[ad_1]

busracavus/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on January 10th, 2022.

The iShares Select Dividend ETF (DVY) is an equity index ETF. DVY invests in the 100 highest-yielding U.S. equities with sustainable, growing dividends. DVY’s diversified holdings, strong dividend growth track-record, above-average 3.1% dividend yield, and cheap valuation make the fund a buy.

DVY Basics

Investment Manager: BlackRock

DVY Overview

DVY is an equity index ETF. It is administered by BlackRock, the largest investment management firm in the world. DVY itself tracks the Dow Jones U.S. Select Dividend Index, an index of dividend-paying U.S. securities.

The index first selects all U.S. equities with positive five-year dividend growth, dividend coverage ratio of at least 167%, and positive earnings. Stocks must also meet a basic set of liquidity, size, etc., screen. The index then selects the 100 highest-yielding securities meeting these screens. To prevent excessive portfolio turnover, index constituents are only removed from the index when their yield rank drops below 200, so the fund can temporarily have more than 100 holdings. It is a yield-weighted index, the higher the yield the greater the weight, with security and industry caps to ensure diversification. To summarize, the index invests in the 100 highest-yielding U.S. equities with sustainable, growing dividends.

DVY’s underlying index seems reasonable enough, and is clearly intended to result in a diversified equity portfolio with strong dividends and dividend growth. It broadly succeeded.

DVY Investment Thesis

DVY’s investment thesis rests on the fund’s:

- Diversified holdings, with the fund providing exposure to at least 100 different U.S. equities, from all relevant industries

- Above-average 3.1% dividend yield, which directly boosts shareholder returns

- Strong dividend growth track-record, particularly important for long-term dividend growth track-record

- Cheap valuation, which could lead to strong capital gains and market-beating returns if valuations were to normalize

The above combine to create a strong fund and investment opportunity, and one which is particularly appropriate for dividend investors. Let’s have a look at each of the points above.

Diversified Holdings

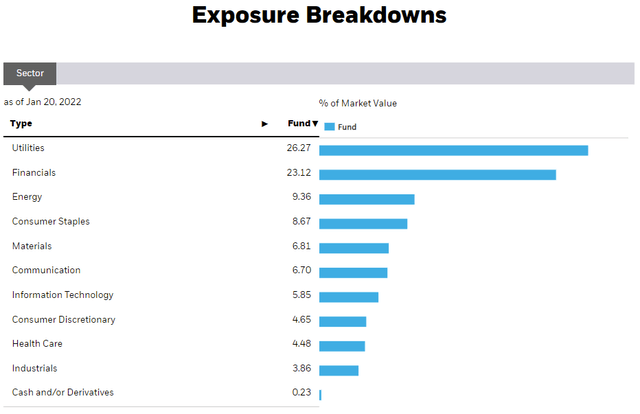

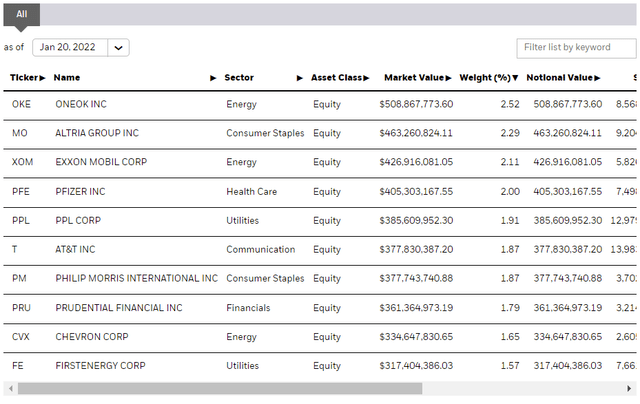

DVY is a well-diversified fund, with investments in at least 100 securities, 101 as of 1/21/2022, and with exposure to most relevant industries. Concentration is quite low too, with the fund’s top ten holdings accounting for just 20% of its value. DVY’s industry exposures and largest holdings are as follows:

DVY Corporate Website

DVY Corporate Website

As can be seen above, DVY focuses on high-yield large-cap U.S. equities like Altria (MO), Exxon Mobil (XOM), and AT&T (T). These are mostly older, stodgier, companies with reasonably safe business models and above-average dividends, but lackluster growth. These are appropriate investments for most retirees or income investors, and so make perfect sense in a fund like DVY.

