[ad_1]

Vertigo3d/iStock via Getty Images

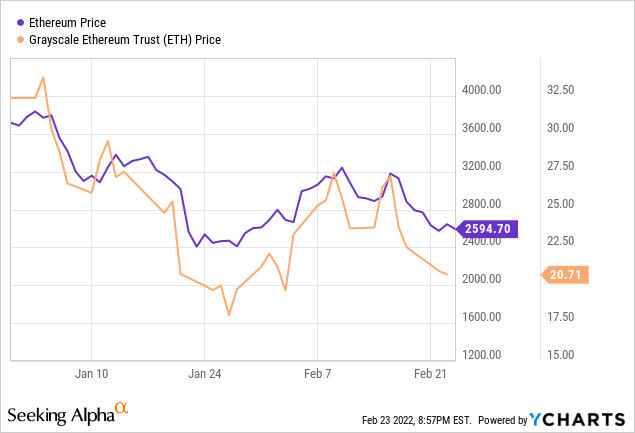

The Grayscale Ethereum Trust (OTCQX:ETHE) is a cryptocurrency fund through which investors gain exposure to Ethereum. The fund has experienced a 229% upside since inception, but more recent price action indicates that it is down by more than 30% since the start of 2022. As a result, the trust is priced at a discount to NAV of more than 19.5%.

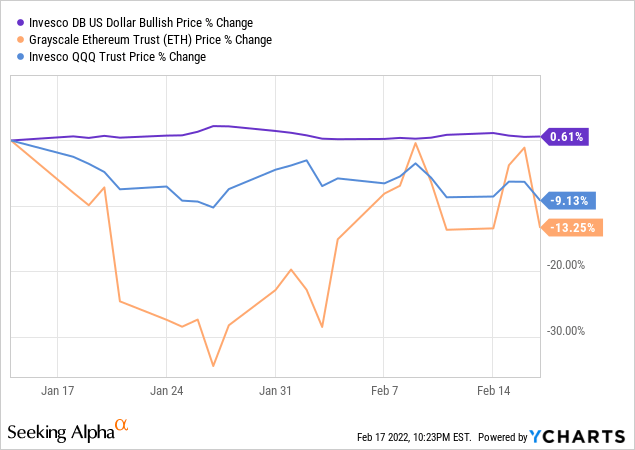

The reason for ETHE’s decline as shown in the orange chart below is that, as a holder of Ethereum assets, it closely follows Ether (ETH-USD) whose value has been highly volatile.

Now, both Ethereum’s and Bitcoin’s (BTC-USD) performances have been impacted by tensions between Russia and Ukraine since the beginning of 2022, with some temporary reprieves resulting in ETHE producing upsides as was the case on February 15.

Specifically, concerning Ethereum, it went through a temporary rise of nearly 15% in the February 16-19 period, coinciding with the launch of JP Morgan’s (JPM) virtual branch in the Decentraland, which is a blockchain metaverse according to Coindesk. The global financial services company is the first on Wall Street to establish a “metaverse office”.

Now, in a world where talks about the metaverse frequently make the headlines, it is important to realistically assess the opportunities in order to avoid disappointments such as when Meta Labs’ (NASDAQ:FB) stock plunged by 28% after Mark Zuckerberg revealed that he had invested $10 billion to build the underlying infrastructure for “meta experiences”.

For investors, I start by providing insights as to the relationship between Decentraland and cryptocurrencies.

The relationship between the metaverse and cryptos

JPMorgan’s branch is located on virtual land developed by Everyrealm after the latter bought a piece of Decentraland land for $913K back in June 2021. According to a publication by the bank, there is a parallel virtual market that is taking shape, encapsulating real estate development, rental, and credit financing.

