[ad_1]

Main Thesis

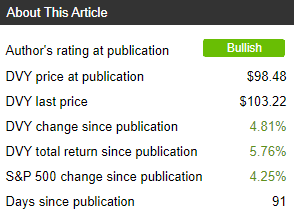

The purpose of this article is to evaluate the iShares Select Dividend ETF (DVY) as an investment option at its current market price. I was bullish on DVY last time around, primarily because of the defensive nature of the fund. In hindsight, this was a good call, and current economic conditions tell me to remain bullish. Specifically, the Fed has now entered an easing cycle on interest rates, and DVY’s heavy Utilities exposure should benefit from this action. Furthermore, while recent trade-related developments have been positive for equities as a whole, it will not take much for a regression on these developments. With markets re-testing prior highs, I would expect any negative story from either the Chinese or U.S. governments to rattle investors, and if that happens DVY should hold up better than the market. Finally, the fund continues to see double digit dividend growth in 2019, and that is helping to keep the yield above 3%, which is quite attractive as treasury yields drop.

Background

First, a little about DVY. The fund seeks “to track the investment results of an index composed of relatively high dividend paying U.S. equities.” The index includes companies with comparably high dividend yields that have at least a five-year track record of paying dividends. DVY is currently trading at $103.22/share and yields 3.26% annually, based on its last four distributions. I recommended DVY back in June, and the fund has delivered a strong return since then. In fact, DVY has actually bested the S&P 500 over that time period, as shown below:

Source: Seeking Alpha

Source: Seeking Alpha

Given the strength the fund has seen, I wanted to take the opportunity to reassess DVY to see if it still makes sense to hold going forward. After review, I believe it does, and I will explain my rationale in detail below.

Utilities Sector Performs Well During Easing Cycles

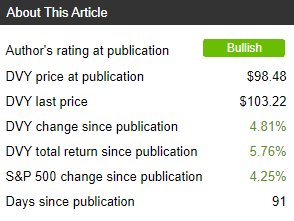

My first point on DVY will be similar to my previous reviews, with a look at the Utilities sector. This is because Utilities have been DVY’s largest sector by weighting for years, and this time around is no different, as shown below:

Source: iShares

Source: iShares

With a weighting of almost 26% total assets, clearly this is a sector of importance for DVY.

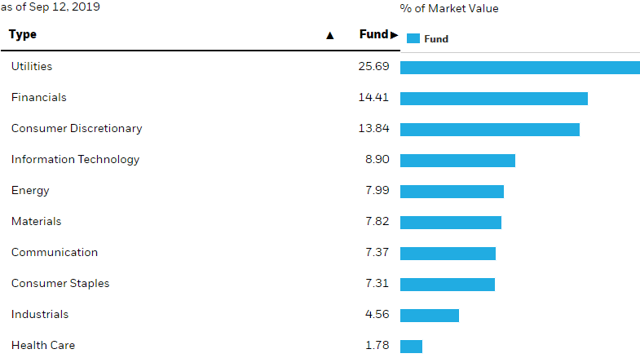

For this review, I want to spend a moment talking about how the outlook for interest rates should impact the Utilities sector, and why this exposure is a net positive for the fund right now. To begin, let us look at the sector’s performance over historical periods of Fed easing, which is a cycle we are currently in now. With the Fed having cut rates back in July, it is fair to say interest rates are on the decline, and past history shows this is a positive for the Utilities sector on a broad scale, as shown in the chart below:

Source: Forbes

Source: Forbes

As you can see, the sector performs well, in some cases extremely well, in almost all Fed loosening cycles. This is the case for a few reasons. One, the Utilities sector typically offers above-average, and consistent, dividend yields. When interest rates decline, this income stream becomes even more attractive. Two, when the Fed decides to lower interest rates, that is often because the economic climate is uncertain. This can be due to issues such as slowing economic growth, geo-political risks, or weak consumer spending figures. During this current cycle, investors are contending with trade disputes, primarily between the U.S. and China, as well as concerns over global economic growth – including within the U.S. This has prompted the Fed to act, and the immediate result has been positive for DVY.

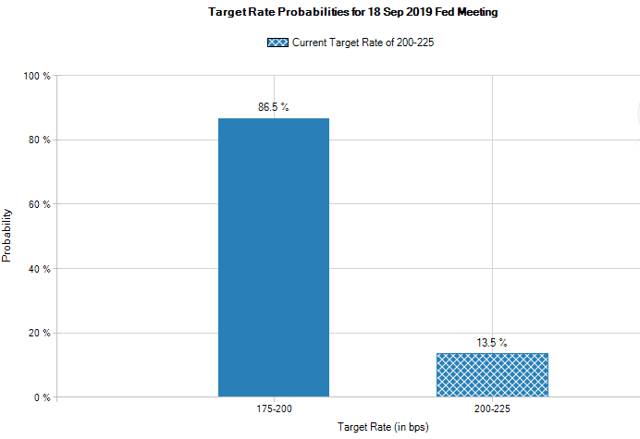

Looking ahead, there is reason to believe this strong performance could continue. This is primarily because the Fed’s latest rate cut may not be a one-off event. In fact, according to data compiled by CME Group, investors have placed a very high probability on another .25 basis point cut during the upcoming September 18th meeting, as shown below:

Source: CME Group

Source: CME Group

My takeaway here is this outlook is favorable for the Utilities sector, and DVY by extension. Using history as a guide, we see that the Utilities sector offers positive returns in almost every Fed easing cycle. If we see further rate cuts from the Fed, and the market expects another cut to be forthcoming shortly, then the natural conclusion would be to expect Utilities to perform well from here. While this is by no means a “sure thing”, based on this precedent I believe DVY’s Utilities exposure will be a net positive going forward.

