[ad_1]

franckreporter/iStock via Getty Images

Main Thesis And Background

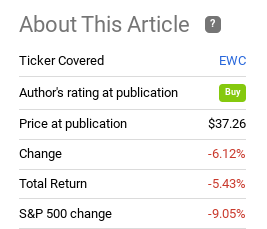

The purpose of this article is to evaluate the iShares MSCI Canada ETF (NYSEARCA:EWC) as an investment option at its current market price. This is a fund that is exclusively focused on Canadian equities, with a bias towards large and medium sized companies. I have owned and recommended EWC for over a year, adding to my position in the early stages in 2022 as a hedge against my U.S.-dominant equity portfolio. Looking back, EWC has offered a little bit of protection, but generally trended with the S&P 500 since January:

Fund Performance (Seeking Alpha)

As I begin to start planning for Q4 and 2023, I wanted to re-evaluate if holding EWC makes sense for my portfolio given this performance spread. After consideration, I do believe buying EWC continues to make sense and I will look to add on weakness in the coming months. This is for a variety of reasons. One, I am adding to my non-U.S. developed market positions across the board. Two, EWC holds the types of sectors – Financials and Energy – that offer both diversification from my Tech-heavy U.S. portfolio and the opportunity for growth. Three, global investors have begun to shun Canadian equities, which always piques my interest as a contrarian play.

A Potential Contrarian Play

To begin, I want to open up with a key reason why I am looking to add to Canadian shares at the moment. As my readers know, I have begun to take a more cautious approach to equities – selling in to the broad rally that we have had and now remaining patient to see if I can pick up some positions at better prices. I saw the market getting a bit too optimistic globally, and felt now was a good time to build my cash position.

Of course, cash is only good on a temporary basis. With inflation where it is, I do not want to sit idle for very long. As a result, I am looking to put that money to work, but being very selective in how I do so. One place in particular I am keen on at the moment is Canada. A simple reason why is that it appears unloved for the time being among the global investor class. While this may seem counter-intuitive, I love a good contrarian play, as they have served me well over the years since I began my investment journey.

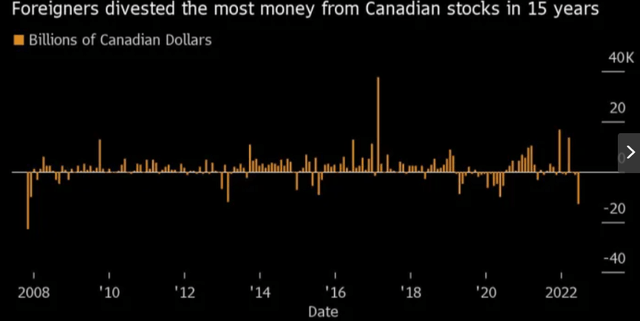

To understand the relevance, let us consider that over the past month global investors have been dumping Canadian exposure. Generally speaking this was a country that saw net inflows over the past two years. Yet, in the short-term, there has been a sharp outflow of foreign funds, as shown below:

Foreign Outflows From Canada (Bloomberg)

Of course, there could be plenty of legitimate reasons why one would want to reduce exposure to Canada. I will get to the merits of that argument next in this review. But the pros and cons aside, my interest is always piqued when I see the market move so confidently in one direction. When that happens I like to take the other side. Given that I was considering building on my Canadian position anyway, seeing the chance to do so as a contrarian play to my global peers only makes me more interested. This is key for why I am thinking of adding to this option now, while I remain cautious on equities more broadly.

I Like The Dividend Story

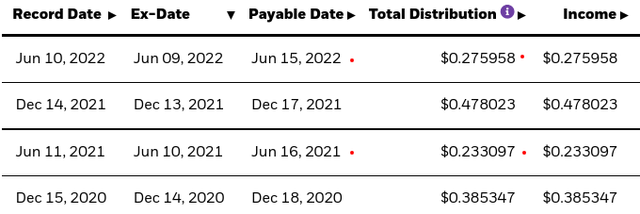

My second point is a simple but important one. This concerns the fund’s dividend, which I view positively at this juncture. While the idea of EWC as a yield play is not entirely attractive given the SEC yield is near the 2% mark, the metric I appreciate the most about this fund is the dividend growth. With the June distribution, investors enjoyed YOY growth above 17%:

EWC Distributions (BlackRock)

This is a straightforward metric so I won’t say much except this is strong growth and makes me more comfortable owning this exposure, all other things being equal. I prefer dividend growth to high yield, and EWC definitely has the growth part on its side at this time.

