[ad_1]

Editor’s note: Seeking Alpha is proud to welcome HA Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Nikolay Evsyukov/iStock via Getty Images

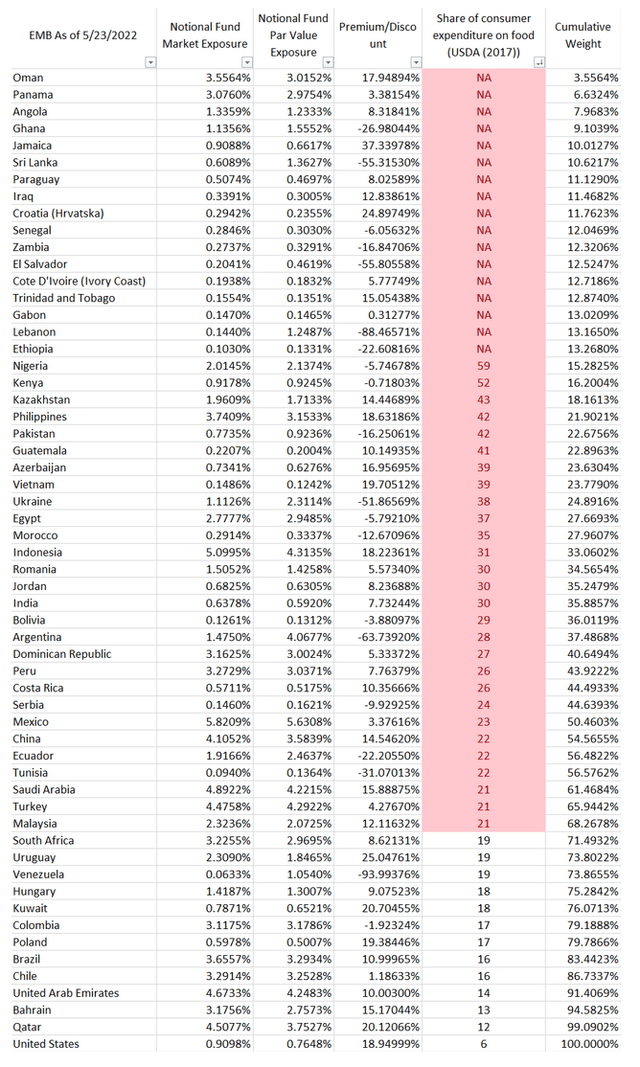

I’m here to give you rope, one solid enough to convince you to dump your iShares J.P. Morgan USD Emerging Markets Bond ETF (NASDAQ:EMB) and similar positions at a loss. However, at a loss small enough to look back with exasperation on how much worse it could have been if you held on to dear life. EMB holds a significant portion of EM sovereign importers, both High Yield and Investment Grade. This, coupled with the historically terrible recovery values for EM sovereign debt, leads me to the conclusion that there could be a lot of downside to the fund holdings that haven’t been priced into the market.

Introduction

Emerging market debt in principle and EMB

Fixed Income are simple instruments. Some would say, by design. In general, they provide fixed cash flows and principal at maturity for some of your money at the start. The Emerging Market space is rife with many investment ‘opportunities’ for those who want higher yield. A look at a simple screen of USD Sovereigns issued on Bloomberg over time shows the past two years, issuances have been the highest they’ve ever been. These have largely been segmented into short duration (<2Y) and moderate duration (>5 years).

Likely, this has been due to the pandemic and the continuation of the Fed’s zero interest rate policy. A policy, mind you, that has been consistently thought, up until the last few months, to last at least until 2023 and a year ago until 2025. The impact of this, in essence, is that countries are going to have to roll over principal for the shorter-term debt and pay interest (with a spread between 100bps and 400 bps).

What’s different now is that the debt of EM countries is a lot larger, the USD is a lot stronger, and spreads may get significantly wider (they have been getting narrower with forward yields of US treasuries rising). This leads to my view that EM debt at higher yields are unsustainable and likely there will be defaults and refinancing in the near term as the Fed tries to normalize monetary policy to fight inflation.

What does EMB invest in?

EMB is one of the largest Emerging Market Hard Currency (HC) bond funds. EMB invests in Emerging Market Sovereign Bonds in many different countries. Their holdings are almost all in Sovereign Bonds denominated in USD or EUR. These countries issue these bonds in USD to obtain cheaper financing terms (as the USD rates are cheaper) and to open up their financing options to conservative investors. In return, investors in these HC bonds may get a better return on investment.

