[ad_1]

aluxum/iStock via Getty Images

About one month ago, I wrote about the Cambria Shareholder Yield ETF (SYLD), an equity fund focusing on U.S. equities with above-average shareholder yields. SYLD’s cheap valuation and market-beating performance made the fund a buy, but the fund’s 2.3% yield is quite low, and a deal-breaker for many investors. As luck would have it, Cambria has two similar ETFs, the Cambria Emerging Shareholder Yield (BATS:EYLD), and the Cambria Foreign Shareholder Yield ETF (FYLD). Of these, EYLD yields the most, with a strong 9.3% dividend yield. EYLD’s strong yield and cheap valuation make the fund a buy. As the fund focuses on cheaply valued emerging market equities, risks are quite high, and so the fund is only appropriate for more aggressive investors.

EYLD – Basics

- Investment Manager: Cambria Funds

- Expense Ratio: 0.65%

- Dividend Yield: 9.31%

- Total Returns CAGR Inception: 9.28%

EYLD – Overview

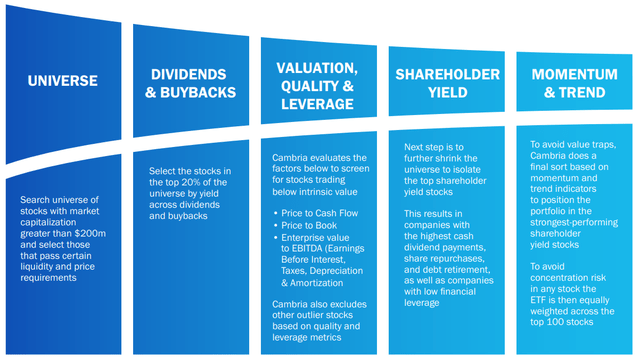

EYLD is an emerging market equity ETF. Although the fund does not technically track an index, it does follow an explicit, detailed investment methodology, and so effectively functions as an index fund. EYLD invests in emerging market equities with the highest shareholder yields, subject to several valuations, quality, momentum, leverage, liquidity, and price screens. EYLD has a handy infographic explaining the process.

EYLD Corporate Website

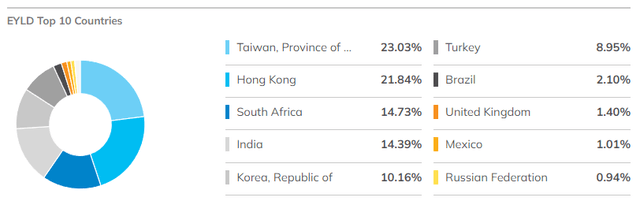

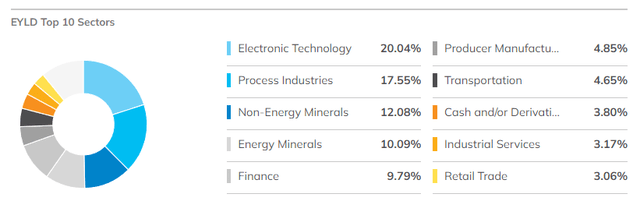

EYLD’s starting investment universe is quite broad, emerging market stocks from all relevant industries, which results in a reasonably well-diversified fund. The fund provides investors with exposure to 100 emerging market equities from all relevant industries, and over a dozen countries. Sector and country weights are as follows.

ETF.com

ETF.com

As can be seen above, the fund is currently overweight materials, industrials and energy, due to their comparatively cheap valuations, and as said sectors tend to be particularly large in emerging markets. Unlike most value funds, EYLD is only marginally underweight tech, with a 20% weight. Frothy tech valuations are more of a U.S. phenomenon, and Chinese tech stocks have underperformed as of late, hence the fund’s average tech allocation. EYLD is currently underweight several assorted industries, including consumer staples, utilities, and real estate, most likely on shareholder yield grounds. Country weights are in-line with broader emerging market indexes, although the fund does not invest in any meaningful quantities in some of the more niche emerging markets, including Saudi Arabia and Mexico. These might be comparatively large countries, but their equity markets are quite small. EYLD is either underweight or does not invest in many of these countries, but allocations tend to be small regardless.

