[ad_1]

zorazhuang

iShares MSCI Malaysia ETF (NYSEARCA:EWM) is an exchange-traded fund that provides investors with direct exposure to Malaysian equities. The fund had assets under management of $245 million as of November 25, 2022, with an expense ratio of 0.50%, making the fund relatively unpopular, and also not especially cheap.

I last covered EWM in February 2022, when I believed that the fund’s bearish trend would continue. Since then, the price of EWM shares has fallen by -8.31% per Seeking Alpha data to the time of writing, as compared to a price-only (comparable) change in the S&P 500 U.S. equity index of -10.64%. Unattractive, low-return sector exposures made the fund appealing, as did the fact that China (an important player in the Asia-Pacific region where Malaysia is located, and is therefore also naturally exposed to) was heading into a recession. I thought that EWM did not offer sufficient reward given the fund’s share price, and regional/cyclical risk.

However, EWM has not fallen (on a price-only basis) as much as the U.S. equity index, and that is also in spite of the Malaysian ringgit falling against the U.S. dollar since my last coverage of the fund. A weaker ringgit will generally serve as a headwind for EWM, given that its underlying holdings are locally valued in ringgits, and yet EWM shares are denominated in U.S. dollars.

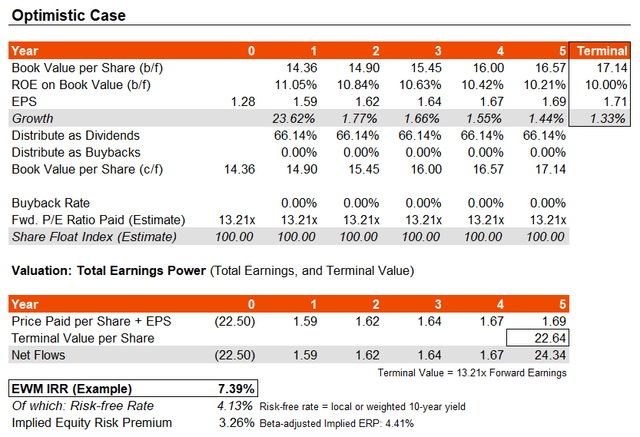

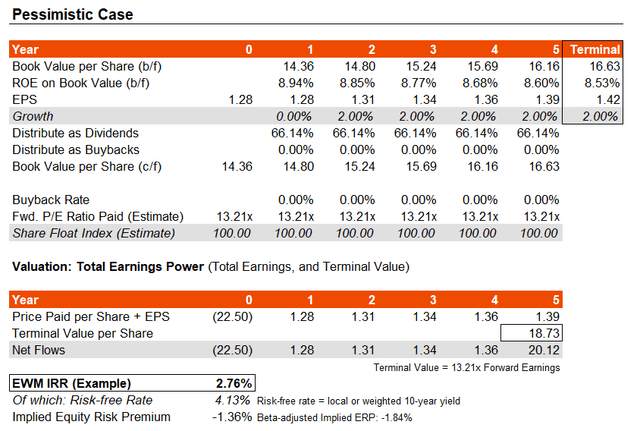

First off, it is worth revaluing EWM, especially as a changing portfolio composition and earnings growth results and expectations have been perhaps especially prone to shift during the end of China’s business cycle. The fund is based on an aim to replicate the performance of the MSCI Malaysia Index, whose most recent factsheet (as of October 31, 2022) reported trailing and forward price/earnings ratios of 16.33x and 13.21, respectively. The factsheet also reported price/book ratio of 1.46x, and an indicative trailing dividend yield of 4.05%. That implies a modest return on equity of 11.05% on a forward basis, with a very high dividend distribution rate of 66.14%.

Assuming that the return on equity moderates to circa 10% by year six (remaining mostly stable across the next longer-term cycle), and distribution rates remain high, the fund should generate three- to five-year average earnings growth rates of circa 5.67-8.55% by my calculations. That compares to a Morningstar consensus of just 3.76%. Given forward one-year earnings growth implied by MSCI of about 23.62%, the Morningstar consensus figure implicitly predicts that EWM’s portfolio will see negative earnings, or otherwise weaker-than-expected earnings growth in year one. Nevertheless, to begin with, I will use my “optimistic” assumptions based on return on equity.

