[ad_1]

btgbtg/iStock via Getty Images

Referendum Upside

I believe the iShares MSCI Chile Capped ETF (BATS:ECH) is a buy prior to September 4th. On that day, Chile votes to approve or reject a new constitution. This political risk has been largely priced in, with equities trading at a 40% valuation discount while the currency has devalued by more than 30%. A rejection outcome could spark a substantial relief rally of 20% to 30% while downside risk on an approve vote could be 10%, in my view.

Chile Insight

I have been living in Chile for the last 13 years and worked as a sell and buy side analyst and PM in Latin America since 1995, which provides me with a good understanding of the markets, macro, and political situation in Chile and the region.

Chilean Assets Under Pressure Since October 2019

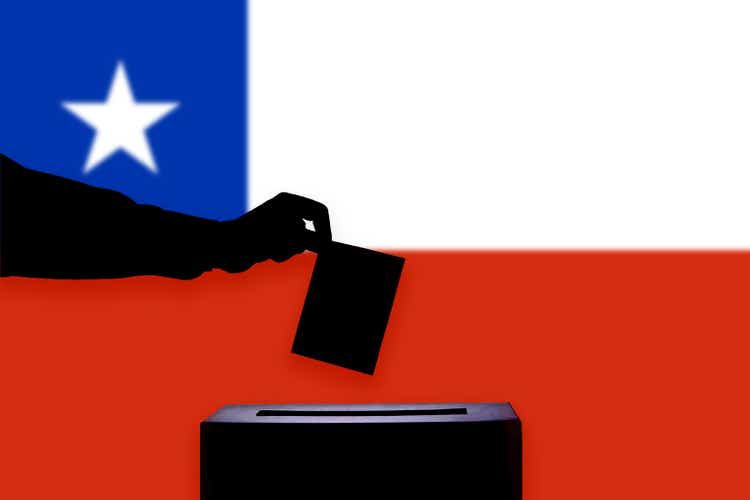

The Chilean equity market has fallen to 2005 levels in USD terms and down 46% (excluding Soquimich (SQM)) since the start of the social upheaval in October 2019. These mass protests resulted in a proposal to write a completely new constitution. This created a high degree of political risk and uncertainty, with obvious asset value implications.

Chile MSCI Index and ECH ETF (Image created by author with data from Capital IQ)

The ECH has declined 26% since October 2019. However, dissecting this performance, we find that SQM, which is now 23% of the ETF, climbed 220% in this time frame. Excluding SQM’s impact results in a 46% decline for the ETF. Going one step further, the depreciation of the Chilean Peso or CLP was 30%, making the underlying equities contribution -16%.

Political Risk Far Worse Than Macro Risk

The stock market and CLP performance has gone contrary to macro results, highlighting the political risk impact. Chile’s economy weathered quite well this political uncertainty and the pandemic, boosted by massive government stimulus and the drawdown of nearly 30% of the private pension fund system, which in combination was close to 20% of GDP. The real estate, consumer and financial sectors reported strong results on low rates and an economy awash with cash in 2021.

Only now is the macro situation seeing signs of stagflation with CPI at 10%, unemployment increasing to 7.7% and GDP forecast at just 1.2% in YE22. While at the same time the country elected a socialist president, who is looking to implement a 4% of GDP tax increase to fund social spending and reform the pension system into a public “pay as you go” scheme and halt contributions into the private pension fund system. All this while the new constitution was being written by a socialist controlled assembly. Under this backdrop Chilean assets (equity, debt and FX) have very little appeal and here lies the opportunity.

Assets Valuations Are Depressed And Largely Factor In Political Risk

The market is now clearly depressed, with the CLP spiking to an all-time high vs the USD, a more than 30% devaluation since Oct 2019. Part of this decline is due to the recent drop in copper prices, which accounts for 50% of exports and impacts USD inflow. The other part is due to capital flight, selling CLP to buy USD and transferring them out of the country prior to the September 4th referendum.

The equity market is trading at a 20yr low on valuations close to 9x PE or 40% below the 10-yr average. However, the bond market is pricing continued prudent monetary and fiscal policy with credit default swaps on Chilean sovereign bonds at 1.6% default risk. I believe the FX and the equity markets have greatly priced in the political risk.

September 4th Referendum Could Lead To A Rejection Of The New Constitution

On July 5th the new constitution was completed and will go to referendum on September 4th for approval or rejection. It has been poorly received by the population and many current and past politicians and parties, economist, lawyers, and opinion makers of all political colors. There is a bombardment of public discussion to reform this new constitution if approved or better yet to amend the current one. The odds of rejection are increasing, while 80% of the population voted in favor of a new constitution, the latest polls show only 30% approve of the new one submitted.

Under a scenario where this new constitution is rejected, it is quite possible the market and currency see a significant relief rally, perhaps between 20% to 30%. If it’s approved the knee jerk downside could be 10% since much of risk has been price in.

