[ad_1]

Over the last week, the VelocityShares 3x Inverse Crude Oil ETN (DWT) has strongly outperformed by delivering a 22% return. However, if you widen the window and look at longer time frames, DWT can actually be seen to be having a pretty bad year with the year-to-date return at -56%. In this article, I will make the case that shorting DWT makes for a great trade and that further downside is likely in the cards.

The Instrument

When it comes to ETFs and ETNs that give exposure to commodities markets, we need to proceed cautiously before making any buying or selling decisions. The reason why caution is warranted when it comes to funds which give constant exposure to the futures markets is that roll yield is a really big determinant of overall fund returns across most time frames. So what is roll yield and how does it impact DWT? I’m glad you asked!

First off, let’s talk about what the DWT ETN seeks to accomplish through its methodology and deployment of capital. DWT is an ETN which seeks to give a negative triple leveraged return of the S&P GSCI Excess Return Crude Oil Index. That’s quite a mouthful, but what it basically boils down to is that DWT gives a multiplied return of the GSCI Crude Index.

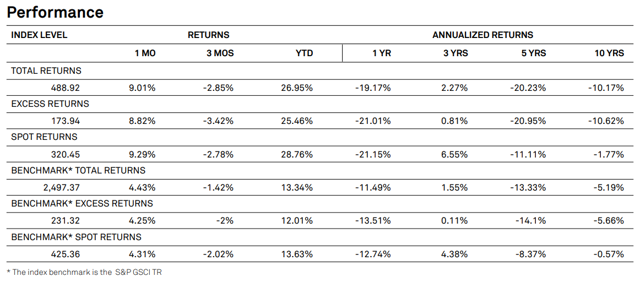

The S&P GSCI Crude Oil Index is a market index that takes a position across a calendar year of WTI futures contracts and as months progress, individual contracts roll off the board. The following table from the GSCI factsheet shows the different returns attributed to the various funds across the years. DWT multiplies the excess return variant of the index on a daily basis.

The reason why the excess return variant underperforms both the total return and spot return is because of roll yield.

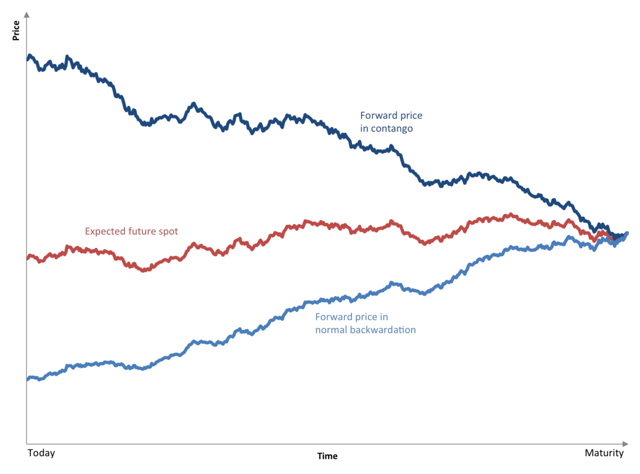

Roll yield is the gain or loss that arises from holding futures positions at further points back on the curve than the prompt contract. As seen in the following chart from Wikipedia, there is a tendency for futures prices to approach spot prices as time nears expiry.

This general process of futures prices trending towards spot prices results in a gain or loss depending on the market structure. When the market is in contango (where back month contracts are above front-month contracts), roll yield is negative in that long positions established at higher prices decrease in value as time approaches expiry in relation to the front of the curve. Conversely, when the market is in backwardation, roll yield is positive in that positions established in the later months will trade up in value versus contracts at the front of the curve resulting in a gain from roll yield.

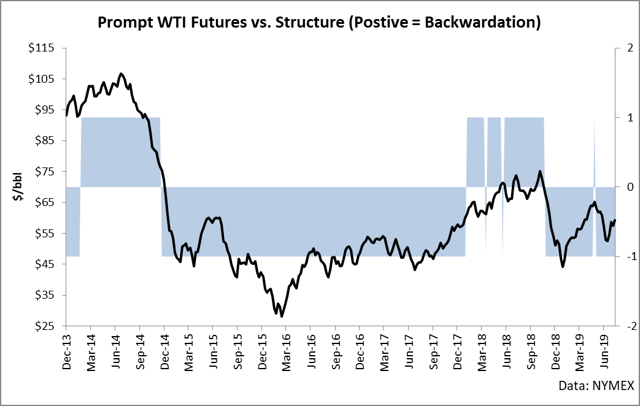

The following chart shows the history of when the market has been in contango and when it has been in backwardation.

