[ad_1]

sturti/E+ via Getty Images

Main Thesis/Background

The purpose of this article is to evaluate the iShares MSCI United Kingdom ETF (NYSEARCA:EWU) as an investment option at its current market price. The fund’s stated objective is “to track the investment results of an index composed of U.K. equities.” The fund offers exposure to large and mid-sized companies that are based in the United Kingdom.

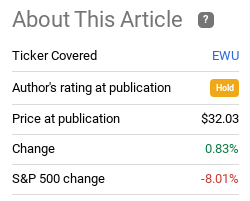

As we moved in to 2022, I took a cautious approach on EWU. I saw more value in North America and emerging markets, and this outlook was only partly correct. While EWU has indeed produced a minor return, justifying a “hold” rating, the fact is this compares extremely well to broader U.S. equities. While developed markets like Canada and Australia may performing better year-to-date, that is not the case for the S&P 500, suggesting EWU would have been the superior play:

Fund Performance (Seeking Alpha)

With this backdrop, I thought it made sense to take another look at EWU. After all, a “buy” case wouldn’t have really generated much of a return in the last four months. Yes, losses may have been avoided, but the reality now is that I see more relative value in the U.S. that I didn’t see before. Whenever U.S. stocks hit correction territory, I get interested. Buying the S&P 500 during those time periods is one of the best time-tested plays there is.

On the other hand, British equities face some real headwinds. Some of these are similar to what we face in America – including high inflation, dwindling consumer sentiment, and a shaky outlook on trade due to supply-chain issues and geo-political risks. Yet, despite some similarities, I believe the U.S., and North America in general, are the better idea. The U.S. dollar has been appreciating while the Sterling pound declines and the Eurozone is going to feel the brunt of any forthcoming fallout from a Russia-Ukraine escalation. To be fair, Britain is more isolated from this conflict that mainland and central Europe. But they are still reliant on the Eurozone for trade, and weakness there will impact Britain more than the U.S. and/or Canada. Ultimately, I see some pros and cons for the next few quarters, suggesting a “hold” rating remains appropriate.

Concern #1: UK Economy Struggling

To begin, I am going to touch on some of my primary concerns for the U.K. as a whole, and how they relate to EWU by extension. Importantly, I want to emphasize that I am not “bearish” here. I do see some value in UK stocks, primarily due to their relative valuations and dividend streams. Further, the isolation of Britain from mainland Europe can be viewed as a positive right now. However, I have some primary concerns over future growth, and those concerns prevent me from slapping a buy case on this option at the moment.

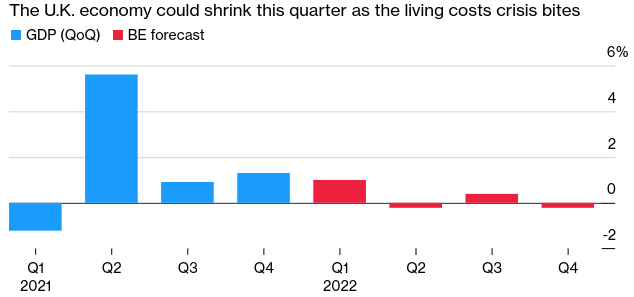

To see why, consider the inflation pressures and worries of continued hostilities in eastern Europe are taking their toll on the U.K. economy. GDP growth is already coming in weaker this year compared to 2021, and forecasts for the next few quarters have been revised downward:

GDP Estimates (U.K.) (Bloomberg)

The thought here is simple. The U.K. is under pressure, and that pressure is coming from multiple sources. It is not surprising forecasts for the broader economy are less optimistic, and that makes me reluctant to get too bullish at this juncture.

Concern #2: Eurozone Growth Under Pressure

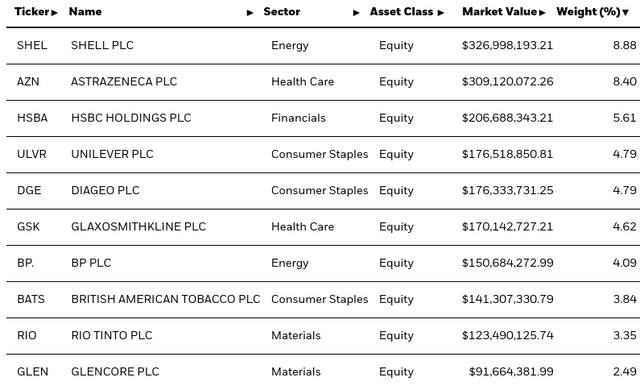

Expanding on the point above, readers may be quick to point out that British companies are only partly exposed to domestic performance. Most of the holdings in EWU are medium and large-cap firms, with a large percentage of their revenues and profits tied to international markets. Therefore, one may surmise that the weakness in the U.K.’s economy is not a reason alone to avoid this investment. A quick scan of EWU’s holdings would reaffirm this sentiment, as these are big names on a global stage:

EWU’s Top Holdings (iShares)

So, in truth, the U.K.’s projected weakness is not reason alone to avoid EWU. I absolutely agree with that conclusion. However, the problem lies in that British companies still rely on the Eurozone a great deal. So, while the weakness U.K.’s domestic economy may not in and of itself be a major pain point, when we note that the Eurozone is also under pressure, we see there is a bit of a problem.