EWC Offers Diversification For U.S.-Centric Portfolios

Expanding on why I like Canadian exposure more broadly has to do with the country’s make-up in terms of sector exposure. This is what got me interested in Canada years ago, and why I continue to stay interested over the long-term. While other metrics like dividend growth and investor outflows may point to the merit behind buying at any one point in time, Canada’s economic make-up is why I want this exposure over the long run.

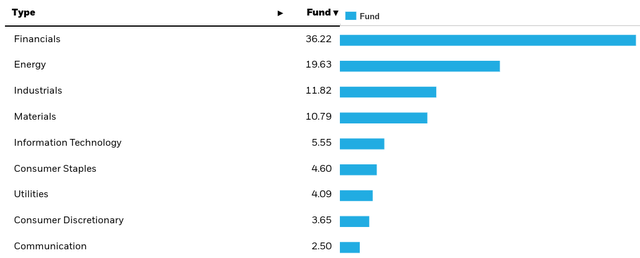

The reasoning is multi-fold. On the surface, Canada offers diversification for a U.S.-centric portfolio (which I have). The S&P 500 is very Tech-heavy, and its next largest sectors are areas like Consumer Discretionary and Health Care. By contrast, none of those sectors are in the top of EWC’s portfolio. Rather, the fund is over-weight areas like Financials, Energy, and Industrials. In fact, the Tech and Consumer exposure is very limited in comparison:

EWC’s Sector Weightings (BlackRock)

The highlights why I generally want Canadian exposure going forward. It provides me with sector exposure where I was previously lacking, as well as the fact that those are areas that I see tailwinds for in the coming months.

To understand why, let us consider that oil and other commodity prices have fallen in the past few months. This is being driven primarily by Covid-related lockdowns in China, as well as concerns over recessions in both the U.S. and across the developed world. While these concerns are valid, I personally see the sell-off as a time to bump up exposure because the longer term trend of constrained supply and rising global demand remain in-tact. I see this as the case because even if Europe and the U.S. begin to enter a more prolonged recessionary period, this should be offset once China comes out of lockdown. If the U.S. and the EU-zone avoid a prolonged recession, then there is significant upside potential in commodity prices, suggesting to me the risk is worth the reward at this juncture.

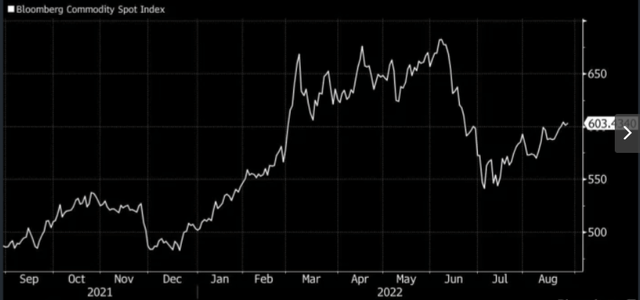

For support, we should recognize that while commodity prices remain relatively elevated on an annual basis, they have seen a sharp drop over the past quarter. This represents a contrarian buy opportunity to me, similar to the backdrop where global investors have been exiting the Canadian market:

Commodity Spot Index (Yahoo Finance)

This is an important point because it highlights a key reason for weakness in Canadian equities recently. As oil prices drop, the economy takes a hit. Further, Canada has a fair amount of Industrials and Materials exposure (more so than the S&P 500), so a decline in more than just oil (i.e. copper, gas, and other chemicals) has had a negative impact on share prices. But rather than flee over this concern, I want to be buying while others are selling.

My thought here is I expect the commodity slowdown/sell-off to be short lived. If that turns out to be the case, EWC is positioned to profit off that scenario.

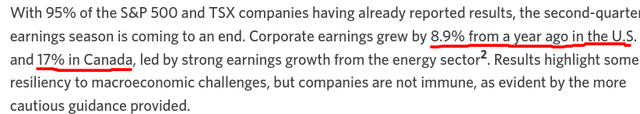

Canada’s Corporate Sector Has Seen Strong Earnings Growth

The next topic to consider is corporate earnings. This is an area that has been resilient in North America, despite inflationary pressures and a difficult consumer backdrop. With the Q2 earnings season coming to a conclusion, investors can take some confidence away from the fact that earnings were pretty strong in both the U.S. and Canada. In fact, earnings growth was actually stronger north of the border than domestically, a positive for EWC:

Corporate Earnings Growth Comparison (Edward Jones)

The takeaway for me here is this gives support for holding Canadian exposure. The Canadian economy has its difficulties right now, no doubt about it. But its heavy exposure to the Energy sector in particular is allowing corporate earnings to showcase strong numbers. Oil is a commodity that I believe will remain at elevated levels through the end of the year and in to 2023. In addition, I view this corporate earnings season as a tailwind for global investors to re-think their Canadian allocation and probably jump back in. I want to front-run this prediction and start to add before the masses do.

