[ad_1]

Investment Thesis

I currently hold positions in the InfraCap MLP ETF (AMZA). As of the market close on 05/10/2019, my AMZA positions are down 22.35% in the aggregate. My contention is that the original decision to purchase this ETF based on its yield was fundamentally flawed, that AMZA is well-positioned to rebound for those investors willing to wait a few months (or years), and for those not willing to wait, that similar and significantly larger MLP funds exist that are better alternatives to AMZA. Let us see if these arguments hold any water.

Fund Background

Directly from the fund’s website, AMZA is a fund that “seeks to provide exposure to midstream master limited partnerships (MLPs) with an emphasis on high current income.” More specifically, AMZA purchases MLPs that own, build, and/or operate oil and gas pipelines, and receives most of its income from partnership distributions based on the levels of product that flow through the underlying MLP’s pipelines. AMZA also utilizes about 20-30% leverage to increase current income. AMZA was established on 10/01/2014 and (as of the date of this article) its website lists net assets of $467 million and an expense ratio of 2.4% (which includes a large provision for deferred tax liabilities).

Distributions

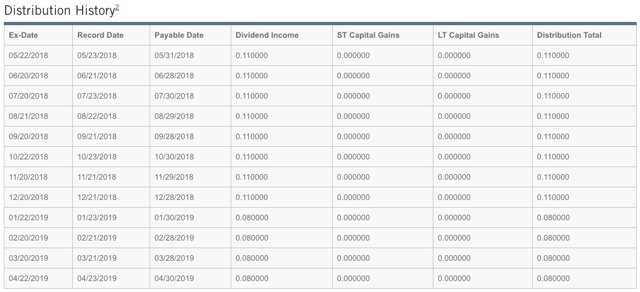

AMZA pays monthly distributions and has done so consistently over the past twelve months as shown below:

Based on the most recent twelve months of dividends (totaling $1.20/share) and the fund’s closing price of $5.66 on 05/10/2019, AMZA’s current distribution yield is 21.2%!! This high level of distributions (and their non-taxable nature) is what originally attracted me to this ETF.

Additionally, you can see on the chart above that AMZA decreased its scheduled dividend by $0.03 in January 2019 and going forward. Additionally, based on documents posted elsewhere on the fund’s website, all of the distributions shown above are classified as “return of capital.” I will analyze this situation later in the financial statements section.

Performance

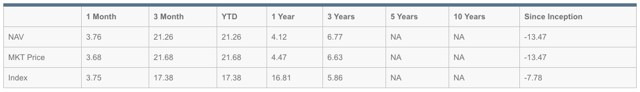

Moving down to the next section of AMZA’s website, we can see that the fund has a variable performance record; beating its benchmark in some years and trailing it in others:

In my opinion, most of the variability in returns can be attributed primarily to the volatility of the previously-mentioned leverage strategies that this fund utilizes. MLPs as a whole have also taken a price hit this past year and are currently an out-of-favor asset class, a fact that I will discuss in the next section.

Financial Statement Analysis

As I always do when analyzing an ETF, my next step is to read the most current set of financials, which is the annual report, dated October 31, 2018. Major sections and any specific items of note are discussed below:

Management’s Discussion Of Fund Performance (pp. 22-26)

Central to the issue that caused me to dig into AMZA’s fundamentals was a sharp drop in price, which is the central focus of this introductory section of the financials. This section discusses the widespread restructurings in the oil and gas infrastructure industry and the resulting distribution cuts that resulted. This major change had a ripple effect on the entire MLP asset class, causing many of these funds to experience a drop in market value. In addition to these industry-based factors, AMZA’s use of leverage served to magnify losses felt by the fund.

Management’s view is that crude oil and natural gas production will increase rapidly over the coming years, leading MLPs out of their current slump. In addition, AMZA will be in a position to offset these future gains with recent tax losses that it has accrued. Notably, on p. 26, AMZA provides a dividend coverage ratio chart which shows that the percentage of uncovered dividends has improved from 40% in 2016 and 2017 to the current figure of 31%.

Schedule Of Investments (pp. 89-92)

A cursory review of the fund’s investments verifies that it only holds the assets stated on its website: energy limited partnerships and options.

Statement Of Assets And Liabilities (p. 93)

AMZA reports net assets of $538 million, almost in line with the current figure reported on its website above. Of note on this schedule is the high level of liabilities, which constitute 36.23% of total assets. Also shown is an accumulated deficit of $99 million, which will be useful in the future if AMZA’s market price increases.

Statement Of Operations (p. 94)

As stated in the management discussion, AMZA did an excellent job offsetting their investment losses with $45 million of gains on written option. However, this was still not enough to offset the entire $38 million reduction in net assets that AMZA suffered this year as a result of its operations.

Statement Of Changes In Net Assets (p. 95)

Related to the earlier discussion about dividend coverage, in the current year, all of AMZA’s $119.4 million in distributions came from return of capital. As this statement shows, the only reason that net assets increased was due to an increase of almost $33 million from net positive shareholder transactions (purchases of the fund exceeded redemptions).

Financial Highlights (p. 97)

This section can be the most instructive when included in financial statements, at it shows changes to the NAV over time. As we have already determined, AMZA has unfortunately suffered some losses recently and its market price has declined as well. On this schedule, for every year of operation since its inception on 10/01/2014, AMZA has suffered both an overdistribution of its net investment income (return of capital) as well as a loss from investment operations. One additional item of note is that since 2015, AMZA has increased its portfolio turnover rate from 60% to 255% in the current period. This frequent trading increases fund costs and also goes against my portfolio preference for low-cost, passively managed investments.

