[ad_1]

Yevhenii Orlov/iStock via Getty Images

The EWT index, which consists of shares of Taiwanese companies, may soon become a promising target for short sales. Its impressive growth in 2020 – the first half of 2021 was made possible by a combination of robust macroeconomic statistics in the Taiwanese economy and its outpacing growth rate compared to other Asian tigers. However, at the moment, EWT has almost come to its ceiling, and all previous growth drivers are gradually fading away. That is why we assume that in Q1 2022, EWT may continue its rise, but in the next quarter, it will reach a plateau and start declining.

Growth Drivers at Macro Level

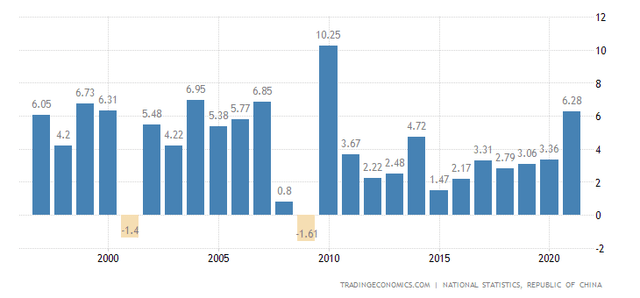

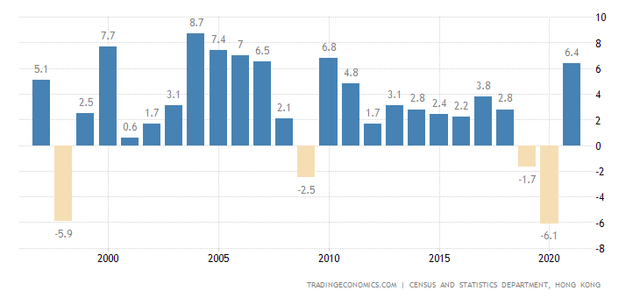

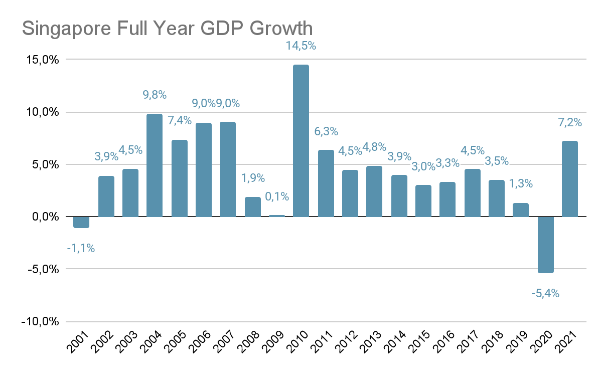

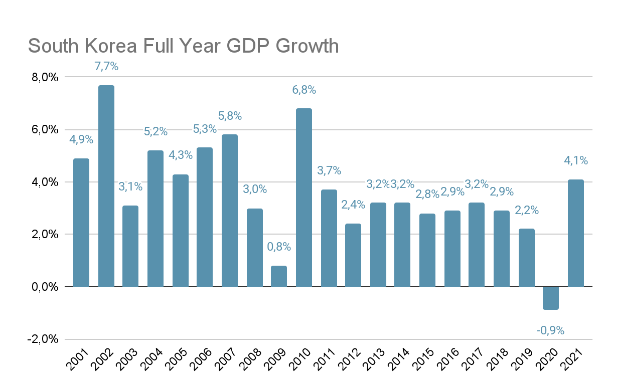

In 2021, Taiwan’s GDP growth was 6.28%, the best reading since 2010. However, compared to other Asian tigers, this figure is not exceptional. All other regional players – Hong Kong (+6.4%), South Korea (+4.1%), Singapore (+7.2%) – showed similar dynamics. In 2021 they all witnessed the best GDP growth rates since 2010. At the same time, GDP growth in Hong Kong and Singapore in 2021 even exceeded that of Taiwan.

Taiwan Full Year GDP Growth

TradingEconomics.com

Hong Kong Full Year GDP Growth

TradingEconomics.com

The Singapore Department of Statistics

Bank of Korea

The reasons for such remarkable growth in all four countries are also the same: robust exports and increased domestic investments. Forecasts for 2022 are less rosy. If we compare the GDP growth and stock market dynamics of these four countries, we can see that in 2020, when TAIEX and EWT printed the most significant gains, Taiwan’s GDP grew by 3.36%, while all other countries showed a decline. In 2022, according to various forecasts, Taiwan’s GDP growth rate could reach 4.03% to 4.6%. For Singapore, GDP growth estimates hover around 3-5%. South Korea’s GDP may grow by 3% in 2022, Hong Kong – by 3-3.2%. In general, for the Taiwanese stock market, such estimates do not provide any significant advantages compared to other Tigers, so investors are unlikely to invest more actively in the assets of this country.