The fund’s many screens and filters exclude, or at least attempts to exclude, the riskiest high-yield U.S. equities. As an example, the fund does not invest in Lumen Technologies (LUMN), as the company slashed its dividend in 2019. Only distressed companies slash their dividends, and these make for very risky investments which DVY attempts to avoid. The fund does not invest in The Williams Companies (WMB), as the company’s financials suffered in the aftermath of the coronavirus pandemic, which puts pressure on the company’s dividend. DVY excludes many other companies with these and other negative, risky characteristics, a benefit for the fund and its shareholders.

The fund’s industry exposures have similar characteristics. The fund is overweight utilities and financials, the two most heavily regulated industries. These industries offer (generally) safe, dependable dividends and returns, but growth is slower than average, and significant market-beating returns are unlikely. To compensate, the fund is massively underweight tech, as is common for most dividend equity index ETFs. Tech offers investors the strongest potential returns, and the frothiest valuations, so underweighting said industry serves to decrease risk and expected returns.

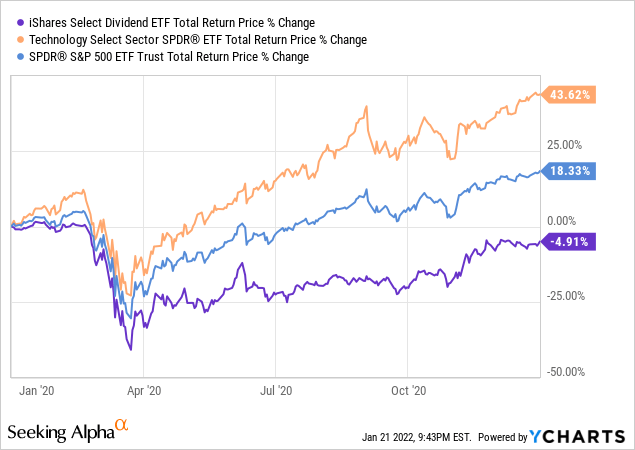

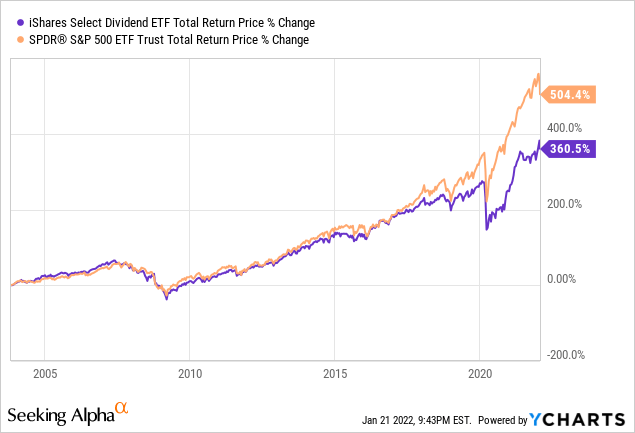

Being underweight tech means that the fund’s relative performance is strongly dependent on the relative performance of said sector. DVY should underperform when tech outperforms, as was the case during 2020, during which the coronavirus pandemic was in full swing.

