[ad_1]

DNY59/E+ via Getty Images

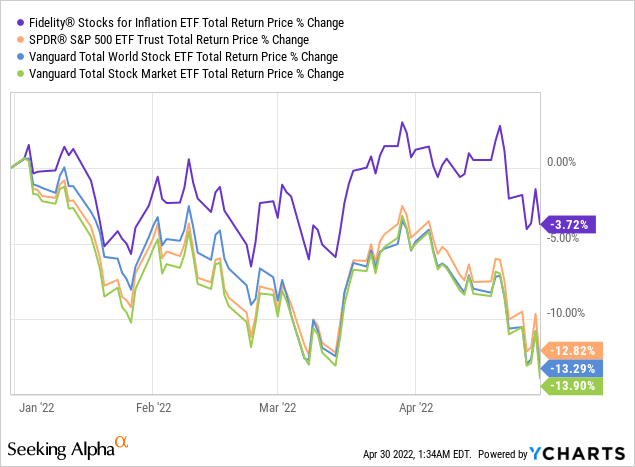

Inflation is skyrocketing, with CPI reaching a decades-high of 8.5% this March. Rising cost of living threatens the retirement of many, with investors scrambling to protect their portfolios from this new threat. There are several inflation-hedge funds which perform particularly well when inflation is elevated, and which can serve to hedge an investor’s portfolio against rising inflation. The Fidelity Stocks for Inflation ETF (BATS:FCPI) is one such fund. FCPI invests in a diversified portfolio of large-cap U.S. equities, but is overweight industries and stocks with above-average exposure to inflation, think oil, commodities, and the like. FCPI provides investors with a reasonably good amount of diversification, and is moderately hedged against inflation, a solid combination. The fund is a buy, and particularly appropriate for equity investors concerned about rising inflation.

FCPI – Basics

- Investment Manager: Fidelity

- Underlying Index: Fidelity Stocks for Inflation Factor Index

- Expense Ratio: 0.29%

- Dividend Yield: 1.39%

FCPI – Overview

FCPI is an equity index ETF, focusing on industries and stocks which tend to outperform in inflationary environments. The fund is technically an index fund, tracking the Fidelity Stocks for Inflation Factor Index. In practice, FCPI’s underlying index is a bespoke index, tailor-made to suit the fund’s needs and requirements. As such, FCPI is closer to an actively-managed or smart beta fund, as opposed to more passively-managed, diversified equity index funds.

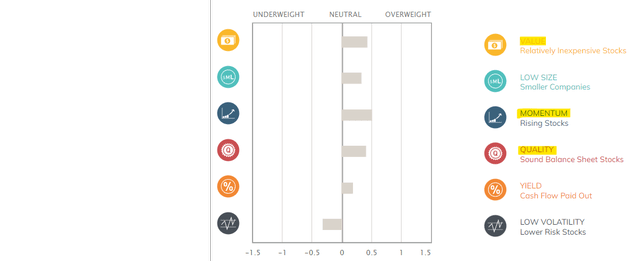

FCPI’s underlying index is somewhat complicated, investing in the top 100 U.S. equities based on value, momentum, and quality criteria. The fund scores quite well in these criteria, as expected.

ETF.com

Sector weights are based on market-caps, but higher weights are given to sectors with above-average exposure and performance during inflationary environment. Security weights are chosen to meet desired sector weights. So, the fund is basically a multi-factor fund, with above-average weights for industries and stocks which outperform in inflationary environments.

Sector-wise, the fund is currently moderately overweight materials, energy, consumer staples, and health care. These sectors have above-average exposure to inflation, as expected.

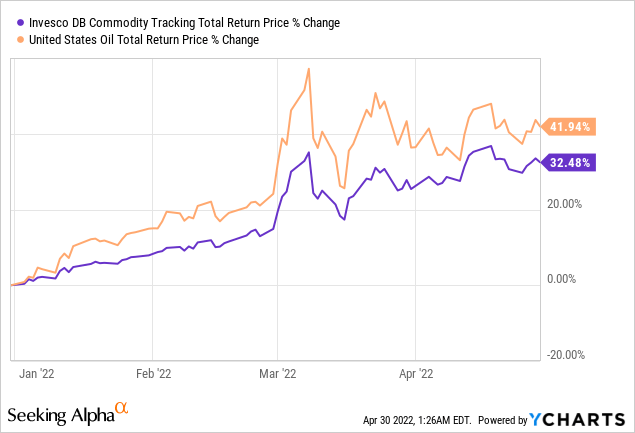

Energy and material companies focus on producing commodities, and so are directly, and strongly, exposed to commodity prices, which tend to spike during inflationary environments. Commodity prices, especially energy prices, have skyrocketed during the ongoing inflation boom, as expected. Skyrocketing commodity prices leads to higher revenue and earnings for energy and material companies, which should ultimately result in strong shareholder returns.