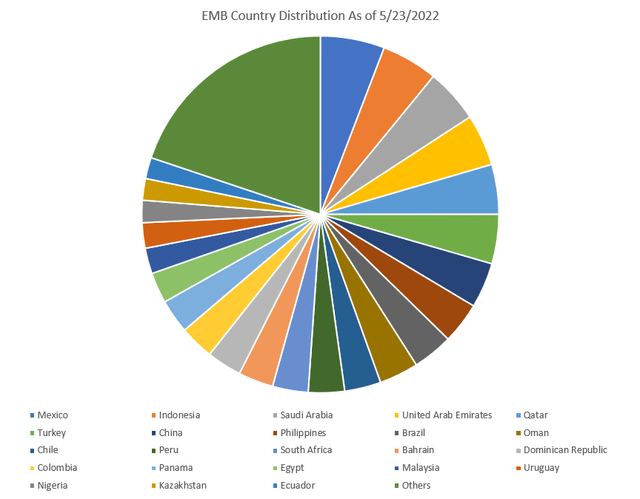

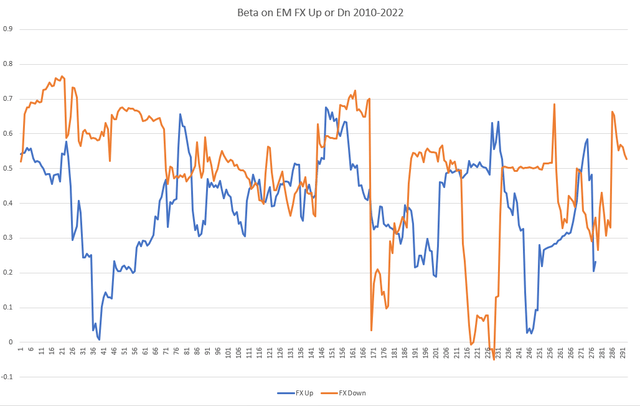

Figure 1: Country allocation of EMB to illustrate the country diversification in terms of market value of the holdings

Fund Website

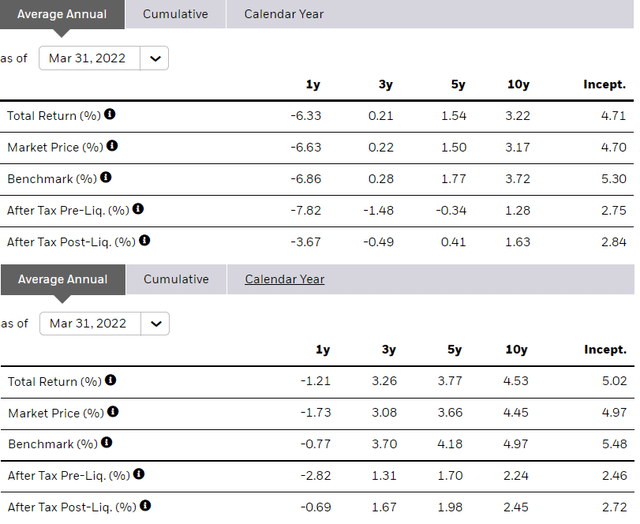

Historical performance and portfolio assessment

The fund and the asset class itself (benchmark) has returned worse than the standard US high yield ETF, iShares iBoxx $ High Yield Corporate Bond ETF (HYG) (see Figure 2). This is in addition to higher volatility characteristics: EMB has a historical volatility of 11.76% vs HYG’s 8.34% (see Figure 3). This is not to mention the obvious glaring difference of EMB having a majority Investment Grade holdings. The only excuse EMB has for such bad performance is the higher average duration (Figure 3).

There isn’t much of a selling point for EM bond Bonds because of the fact that when countries default, there isn’t much recourse for investors to get back their money. Bankruptcy laws for developed markets tend to allow companies many resources to restructure and ensure bond holders don’t lose money, which improves recovery value. Sovereign bonds not only don’t have this feature, but historically have had a recovery value of <10% once you factor in increased duration effects.

