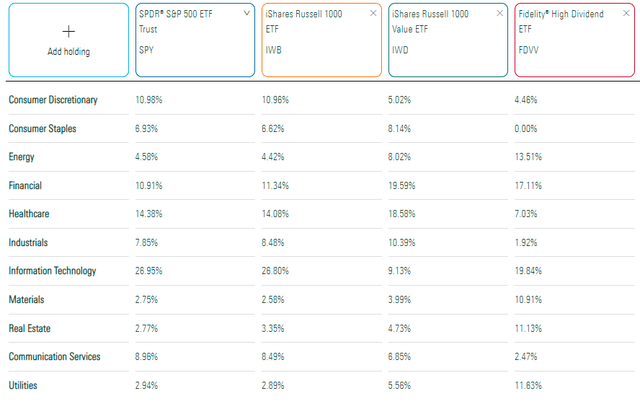

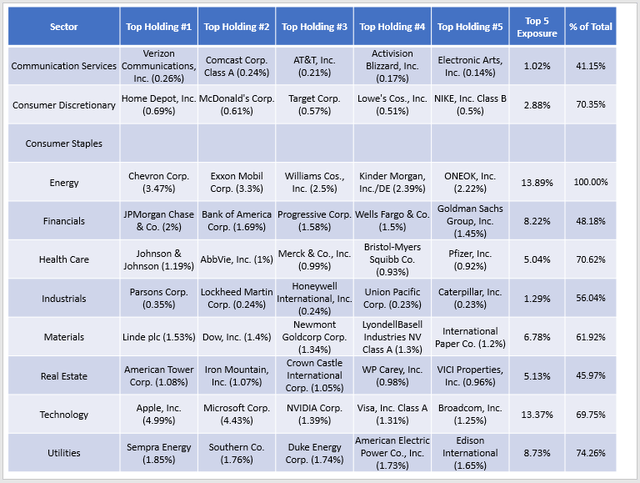

The table below highlights FDVV’s sector exposures alongside three other ETFs: the SPDR S&P 500 ETF (SPY), the iShares Russell 1000 ETF (IWB), and the iShares Russell 1000 Value ETF (IWD). As mentioned previously, calculating composite scores at the sector level means Technology stocks aren’t penalized. FDVV’s allocation to this sector is 19.84% and is one of the highest among dividend ETFs.

Morningstar

FDVV’s top ten holdings as of April 29, 2022, are listed below. In May, weightings have changed slightly, and I’ll be using the most updated numbers in my analysis. Still, most of this list is intact, though Williams Companies (WMB) and Kinder Morgan (KMI) have fallen to #14 and #15, while Wells Fargo (WFC) has entered the top ten.

Fidelity

Performance Analysis

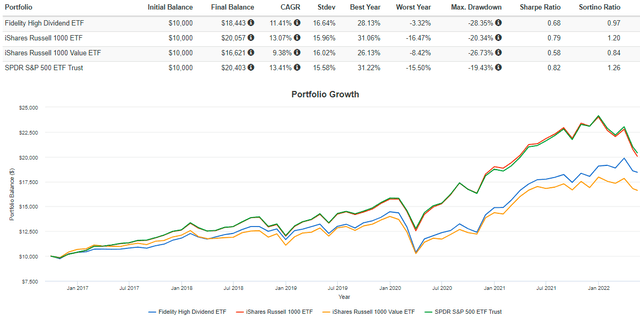

FDVV hasn’t been around too long, but since its inception, it has delivered an annualized 11.41% gain assuming reinvested dividends, placing it about in the middle of IWD and IWB’s gains of 9.38% and 13.07%, respectively. Like many high-dividend ETFs, FDVV failed to offer much protection through the Q1 2020 crash, losing 28.35%. However, it’s only down 3.32% this year, 4.15% and 13.15% better than IWD and IWB.

Portfolio Visualizer

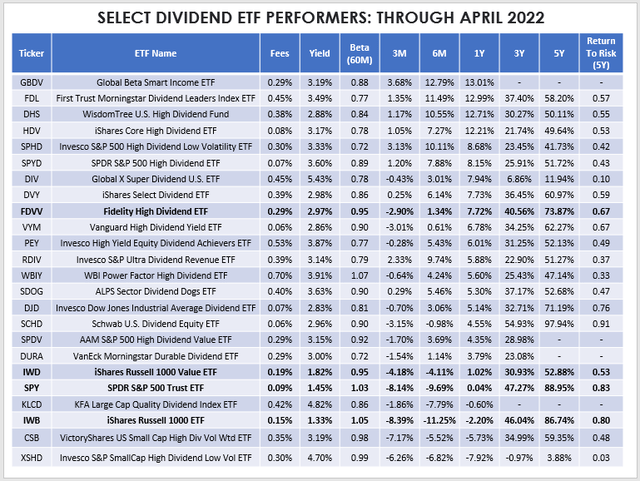

The high-dividend category has excelled lately, so FDVV is far from a unicorn ETF. Below is a table highlighting performances through April 2022 for dividend ETFs with yields around 3% or better. I’ve also included SPY, IWB, and IWD, making it easy to see how well the category has done over the last year.