Consumer staple companies focus on nondiscretionary consumer products, which see strong demand regardless of economic conditions, prices, or consumer sentiment. These companies should see stable product demand and sales during inflationary environments, even if consumer purchasing power decreases. Companies in this sector also have pricing power, and so can easily pass costs to consumers, in the form of higher prices, during inflationary environments. As such, consumer staple companies should see stable demand and margins when inflation is high, ultimately leading to reasonably good performance.

Health care companies are similar to consumer staple companies in the above, but to a much greater extent. Approximately no one will forego medically necessary procedures due to rising costs, especially when insurance covers most procedures.

Although the industries above all perform reasonably well when inflation is high, share prices and returns are somewhat dependent on investor sentiment too. Sentiment might not necessarily track fundamentals, especially in the short term. Fundamentals do matter, and markets rarely remain irrational for long, but sentiment matters too.

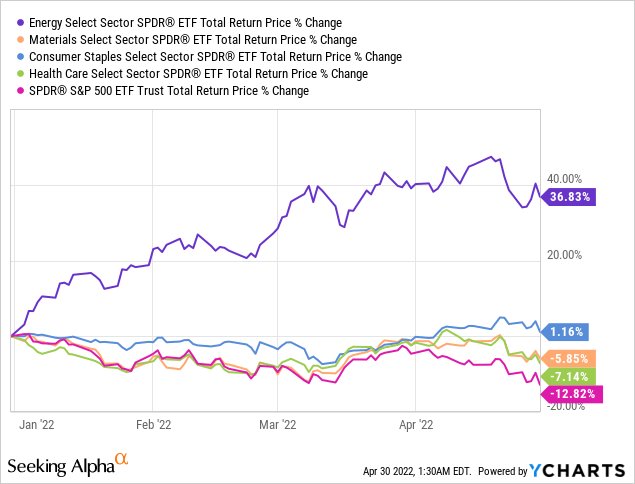

YTD, all industries above have outperformed relative to most relevant equity indexes, as expected. Energy has significantly outperformed, posting gains of 40% YTD, as energy prices have increased by quite a bit more than average, as energy valuations were at rock-bottom levels earlier in the year, and as investor sentiment has improved. Materials, consumer staples, and health care, have all slightly outperformed, as these sectors saw comparatively smaller price increases, and as sentiment has not significantly improved.

FCPI is overweight the sectors above, and so has significantly outperformed YTD, a period of heightened inflation.

In my opinion, and considering the above, FCPI will likely outperform during future periods of above-average inflation. As inflation will likely remain elevated for months, due to elevated commodity prices, supply chain disruptions, and strong consumer demand, the fund seems likely to outperform in the coming months and years. As such, the fund is a buy, and particularly appropriate for investors looking for equity funds that are partially hedged against inflation.

FCPI – Peer Comparison

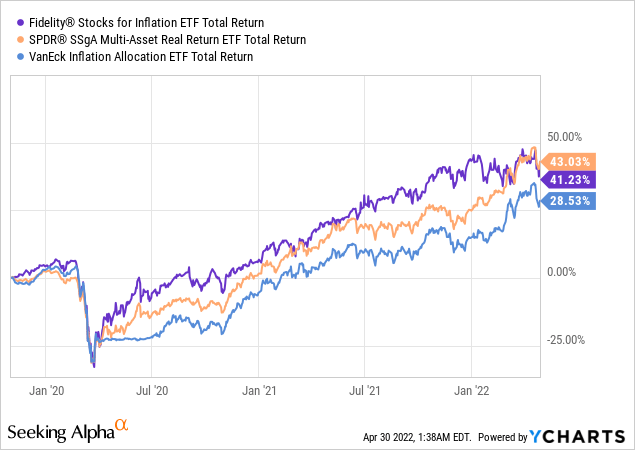

I’ve covered quite a few inflation-hedge ETFs in the past few months, so thought to do a quick comparison between FCPI and some of these.