In my opinion, EYLD’s holdings are reasonably well-diversified. Diversification is roughly comparable to that of most broad-based emerging market equity indexes, although slightly less so.

Besides the above, nothing much stands out about the fund, its strategy, or holdings themselves.

EYLD – Valuation Analysis

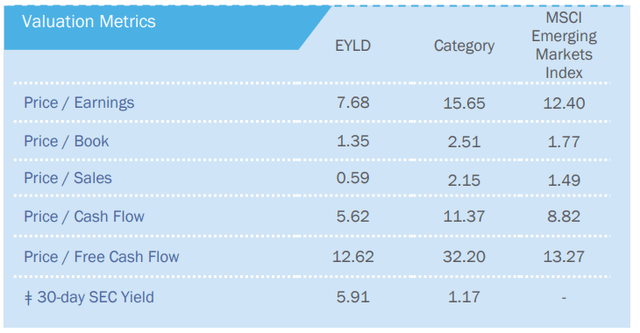

EYLD focuses on emerging market equities with the strongest shareholder yields, and considers other relevant valuation metrics when selecting securities for portfolio inclusion. As a result, EYLD’s underlying holdings are incredibly cheaply valued, with the fund comparing favorably to its index on most relevant valuation metrics. These are as follows.

EYLD Corporate Website

From the above, the fund’s 7.7x price / earnings ratio and 5.6x price / cash flow ratio look particularly attractive. Both ratios are about 40% lower than those of its index, and less than half that of the S&P 500. EYLD’s underlying holdings generate a lot of income and cash relative to their share prices.

EYLD’s cheap valuation has three significant benefits for shareholders.

First, cheap valuations mean strong potential capital gains. The cheaper the valuations, the stronger the potential capital gains, so these could be massive for EYLD and its shareholders.

On a more negative note, valuations are dependent on market sentiment, which is quite fickle. There is no guarantee that markets will reward cheaply valued stocks with higher share prices and valuations, or that they will do so in a reasonable amount of time. As Keynes said, markets can remain irrational longer than you can remain solvent, so valuation gaps can persist for a very, very long time. Valuations have started to normalize across markets these past few months, but remain stubbornly low in most emerging markets.

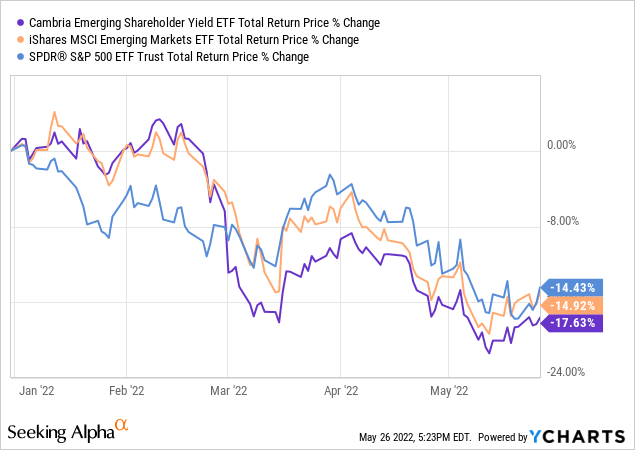

EYLD itself has slightly underperformed relative to most emerging market equity indexes and the S&P 500 these past few months. Valuations have not normalized and valuation gaps have, if anything, widened.

In my opinion, EYLD’s cheap valuation will likely lead to significant capital gains in the coming years, but this has not been the case in the recent past, and there is no guarantee that it will be the case moving forward.

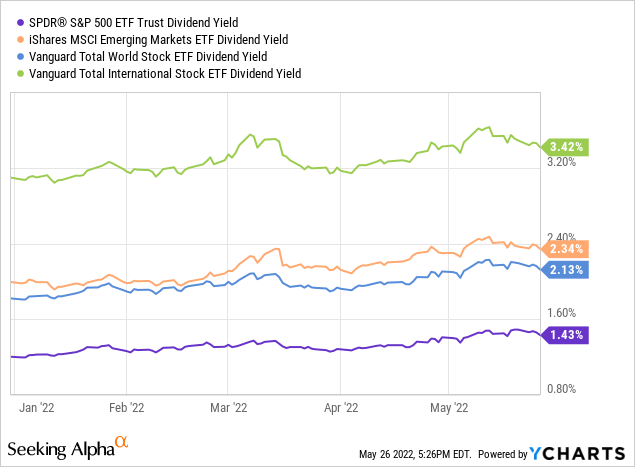

Second, cheap valuations mean low share prices, and low share prices mean higher dividend yields. EYLD itself yields a massive 9.3%. It is an incredibly strong yield on an absolute basis, and significantly higher than that of most broad-based equity indexes.

