[ad_1]

zorazhuang/E+ via Getty Images

iShares MSCI Malaysia ETF (NYSEARCA:EWM) is an exchange-traded fund offering investors exposure to Malaysian stocks. The expense ratio is quite high at 0.50%, but the strategy is focused and niche, “proven” by the low level of assets under management (just $244.3 million as of February 4, 2022).

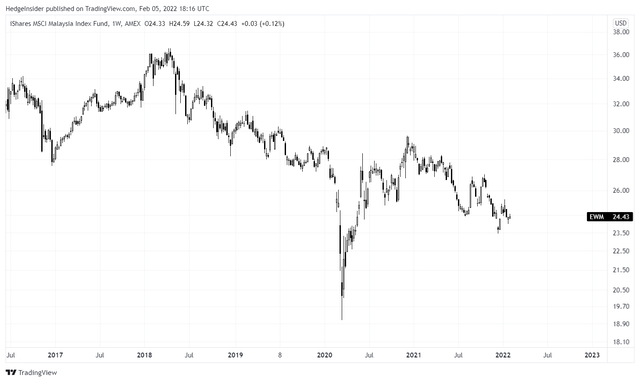

EWM has performed poorly in recent years (see price action below, from late 2016 to present).

TradingView.com

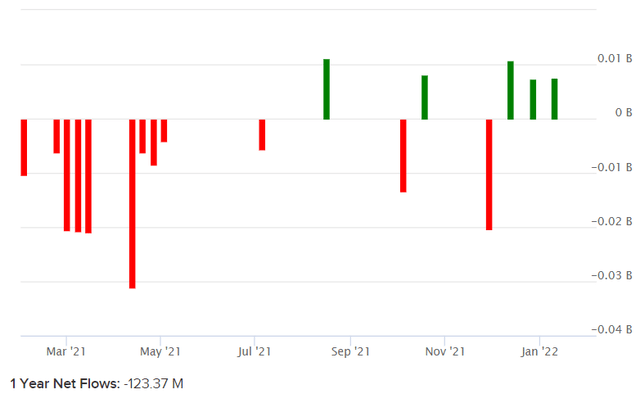

Over the past year or so, EWM seems to have maintained a bearish trajectory with few pit stops. As shown below, this has coincided with negative fund flows; over the past year, fund flows were negative about $123 million, which is large given EWM’s already relatively low AUM.

ETFDB.com

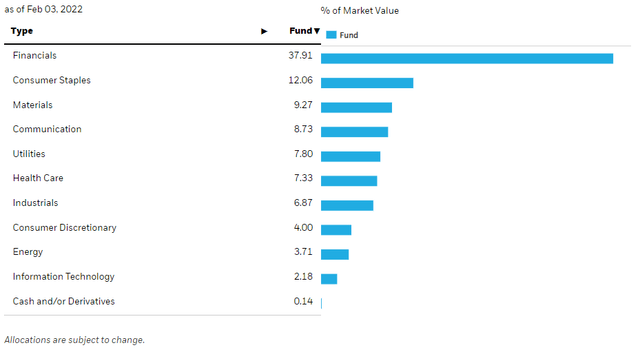

EWM is heavily exposed to Financials and Consumer Staples. While the Financials sector (including banks) can be viewed as a cyclical sector exposure, the banking sector is mature, and hence returns on equity tend to be lower. That is, especially in light of historically low global interest rates (in spite of recent global inflationary pressures). Additionally, Consumer Staples stocks are generally viewed as defensive, and low-return. Just these two sectors alone, together, represented just under 50% of EWM’s portfolio as of February 3, 2022.

iShares.com

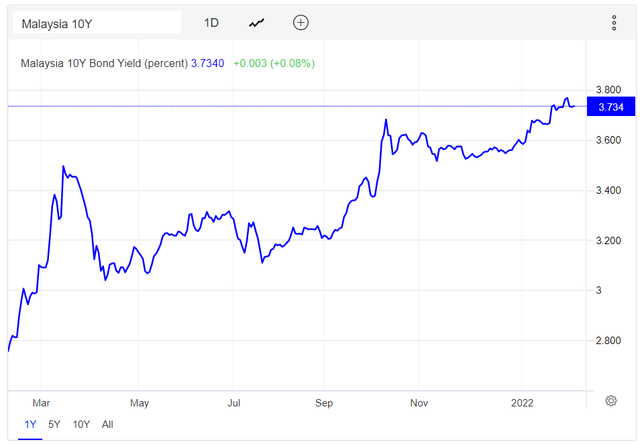

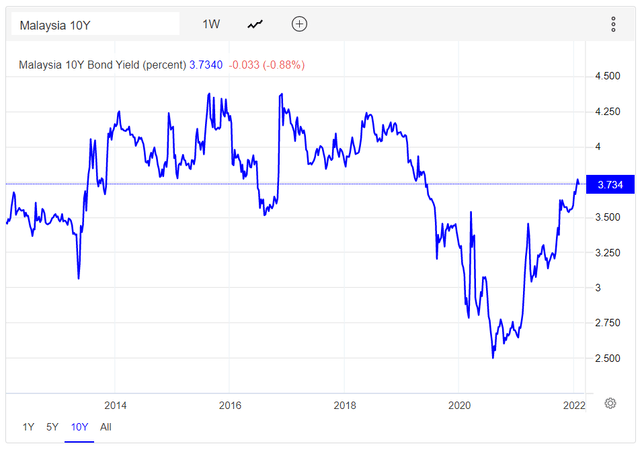

The current Malaysian 10-year yield (a proxy for the regional risk-free rate) is currently about 3.73% (see below), having risen substantially from under 2.80% over the past year.