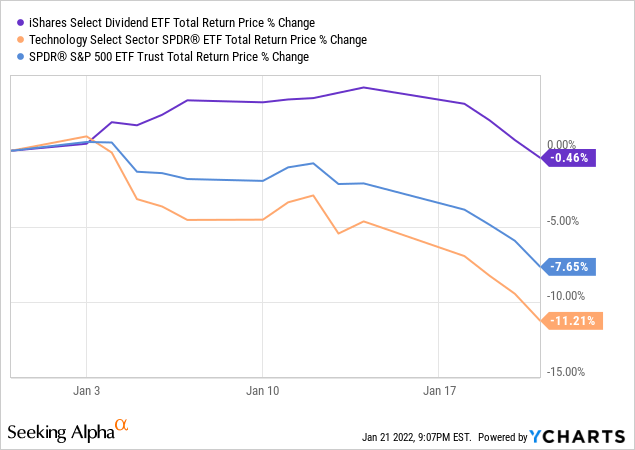

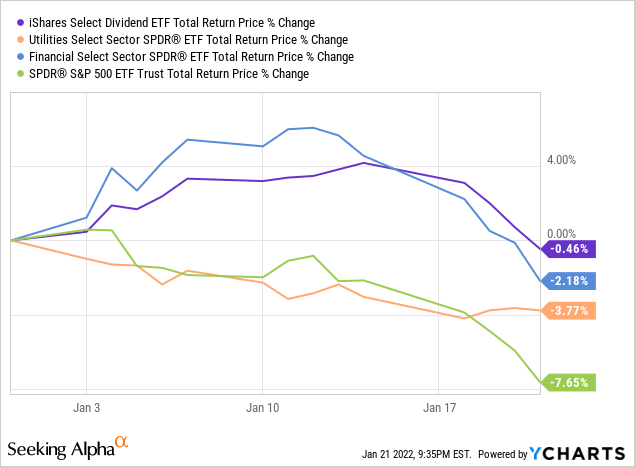

DVY should outperform when tech underperforms, as has been the case YTD.

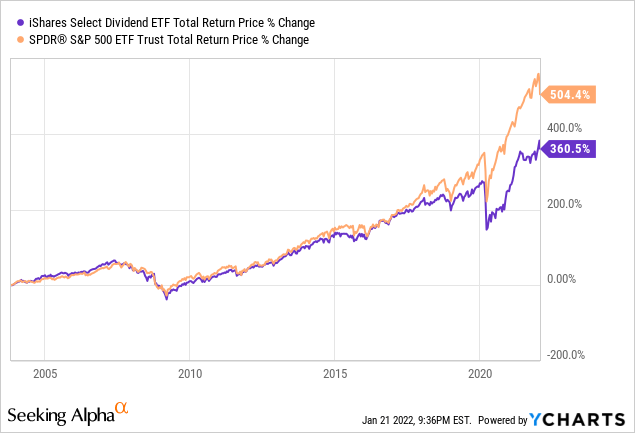

As tech has been in a massive bull run these past few years, the fund has underperformed since inception. Not the best results, but not necessarily predictive of future performance.

Notwithstanding the above, DVY remains a reasonably well-diversified fund, with investments in at least 100 securities, and with exposure to most relevant industries. As the fund is underweight tech, investors interested in DVY should consider pairing the fund with a tech fund, so as to maintain adequate exposure to said industry.

Above-Average 3.1% Dividend Yield

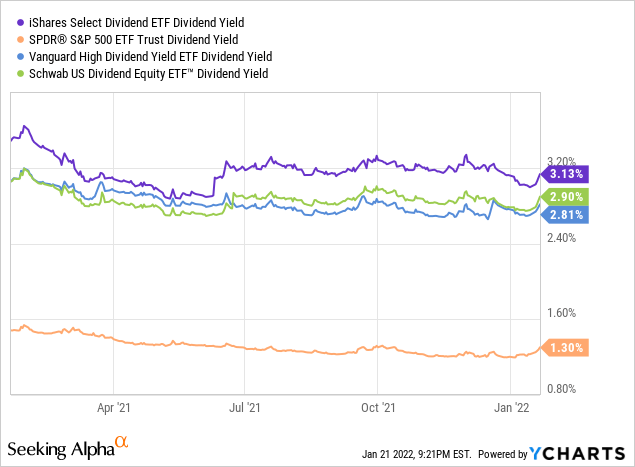

DVY invests in the 100 highest-yielding U.S. equities, subject to several screens and filters, meant to ensure dividend growth, sustainability, and profitability. This results in a fund with a comparatively strong 3.1% dividend yield, which is quite a bit higher than that of most equity indexes or fund peers. It is not an incredibly high yield, as the fund’s screens prevent the fund from investing in most of the riskier, higher-yielding equities.

DVY’s above-average 3.1% dividend yield is a benefit for the fund and its shareholders, although a relatively small one.

Strong Dividend Growth Track-Record

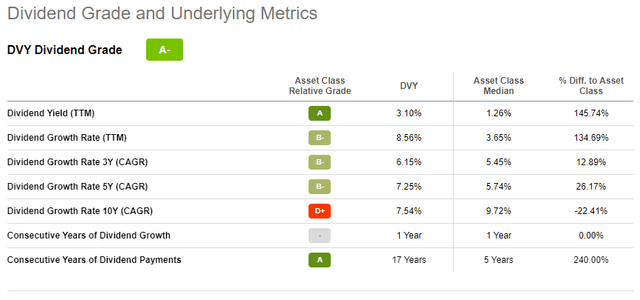

DVY only invests in companies with positive 5Y dividend growth, which results in a fund with a relatively strong dividend growth track-record. The fund’s dividend tends to grow in the high single-digits every year, and has experienced 17 consecutive years of dividend growth.