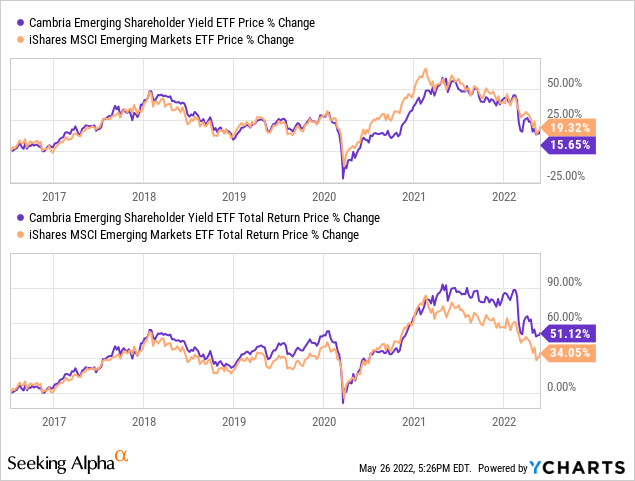

Strong dividends directly increase shareholder returns, a significant benefit for the same. Most importantly, dividends are not dependent on market sentiment: investors receive their dividends regardless of what the market thinks of EYLD, its underlying holdings, or emerging markets. Dividends are particularly important when markets are bearish, as has been the case since the fund’s inception. EYLD’s capital gains have been quite low, roughly equal to those of its index, since inception. Capital gains have significantly lagged behind those of the S&P 500 and similar U.S. equity indexes, as investors are broadly bearish about emerging market equities. EYLD’s total returns, however, have moderately outpaced those of its index, due to the fund’s strong dividends.

EYLD’s cheap valuations mean strong potential capital gains and dividends, a solid combination, and a significant positive for the fund and its shareholders.

EYLD – Risks and Negatives

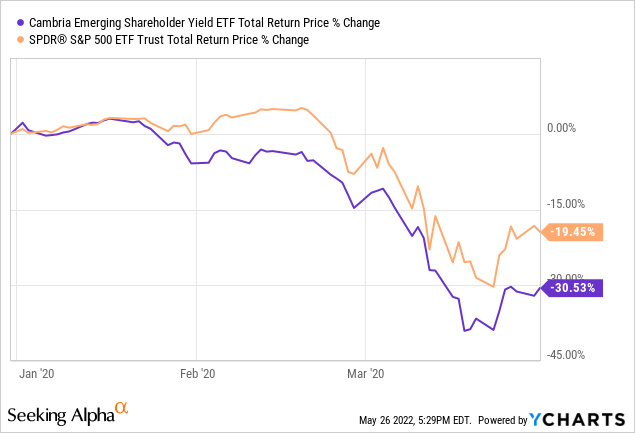

EYLD is a relatively risky fund, due to focusing on emerging market equities. These securities tend to have weak balance sheets, volatile financials, and corporate governance issues. Emerging market equity funds, including EYLD, tend to be overweight cyclical industries, including materials, with all the risk that entails. Emerging market countries themselves tend to be quite risky, due to governance issues, and volatile, weak economies. These factors all increase risk, volatility, and losses during downturns. Diversification reduces these risks, but do not eliminate them. As such, investors should expect EYLD to underperform during downturns and recessions, as was the case during 1Q2020, the onset of the coronavirus pandemic.

Further underperformance during downturns is quite likely, a significant negative for the fund and its shareholders.

In my opinion, EYLD’s cheap valuation and strong potential returns outweigh the fund’s elevated level of risk. Other investors, especially those more risk-averse, might think otherwise.

Conclusion

EYLD invests in emerging market equities with above-average shareholder yields. EYLD’s strong 9.3% yield and cheap valuation make the fund a buy.

[ad_2]

Source links Google News