Again, I am not being alarmist here. The U.K. is a developed, stable jurisdiction and I do tend to prefer developed markets for non-U.S. exposure. Further, while the Eurozone is coming under pressure, the trading bloc is still expected to pump out GDP growth this year. While that is good news, in relative terms the expectation is that growth will be stronger in the U.S., as it was in 2021:

U.S. and Eurozone GDP Growth (Bloomberg)

This is an important takeaway because we do not invest in isolation. While the U.K.’s stats are not terrible and the Eurozone seems resilient, we have to appreciate that the U.S. remains one of the dominant economies in the world. Therefore, when U.S.-based investors choose a fund like EWU, they should have a forward outlook that prospects are not just good in the U.K. and Europe, but perhaps better than here. As we see above, the opposite is true.

Concern #3: Retail Sales Suggest Difficult Consumer Environment

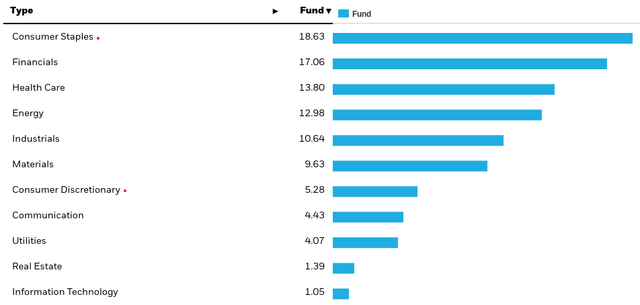

My next topic looks at the consumer environment within Britain. Although I mentioned already that Britain is not the only territory that matters to EWU, which should keep in mind that roughly a quarter of fund assets are directly tied to consumer spending, as shown below:

Fund Holdings (iShares)

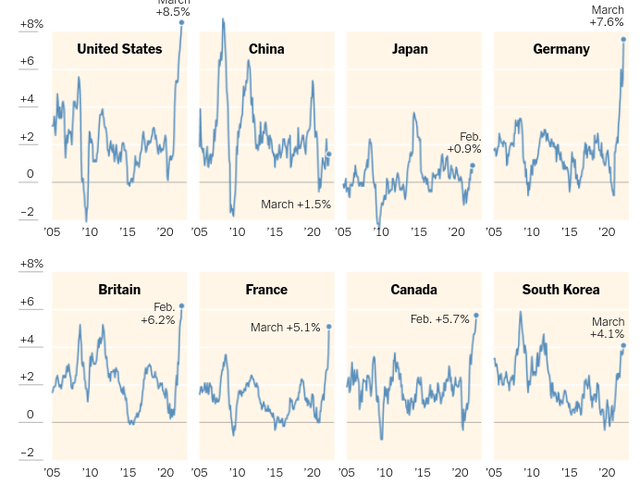

On this front, I again am concerned. The problem here is that while we know first-hand that inflation is a problem in the U.S., readers should recognize this is not a U.S. phenomenon. This is a global problem, challenging consumers and producers from here to London, Tokyo, China, and beyond. Not only that, but it is accelerating in Britain (and other countries), just like it is in the U.S.:

Global Inflation Rates (NY Times)

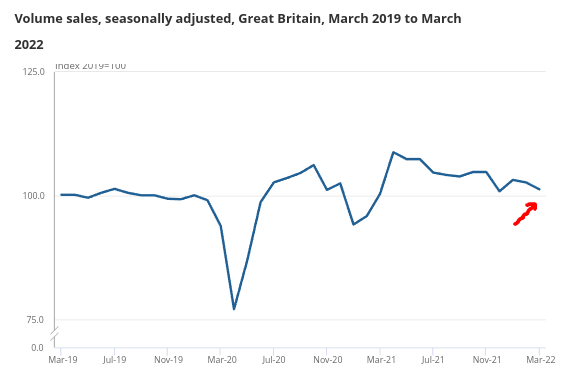

So, why is this a problem? The answer to that is multi-fold, but when we focus in on consumer-oriented sectors, we have to remember that inflation reduces purchasing power (all other things being equal). As a result, consumers in Britain have had to cut back on purchases, partly because of inflation and partly because they are becoming gloomier about the future. The result has been declining retail sales over the past few months:

British Retail Sales (Office for National Statistics)

Fortunately, the story is not all negative. Yes, the trend is not a good one, but if we put it in perspective there is some upside. One is the sales by volume are still higher than they were in February 2020, right before the pandemic hit. This means that the comeback has been resilient and that the island has not gone past the point of rescue. This push-pull reality also supports my “hold” rating. The news is not all good or all bad, so a modest approach makes sense.