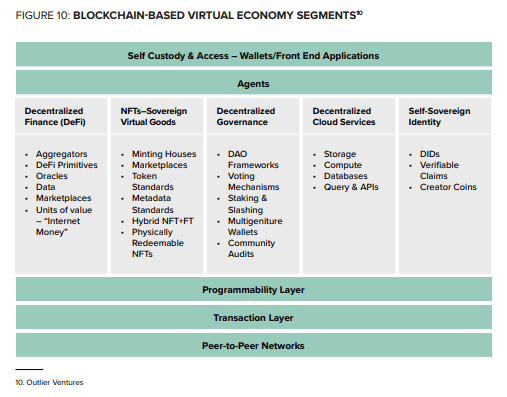

Now, these opportunities are based on decentralization or more specifically, DAOs (decentralized autonomous organizations) or a system of exchange enabling different stakeholders like creators and end-customers to exchange goods without necessitating intermediaries. Such a system where people interact through their digital identities or avatars is made possible by blockchain technology. Decentraland for example uses a cryptocurrency called MANA (MANA-USD) which is built on the Ethereum platform where plots on land are tokenized (digitally wrapped) as non-fungible tokens (NFTs).

Grayscale Digital Currency Toolkit (grayscale.com/wp-content/uploads/2021/07/grayscale-digital-currency-toolkit.pdf)

In addition to land, other real-world assets like artworks can be embodied into tokens, but, coming specifically to NFTs, these are unique, signifying that they cannot be copied. At the same time, they are more exchangeable than during normal transactions where one has to go all the way through an intermediary and pay brokerage fees as well.

At this stage, it must be mentioned that the metaverse is not something new, as evidenced by multiplayer games like “Counter-Strike,” which has been around for years, but these are rather centralized. They also use traditional means of payments like credit cards and are platform-based, normally set up by gaming companies. On the other hand, blockchain-based decentralized NFTs provide for a broader perspective as they are not restricted to a specific platform, encompass features like crypto wallets, and have larger community involvement.

Financially speaking, with NFTs boasting a market cap of $41 billion, JP Morgan is not alone, and, in January, Samsung Electronics (OTCPK:OTC:SSNLF), the smartphone and semiconductor giant manufacturer also opened a branch (store) in Decentraland. Others are also following suit.

Exploring further, according to CNBC, JPM’s wealth management clients could also access six crypto funds including four from Grayscale back in August 2021. These funds cover Bitcoin, Bitcoin Cash, Ethereum, and Ethereum Classic. The reason I mention these is that institutional investment is an important measure of interest including confidence in cryptocurrencies, especially for Ethereum which has more to offer than Bitcoin.

The Ethereum differentiator and ETHE’s price action

This confidence stems from Ethereum’s differentiator, as, unlike Bitcoin and other related altcoins which are used only as stores of value or means of exchange like fiat currencies, it is its usage as a tool allowing for developers to build decentralized apps, namely for NFTs and DeFi (Decentralized Finance) that confers it a better value. Interestingly blockchain-based applications can prove useful in a high-inflation environment with their ability to reduce costs for transactions like money transfers.

This leads to monetary policy, where the U.S. central bank has printed a lot of dollar notes since the beginning of the pandemic, and, nearly two years later and right in the middle of the economic recovery, there appear to be discordant voices within the Federal Reserve itself as to how to control inflation. Now, this implies uncertainty as to the U.S. dollar, namely about its ability to continue to outperform the Eurozone’s euro or the Japanese yen.

Thus, my next step is to look for a hint in the price action of ETHE that would suggest a differing trend to that of the U.S. dollar.

For this purpose, coming to the price-performance for the last one month, there is a slight downward trend in the Invesco DB US Dollar Bullish ETF (UUP) as shown in the deep blue chart below from January 26-27. Conversely, the Grayscale trust (in orange) has produced an uptrend. Now, this may just be a temporary bump for the dollar and I am also not going to the extent of asserting that Ethereum or ETHE is starting to play a role as an inflation hedge, but these observations deserve to be highlighted, and most importantly, they need to be monitored with time for any sustained price action.

Another noteworthy event is ETHE’s share price alignment with the Invesco QQQ Trust (QQQ), represented in the above pale blue chart. These two look less aligned as from January 26-27. Again, this is another useful trend to follow, and this time, this should be done in a context where a rise in the 10-year Treasury yields is proving to be detrimental to tech stocks.