A rejection would likely result in a very large sigh of relief from the business sector, domestic and foreign. It would reduce the power and ambitions of the current government and possibly lead to a far better business and macro environment in the medium term. On the negative side, protests could flare up and grab headlines, but they may not have popular support, the people would have voted against extreme change.

iShares Chile ETF Captures Referendum Upside

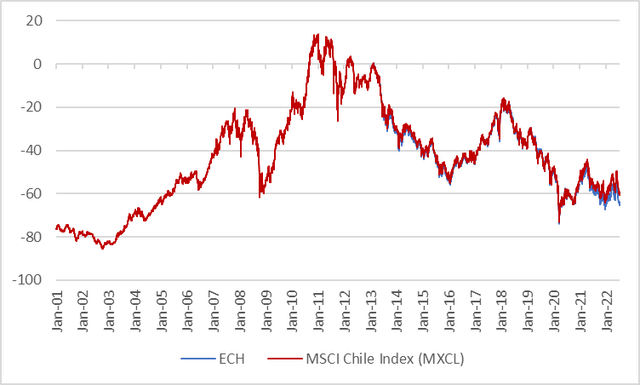

The ECH is composed of 25 stocks and replicates the MSCI Chile Capped Index. All of the sectors and companies (except Vapores) have negative exposure to the new constitution and a more powerful socialist government, and thus would benefit from a rejection vote.

ECH Holdings (Image created by author with data from iShares)

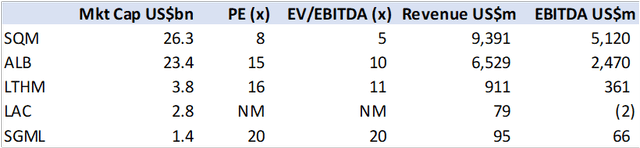

The biggest weight (37%) is in the materials/export sector, SQM (lithium and fertilizers) Copec and CMPC (pulp) and Cap (iron ore). Valuations for this sector have been impacted more by the political risk than macro. Mining and forestry are exposed to increased taxation, environmental regulation, and outright nationalization. SQM, despite this massive outperformance it is still discounted vs Albemarle (ALB) and other lithium startups in the region, Livent (LTHM), Lithium Americas (LAC) and Sigma (SGML) .

SQM peer comps. (Image created by author with data from Capital IQ)

Financials are the second-largest sector with a 21% weight and have benefited from government stimulus and now inflation, since a large chunk of loans are inflation indexed. However, under a more socialist constitution they may see interest rate controls and/or forced lending, higher loan losses and lower ROE.

The consumer sector has lower political risk but high macro risk on reduced disposable income and higher FX devaluation since much of the consumer goods are imported. Falabella, however, has a sizable financial business that can offset weaker retail sales/margins as well as operations thought Latin America. Cencosud has greater exposure to food retail and a regional footprint.

The utilities (electricity and water) are politically exposed as they derive returns from regulated tariffs, while increased environment regulation can increase costs and hamper returns. Nationalization risk is also possible.

Direct stock investment is limited to SQM, Banco de Chile (BCH), Banco Santander Chile (BSAC), Andina (AKO.B), and CCU (CCU).

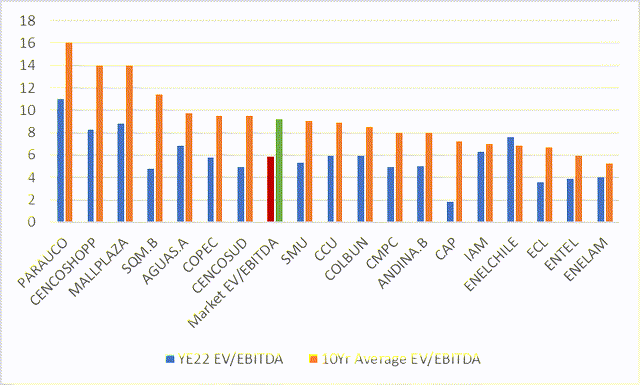

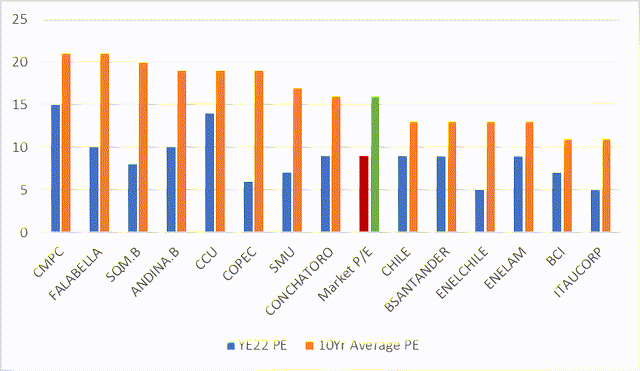

I have compiled forward consensus estimates for each of the component stocks, derived their PE and EV/EBITDA, and compared this to the last 10yr average. As can be seen, the non-weighted average is 40% below historical. Part of this may be due to the high rates implemented by the central bank, which have increased to 9% from 0% in one year. However, rates are close to peak and could decline in 2023 on a need to begin to stimulate the economy post stagflation, regardless of the new constitution.

Valuation discount EV/EBITDA YE22 vs 10yr average (Image created by author with data from Capital IQ) Valuation discount PE YE22 vs 10yr average (Image created by author with data from Capital IQ)

ECH Offers Solid Risk Reward Driven By The Sept 4th Referendum

In conclusion, the Chilean FX and equity market has been substantially de-rated (in the price) due to very real political risk that is now about to become reality or dispelled on Sept 4th. In my view, there is now a better than 50% probability that the new constitution is rejected, and the power of the current socialist government is curtailed. This should lead to a powerful relief rally of 20% to 30%, while confirmation could lead to a 10% decline. Broad exposure to this trade is via the Chile ETF ECH, while US listed SQM, CHILE, CCU, AKO and BSAN could outperform the index.

[ad_2]

Source links Google News