[ad_1]

Our research updates are supposed to focused on developments in the ETF ecosphere, but the recent zigging and zagging by one common stock of a most uncommon company has us chucking our own guidelines to spill more ink over the latest developments at Tesla (TSLA). It’s been a disappointing week for stocks in general, but Tesla has been a leader at delivering investor pain since its March 1 announcement of the long-promised $35K variant of its Model 3. Car geeks might be excited about a sexy electric car for the masses, but shareholders have been less enthused, whacking the equivalent of more than $6.5 billion off the stock’s market cap since then. Maybe because the latest Model 3 only comes in black?

There are plenty of reasons investors might be turning on Tesla, but that recent pullback only highlights a trend that has been developing for several years and where the “zigging and zagging” come into play. You wouldn’t know all the hype surrounding Tesla and electric cars by only watching its stock price, which has been stuck in a broad trading range since 2017 that has left long-term shareholders remarkably underwhelmed. Over the last three years, Tesla has delivered an annualized return of 10.45% compared to a 13.3% for a low-fee S&P 500 replicator like SPDR S&P 500 ETF Trust (SPY). But stretch that out to five years and Tesla’s annualized return is a mere 3% compared to 10% for SPY. That’s the same kind of performance you would have had with GM, the same company once disparagingly referred to as “Government Motors.”

Seeking Alpha has plenty of commentators who can offer insights into Tesla’s profit outlook, manufacturing capabilities or product line-up, but we think there’s one seriously overlooked factor in underperformance of its stock. Like many of the more volatile stocks out there, Tesla is significantly under-owned by ETFs, especially for a company of its size and with such name recognition and media attention. But if CEO Elon Musk’s recent comments about future negative earnings are to be believed, investors should brace themselves because that light ETF ownership, and volatility, aren’t going anywhere anytime soon.

A Lot of Pain For Little Gain

Before we get to that, let’s look at a weekly chart for TSLA where it quickly becomes obvious that investors were beginning to get anxious way before the recent spate of bad press. In fact, while TSLA managed to defy the broader market’s negative trend in the fourth quarter, the stock has been range-bound since early 2017 after it first got above $380 in June and then again in September. Call it “peak Tesla,” with each successive move to that level triggering strong selling. The flip side of course is that the stock also has found support at or just below the $260 level, most recently in early October when the promise of actual GAAP profitability helped send the stock back toward $380 where it once again ran out of steam.

That recent sell-off from the December high is a lot of pain to inflict on investors, but for us, the real kick in the pants was the announcement that Tesla’s net income would likely go negative again in the first quarter of 2019 as the company adjusts its production for a lower-margin car like the latest Model 3. For some long-term investors, that might be a minor blip on the road to dominance in the electric car market, but for people in the ETF world, it’s just one more roadblock to Tesla’s inclusion in some of the largest funds and could point to more volatile moves for the stock in the future.

We’ve already talked at some length about the benefits on ETF ownership in our post about Dropbox (DBX) which you can read here (ETF Inclusion Of DBX) and it’s not just index inclusion arbiters who should take note. Many believe that widespread ETF ownership can help lower overall volatility, specifically because large index funds provide liquidity to the market by indiscriminate buying and selling thanks to fund flows while also providing a deeper pool of potential buyers for current owners to offload their positions to.

Our daily equity summary report for Tesla as of March 7 showed long ETF ownership of Tesla at $1.32 billion spread across 125 funds. With the stock’s current market cap of slightly over $47 billion, that gives it a nominal long ownership percentage of 2.8%. That might sound impressive, but remember, context is for kings, and in this case, so are accurate comparable companies. Tesla’s only-slightly larger rival GM has a 5.24% long ownership ratio while Vertex Pharmaceutical (VRTX), an S&P 500 component of a similar size to Tesla, has an ETF ownership percentage of 7.27%. The gap between GM and Vertex is largely due to the fact that auto manufacturers tend to be under owned given a distinct lack of industry ETFs. In this case, there’s just one automotive ETF vs. at least 15 biotechnology funds.

The main difference between those other stocks and Tesla is of course that they’re S&P 500 components, which means they get to be included in some of the largest index replicators around like the SPDR S&P 500 ETF Trust (SPY), iShares Core S&P 500 ETF (IVV) or the Vanguard S&P 500 ETF (VOO) which being three of the five largest ETFs in the world between them have over a half a trillion in assets. Not to mention all the other funds that rely on the S&P 500 or the broader S&P 1500 index to build out their investment universes like sector, style or smart beta funds. TSLA is still a component of some of the largest index funds replicating the Nasdaq 100 or Russell 1000 and a host of actively-managed ETFs from Ark Funds, but there’s no denying that being excluded from the most well-known S&P index series has been a huge drag.

Quantifying that drag can be challenging, Tesla is large enough to have low bid-ask spreads and has a relatively high correlation to the broader equity market. Where most investors might notice the lack of ETF ownership is through volatility, especially compared to fellow auto manufacturer GM. GM hasn’t been setting the world on fire performance wise over the last few years although it has endured less volatility than TSLA in doing so. GM’s trailing three-year annual standard deviation is 22.89, according to Morningstar, vs. 37.93 for TSLA and 11.18 for SPY. That translates into violent moves by TSLA (down 11% in 2016, up 45% in 2017 for example) that might produce quick profits for investors who buy at the lows, but they make it challenging to stay with the stock for long periods of time, especially if using leverage. Take a look at this daily chart of the last two years for more inspiration.