Figure 2: Historical returns of EMB (Top) and HYG (bottom)

Figure 3: Portfolio Breakdowns of EMB (top) and HYG (bottom)

So far, I’ve painted a picture of a bad asset class and maybe a fund that may under perform. Ostensibly, these are still sovereigns that want/need access to financing, what could possibly be so bad for me to accept a loss if I’ve already held it?

Breaking down the credit grades

My thesis is a further repricing of risk in the EM space that would significantly impair many countries from being able to sustainably pay EMB sovereign holdings. This repricing, if it were to continue, would lead countries to the hard decision of choosing to pay inflated interest payments with their weaker currency or make the hard decisions of sand bagging investors.

Defaults would lead to a significant decrease in the present value of many of EMB’s bond holdings. The most important would be de-risking outflows out of the fund and the EM space in general. It wouldn’t need that many countries to default to force many other positions into disorderly liquidations and lead to a 30-40% decline in the fund value.

My rationale

Breakdown of issuers and composition of EMB and other similar ETFs

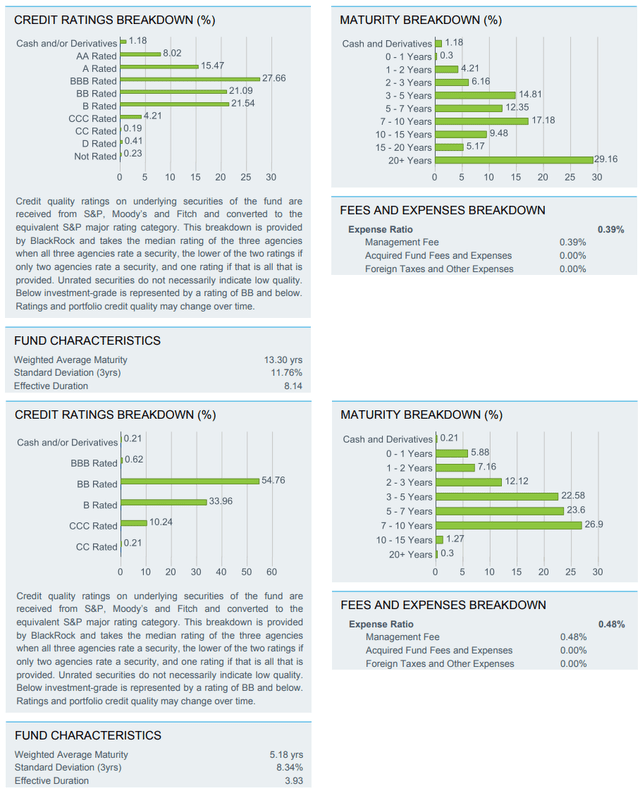

HC bonds are issued by a broad array of net exporters and net importers. A look at the weighted average of the country holdings of EMB shows that there’s a split between net energy/food importers and exporters. However, as usual, most of these countries have a sizable GDP component of food and energy (in sharp contrast to developed markets), as shown in Figure 4.

This leads to an outsized negative impact of inflation to these countries. Net Energy Exporters (i.e., Arab states and some South East Asian countries) may weather the storm and accept higher food prices with a massive current account surplus, as we’re already seeing with many of these energy exporters. However, most countries do not have this luxury. This could lead to a higher default rates and impairment of EMB’s NAV and their dividends.

A decline in dividends to 3% due to defaults would suggest a decline in NAV of ~20-32% from the portfolio duration assignment.

Let’s look at EMB more closely.

Food, Food, Food

I’ve constructed a table to see the holdings of EMB; for each country, I looked up the % of consumer expenditure spent on food. NA means no data, but this still means 55-68% of the countries have a food consumer expenditure above 20% in 2017 prices. This suggests a much higher food price will almost assuredly cause many of these bonds to enter distress territory or, more importantly, reflexively lead investors to dump positions which may instigate the problem to begin with.

The ones that are currently showing distress are Ghana (-27% discount to par), Sri Lanka (-55% discount to par), Lebanon (-88%), and Ethiopia (-22%). There are many other countries that may show distress (e.g., Indonesia, Iraq, Nigeria, Kenya, Egypt, Jordan, and India). India even made a deal with Russia, likely to avoid such a future catastrophe. If we use Ghana and Ethiopia discounts, then this suggests a 20-30% decline in present value.