Consumer Spending Holding Steady

I noted earlier in this review that EWC is not as consumer-focused as a comparable U.S. large-cap index. This is true, but it does not mean that investors should remain ignorant of the consumer picture, since that can have a trickle-down impact on other areas. Therefore, understanding the health of the Canadian household and consumer remains relevant.

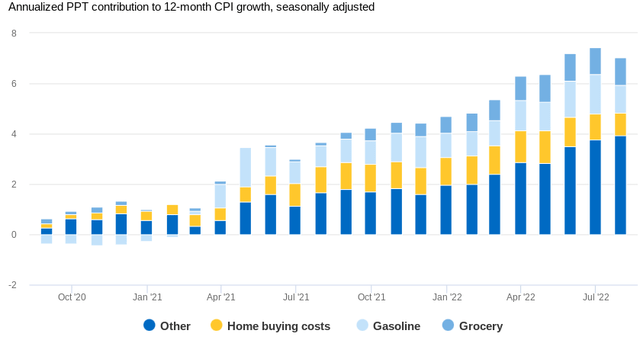

In this vein, we should recognize that inflation remains a hot-button issue north of the border as well as here. While the decline in oil prices over the past few months has tempered inflation a little bit, it remains at elevated levels:

Canadian Inflation Metrics (Royal Bank of Canada)

This is definitely taking its toll on Canadian households. However, the fortunate reality is that consumer spending has been resilient. While figures have leveled off from the beginning of the year, retail sales are still showing year-over-year growth across the board:

Retail Sales Growth (MasterCard)

I view this to mean that Canadian consumers are managing this environment relatively well. Are they likely worried? Of course. Are their concerns valid? Absolutely. But the reality is that Canada is a developed country with a citizenry that is wealthy by global standards. This has allowed them to cope with a difficult inflationary environment better than most. Therefore, I do not view the consumer picture as a reason to avoid EWC.

Rate Hikes To Benefit Large Banks

The final thought here is on the interest rate outlook, which remains hawkish for Canada. Similar to the Federal Reserve here in America, the Canadian central bank has made fighting inflation a priority. They have been consistent with rate hikes in 2022, including the most recent move in July. While there is probably more work to be done given how stubborn inflation remains, the upside here is that EWC’s exposure means investors can benefit from this trend.

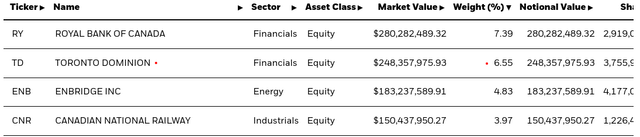

As the Bank of Canada raises its benchmark rate, Canadian lenders and large banks are able to pass on these costs to their borrowers. We have already seen some banks realize the gains from this backdrop, including Toronto-Dominion Bank (TD), which happens to be a top holding in EWC:

EWC’s Top Holdings (BlackRock)

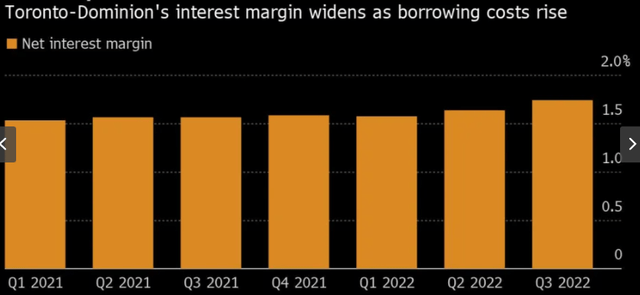

Specifically, TD Bank has seen its net interest margin improve in each quarter this calendar year, reaching a 2-year high in Q3:

TD Bank Net Interest Margin (TD Corporate Filings)

This is a trend for most of Canada’s large-cap banks, including the Royal Bank of Canada (RY), which is EWC’s largest single holding. Other banks pepper the holdings list, most of which can capitalize on this environment. While rising inflation and higher interest rates pose economic challenges, investors can take some comfort in knowing that EWC holds a large allocation to one of the sectors that can actually profit off this macro-trend.

Bottom Line

Canada continues to pique my interest due to its diversification benefits compared to the S&P 500, its status as a wealthy, developed market that has limited European exposure (I want to avoid exposure too close to the Russia-Ukraine military conflict), and its ability to offer dividend growth. While 2022 has posed a challenge to our friends north of the border, just like in the United States, I see benefits to adding to my position in EWC. As a result, I believe a buy rating remains appropriate. However, I would caution readers to approach positions selectively at this time, given the global headwinds that are challenging both economic projections and consumer and business sentiment around the world. While Canada looks attractive in relative terms, it is not immune to these challenges, so look to add on weakness and the days of decline that will almost certainty present themselves.

[ad_2]

Source links Google News