[ad_1]

Earlier today, I saw an interesting report by Morgan Stanley’s head of cross-asset strategy Andrew Sheets. In this report, the bank downgraded global equities to underweight, essentially advising investors to sell stocks. While we will discuss the contents of this report and the reasons for this advice later in this article, what struck me as interesting was the bank’s advice on what to buy. That is emerging markets bonds, which can be a difficult asset class for most investors to access due to the fact that most brokerage houses do not keep an inventory of these bonds and require very large minimums to obtain them for clients. For most of us, perhaps the easiest way to take Morgan Stanley’s advice is by purchasing an emerging market bond ETF such as the iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB).

About The Fund

As is the case with most exchange-traded funds, the iShares J.P. Morgan USD Emerging Markets Bond ETF is designed to track the price and yield performance of a financial index. In this case, that index is the J.P. Morgan EMBI Global Core Index. This index is comprised of the government bonds of various emerging markets around the world. The interesting thing about these bonds though is that they are not denominated in the currency of the issuing nation. Instead, they are denominated in U.S. dollars. This is something that emerging markets sometimes do in order to sell their bonds since it is generally assumed that investors will be more interested in receiving interest payments in a perceived stable currency like the dollar instead of one that can see its value fluctuate to a much greater degree.

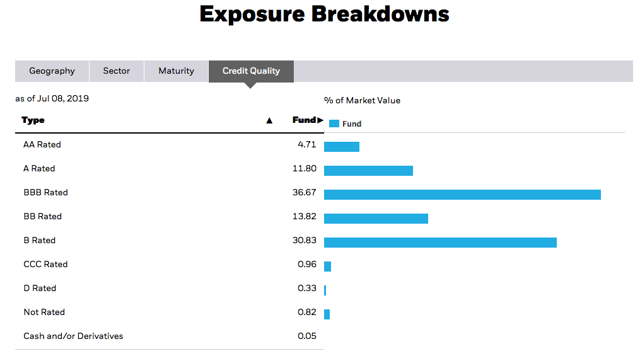

Government bonds are generally considered to be relatively safe investments. This is due to the perception that governments are large and enduring institutions that have the power to tax their citizenry by whatever amount is needed to ensure that their bond holders are repaid. With that said though, emerging nations have been known to default on their debt obligations at a higher rate than developed nations. There have been a few high-profile cases of such in the past like Russia’s default back in the 1990s and a few defaults by Argentina over the years. For the most part, the ratings of the various sovereign bonds in the fund reflect this, and EMB’s portfolio is about evenly split between investment-grade and below investment-grade:

Source: iShares

Source: iShares

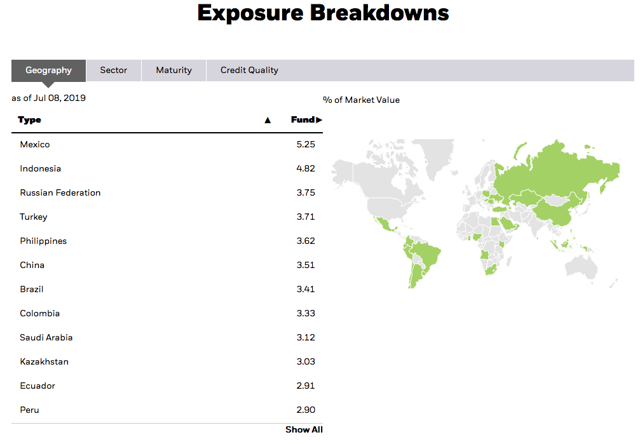

This may be concerning to some investors, particularly conservative ones that tend to gravitate to fixed-income investments for reasons of safety. Fortunately, the fund is fairly well-diversified and includes exposure to the sovereign bonds of more than thirty nations. It is highly unlikely that all of these countries (or even a couple of them) will default en masse. Here is how the fund’s exposure breaks down:

Source: iShares

Source: iShares

As my regular readers are no doubt well aware, I generally do not like to see any individual asset account for more than 5% of a portfolio. This is because 5% is approximately the level at which that asset begins to expose the portfolio to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. Thus, the concern here is that if some event occurs that causes the price of a given heavily-weighted asset to decline independently of the market, then it will have a noticeable impact on the value of the portfolio as a whole. While there are no individual bond issues that account for more than 5% of the fund’s portfolio (the largest is Turkey’s at 3.47%), we do have 5.24% exposure to Mexico’s bonds in aggregate. Thus, should Mexico run into trouble or default or something to that effect then investors will see a very noticeable decline in the value of the fund.