DVY Remains A Good Value

A second point I want to make with regards to DVY is the fund’s valuation. As investors are aware, the major indices are back near all-time highs, and earnings multiples have been rising in turn. While there has been earnings growth which has kept a lid on rising multiples, they are still climbing. In fact, both DVY and the S&P 500 have seen their multiples inch up since my last review, as the chart below illustrates:

| Benchmark | P/E in June | Current P/E | Current Yield |

| DVY | 14 | 15 | 3.3% |

| S&P 500 | 21 | 22 | 1.9% |

Source: iShares; Multpl.com

My takeaway here is the DVY is still markedly cheaper than the broader market, which helps reinforce the defensive aspect of the trade. Considering DVY’s short-term out-performance over the S&P 500, this valuation appears even more attractive. Further, its higher yield helps compensate investors for taking the more defensive position. While the Utilities sector is certainly not cheap, DVY is balanced out by its broad asset allocation, helping to keep the fund’s P/E well below the S&P 500. With the market sitting at such high levels, finding value is a challenge, but DVY is clearly a fund that offers it.

Double-Digit Dividend Growth Continues

My third point on why I like DVY relates to the fund’s dividend. Considering where we stand with interest rates, including the short-term outlook, a yield above 3% is pretty attractive. Furthermore, DVY is also delivering dividend growth, which is helping keep the fund’s yield above the 3% threshold even as the share price climbs. In fact, DVY saw its dividend increase markedly year-over-year in the first two quarters of 2019, as shown in the chart below:

| 2018 Q1 Distribution | 2019 Q1 Distribution | YOY Gain |

| $.78/share | $.87/share | 11.5% |

| 2018 Q2 Distribution | 2019 Q2 Distribution | YOY Gain |

| $0.80/share | $0.88/share | 10% |

Source: iShares (Calculations by Author)

As you can see, DVY has started the year off strong in terms of dividend growth. While the growth has decelerated slightly since Q1, the fact that the fund still saw double-digit growth in Q2 gives me confidence DVY is holding the right types of stocks for our current environment. In fact, these metrics both exceed the growth from 2018, so I view this development quite positively. Therefore, for now, I view the dividend story behind DVY as a reason to own the fund, and will closely monitor the upcoming quarters for any further progress or correction.

What’s The Risk?

Of course, there is certainly risk to buying DVY, especially with the fund sitting near its all-time high. While I feel that DVY currently offers a reasonable value, it could certainly trend lower from here. A primary factor that could cause the fund to under-perform (or go lower), would be progress between the U.S. and China, with respect to the current trade dispute. While the defensive Utilities exposure will help DVY withstand potential trade-induced volatility, it could also hold the fund back if substantial progress is made and the “risk-on” trade generates the most momentum.

And there are reasons to seriously consider this possibility. In fact, the primary reason for the recent run-up in equities has been positive news of the trade front. For example, on Wednesday (9/11), President Trump announced a delay of planned tariff increases on $250 billion in Chinese goods in what he dubbed a “gesture of good will”. While the delay was simply pushing the date from October 1st to October 15th, the gesture was symbolic in the sense that it showed a potential willingness of President Trump to come to the table for negotiations, rather than escalating the dispute further. Additionally, the following day, it was reported that President Trump is looking to make at least an “interim deal” with the Chinese government. Specifically, he stated:

If we’re going to do the deal, let’s get it done.

Of course, at this point, aside from the two-week delay on new tariffs, there has not been substantive progress, simply a dialing back of the rhetoric. However, further progress will likely pacify investors, which will probably lower the attractiveness of the Utilities sector, as well as defensive funds like DVY.

However, it is worth pointing out that, at this point, I feel the market is getting a bit too optimistic in terms of a trade agreement. With the Dow and S&P re-testing highs, it will not take much to set us back from these levels. While President Trump wants a strong stock market to boost his chances of re-election, he also wants to appear “tough” on China, which will certainly make for an interesting year ahead.

Bottom line

While I was bullish on DVY in June, its performance has exceeded my expectations, considering the fund has provided 1.5% of alpha over the S&P 500. While the fund is looking expensive on the surface due to its high share price, I feel there are reasons to remain long. One, despite the stock hitting a 52-week high, it remains reasonably priced in terms of its earnings multiple. While a P/E of 15 is not necessarily “cheap”, it is well below the valuation of the S&P 500. Two, DVY’s Utilities exposure should be beneficial for the fund as interest rates drop, as historical guidance suggests this sector performs very well during periods of Fed easing. Furthermore, this is a defensive, domestic-oriented sector that will benefit from any trade-induced volatility. Three, DVY has seen double digit dividend growth in 2019, which is especially attractive considering yields on risk-free assets are declining. Therefore, I continue to recommend DVY, and would encourage investors to give the fund serious consideration at this time.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News