For the vast majority of months since the shale revolution began, WTI futures have been caught in contango. Contango is basically a statement that there is more supply today than is needed so prompt prices are sold off to the point that supply is reduced through storage or production cuts. Historically speaking, contango has been the normal state of the market in about 80% of all months during the last decade.

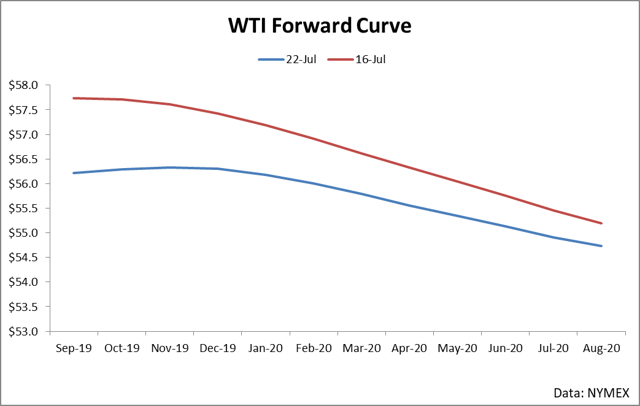

The picture is deeper for holders of DWT in that since exposure of GSCI is across several months (and shifts as the year progresses), roll yield can be positive even if the curve is contango in the front. For example, here is the current forward curve in WTI futures.

The market is currently in contango in the front of the curve but switches to backwardation in the November time frame. This switch is such that across the remainder of the calendar year (which the GSCI is exposed to), the average month-to-month market structure is backwardation. This means that for those holding the GSCI, roll yield is currently positive and is currently giving positive returns to a long exposure of the index. When it comes to DWT however, there is a problem because the ETN gives a short exposure to this relationship. In other words, even though roll yield is positive for holders of the index, DWT holders are currently consistently experiencing a drag on their holdings due to essentially shorting the roll. As long as this relationship remains (which fundamentally I believe could be at least through year-end), DWT shareholders will suffer.

Before talking about the fundamentals however, there is another clear reason to not hold DWT: leverage decay. Leverage decay is what happens when you seek to give a leveraged daily return of an index and hold it for longer periods than a day. If you’re trading in ETNs or ETFs which give daily leverage, I would do a full stop until you understand what leverage decay is.

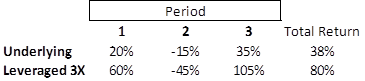

Leverage decay is the result of unfolding volatility in the underlying index which funds track as well as the math of percentage returns. For example, in the following table, I’ve recorded a series of returns and shown the compounded return of an underlying index and the compounded return of a leveraged multiple of these returns.

In the table above, I have plugged in a substantial amount of volatility to make the point: leveraged returns don’t track the spot market returns very well. For example, in the above table, by following that specific series of returns, the 3x leveraged return only gave a 2.1x return over this period due to leverage decay. For holders of DWT, you can’t predict exactly how these returns will unfold, but depending on how volatility unfolds, the instrument could substantially lag the spot return across any time period longer than a day.

Crude Fundamentals

Let’s step back from the concepts of roll yield and leverage decay as they relate to DWT and instead look at the actual market which DWT is exposed to: crude oil. From a fundamental standpoint, it is really hard to make a bearish case for crude oil right now – despite the recent 1-week decline in prices.