Reasons To Buy In

As I mentioned in the introduction, the thing that originally prompted me to look at EMB was a recent report from Morgan Stanley advising investors to rotate money out of stocks and into emerging market bonds. Let us now take a look at the reasons for this advice.

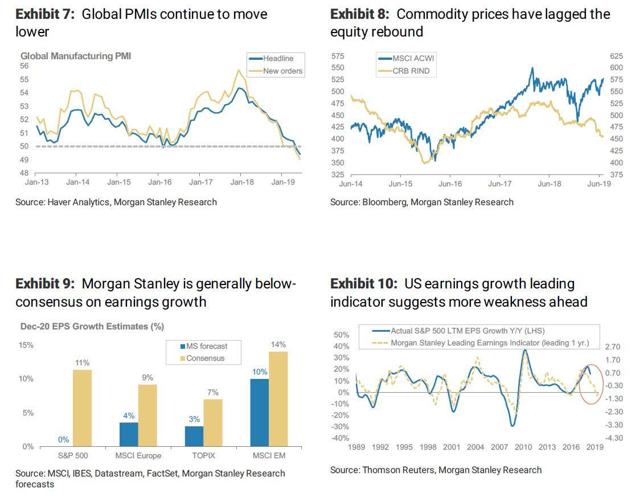

The primary reason for this advice is that, based on current prices, the expected forward returns for equities are at a six-year low. This largely comes about because of the strong run-up that we saw in June despite some of the weakening signs present in the broader economy. These are the same signs that have caused market participants to believe that the Federal Reserve will begin to cut rates shortly. As a result of these things, the bank believes that consensus earnings estimates in the United States, Europe, Japan, and even emerging markets remain too high and will not justify current equity valuations. If the bank proves to be correct here, then stocks will likely begin to decline as valuations move back into line with what the underlying companies are actually able to deliver.

Source: Zero Hedge

Source: Zero Hedge

The fact that the market surged on expectations of rate cuts over the remainder of this year could also serve as a downward catalyst going forward if the Federal Reserve fails to deliver on these expectations. We can all recall what happened in the fourth quarter of 2018 when the market generally thought that the central bank would raise rates. When it decided to hold them steady, the market promptly reversed course. The same thing happened to reverse May’s decline when the market started to think that the Federal Reserve would start to cut rates. Thus, expectations for a rate cut are high, and should the central bank fail to deliver, it could very easily spark a market selloff.

These factors would generally be good for bonds in general, as the money rotating out of stocks needs somewhere to go and bonds are the logical place. So, the question then becomes why to like emerging markets bonds in particular. Well, one reason is that developed market bonds were also run up significantly over the past month due to the expectations of a rate cut. I have discussed this in various previous articles posted to this site. This has resulted in yields being extremely low, and in several developed markets outside of the United States, bonds have negative yields. Admittedly, it makes no sense at all to hold something with a negative yield, but that is the environment that we are in. Meanwhile, emerging market bonds have not been bid up to the same degree, so they currently still have a reasonably appealing yield. In addition, since these are government bonds and they are denominated in U.S. dollars, they are likely reasonably safe. At least, there is unlikely to be a significantly greater risk than with most American bonds, but you receive a higher yield.

Distributions

As just mentioned, emerging market bonds have not been bid up to the same degree as other assets and so still boast rather appealing yields. This is reflected in the yield of EMB, which at 5.50% is quite a bit higher than most other bond ETFs. In fact, this is a better yield than even domestic junk bonds deliver, but these are the debt issues of sovereign governments, many of which have much better debt-to-GDP ratios than the United States and other developed markets! Thus, EMB can certainly help an investor to receive a very reasonable yield to ride out the trouble that Morgan Stanley is projecting.

Conclusion

In conclusion, the valuation for many assets appears to be fairly high. In the case of equities, earnings may not be sufficient to justify these valuations. This could cause the market to decline. Morgan Stanley projects that this decline could start as early as next week when the first earnings announcements start to come out. Meanwhile, emerging market bonds appear to still offer appealing yields at these prices, and with EMB, you also get the safety of being owed money by sovereign governments. It may be a good idea to consider adding this fund or a similar one to your portfolio.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. We are currently offering a two-week free trial for the service, so check us out!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News