[ad_1]

DKosig/iStock via Getty Images

Investment Thesis

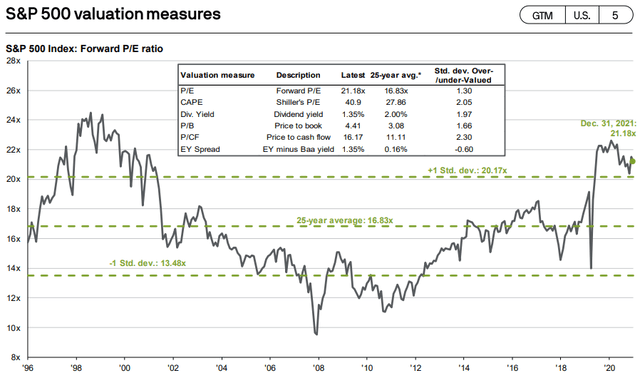

Even if valuations have come down from their peak in 2021, the US stock market is still an expensive place to invest in. Back in December 2021, JPMorgan estimated that US equities were trading one sigma above the 25-year P/E average. The last time this level was reached was during the dot-com bubble.

J.P. Morgan Asset Management

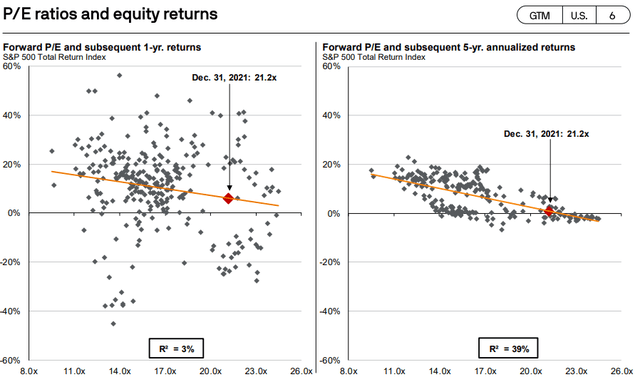

Valuations are a crucial investment characteristic since future returns can be influenced by the price we’re paying today for an asset. According to JPMorgan, the five-year annualized returns at the current valuation for US stocks is close to 0%, which makes investing in the US stock market an unattractive risk-reward trade.

J.P. Morgan Asset Management

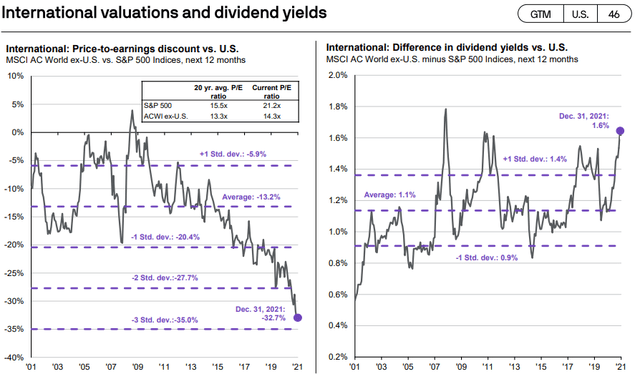

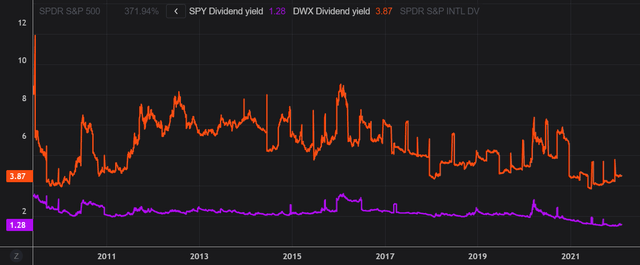

Therefore, investors are increasingly turning to international markets in the hope of finding a better deal. Luckily for them, international markets are fairly valued relative to the 20-year average. Moreover, the difference in dividend yield between international and US equities is now at the highest point in 10 years, which makes investing in those markets appealing. In this article, I will review the SPDR S&P International Dividend ETF (NYSEARCA:DWX), which provides exposure to a diversified basket of international dividend-paying stocks.

J.P. Morgan Asset Management

Strategy Details

DWX tracks the S&P International Dividend Opportunities Index, which provides exposure to the 100 highest yielding international common stocks that have passed certain sustainability and earnings growth screens.

What I like about this ETF is the fact that the index screens for stocks using the fundamentals of the business. To give you a few examples, the index only adds companies with:

- Positive TTM EPS.