At the time that I first initiated a position in AMZA (June 2018, see below), I was in favor of the high level of distributions and felt that the fund would soon be able to offset accumulated losses from prior years with future investment gains. However, this logic was flawed and looking back now, I would have decided against initiating a position in AMZA. (Note: In a future Seeking Alpha article, I will examine the universe of commodity ETFs to determine the best way for me to gain portfolio exposure to commodities.)

Portfolio Tax Lot Analysis

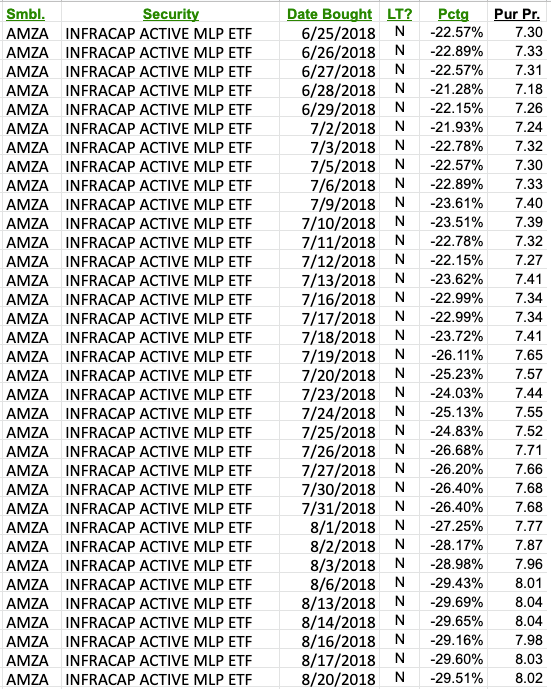

Taking a closer look at my actual positions in AMZA, I will start with the earliest positions (beginning in June 2018):

Of these, you can see that my earliest purchases of AMZA occurred in the $7.18-$8.04 range, significantly (23%-29%) above the current market price. AMZA would need to reach a price of $7.29/share in order for these positions to turn positive in the aggregate.

Of these, you can see that my earliest purchases of AMZA occurred in the $7.18-$8.04 range, significantly (23%-29%) above the current market price. AMZA would need to reach a price of $7.29/share in order for these positions to turn positive in the aggregate.

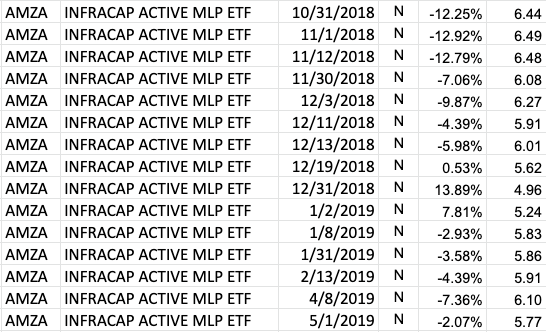

In order to take full advantage of this drop in price (and to initiate some tax loss harvesting), I added to my AMZA positions several weeks ago on 05/01/2019 at a price of $5.77. This is only slightly above the most recent closing price of $5.66.

With this lower-priced position established, I am currently waiting 32 days (until June 2nd) to avoid the wash sale rule and will be selling most of those losing positions from June, July, and August in order to harvest the short-term losses. These losses will offset other capital gains in my portfolio and the proceeds from those sales will be used to either rebalance into other portfolio assets or to establish a position in a new commodity ETF (which I am currently researching). Here is how the most recently-purchased positions of AMZA are situated:

As you can see, several of these positions are not too far above the current price point, and one of them even has an unrealized gain of almost 14%! While I did not anticipate the large losses on the older, top half of the portfolio, the bottom half is well-positioned to take advantage of any large increase in AMZA’s market price.

As you can see, several of these positions are not too far above the current price point, and one of them even has an unrealized gain of almost 14%! While I did not anticipate the large losses on the older, top half of the portfolio, the bottom half is well-positioned to take advantage of any large increase in AMZA’s market price.

As stated previously, after shedding some of the older short-term losses the first week of June, I will wait 32 more days and make another buy/sell decision. In the event that the price remains significantly below my break-even point of $7.29/share, adding another position in the $5-$6 range would possibly drop my break-even point several cents or more. Should the shares rebound, then no action is needed except any necessary rebalancing into the other asset classes in my portfolio.

The Takeaway

AMZA is currently suffering from a downturn in the midstream oil and gas MLP industry that has been magnified by its use of leverage, as we have discussed above. When I first purchased this ETF, I overlooked that fact (as well as the sizeable expense ratio) in favor of the prospect of tax-advantaged high dividend yields. At the time, I didn’t anticipate that AMZA’s price would take a dive as it has.

In any case, AMZA is much smaller than its largest peer (which I discuss in another article comparing MLP ETFs), however, if investors are willing to wait for AMZA’s price to recover and don’t mind the high expense ratio and return of capital distributions, AMZA could be an excellent play over the coming months and years. However, for my purposes, the fund is way too expensive, much too active, and no longer fits my long-term investing goals. For this reason, I have begun harvesting some of the capital losses from AMZA in my portfolio and will be rebalancing into a separate, low-cost, passively-managed commodity ETF.

Note: In an upcoming article, I will reexamine my comparison of MLP ETFs and look at the commodity ETF universe as a whole to identify the best funds for exposure to this diversifying asset class.

Disclosure: I am/we are long AMZA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News