iShares MSCI Taiwan ETF

TradingView.com

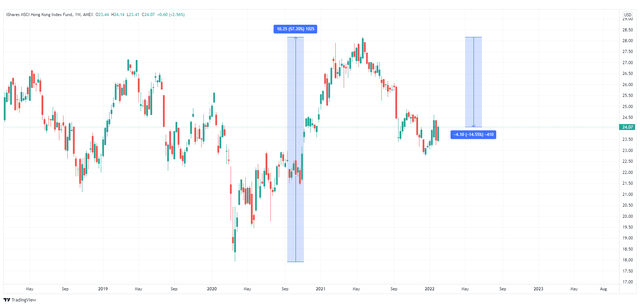

iShares MSCI Hong Kong ETF

TradingView.com

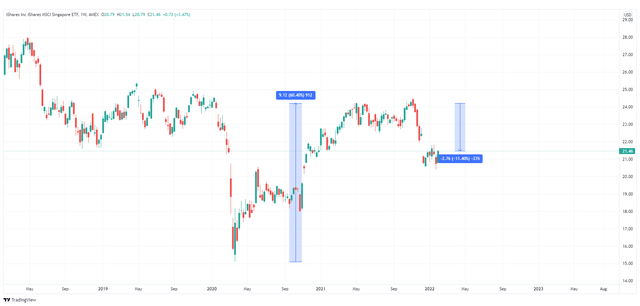

iShares MSCI Singapore ETF

TradingView.com

iShares MSCI South Korea ETF

TradingView.com

The interest rate in Taiwan is likely to follow the change in the US interest rate. Now it is at the level of 1.125%. According to Bloomberg, in Q3 and Q4 of this year, it will reach 1.25% and 1.375%, respectively. Compared to other countries, this level is in line with the average figures (0.86% in Hong Kong, 0.31% in Singapore, 1.25% in South Korea).

Yes, any increase in the interest rate could cause the Taiwan dollar to rise, which will harm exports. Still, these concerns are fading into the background, as the Central Bank of Taiwan, in an environment of mild inflation (+1.96% in 2021 YoY), does not intend to raise the interest rate in the first half of 2022. The forecast for the current year assumes lower annual inflation than in 2021, but the Fed’s rate hike suggests a similar move by the Taiwan Central Bank.

For [2022], the Bank saw the CPI and the core CPI to rise by 1.59% and 1.45% year on year, respectively, in anticipation of a softer upswing in international oil prices. Meanwhile, major institutions forecasted Taiwan’s CPI annual growth rate to be […] 1.10%-2.00% [in 2022].

– Source: Central Bank of the Republic of China (Taiwan)

Export growth has been the most significant driver of Taiwan’s GDP growth in recent years. If we exclude the seasonal factors, forecasts for 2022 include too many uncertainties that make accurate estimates difficult. However, all experts agree that maintaining the pace of growth like in 2021 (+29.9%) this year will be difficult. The outpacing growth in export orders in December 2021 (+12.1% YoY) is likely due to the New Year sales. The same situation may occur in January and early February during the Lunar New Year. However, after that, we expect a fall in export orders.

Resurgent COVID-19 in the United States and China could affect the outlook, and coming off a high base last year export order growth in the first quarter was likely to stall.

– Source: Reuters

Sectoral Analysis

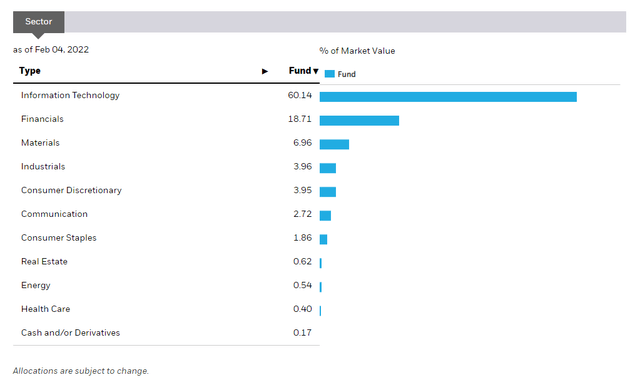

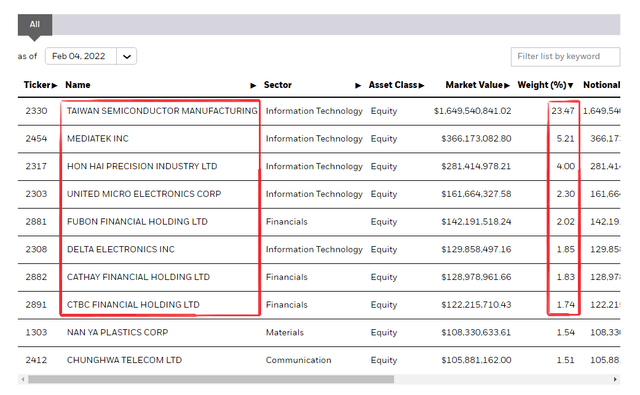

If we look at the sectoral breakdown of EWT, we will see that the share of information technology companies and financial holdings is almost 79%. Further, companies from the semiconductor industry (TSMC (NYSE:TSM), Mediatek (OTCPK:MDTKF), United Microelectronics (NYSE:UMC)) and electronics manufacturing business (Foxconn (OTCPK:HNHAF), Delta Electronics) occupy the largest share in the index.