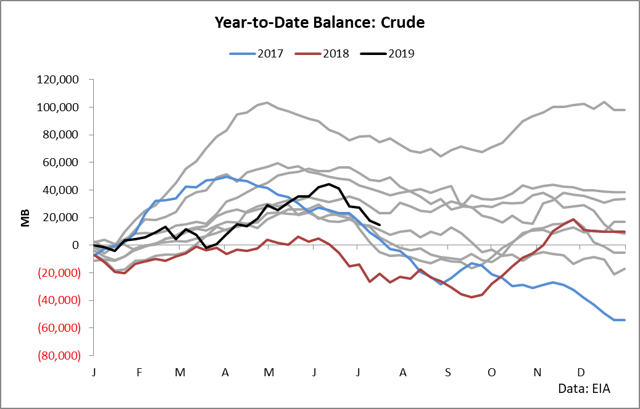

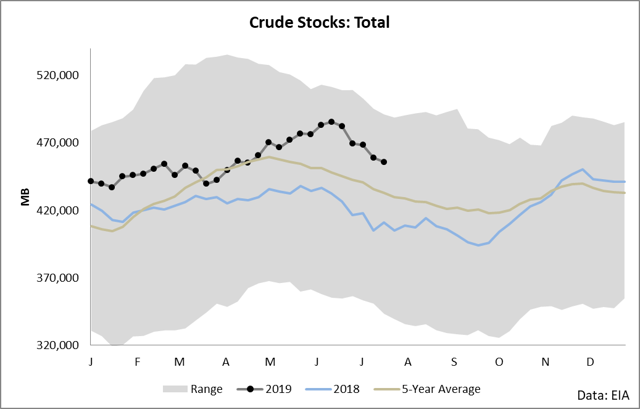

As seen from the year-to-date balance perspective, what was looking to be one of the larger to-date builds in the June time frame rapidly reversed to mirror the declines we saw in 2017.

In 2017, we witnessed similar declines in conjunction with a substantial rally in the price of crude oil with price increasing by nearly $20 per barrel.

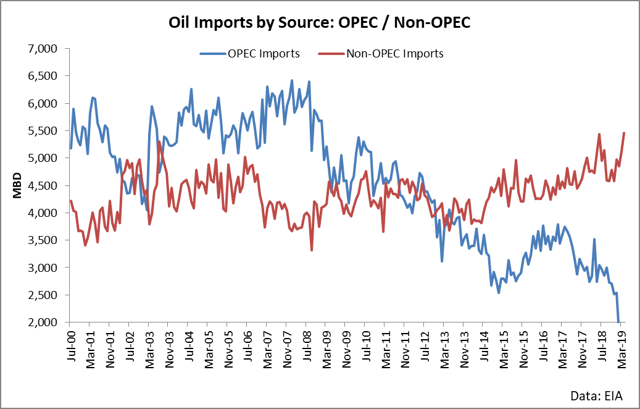

The reason for the current draws is pretty simple: OPEC cuts are cutting off supply into the United States markets. On a year-to-date basis, this is one of the lowest levels of imports we’ve received in decades – with most of the declines coming from OPEC nations.

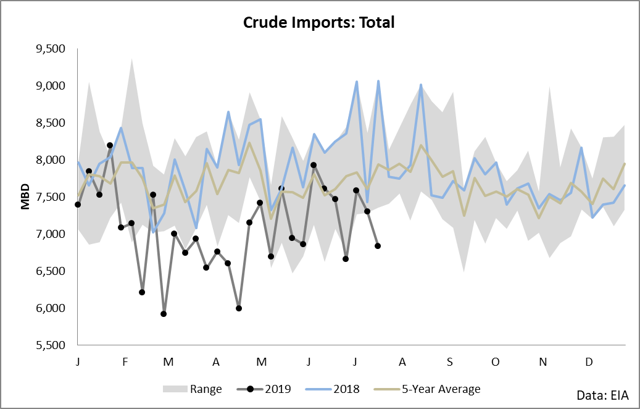

Seen on a little more frequent basis, the impacts are pretty consistent across the year with most weeks coming in near or at 5-year lows.

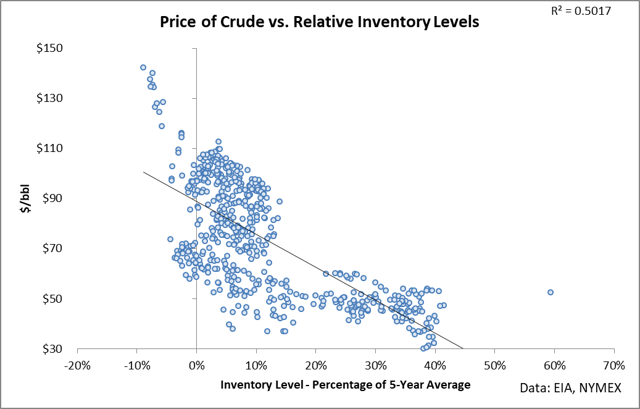

Why this matters for DWT is this: when crude inventories fall versus the 5-year average, the price of crude rises as seen in the following two charts.

The current OPEC cuts have been extended through the first quarter of next year. This means that the forces at work which have driven down inventories are going to remain in effect for the duration of the year and the large draws associated with a normal driving season and suppressed supply are almost certainly going to continue. As this relationship continues, the price of crude will continue to rise and the share price of DWT will continue to fall. I would highly suggest avoiding DWT since it is literally the worst trade you can put on in an environment of OPEC cuts based on a market entering backwardation and the rising price of crude oil.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News