Author’s Calculations

The base case, which is also potentially optimistic (albeit still driven by MSCI estimates, which are typically fair), generates a possible IRR of 7.39%. That would imply an equity risk premium of just 3.26%, given a local Malaysian 10-year yield (risk-free rate proxy) of 4.126% at the time of writing. That is very small; for a mature market, I would demand at least 4.2%. Malaysia deserves a further country risk premium: Professor Damodaran recommends as much as 1.19%. Having said that, the historical beta of the fund is low, and therefore it may be that international investors are pricing EWM as if there is no regional political risk; pricing it based only on price volatility, which seems irrational to me.

If instead I were to assume that earnings generate zero growth in the next year, and then mediocre growth of 2% thereafter (in line roughly with smoothed-average Malaysian CPI inflation rate over the past 25 years) through year six, my model would instead suggest a much lower IRR of 2.76%, with a negative implied ERP (suggesting gross over-valuation).

Author’s Calculations

The three- to five-year average earnings growth rate in this pessimistic case would come to less than 1.60%, which is actually even more conservative than Morningstar’s analyst consensus figure. So, in actuality, the likely forward IRR for EWM at present prices, based on underlying earnings power, is likely in the range of 2.76-7.39% (my pessimistic and optimistic model outputs). Yet neither of these results offer attractive returns given the local risk.

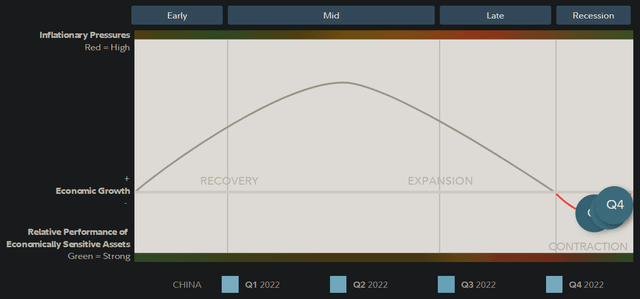

I often like to relate to readers that markets lead the real economy (by around 6-12 months as a fair estimate), and with China firmly in recessionary territory (see Fidelity’s estimate below as of Q4 2022, for China), it is likely that Malaysia has borne some brunt of this regional slowdown.

Fidelity.com

However, a real economy bottoming in Q4 2022 or around now, might lend to a market-bottoming process in Chinese and regional APAC equities around this time (that would include EWM). So, in theory, EWM is ripe for a bounce-back, and yet I cannot turn bullish on the fund, as it still appears overvalued. That is, even if we are optimistic on forward, long-term earnings growth.

With an optimistic-case IRR of 7.4%, and with a fairer cost of equity of say 9.52% (local 10-year yield, plus 4.2% ERP base, plus 1.19% country risk premium per Professor Damodaran’s work), you have implicit downside potential of around -22%. This fair-value deviation is in line with my past work, albeit based on more conservative earnings growth estimations (even in my optimistic model). The conservatism is due as earnings growth expectations have actually significantly dropped for Malaysian business, and I would rather not make a beyond-optimistic assessment.

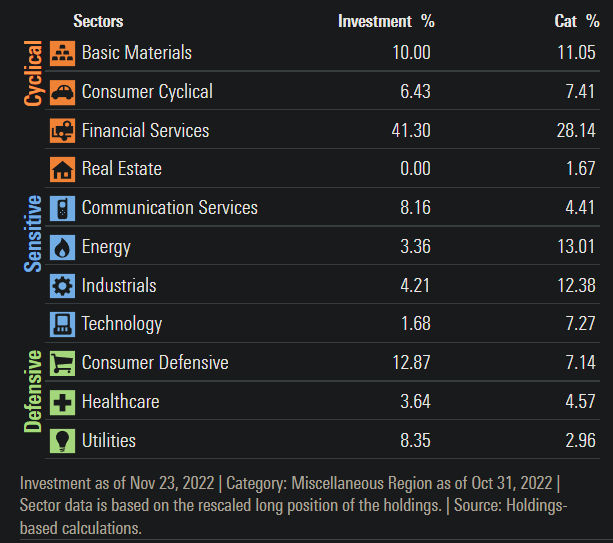

Part of the problem is also that EWM’s portfolio is made up of mature sector exposures (see below), with an emphasis on Financial Services (at 41.30% of the fund, as of November 23, 2022).

Morningstar.com

These are not the kinds of economically sensitive sectors that can produce strong and positive earnings surprises when you need them.

In summary, I think EWM is probably cyclically well positioned but remains overvalued, and should not benefit from any regional economic resurgence. I certainly think better value exists elsewhere, and yet due to (regional) cyclical favorability, I would withdraw my previously bearish view on the fund at this time.

[ad_2]

Source links Google News