[ad_1]

ETF Overview

The iShares MSCI Japan ETF (EWJ) owns a portfolio of Japanese stocks. The ETF basically tracks the performance of the MSCI Japan Index. This fund has high exposure to cyclical sectors that generally do not do well in an economic downturn. Japan’s economy is also heading for a slowdown, as indicated by the declining manufacturing PMI and consumer confidence index. Therefore, we think investors may want to stay on the sidelines until there is better visibility.

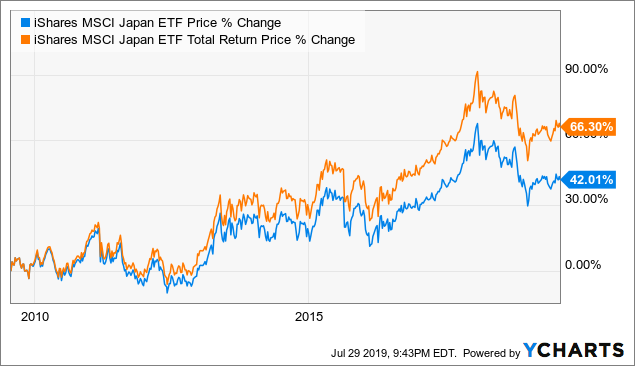

Data by YCharts

Fund Analysis

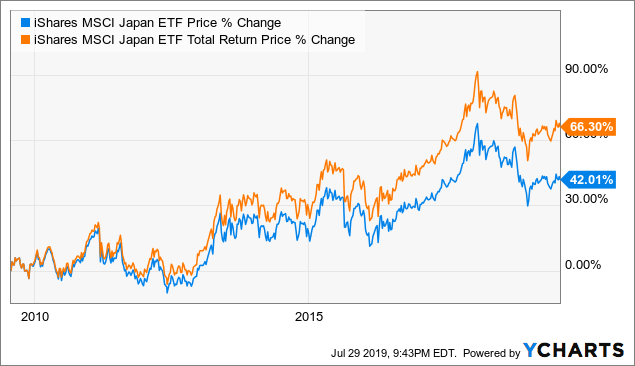

EWJ has high exposure to cyclical sectors

EWJ has a high exposure to cyclical sectors. As can be seen from the chart below, the industrial, consumer discretionary, information technology, financials, materials, and energy sectors represent about 67.8% of the total portfolio.

(Source: iShares website)

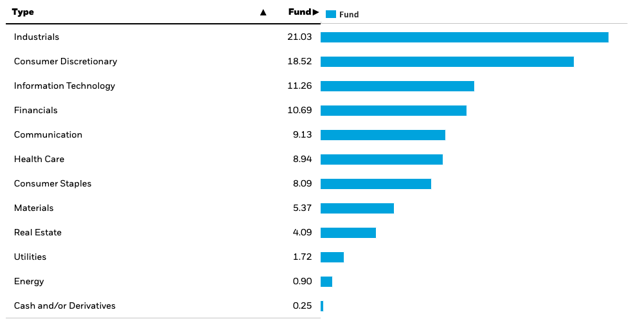

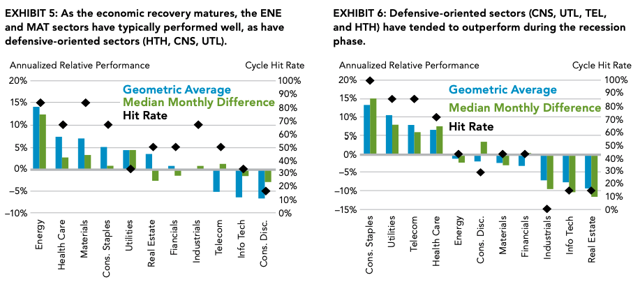

Cyclical sectors such as industrial, information technology, and financial tend to perform well in the initial stage of the economic cycle (see bottom left chart). As consumer confidence gradually improves, these sectors will benefit from more business activities and higher consumer spending. EWJ’s high exposure to cyclical sectors means the fund will likely perform well in the early-cycle and mid-cycle phases.

(Source: Fidelity: The Business Cycle Approach to Equity Sector Investing)

As the economic cycle matures, wage and material costs will gradually rise. Therefore, companies in cyclical sectors will generally experience a deceleration in their profit growth rates. As soon as the economy falls into a recession, these companies will likely experience declining orders and sales or lower business activities. Therefore, stocks in the cyclical sectors generally do not perform well in an economic recession (see bottom right chart). Likewise, EWJ’s high exposure to cyclical sectors means that its fund performance will likely underperform other ETFs that have much lower exposure to cyclical sectors.

(Source: Fidelity: The Business Cycle Approach to Equity Sector Investing)

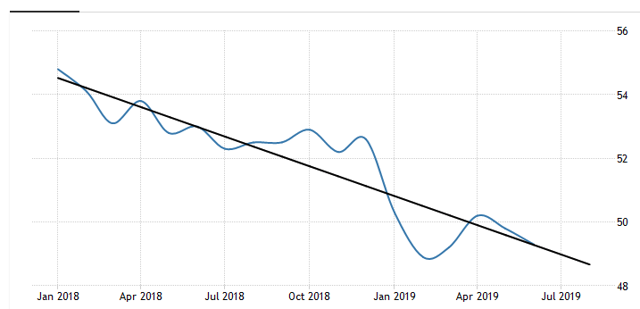

Japan’s economy is heading for a slowdown

Japan’s economy has struggled for quite some time since the peak in the 1980s. The central bank’s monetary policy (quantitative easing) that started a few years ago has improved the country’s economic outlook. However, this appears to be short-lived. Since the beginning of 2018, Japan’s manufacturing PMI, a leading economic indicator, has gradually declined from nearly 55 to less than 50 lately. This is the lowest we have seen since 2016.

