[ad_1]

The No. 1 question I got asked in the month of October was, “How’d ETFs do?” What’s behind that question was a decade of hand-wringing by pundits claiming ETFs would cause, or exacerbate, the next big crisis.

Instead, what I think we’ve seen is ETFs acting as shock absorbers for the market—putting bids underneath falling securities. If nothing else, we’ve seen firsthand some great examples of precisely how creation and redemption work to keep ETF pricing in line in times of stress.

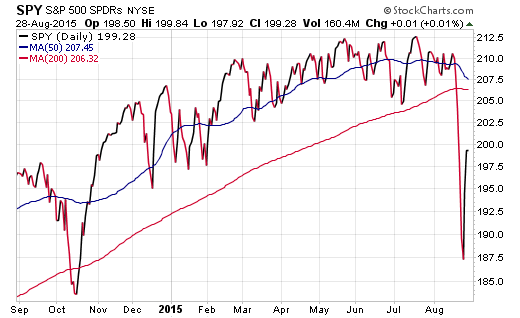

Let’s start first with the world’s most liquid security—the SPDR S&P 500 ETF Trust (SPY). Most ETF investors know that for all ETFs, even SPY, there are two “values” at any given moment in time. There’s the price at which it’s trading, and there’s a “fair value”—the actual net asset value based on all the underlying securities; in the case of SPY, the value of all the stocks in the S&P 500.

These two values don’t always match perfectly, so investors can monitor that “fair value” through the intraday NAV, or iNAV. iNAV has lots of problems, but in the case of big, liquid funds and big, liquid securities, it works pretty well.

A Tale Of 2 Days

Here’s the difference between SPY’s trading price, and the iNAV, during the most volatile parts of the last month:

A few things to note: This is actually pretty typical. SPY trades currently in the $270 per share range, and it can be “mispriced” by 10-30 cents regularly—that’s about 0.07% plus or minus few hundredths of a percent if you’re doing the math, and that falls among the smallest perceived premia/discounts in the market.

I say “perceived” because there are a lot of factors that go into this: differences in the timing of when stocks trade versus when the ETF trades. The spreads on the underlying stocks themselves are often much wider than that 0.07%, so there’s a lot of “wiggle room” in this analysis.

But what we do know is when it makes sense for an authorized participant to do something about it. Anytime the stocks in the S&P 500 seem “cheap” relative to the price of SPY, they will buy the stocks, and sell the ETF. If the stocks seem “expensive” relative to the ETF, they’ll sell the stocks, and buy the ETF.

If, at the end of the day, they end up with a lot of stock, and have sold a lot of SPY they don’t actually own, they do a creation, trading the stock for the shares of SPY, and they go home happy.

So in this recent volatile window, what went on with SPY in terms of creation/redemption:

Clearly, a little bit of each. A few huge caveats: Flows data is self-reported, and not always reported the same way by all issuers. We know from experience that the flows in SPY as we report them here (from FactSet data) are in fact a day off. That is, the inflows you see on Oct. 11 on this chart, of roughly $2.5 billion, represent orders placed for creation on Oct. 10.

If we go back to Oct. 10 on the first chart, what do we see? Well, SPY looks like it traded above fair value for most of the day. So, you’d expect that APs would sell the ETF and buy the underlying stocks, making new shares at the end of the day—positive inflows. And that’s what happened.

If you move ahead a day to the big outflows on Oct. 12, you can see that’s a response to the discounts from Oct. 11. In other words, SPY was trading under fair value, so the AP bought shares of SPY, and sold shares of stock and did a redemption at the end of the day.

[ad_2]

Source link