EWT’s Exposure Breakdowns by Sector

iShares

EWT’s Holdings

iShares

If we look at the semiconductor industry, the World Semiconductor Trade Statistics (WSTS) predicts that the semiconductor market will grow by 8.8% in 2022. For comparison, in 2021, this growth stood at 25.6%. Thus, this year the market volume should be almost three times lower. Despite slower growth, the demand for semiconductors should remain robust throughout 2022. If we take a closer look at the EWT performance in 2021 and at the stocks of the most significant market players (TSMC, MediaTek, UMC), we see that most of this growth came in the first half of last year. Back then, persistent logistical problems and a physical shortage of chips amid recovering demand produced favorable conditions for semiconductor manufacturers. According to Deloitte, this year, the logistical challenges in the semiconductor industry will not be as acute as in 2020 and 2021.

Another negative factor for EWT is its heavy dependence on semiconductor manufacturers. A similar situation occurred in South Korea, where the sale of technology stocks in August 2021 set off a knock-on effect throughout the stock market. At the same time, Taiwan’s dependence on semiconductor manufacturers is even higher than in South Korea.

The financial sector of Taiwan in 2022 may show a softer result. Loan growth might reach 4.8% (+7% in 2021), but a stable rise in demand for banking products should support the banking sector of this state. As for the shares of financial companies, Fubon Financial Holding (OTCPK:FUIZF) and Cathay Financial Holding look overbought and cause our particular concern.

Fubon Financial Holding, 1W

TradingView.com

Cathay Financial Holding, 1W

TradingView.com

CTBC Financial Holding, 1W

TradingView.com

Technical Outlook

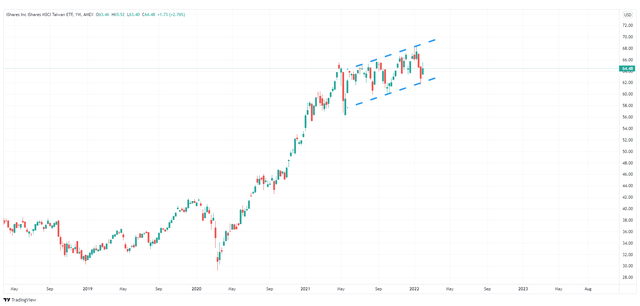

It is very likely that in 2022 the EWT will show the same direction as the South Korean EWY starting from the second half of 2021. However, in February-April this year, we expect a moderate inertial growth of this index supported by last year’s strong readings. The ceiling of EWT in Q1 will be the mark of 70 points, above which it is unlikely to rise.

The fact is that to exit the congestion area marked on the weekly chart and resume the rise, EWT needs much stronger growth drivers than those that we have now. Such drivers could arise in two scenarios. First, we can imagine a situation like in H2 2020 when the economy of Taiwan was growing while the economies of all other Asian tigers were declining. Second, we can suppose this year we could see much faster growth rates in Taiwan than in other neighboring countries so that investors may decide to switch to the Taiwanese stock market. Both scenarios are unlikely. Therefore, in our opinion, in Q2 2022, the EWT index will reach a plateau. Also, in Q2, we can observe a short period of sideways trading, after which the most likely scenario for price movement will be a breakdown below the 60 points level and a further fall in the index.

iShares MSCI Taiwan ETF, 1W

TradingView.com

In addition to the lack of drivers for further growth, we can also note the effect of a higher base for EWT. If all other indices have retreated from the highs reached during the 2020’s rise (EWY fell by 24.5%, EWH – by 14.5%, EWS – by 11.4%), the EWT is holding near its maximum values. In this regard, the indices of other Asian tigers, which do not have a high base effect, look preferable.

Conclusion

Therefore, at the moment, we can consider two main options for trading EWT. Those investors who opened long positions in EWT should hold them until the price reaches the level of about 68-70 points and then take profits. For those traders who want to benefit from selling EWT shares, we recommend opening short orders from the 68-70 level and building them up as the price moves out of the congestion area. As for the EWT’s buying opportunities, in our opinion, despite its likely increase, the potential profit will be too small to enter the market right now.

[ad_2]

Source links Google News