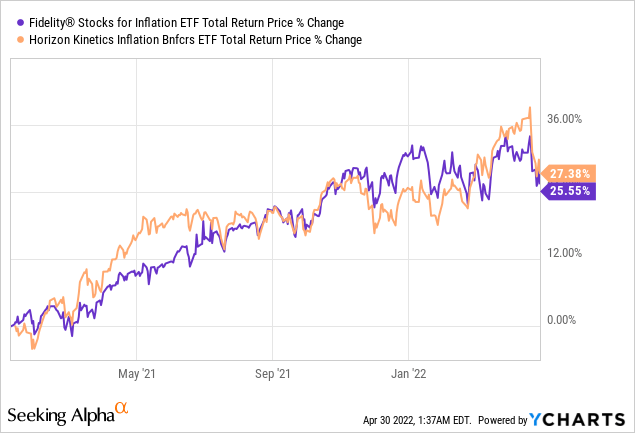

FCPI is most similar to the Horizon Kinetics Inflation Beneficiaries ETF (INFL). Both focus on U.S. equities in industries with above-average performance during inflationary environments. FCPI is an index fund, and quite diversified across industries and sectors, while INFL is actively-managed, and laser-focused on industries which outperform when inflation is high. As both funds focus on U.S. equities, their long-term performance should be about the same, as has been the case since inception.

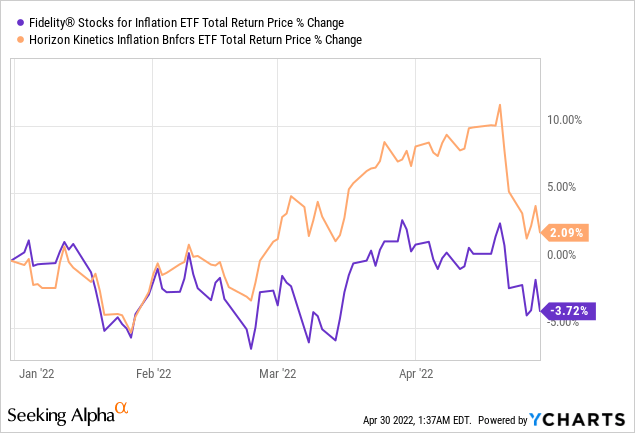

As INFL focuses much more strongly on inflation-hedge equities, the fund should perform comparatively well during periods of heightened inflation. This has been the case YTD, as expected.

INFL is quite clearly a more effective inflation-hedge than FCPI, but is more concentrated, and riskier. In my opinion, the tradeoff is worth it, especially considering the fact that both funds are meant to be effective inflation-hedges. Other factors matter too, but INFL is much more effective at what it set out to do, and I think that matters.

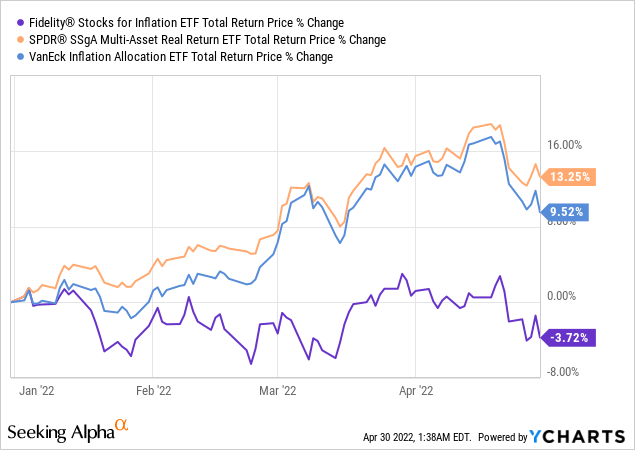

Besides INFL, there are several diversified, multi-asset class inflation ETFs out there, including RLY and RAAX. Both of these funds invest in several different asset classes, including equities, bonds, real estate, and similar. Greater asset class diversification increases their effectiveness as an inflation hedge, and reduces their dependence on fickle market sentiment for their returns. Bearish market sentiment could cause energy stocks to underperform even if energy prices remain elevated, while the same is not true for energy futures. Stronger, more diversified exposure to inflation-hedge asset classes should more reliably lead to outperformance during inflationary environments. Both RLY and RAAX have outperformed YTD, as expected.

On the other hand, FCPI’s equity focus should lead to comparatively strong long-term returns, as equities simply outperform most asset classes long-term. This has mostly not been the case since inception, as these are all relatively new funds, and have only existed during periods of elevated inflation. Still, I do believe that FCPI will outperform these other funds long-term.

RLY and RAAX are both significantly more effective inflation-hedges than FCPI, but with lower potential long-term returns. FCPI seems like the better choice for more long-term investors, while RLY and RAAX seem stronger for more short-term, aggressive investors or traders.

Conclusion – Effective Inflation Hedge

FCPI is a diversified U.S. equity index ETF, overweight industries and sectors which outperform during inflationary environments. The fund is a buy, and particularly appropriate for investors concerned about rising inflation.

[ad_2]

Source links Google News