Figure 4: Food Expenditure by EMB’s Country Holdings (sorted by select metrics)

Data obtained from fund website & USDA about the % share of consumer expenditure on food

Massive levels of issuance post GFC and, again, post COVID-19 crisis

Issuances of HC debt are also the highest they have ever been by EM countries, likely to weather the COVID storm and get back to sustainable growth. This would have likely worked as long as the USD stayed weak and the proceeds from the debt was used for long-term growth projects. We did not see this happening.

Why is this an issue? If the supply of HC bonds comes in rapidly on the USD weakening, it leads to the obvious end point of requiring growth (or further USD weakening), in order to sustainably roll over the debt. Debt is priced against its benchmark yields and spreads widen due to the repriced risk and supply/demand imbalances.

Therefore, EMB might decline in value from a dynamic of increased yields in the 10-30 year benchmark US treasuries and of course the outsized impact of spread widening. If yields go 2% in 1 year, the risk to this portfolio could be a decrease of 20-32% in value (duration 13.3 years).

Knowing that EM countries tend to be more Keynesian vs. supply side leads us to the conclusion that a weakening growth will do consistent damage to itself whenever the developed market countries have to tighten policy. Higher taxes and rates will cause the underlying issuers to potentially implode.

Talking about the currency further, as it relates to EMB’s credit quality and value before maturity, this leads us to an interesting observation.

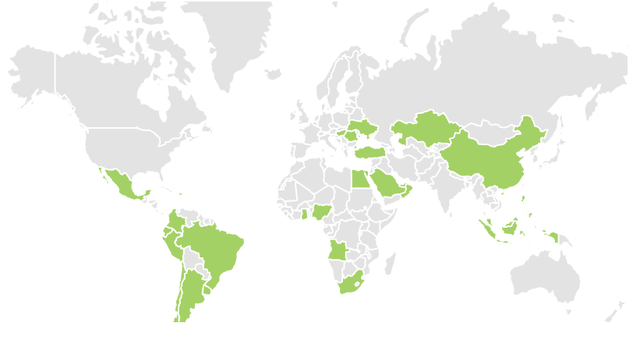

EMB beta skew on the downside against USD strength, an issuance phenomena

EMB tends to have a stable beta on the way down and an unstable beta on the way up, with a running average of 0.5. I believe this is from the observation that as the USD weakens, issuances increase leading to a higher supply and better growth metrics in EM countries. When the USD weakens, capital inflows increase, debt issuance increase, and growth appears sustainable.

However, when the dollar strengthens, the opposite occurs but much more predictably. Leverage increases, future payments are going to rise, and imports become more expensive.

We can see this in Figure 5 where the beta between EMB and an EM currency index shows a higher beta when the currency goes down than when it goes up. EM currencies will likely weaken due to the impact of food imports getting more expensive which feeds into the current account. Only energy exporters will likely be spared from these effects, and they make up less than 30% of EMB.

Figure 5: Rolling weekly beta split between an emerging market currency index and EMB

How bad can this get?

Contingent upon a stronger dollar and sustained global inflation due to supply side issues (which will likely not wane in the near future), we could see significantly higher default rates in many EM sovereign bonds, many of which are in EMB’s portfolio. This will lead to duration extensions, financing, and write-downs even in the most creditworthy importing EMs.

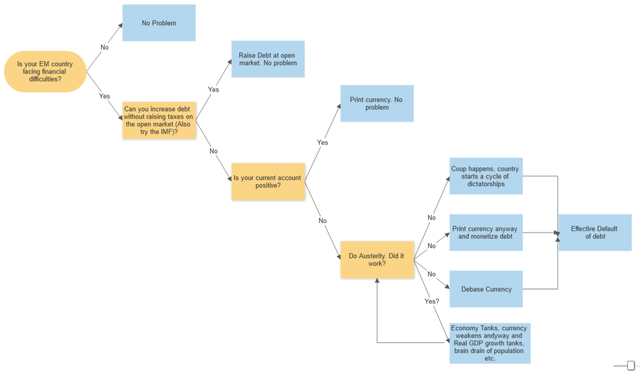

The defaults may follow the same playbook as they always have and are path dependent on what the country chooses to do. This is consistent with historical paths of how EM countries go into default (Figure 6).