The Story Is Not Hopeless

Through this review I have highlighted some primary reasons why I am not interested in buying EWU just yet. But I already alluded that I do not see a lot of downside from these levels either, so there is absolutely an argument for buying that could be made. One reason comes down to valuation. EWU, and British equities in general, have remained in value territory for years, after never having fully recovered from the impacts of Brexit. Despite outperforming the S&P 500 over the past four months, the fund is markedly cheaper than our domestic index, with a current P/E around 14.5:

EWU P/E (iShares)

While this may not seem outright cheap on the surface, most times it is relative valuation that matters. When we look at the S&P 500 right now, we see clearly how it compares to EWU:

S&P 500 P/E (multpl.com)

This is no way signifies that EWU will out-perform, or even produce a positive return. But it should provide investors will some comfort that downside is limited, especially those investors who favor a value-focus.

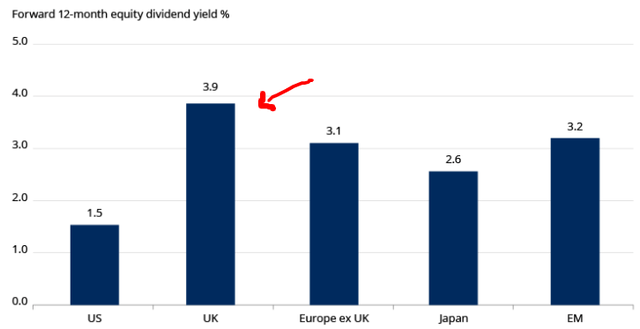

Dividend Seekers Rejoice

Another positive metric is the yield one can find by investing across the pond. With a relative valuation advantage, coupled with a national history of above-average dividend returns, those looking for dividend income can find something they like in British equities, and EWU by extension. This fund had a trailing 12-month yield over 4%, and while that may not seem overly ‘high”, we have to consider the yield investors can find elsewhere. The S&P 500 is not known for being an income play, given its overweight allocation to Tech and growth stocks. But Britain’s income advantage extends beyond that, offering a higher yield than other developed and emerging markets, as seen below:

Relative Yields (Schroders)

This is actually a primary reason why I keep EWU on my radar. The income story helps soften the blow if stocks drop or even stay stagnant. While I don’t love to bull proposition here, if EWU sees a drop or under-performance compared to my other holdings, I will look to buy it for the dividend.

Bottom line

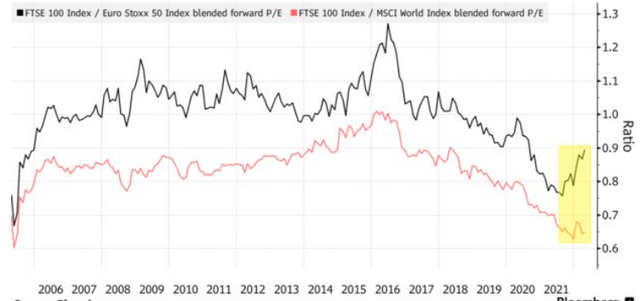

EWU had treaded water over the past fourth months, but that isn’t as bad as it sounds. This compares to drops in the indices that track the Eurozone, as well as an 8% decline in the S&P 500 since my last article on EWU. So, all things considered, the fund has held up pretty well. Further, even with that out-performance, EWU trades at a discount to the S&P 500 and to its global peers as well, as seen below:

P/E Comparisons (Bloomberg)

When I couple this with the income advantage, EWU may seem like a sure thing.

However, there are risks that balance out these positive points. One is that inflation keeps hammering British consumers, along with their peers around the globe. Retail spending is down, and business and consumer confidence is down with it. Further, GDP forecasts have come in lower in both the U.K. and Europe, which suggests North America (and other developed markets) may have an edge in the coming months. Finally, the war in Ukraine is nothing to sneeze at, and although the U.K. is relatively isolated from it given its proximity, Prime Minster Johnson has been a vocal supporter of Ukrainian President Zelenskyy. If the conflict escalates, or Russia takes punitive action against Britain for its decision to stand with Ukraine, some pain could be ahead.

As a result, I believe a “hold” rating on EWU is a fair assessment, and I suggest readers approach any positions selectively at this time.

[ad_2]

Source links Google News