Why the lack of love from one of the world’s leading index providers? Well you don’t need to have faith to be a part of the S&P 1500 (from which the largest components become the S&P 500) but you do need to have a few other things. You must have the right structure, a single share class, trade on certain exchanges, be liquid and most importantly, you must have something S&P refers to as “financial viability” which in this case they define as:

The sum of the most recent four consecutive quarters’ Generally Accepted Accounting Principles (GAAP) earnings (net income excluding discontinued operations) should be positive as should the most recent quarter.

Translating that as “the trailing twelve-month (TTM) earnings should be positive as should the most recent quarter” means nothing good for Tesla. Despite having posted positive net income for the last two quarters, TSLA is still significantly in the red for 2018 with a net loss of $976 million although the focus here with S&P is on most recent four quarters. If Tesla managed the same $139 million in net income in the first quarter of 2019 as it did in the prior quarter, the TTM net loss would drop to just $120m as the 1Q 18 loss rolls out of the calculation field. The TTM income could even have flipped into positive territory by the end of 2Q 2019 if they have continued to post even those reduced profits they had in 4Q 2018. And given that there’s no fixed schedule for changes to the S&P 1500, along with Tesla’s name brand, the stock could’ve gotten a significant source of liquidity as soon as the ink was dry on the financials.

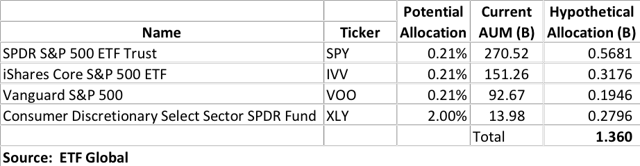

How much “liquidity” are we talking about? Let’s do some quick and dirty calculations to see. Here we’ll look at the just four most obvious candidates, the three S&P 500 replicators we’ve already mentioned along with the Consumer Discretionary Select SPDR Fund (XLY), the largest sector fund where Tesla would most likely find a home.

Using the S&P allocation for a company of almost identical size and a strong guesstimate on XLY, you can see that inclusion in just those four funds would add $1.36B to Tesla’s ETF ownership total, which using today’s closing market cap would give you an ownership percentage of 5.7%, inline with another car manufacturer like GM. And that’s only from four funds, without considering what other S&P linked products are out there that could be potential buyers of the stock in the event Tesla made it to the big time. And that’s how you miss out on a billion in added liquidity.

Playing the Calendar Game

Now the question investors need to focus on becomes just how deep could this first quarter loss be and does the continuing margin erosion mean that red ink is more likely than black going forward?

Remember that the great virtue of the S&P methodology is that it takes a rolling approach which means that come the end of June, the first and second quarter losses from 2018 will no longer be a factor in the calculation while the combined net income from the third and fourth quarters is over $450 million. If the loss for the first quarter is a narrow one, then a profitable second quarter might be enough to get the company to a positive trailing twelve-month income, and then (possibly) into the S&P 500. We say possibly because index membership is never guaranteed. And the second quarter would also have to be positive for index inclusion so even a positive TTM net income, but with narrow losses over two quarters would be a deal breaker.

So while traders looking for a quick buck may be watching Musk’s Twitter account, you’d be doing better to keep an eye on the bottom line than obsessing over the headlines! If Musk can focus on profitability over output and get into the company into the S&P 500, a sea of liquidity could give the stock new life.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Assumptions, opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. ETF Global LLC (“ETFG”) and its affiliates and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively ETFG Parties) do not guarantee the accuracy, completeness, adequacy or timeliness of any information, including ratings and rankings and are not responsible for errors and omissions or for the results obtained from the use of such information and ETFG Parties shall have no liability for any errors, omissions, or interruptions therein, regardless of the cause, or for the results obtained from the use of such information. ETFG PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall ETFG Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information contained in this document even if advised of the possibility of such damages.

ETFG ratings and rankings are statements of opinion as of the date they are expressed and not statements of fact or recommendations to purchase, hold, or sell any securities or to make any investment decisions. ETFG ratings and rankings should not be relied on when making any investment or other business decision. ETFG’s opinions and analyses do not address the suitability of any security. ETFG does not act as a fiduciary or an investment advisor. While ETFG has obtained information from sources they believe to be reliable, ETFG does not perform an audit or undertake any duty of due diligence or independent verification of any information it receives.

This material is not intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only correct as of the stated date of their issue. Prices, values, or income from any securities or investments mentioned in this report may fall against the interests of the investor and the investor may get back less than the amount invested. Where an investment is described as being likely to yield income, please note that the amount of income that the investor will receive from such an investment may fluctuate. Where an investment or security is denominated in a different currency to the investor’s currency of reference, changes in rates of exchange may have an adverse effect on the value, price or income of or from that investment to the investor.

[ad_2]

Source link Google News