Defaults of sovereign debt historically have very low recovery values for investors

Figure 6: Flowchart of what EM countries may do when faced with financial difficulties

Little upside if macro outlook turns positive

This is where it gets interesting – there is also very little upside to EMB’s bonds. Let’s give EM bonds some rope and say that: (1) the USD will weaken allowing cheaper financing; (2) food inflation wanes slightly; (3) political instability is muted. EM countries will still face: (1) bond refinancing at 3x interest cost; (2) safe haven related outflow risk from the current Ukraine-Russian conflict; (3) economic growth that fails to reach pre-COVID trend levels.

This leads to the obvious “heads you lose, tails I win” scenarios for EM issuers if bonds are not repriced at higher yields and the ‘optimistic’ outlook prevails. EM issuers will issue more bonds! This will obviously cap any capital gains that’s possible just from oversupply as the new issues compete with existing debt obligations held by EMB and many other EM sovereign ETFs/funds. In addition, at a fairly unattractive carry (3-4%; 1-2% implied in options), even US HY bonds look like treasuries compared to EM HC bonds. This will lead to the obvious conclusion of the EM HC sovereign bond class not performing against countries that are not issuing as many bonds (i.e., developed markets tightening monetary and fiscal policy).

EM/USD outlook and impact on EMB

Emerging market currency strength is highly correlated to EMB as payments in USD require a conversion of the underlying fixed liability of the EM country (i.e., Angola needs to pay $12 per $100 borrowed per year, regardless of the exchange rate). This leads to a dynamic of decreasing credit quality of HC sovereign bonds as the issuer’s home currency weakens.

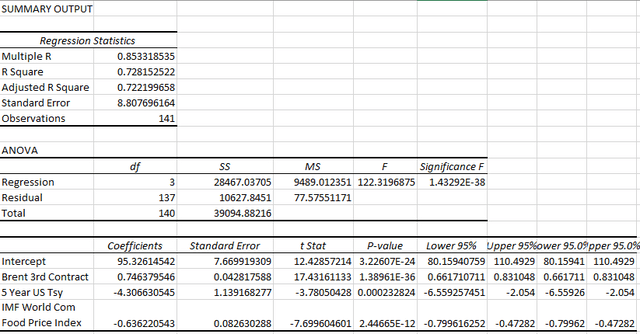

I believe EM currencies may weaken significantly knowing the global macro economic backdrop. Using Figure 7’s regression coefficients, and using some basic forward looking assumptions: (1) Oil stays > $80 a barrel for 1-2 years; (2) 5-year rates go up 1 %; (3) food prices go up 25%, we get an estimated price of (80)*(0.746) – (4.3066)(4) – (0.6362) (200) = 10.21; a staggering 80% decline in currency strength. Now, this doesn’t take into account convexity and covered interest rate parity, but illustrates just how sensitive EMs can be to negative factors they don’t control.

A weaker currency is extremely tenuous to the current account especially for countries that are not competitive in their exports (i.e., EM countries). It will lead many leaders to make rational and understandable decisions laid out in Figure 6.

This suggests a high likelihood of default for the holdings in EMB due to the impact of a rapidly weaker currency. A recourse the countries could take is to aggressively hike interest rates to defend their currencies; however, this would force economies into recession and, coupled with a food crisis, that’s a recipe for a significant political instability, which does not instill trust in their investors.

How badly? Well, with a downside beta of 0.5, talked about in Figure 5, an 80% decline in currency strength suggests an NAV decline of 40%!

Figure 7: Multiple linear regression of an EM currency Index against rolling Brent third contract (to minimize front contract vol), 5-year US treasury yield and IMF World Commodity price index

I tested for assumptions and it passes the no multiple co-linearity and residual normality, but may fail the homoscedasticity assumption, seeing as how we’re interpolating into data that we previously haven’t seen before (i.e., much weaker EM currency strength).

What about the net exporters?

The exporters should be fine, no? Higher oil prices should be a tailwind for net exporting countries in the Arab states, mining states in Africa and some net exporters in Asia.

The key issue with this is that geopolitical turmoil will build up. Wealth disparity doesn’t build up geopolitical tensions like food does. Food is the great equalizer of us all, we will die without it, so wars and conflicts may start because of it. This will definitely be a non-linear risk that will very likely be priced into exporter countries. The repricing of these risks may just transfer into countries next to them. This suggests a 10% further drawdown on countries that have nothing to do with the conflicts, by just being surrounded by countries in crisis.