Japan’s Manufacturing PMI

(Source: Trading Economics)

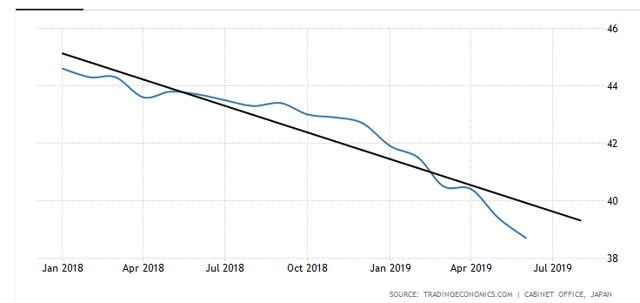

On the consumer side, Japan’s consumer confidence is also declining. As can be seen from the chart below, its consumer confidence index has declined from over 44 in the beginning of 2018 to below 39 in June 2019.

Japan’s Consumer Confidence Index

(Source: Trading Economics)

Since the two charts above (Manufacturing PMI and Consumer Confidence) are good leading economic indicators, we think a slowdown is likely inevitable. Therefore, stocks in EWJ’s portfolio may not perform well in the next little while.

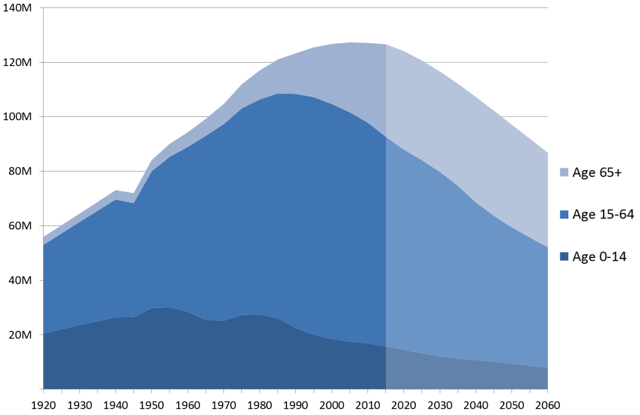

Japan’s declining population not a good sign for many sectors in EWJ’s portfolio

Japan’s population has been on a structural decline since 2011. In 2018, its population declined by more than 430 thousand people. As can be seen from the chart below, Japan’s population is expected to shrink to 107 million by 2040 (or a decline of 16% from the current level). We expect this will impact companies that have focused their businesses domestically. We expect the consumer discretionary (about 18.5% of the portfolio), consumer staples (8.1%), financials (10.7%), real estate (4.1%), and utilities (1.7%) sectors to be impacted the most. These sectors represent about 43% of the total portfolio.

(Source: Wikipedia)

Valuation Analysis

We have included the following table that compares EWJ’s valuation with other ETFs that focus on the region, such as the iShares MSCI Taiwan ETF (EWT) and the iShares MSCI South Korea ETF (EWY). As can be seen from the table below, EWJ’s forward P/E ratio of 12.82x is slightly below EWT’s 14.38x but higher than EWY’s 11.42x. Similarly, EWJ’s price-to-cash flow ratio of 4.85x is slightly below EWT’s but higher than EWY’s. We think EWJ is not expensive on a relative basis.

|

EWJ |

EWT (Taiwan) |

EWY (South Korea) |

|

|

Forward P/E Ratio |

12.82x |

14.38x |

11.42x |

|

Price-to-Cash Flow Ratio |

4.85x |

5.66x |

3.58x |

|

Sales Growth (%) |

4.09% |

6.56% |

3.89% |

|

Cash Flow Growth (%) |

0.62% |

4.05% |

10.12% |

(Source: Morningstar, Created by author)

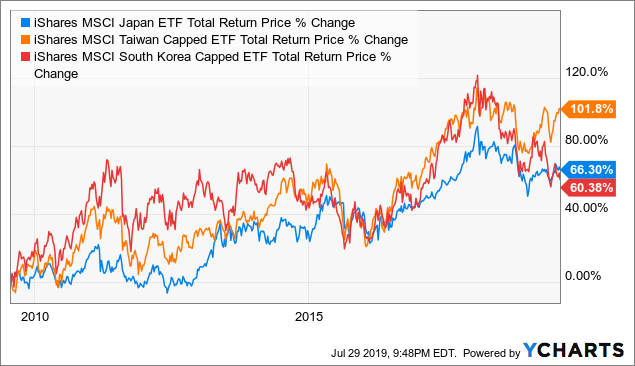

In the past 10 years, EWJ registered a total return of 66.30%. This is slightly better than EWY’s 60.38% but lagged EWT’s 101.8%.

Data by YCharts

Investor Takeaway

We think Japan’s economy is heading for a slowdown due to declining manufacturing PMI and consumer confidence index. Given EWJ’s high exposure to cyclical sectors and a structural decline in Japan’s population, we think the fund may not be the best place to gain foreign exposure in the long term. Therefore, we suggest investors seek opportunities elsewhere or simply wait on the sidelines.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

[ad_2]

Source link Google News