These two trends, if sustained, would signify big opportunities for ETHE by giving credence to Grayscale’s statements that cryptocurrency could first, constitute an inflation hedge as protection against currency debasement, and second, provide for an uncorrelated asset relative to stocks, bonds, or commodities.

Conclusion

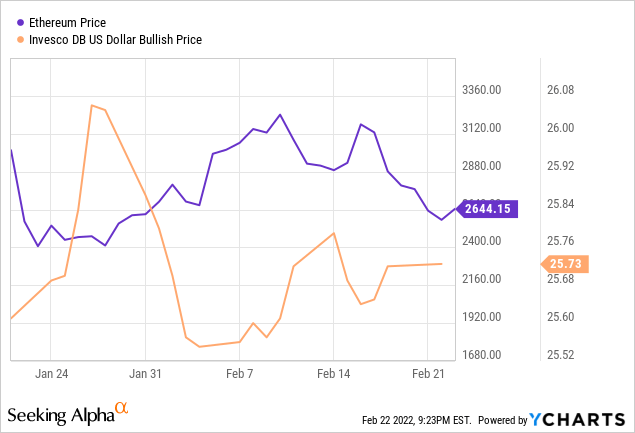

In the meanwhile, volatility persists and further reports of an escalation of tensions in Eastern Europe made the market see red on February 18. Ethereum went below the $3,000 range, after dropping by over 7%, but it has not gone below the $2,400 level (blue chart below) despite further escalation. As of the time of writing of this article on February 23, the token was trading at $2,458.6.

Despite Ethereum getting some support at the $2,400 level, I still do not recommend any dip-buying, as, Coindesk reports that there could be regulatory moves by the White House this month, possibly in the form of an executive order. I generally view regulations as a good sign for an asset class, but they create short-term volatility.

Pursuing further, while the two (Ethereum and Ether) are often used interchangeably, Ether is in fact Ethereum’s blockchain native token and has become widely popular since its launch in 2015. At that time, its price was only $0.311. Today, or about seven years later, it is worth 8,000 times more, and it is tantalizing to see the number of metaverses, the coins used, and their respective market capitalizations on Coinmarketcap.

This rise in the value of Ethereum has translated into $8.1 billion in assets under management for ETHE which is available at a fee of 2.5%. This is a considerable amount for a passive investment vehicle compared to peers charging expense ratios of less than 1%. Still, its ability to enable investors to gain exposure to Ethereum in “the form of securities while avoiding the challenges of buying and storing” digital coins is appealing.

Furthermore, as evidenced by Coinmarketcap, each metaverse makes use of its own digital currency to perform economic activities for buying and selling. As I mentioned above, MANA is used for Decentraland, but, Ether, which constitutes a layer one crypto platform can also be used. With time, several competitors to Ethereum have emerged with the most prominent one being Solana (SOL-USD). This coin is popular in DeFi applications. One example of DeFi is a lending platform that allows users to contract loans using their virtual land as collateral.

However, as of date, Ethereum’s blockchain still hosts the top metaverse plays operating across gaming, music, entertainment, and even DeFi. Despite Solana providing for faster transaction speeds, Ethereum’s market cap at $365.5 billion dwarfs Solana’s $31.5 billion by more than ten times after the latter lost nearly 13% on February 17.

Consequently, demand for Ethereum should increase as a value creator for the NFT ecosystem, and for those who find owning crypto wallets too complicated, passively owning ETHE shares makes more sense. Furthermore, continued development in the metaverse should positively influence the price of Ethereum in the long term, with the cryptocurrency possibly outperforming the dollar in an inflation-dominated environment.

After a highly volatile 2022, unless you are a professional trader, it would be better to wait for the emergence of sustained trends before adding ETHE to your portfolio. Along the same lines, bearing in mind the need for investor protection, it is important to be on the watch out for cybersecurity measures implemented by the Security and Exchange Commission as the Eastern Europe situation becomes tenser.

Ending on a positive note, according to some unconfirmed news from Bloomberg, the hacker behind the 2016 Ether hack amounting to $55 million from the DAO smart contract has been identified.

[ad_2]

Source links Google News