The Sunday Investor

In this sample, FDVV placed #9 in the last year, and out of 65 dividend ETFs I report on each month, it was 17th best. ETFs with lower technology exposure did better, but FDVV shareholders should be happy with the performance as far as diversified dividend funds go.

This table also highlights a changing of the guard since the top recent performers all have relatively low five-year return-to-risk ratios (annualized return divided by annualized standard deviation). I think value stocks will continue to outperform in the near term, but it’s always nice to also have some growth potential if growth stocks make a comeback. Next, let’s look at how FDVV changed after the February reconstitution and compare its current fundamentals with IWB and IWD.

ETF Analysis

Reconstitution Results

The Diversified Banks industry was FDVV’s top exposure area in February, but today it’s Electric Utilities, and that’s a change I favor. As I described in my article on the Utilities Select Sector SPDR ETF (XLU), utility stocks are the most efficient way to de-risk a portfolio. XLU won’t necessarily underperform just because U.S. Treasury yields rise. After my bullish article, XLU performed the third-best out of the 11 SPDR Sector ETFs with a 0.99% total return since March 17. Consumer Staples gained 4.90%, while Energy gained 13.19%. Interestingly, the top five additions by weight were all Utility stocks:

- Sempra Energy (SRE): 1.85%

- Southern Company (SO): 1.76%

- Duke Energy (DUK): 1.74%

- American Electric Power (AEP): 1.73%

- Edison International (EIX): 1.65%

The top five deletions by weight were Consumer Staples stocks along with one Financials stock, as follows:

- Procter & Gamble (PG): 2.41%

- Coca-Cola (KO): 2.09%

- PepsiCo (PEP): 2.07%

- Philip Morris International (PM): 2.07%

- Prudential Financial (PRU): 1.76%

The table below should give you more insight into FDVV’s makeup. It shows the top five holdings in each sector and their current allocations and represents about 69% of the ETF.

The Sunday Investor

This table lets you see how diversified FDVV is within each sector. For example, the top five Energy stocks account for 100% of FDVV’s allocation to that sector. In other words, it’s not very diversified among Energy stocks. In contrast, the top five Real Estate holdings total only 45.97%, indicating there are many other Real Estate securities in the portfolio, and you’re more likely to get some diversification benefits in this sector.

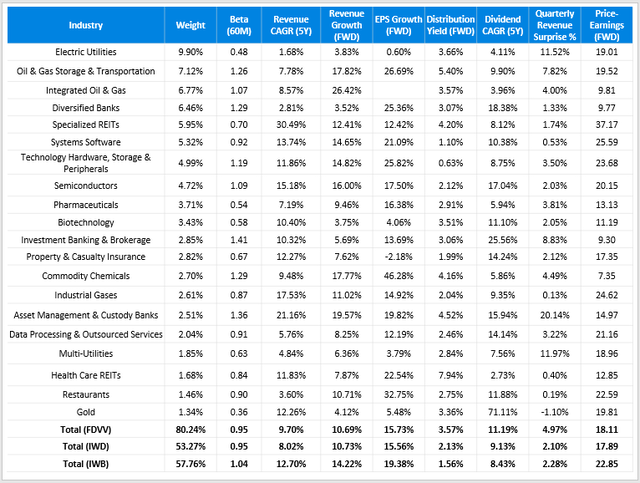

Snapshot By Industry

The table below provides a summary of FDVV by its top 20 industries. Electric Utilities and Oil & Gas stocks make up almost one-quarter of the ETF, followed by Diversified Banks, Specialized REITs, and three tech-related industries.

The Sunday Investor

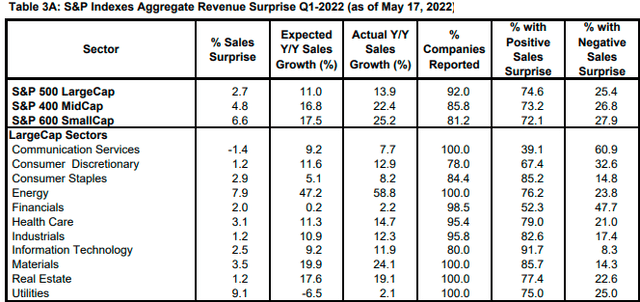

Overall, FDVV’s five-year beta decreased to 0.95 and is now in line with IWD, meaning shareholders can expect about the same level of volatility. However, it doesn’t look like FDVV has any advantage on revenue and EPS growth or valuation. If anything, the bright spot has been the Electric Utilities industry since its weighted-average revenue surprise was 11.52%. This result is confirmed by Yardeni Research, showing the large-cap Utilities sector had the biggest revenue surprise (9.10%) this quarter. Worth noting is that all seven of FDVV’s holdings in this sector had a positive revenue surprise.