- Stable or increasing three-year dividend growth.

- A dividend yield greater than the median dividend yield of the remaining universe of stocks that have passed all fundamentals and investability criteria (defined as companies with a float-adjusted market capitalization of at least $500 million and three-month median daily value traded of at least $5 million).

Once the universe is defined, the index will select the stocks based on the risk-adjusted yield. This is determined by dividing the dividend yield by the volatility of monthly dividend yields over the previous 36 months.

Portfolio Overview

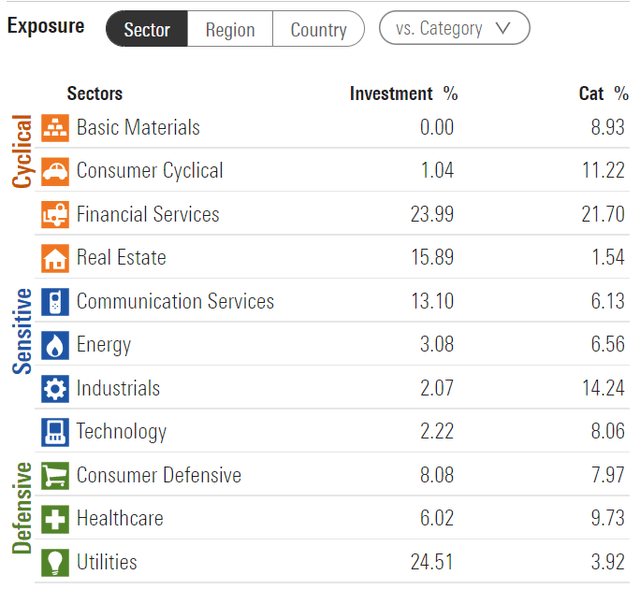

From the sector allocation chart below, we can see the index places a high weight on Utilities (representing around 24.5% of the index) followed by the Financial Services sector (accounting for 24% of the index) and Real Estate (representing around 16% of the fund). The largest three sectors have a combined allocation of approximately 64.4%.

Morningstar

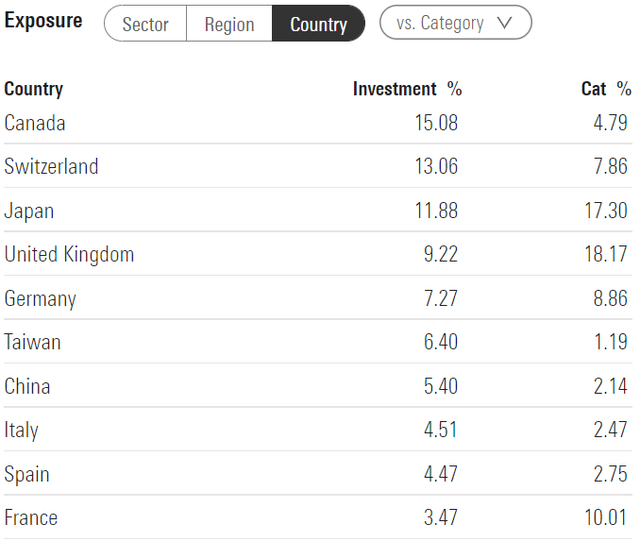

As of December 31st, 2021, the top ten countries represented approximately 81% of the portfolio. Canada has the largest allocation (15% of the fund), followed by Switzerland at 13% and Japan at ~12%.

Morningstar

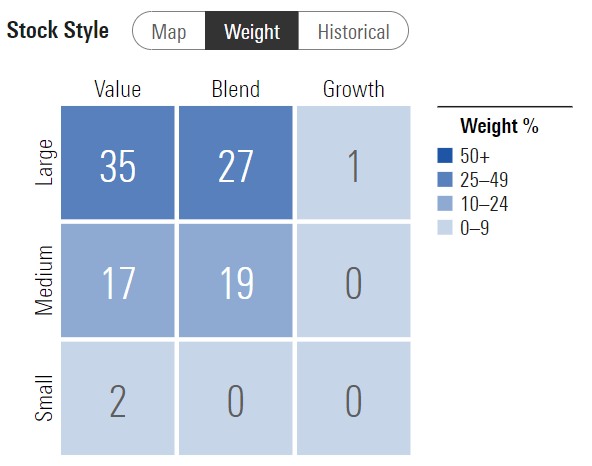

DWX invests over 35% of the funds into large-cap value stocks, characterized as companies where value characteristics predominate. The second-largest allocation is in large-cap blend issuers, representing 27% of the ETF. Large-caps are generally defined as companies with a market capitalization above $8 billion. It is interesting to see that DWX allocates ~63% of the funds to large-caps and only 2% to small-cap issuers, which generally tend to perform better than large-cap stocks over a long period of time. I think the main explanation for this is the fact that large caps are typically mature companies that have limited growth prospects and generate excess cash.