Seeking Alpha

DVY’s strong dividend growth and above-average 3.1% dividend yield are particularly beneficial for long-term dividend growth investors, who should see significant dividends after holding the fund for a few years. As an example, DVY has a 5Y yield on cost of 4.3%, and a 10Y yield on cost of 7.1%, both reasonably strong figures. Re-investing the fund dividends would have resulted in even stronger yield on cost figures too.

Seeking Alpha

DVY’s strong dividend growth track-record is a significant benefit for the fund and its shareholders, and makes the fund an ideal long-term dividend growth investment.

Cheap Valuation

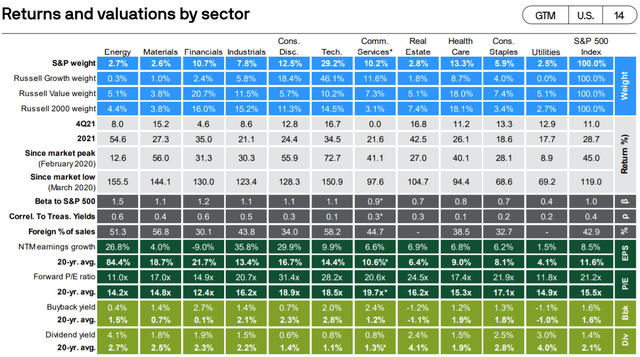

DVY focuses on high-yield utilities and financials, two of the cheapest industry segments right now, as per J.P. Morgan data.

J.P. Morgan Guide to the Markets

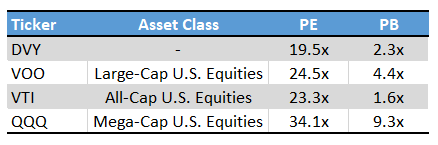

DVY’s holdings themselves tilt towards cheaply valued, high-yield stocks too. This results in a relatively cheaply valued fund, with DVY sporting a 19.5x PE ratio, and a 2.3x PB ratio. Both are moderately lower than that of most broad-based equity indexes, including the S&P 500.

ETF.com – Chart by author

DVY’s cheap valuation could lead to significant capital gains and market-beating returns if valuations were to normalize across industries. That has been the case for the past month or so, with investors rotating into utilities and financials, leading DVY to outperform.

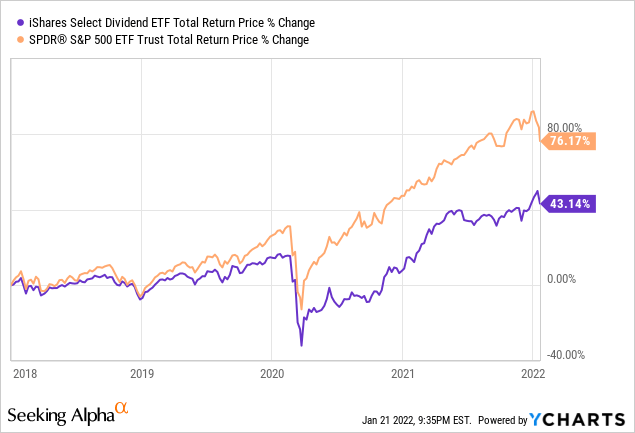

On a more negative note, cheaply valued stocks have almost always underperformed in the past, as they wouldn’t be cheaply valued otherwise. That has been the case for DVY in prior years, especially between 2018 and 2021, during which tech boomed, while utilities, financials, and other old-economy industries and stocks stagnated.

DVY’s longer-term performance is somewhat better, but the fund has still moderately underperformed since inception. Underperformance has been, however, concentrated between 2018 and 2021.

Moving forward, I think that DVY’s focus on cheaply valued industries and stocks will be a net positive for the fund and its shareholders, but that has mostly not been the case since inception.

Conclusion

DVY’s diversified holdings, strong dividend growth track-record, above-average 3.1% dividend yield and cheap valuation, make the fund a buy.

[ad_2]

Source link Google News