Yardeni Research

While FDVV looks similar to IWD on valuation and growth, it does provide a substantially higher dividend. The weighted-average gross yield is 3.57%, and after deducting fees, shareholders can expect an annualized yield of 3.28% at current prices. Dividend growth is also strong at 11.19%, standing in contrast to the fund’s historical lackluster growth mentioned previously. This combination of high yield and dividend growth is excellent, but if you plan on reinvesting your dividends anyways, you should aim for a low-cost, low-yielding fund to save on fees and taxes.

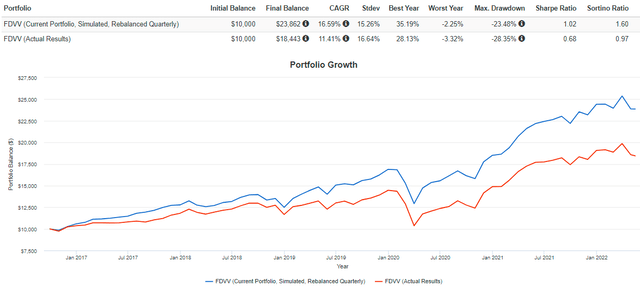

Simulated Portfolio

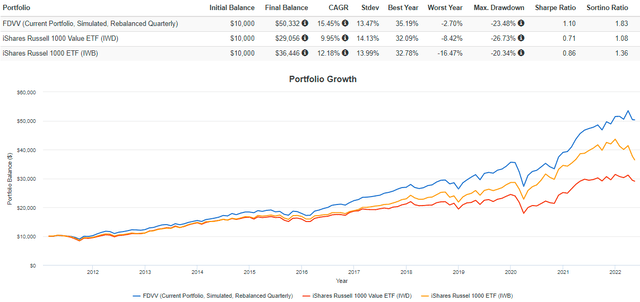

Finally, I want to provide backtested results for FDVV’s current portfolio to see how it compares with the ETF’s actual returns. I noticed a fair bit of turnover in February, and there’s a chance that past results aren’t indicative of what the ETF holds today. To get at least a ten-year lookback, I excluded 15 stocks from this analysis, but they only total 6.34% in weight, so it’s unlikely to have much impact.

Portfolio Visualizer

FDVV’s current portfolio would have returned an annualized 16.59% since October 2016 compared to FDVV’s actual 11.41% annualized return. All metrics were favorable, including lower volatility, lower maximum drawdown, and better risk-adjusted returns (Sharpe and Sortino Ratios).

To clarify, it’s not uncommon for backtested results to appear overly positive due to the benefit of hindsight. An Index is usually created based on a proof of concept that suggests specific factors will produce better returns. However, it doesn’t always work out well. Nevertheless, I think it’s telling that an Index that should select deeply discounted (i.e., high yield) stocks happened to choose ones that performed exceptionally well in the past. This becomes clearer when comparing ten-year results with IWD and IWB (link here).

Portfolio Visualizer

Though FDVV’s current portfolio would have performed exceptionally well in the past, I won’t base my conclusion on simulated results. However, I’m pleased to see that FDVV doesn’t just own the most beaten-down, high-yield stocks. There’s a quality aspect that indicates these stocks can perform well.

Investment Recommendation

In this article, I evaluated FDVV based on its past performance, the impact of the February reconstitution, an assessment of its fundamentals, and the backtested results of its current portfolio. While results were positive for three of these tests, I place the greatest importance on fundamentals, and in that respect, I don’t see FDVV having much of an advantage over the IWD from a total returns perspective. Its five-year beta, forward revenue and EPS growth, and forward price-earnings ratios are virtually identical, and as a rule of thumb, you should default to the lowest-cost option. IWD charges 0.19%, and the Vanguard Russell 1000 Value ETF (VONV) is even better at 0.08%.

However, FDVV has a clear edge on dividend yield. Constituents have an estimated yield of 3.28% after fees, and the ETF is also poised to improve its dividend growth record. Therefore, I recommend buying FDVV if you need a high yield or don’t plan on reinvesting dividends. Otherwise, I think you can do just as well with a cheaper large-cap value fund like IWD or VONV. Thank you for reading, and I look forward to your comments.

[ad_2]

Source links Google News