[ad_1]

serts/E+ via Getty Images

The iShares MSCI Germany ETF (NYSEARCA:EWG) is an exchange-traded fund providing investors with exposure to mid- and large-cap German equities. The German equity market is not as developed as, say, the U.S. equity market. Hence the fund has relatively few holdings, of 61 as of May 26, 2022. The level of concentration is not too high, although the top 10 holdings represented about 52.54% of the portfolio as of May 26, 2022. The expense ratio of the fund is 0.50% (not particularly cheap), while assets under management were $1.69 billion as of May 27, 2022.

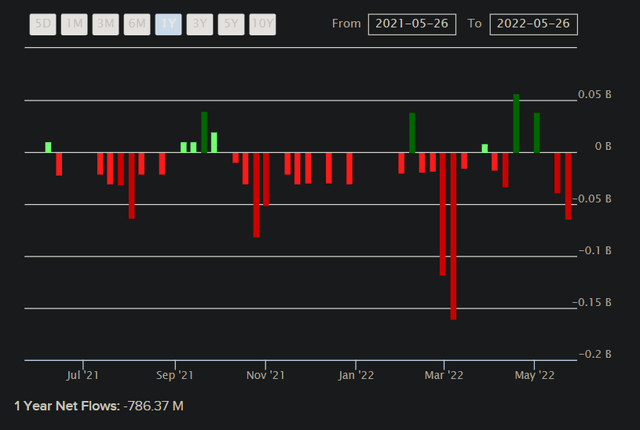

AUM of $1.69 billion follows a year of net outflows of circa $786 million, as illustrated in the chart below.

ETFDB.com

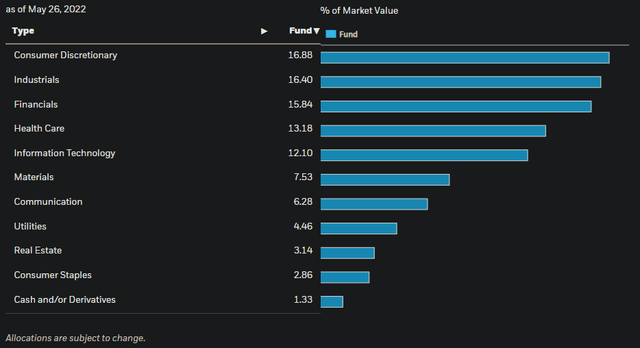

European equities are not known for high earnings growth and corporate productivity. Nevertheless, all equity funds can be valued and offer good value from time to time. Some mature, developed and economically sophisticated economies, particularly in Europe, can often be comprised of fairly low-return and “stodgy” sectors like Financials and Real Estate. There is some of that in EWG, but the portfolio does have some nice level of exposure to Consumer Discretionary, Industrials, and Technology; a mix of cyclical and economically sensitive sectors that give EWG some chance to out-perform.

iShares.com

The fund seeks to replicate its benchmark, the MSCI Germany Index. As of April 29, 2022, the index carried a trailing price/earnings ratio of 14.03x, a forward price/earnings ratio of 11.06x, and a price/book ratio of 1.47x. The dividend yield was 3.42%, implying a dividend distribution rate of circa 48% (call it 50%), and an implied forward return on equity of 13.3% (reasonably good; not close to the best-performing U.S. businesses, but better than some lower return countries like Japan).

Given how long rates are in Germany (the current 10-year bond yield is less than 1.0%), I would argue that the forward price/earnings ratio is fundamentally too low. The implied forward earnings yield is about 9%, so stripping out the 10-year of 1% as a proxy for the risk-free rate would reveal an underlying equity risk premium of 8%. That is not the long-term equity risk premium, but it is a start. If we were to assume stable growth of, say, 2% earnings growth hereafter, and a cost of equity of say 1% (risk-free rate) plus a 5% equity risk premium, the cost of equity would be 6%. Stripping out the long-term growth rate of 2%, that would enable us to justify a forward price/earnings ratio of 25x. If we increased the ERP to 6%, and the long-term growth rate to even 0%, you are still looking at a multiple of 14.29x. That is higher than EWG’s benchmark index’s forward multiple of 11.06x.

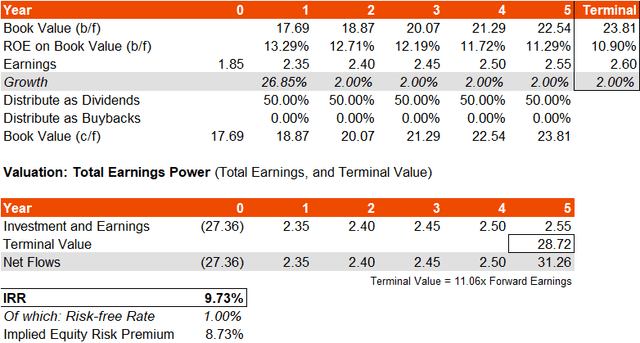

Nevertheless, assuming no buybacks for the moment, and holding the dividend distribution rate constant at 50%, and a declining ROE toward 10% (but keeping earnings growth at least at 2% per annum after the first forward year), I arrive at the following simple valuation. Morningstar project three- to five-year earnings growth at an average of 8.34%, while my three-year average (including MSCI’s projected jump over the next year or so) comes to 9.69% even with my lower 2%-per-annum assumption afterwards. My five-year average earnings growth number would be 6.55% though, which is under the Morningstar figure, and so I think these numbers are roughly in line with expectations (loosely speaking; not optimistic or overly pessimistic).

Author’s Calculations

This “valuation” gives me an IRR of 9.73%, with an implied ERP of 8.73%, which is considerably high, even with an arguably low forward price/earnings ratio of 11.06x in year five (for the terminal value number). This assumes no buybacks and is based simply on the whole earnings power of EWG’s portfolio (based on, perhaps, a less optimistic forecast).

I think 2% earnings growth from year two onward is not unreasonable, which would include inflation, and if we keep that as a minimum, any buybacks (not included in my calculations above) would only serve as a bonus (i.e., our IRR might rise to as much as 14-15% if we were to value EWG on the basis of dividends and equally large buybacks). But at base, our IRR should be almost 10%, which is very high as compared to low rates in Europe and Germany specifically.

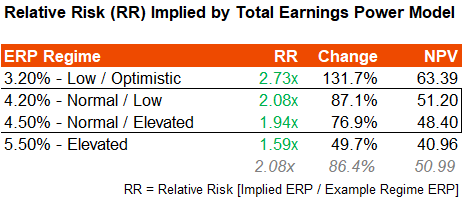

The table below compares my implied equity risk premium of 8.73% to a mix of different ERPs under different regimes. Even under an “elevated” ERP of 5.50%, EWG probably deserves about 50% of upside in price appreciation.

Author’s Calculations

However, it is possible that an “elevated” ERP of 5.50% actually makes sense for lower-return (and less “exciting”) nations like Germany. While there is a lot of money sloshing around the global financial system, capital is ultimately finite, and so equity investors will often preference more exciting, faster-growth countries and sectors over less exciting ones, all considered. The point is, the ERP for Germany can remain elevated. Still, the IRR is good, and for more risk averse investors and/or U.S. investors looking for international diversification, German stocks still look attractive on a valuation basis. Any positive earnings surprises should also be met with further price appreciation, and I think at these levels, you should be able to benefit from some earnings multiple expansion over the longer term (especially if risk-free rates remain low).

[ad_2]

Source links Google News