Morningstar

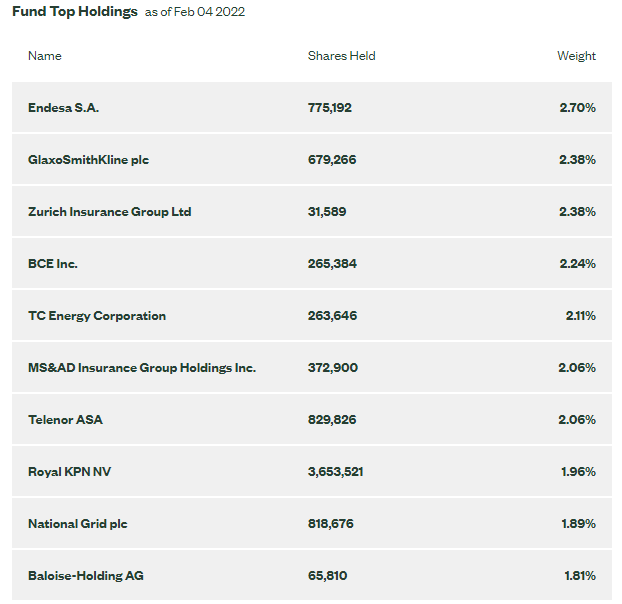

The fund is currently invested in 99 different stocks. The top ten holdings account for 21.60% of the portfolio, with no single stock weighting more than 3%. All in all, I would say that DWX is very well-diversified across issuers.

State Street

Since we are dealing with equities, one important characteristic is the valuation of the portfolio. According to data from Morningstar, the fund currently trades at an average price-to-book ratio (P/B) of 1.6 and an average price-to-earnings ratio (P/E) of 13.9. It is important to point out that DWX is slightly more expensive than the index it is tracking, which has a P/B of 1.6 and a P/E of 13. Overall, I like the fact that the strategy is cheaper than a plain vanilla S&P 500 ETF. Moreover, this strategy provides a good source of income.

Is This ETF Right for Me?

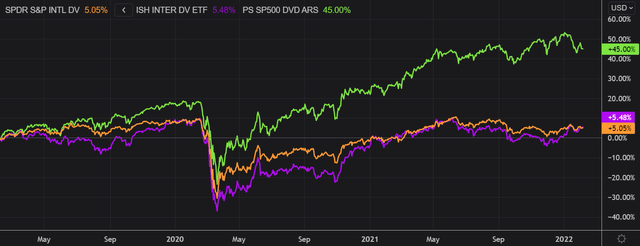

The fund has a distribution rate of 3.5%. Given the relatively good dividend yield compared to other funds, this ETF is suitable for the dividend investor. Furthermore, I have compared below the price performance of DWX against the price performance of the S&P 500 Dividend Aristocrats ETF (NYSEARCA:NOBL) and the iShares International Select Dividend ETF (NYSEARCA:IDV) over 3 years to assess which one was a better investment. Over that period, NOBL clearly outperformed both international strategies, in what was one of the greatest bull markets in US history. However, this is a good example of an investment where past returns are not necessarily correlated to future returns. I personally don’t believe US stocks can grow at the pace of the last two years and at some point, there should be a slowdown which should favor international stocks.

Refinitiv Eikon

On top of that, US stocks are overvalued from a historical perspective which should make future returns less attractive. As a result, I would personally stay away from the US market and seek exposure to international dividend-paying stocks.

Refinitiv Eikon

Key Takeaways

DWX provides exposure to a basket of international dividend-paying stocks. This ETF is very well diversified, both across sectors and issuers, and can be used as part of a broader portfolio strategy to diversify your US equity risk, while maintaining a decent level of income. I think we’re at the pivotal point for US equities where there is a high chance that valuation will revert to the historical average. As a result, I believe it is risky to invest in US stocks at the moment and I would rather seek international diversification.

[ad_2]

Source links Google News