[ad_1]

Felipe Brayner/iStock via Getty Images

The iShares MSCI Chile ETF (BATS:ECH) covers the main elements of the Chilean economy. It is Peso exposed on the FX front, copper exposed in commodity exposures and also exposed to Chilean financial businesses. Thankfully, on all fronts the outlook is good, and that value is unlocked by a rejection of an untested socialist constitution. Chile and the ECH look good now.

Key Note On Chilean Politics

Starting with protests over public transport price hikes in 2019, the socialist movement began that has made investors nervous for years about the socialist constitution that they are trying to instate through referendum. The old constitution is the same one from under Pinochet, but what matters is that it supports free markets. This new socialist constitution was massively rejected by referendum, an overwhelming upset. Chilean markets and the Peso have since rallied as concerns about major changes in the private sector have been assuaged. In fact, the ECH ETF is up 10% YTD thanks in part to that.

ECH Breakdown

With the political factor mitigated, what are you betting on? Primarily on copper. With political risks no longer too major a factor for the FX, copper prices affect the ECH both indirectly through its effects on copper and through copper exposure in the very top holding of the ECH:

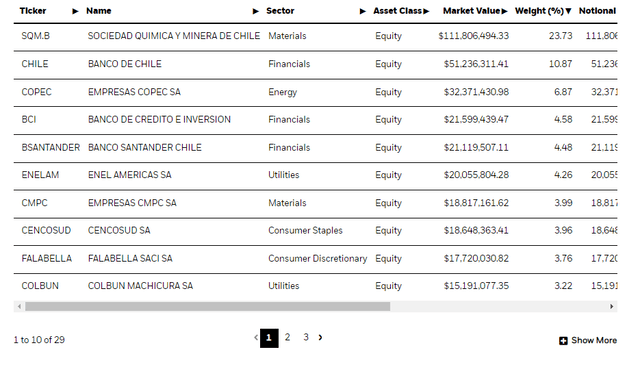

Top Holdings (iShares.com)

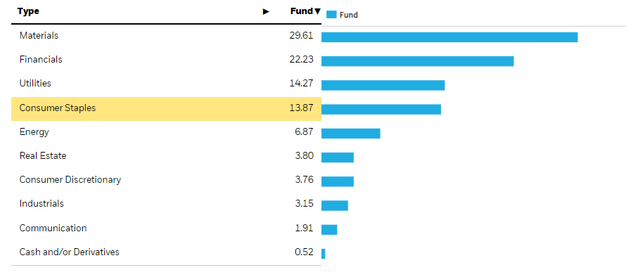

At 23%, copper exposures affect the profits of Sociedad Quimica Y Minera de Chile (SQM). Copper dominates the whole 29.6% exposure to materials in the ETF. The story of copper is pretty simple: every aspect of the renewable transition, in any of its possible permutations, will require lots of copper.

22% of the portfolio is otherwise in financials. Chile is dealing with high inflation like the rest of the world, slightly mitigated by a strong CLP. Their rates are higher than what western investors might be used to at over 10%, and the recent rate hike was of 100 bps. Retail and general consumer sentiment isn’t great, possibly the reason why the referendum for the new constitution failed. This also means that not much further growth can be expected in rates, but a still hawkish tone is good for net interest income from banks.

Other exposures are in utilities. These are now protected from political risks, but still face hydrology risks that interact with the potential need to supplement production using gas fired, which is a very expensive energy production modality right now. Otherwise 14% of the portfolio is in consumer staples, so presumably resilient exposures.

Sectors (iShares.com)

Remarks

The ETF contains 25 stocks. There aren’t that many equities to represent Chile that could be taken up by an ETF. What they have still well represents what a Chilean investment can offer. It’s all about copper, and now actually a pretty strong currency even relative to the dollar. The rate hikes, while in the face of retail consumption issues, will help the financial exposures too. The ETF has an expense ratio of 0.57%, which is not that low relative to other iShares ETFs, but the yield is high at 7%, and the 8x PE implies a 12.5% earnings yield which outpaces western risk-free rates by a lot. Overall, the rejection of the socialist constitution is a good thing for investors, and while not to be totally discounted as more change may be in the future, it certainly seems that while the economy is uncertain, those political risks can be mitigated.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Source links Google News