TradingEconomics.com

Still, zooming out, the 10-year has barely budged over the past ten years or so.

TradingEconomics.com

Even if risk-free rates are rising, which can help banks expand their net commercial interest rate margins, it is unlikely that we are going to see a long-term upward resurgence in banking returns on equity (beyond normal ranges). EWM’s portfolio is going to remain heavily exposed to mature, lower-return sectors. And higher risk-free rates should also compress equity valuations, since the 10-year should form part of our (long-term) cost of equity estimate.

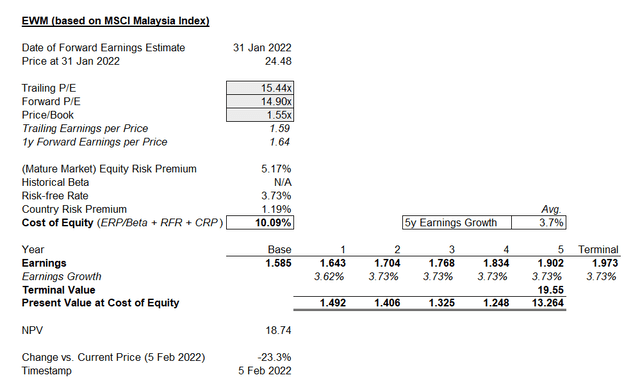

The other half of the cost of equity estimate is the equity risk premium, plus any adjustment for the country risk premium. For Malaysia, per data and estimates from Professor Damodaran, the mature market risk premium of 5.17% and an estimated country risk premium for Malaysia of 1.19% comes to a total equity risk premium of 6.36%. Adding that to our Malaysian 10-year yield of 3.734% (illustrated above) results in a fairly hefty cost of equity of 10.09%.

EWM invests in accordance with the MSCI Malaysia Index, whose price/book ratio was 1.55x as of January 31, 2022. The trailing price/earnings ratio was 15.44x, and the forward price/earnings ratio was 14.90x (i.e., a forward earnings yield of circa 6.71%). The implied forward return on equity was 10.40%, which is incidentally quite close to our cost of equity estimate of 10.09%. But we do have to “pay up” modestly at a price/book ratio of 1.55x. And forward three- to five-year earnings growth rates are currently estimated (Morningstar’s aggregated consensus) to be in the range of 7.49%.

However, following my previous coverage of EWM, I am going to use the 10-year risk-free rate as the forward earnings growth rate. This has served me well so far; while it potentially undervalues earnings growth potential, the current forward implied earnings growth rate is actually in the same ballpark as the current Malaysian 10-year yield. And EWM is exposed mainly to mature sectors that are less likely to produce positive earnings surprises. If anything, earnings could well underperform, especially if long-term yields revert to their long-term downward trend (after the recent rise).

Author’s Calculations

Downside of about -23% is possible in this potentially conservative scenario. If I were to assume double the rate of earnings growth in year two and beyond, to 7.46% (very close to Morningstar’s number), I would still arrive at downside of -12%. So, even relatively strong earnings growth rates cannot justify the current valuation given Malaysia’s higher fair cost of equity.

The credit impulse, as measured by the change in bank lending to the private non-financial sector scaled by GDP (per data from the BIS) is positive (138.9% of GDP in Q2 2021 vs. 138.6% in Q2 2020; a lag of 9-12 months is a reasonable assumption). But the credit impulse is only very modestly positive, and therefore I would not anticipate any positive earnings surprises here.

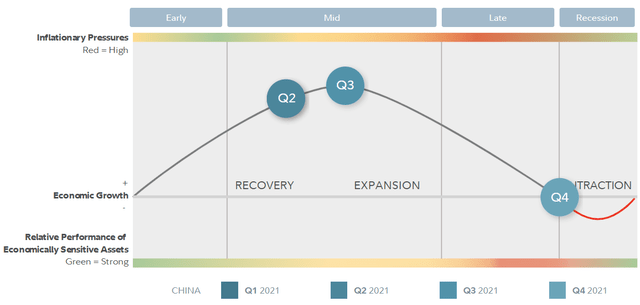

Also, Malaysia is heavily exposed to Asia-Pacific (a region to which it belongs), with China alone representing circa 13.3% of Malaysian exports and 23.9% of Malaysian imports. Based on research from Fidelity (see below), China in Q4 2021 is likely entering into a recessionary phase of its prevailing business cycle, which should support a generally negative outlook for APAC economies in the medium term.

Fidelity.com

EWM’s portfolio is unattractive from a cyclical standpoint, and from a valuation standpoint I also think the fund is unappealing, with potential downside in store from present prices. While I am not bearish on global stocks, I think EWM’s current bearish trend could remain intact. There is potential for the fund to begin to consolidate instead, but I think upside potential at this juncture is likely to be limited and short-lived.

[ad_2]

Source links Google News