[ad_1]

yorkfoto

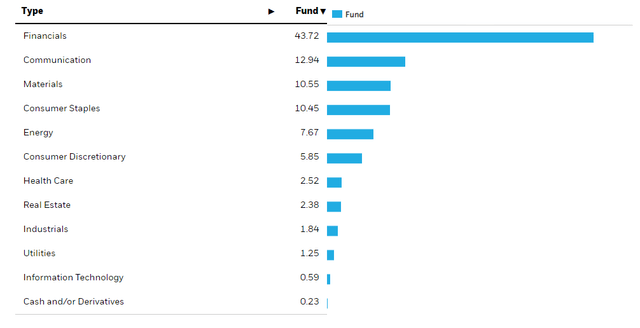

The iShares MSCI Indonesia ETF (NYSEARCA:EIDO) is a bet primarily on the financial sector of Indonesia. We like Indo a lot, it’s a large population with very good demographic structure. The issue is that the central bank is keeping a dovish policy which isn’t great for the primarily bank-exposed EIDO ETF. The spread between lending and savings rates is only improving in other countries. The interest margins in Indonesia are not going to experience that. With the quite low yield and high PE, there isn’t much here to compel investment.

EIDO Breakdown

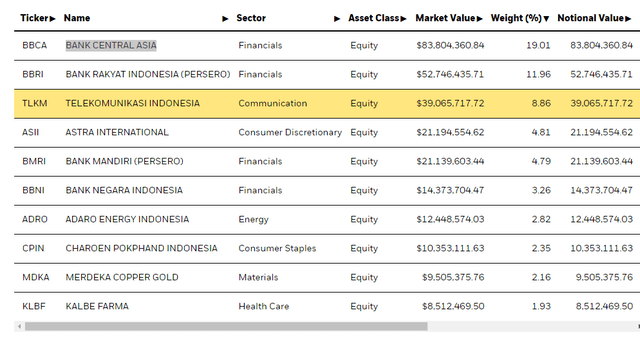

EIDO’s holdings look like this.

EIDO Holdings (iShares.com)

Large allocations are being made to companies like Bank Central Asia (OTCPK:PBCRF) and other Indonesian focused banks. Bank Central Asia focuses entirely on Indonesia’s various Islands, and this is how its segments are structured. Its other exposures are very similar representing that the population being banked still has scope for growth, which is typical of emerging markets.

Sector Breakdown (iShares.com)

Remarks

Underlying growth in these emerging countries are the basis for loan growth. In that respect, secular conditions are good. On the other hand, there is the lack of other levers that could improve performance. Specifically we worry about the central bank policy which is to keep rates low. While they did surprise with a rate hike, it was small, and the rate hikes of the USD, which is the reserve currency, dwarfs it. This constitutes two problems. The first is that it doesn’t create much impulse for growing spreads between borrowing and savings rates achieved in Europe. The second issue is that it creates an FX risk of the Rupiah against the USD, which has already declined against the dollar by about 5% YTD. While there was a bounce against the dollar on the recent rate hikes, those have already started to reverse. As a major trading partner to Indonesia, the 11% US exposure in the terms of trade isn’t such a good thing. Relative to other south-east Asian currencies the Rupiah is pretty resilient thanks to good billing on commodity exports, but rates are a bit of an issue for the currency as well as the margins of EIDO’s substantial financial exposure.

What’s more is that Indonesia is being courted by China, who is trying to develop its sphere of influence in the east. Russia likewise is consolidating its alliances there, and as with other countries who are indifferent to the conflict in Ukraine like India, are offering major discounts on oil and gas supplies. This is good for Indonesian people, but it does limit the pressure on the central bank to react to imported inflation with further rate hikes, which would keep profitability of the banks more limited, and their economics more dependent on loan growth.

We still think the Indonesian financial sector is fine. It looks like the West’s from before the rate hikes began, depending primarily on loan growth. Their loan growth is indeed better than in the West. But without the added lever of net interest margin growth, which is in decline as of the last H1 2022 as you’d expect, and the added (although limited) risk of the Rupiah for US investors, the 17x PE and 2% yield on a 0.57% ETF fee is not too striking. The implied earnings yield is just above 5%, where reference rates are now above 4% in Indonesia. The risk premium there isn’t great, so we pass.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Source links Google News