Many countries that issued these HC bonds are in close proximity to potential conflict areas, and I’m not talking about Russia-Ukraine.

Figure 8: Countries where bond holdings are issued (includes many countries in South America, Africa, and Asia)

Am I not late to the party?

Most EM bond funds are already between 10% and 25% down, should I bet for a rebound? I’d argue no. Let’s see some more fundamentals on EMB and option pricing data, related to the key ETF I’m looking at.

EMB ETF Fundamentals (05/19/2022)

- Weighted average yield to Worst of portfolio: 7.00

- IG portion YTW: 3.99 – 4.91%; 50% Weight

- Marginal HY YTW (>B): 6.73 – 10.26 %; 42.62% Weight

- Not rated and Near Default YTW: 26.11%

- 3 year default % from CDS: 6.45%

What’s the outlook for the fund?

Downside for EMB here is convex, 3-6 month options are pricing in an implied volatility of >50% for 30% out-of-money puts and 14% for ATM-5% OTM puts. However, market spreads are wide. Forward pricing implied by options suggests that the carry is between 2% and 3%, lower than the YTW (as most of the gains will be coming from rolling down the yield curve).

Current Price as of Wednesday Close (05/23/2022): $89.16

Target Price 6-18 months: $54 (~40% downside)

Dividend price in 12-25 months: ~3%, defaults and duration extensions.

Implied negative carry (if sold): -4% (from the coupons that are paid).

What’s the play(s)?

Minimized loss long exposure

For current investors of EMB showing up with a loss, who want a more attractive way to go long these funds, going short OTM (20-30%) 3 month and using it to build up 1-year call position (risk reversal) strategies looks attractive. A stock replacement strategy (1-2 year calls) also looks attractive as call options tend to be very underpriced (use slightly in-the-money options). Forward prices will also be lower, which allows you to benefit from carry (fi you get the right price, so use limit orders). Risks: Bid-ask spreads are often large (30-60% wide). Limit orders are recommended. Risks are whipsaws in the price and getting a terrible price for the order. Other than that, maximum loss has turned into the premium paid.

Sell it

For buy-and-hold investors that were looking for diversification in EM HC bonds and trying to capture attractive carry, if you currently have exposure to these funds, decreasing exposure significantly or selling out completely is likely the best option in the next 3-18 months contingent on the current situation not improving. Risks: Losing out on carry and capital appreciation on spread narrowing.

Hedged short

For the more aggressive investors looking to go short, this is a short idea that could be attractive 3-9 months out. You may want to go long a low-duration, high-yield US ETF or a higher-duration IG US ETF to minimize negative carry or duration exposure. You’d also need to increase the short position on the way down as the thesis is convex (price declines lead to more price declines). A 50:50 mix may work well too. Risks: Spread tightening, US-centric risk event.

(Preferred) At-the-money and out-of-money options

Investors who understand and want to use optionality may want to use a mixture of near at-the-money and out-of-money options to take advantage of a decline. Out-of-money bear put spreads on longer-term options also look attractive. Out-of-money leaps (6-9 months out), at 3% of the portfolio, look attractive. This is attractive as my thesis is asymmetric. Risks: Negative premium carry, execution risk.

Risks to the outlook

My outlook for EMB is highly dependent on any of the points as stated here from occurring:

- Deterioration in political stability caused by food and energy crises

- Tightening of monetary policy by developed markets forcing EM countries to tighten during an unfavorable time when they haven’t recovered from COVID-19 fully.

- A severe weakening of the underlying issuer’s home currency, making refinancing the USD bonds difficult.

- Higher risks and prevalence of defaults in the next one year leading to many EM countries getting their creditworthiness repriced.

- EMB taking a passive stance and not selling holdings before defaults are priced in.

Some or all of the above are required to occur in order for my outlook to likely work.

Final thoughts

This is disastrous situation overall worldwide. We collectively have to endure the pain and suffering even after a global pandemic. EMB was never a great fund, taking into account the risks you’re exposed to. It has a very long duration which exposes you to interest rate risk, and the fact that it’s Emerging Market sovereigns leaves you with very little recovery value in cases of default. Therefore, selling or going into option-based strategies are the best options.

Thanks for reading, feel free to tell me what you think by sending me a message or commenting, and see you on the next one!

[ad_2]

Source links Google News