[ad_1]

NicoElNino

Unique markets often require different strategies for investors to achieve their objectives. When market conditions are, normal creative approaches aren’t usually necessary, but in challenging times different approaches are often required.

Investors today face unique challenges that have not been seen in decades. Markets remain volatile as inflation is at a 40-year high, volatility levels remain elevated as signs of a wider economic slowdown in the US and abroad are mounting, and interest rates are now rising.

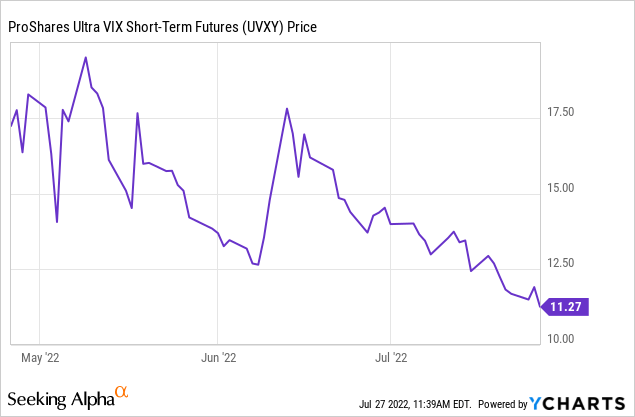

Even though the VIX has fallen slightly over the last several weeks, markets have been very volatile over the last 3 months as changing economic conditions and rising rates have created uncertainty across the major markets.

Volatile markets can create fear in some investors, but fear almost always creates opportunities for patient investors with a long-term perspective.

One investment fund that is uniquely positioned to take advantage of the current elevated levels investors are likely to see for some time is the Amplify CWP Enhanced Dividend Income ETF (NYSEARCA:DIVO).

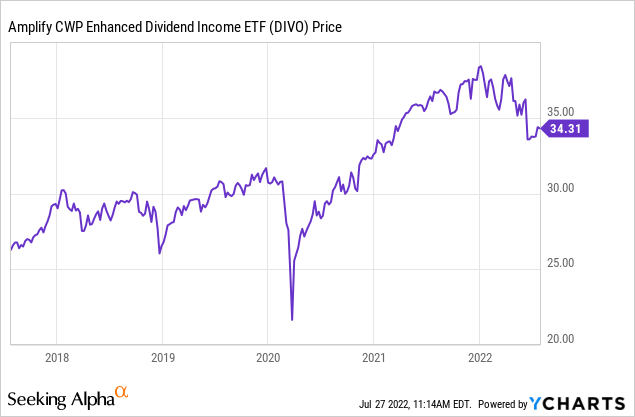

This ETF was started in 2016, and the fund has consistently delivered strong income and capital gains.

DIVO predictably sold off during the pandemic, but the fund has performed very well since this ETF was listed at the end of 2016.

DIVO is a diversified exchange-traded fund that invests primarily in large-cap dividend stocks. The fund invests no more than 25% of the allocated assets in any one sector, and no more than 8% of assets in any one stock. The fund’s holdings are 22% to the financial sector, 17.95% health care, 13.81% technology, 11.24% consumer cyclical, 9.16% industrials, 8.62% energy, 7.03% consumer defensives, 4.78% basic materials, 3.47% utilities, and 1.81% to the communication sector. DIVO invests 80% of the fund’s assets in dividend-paying securities. The fund is well-positioned in an inflationary environment because of the exposure to large-cap companies in sectors such as energy, consumer cyclicals, industrials, and the financials. The current yield is 5.16%.

DIVO’s top holdings are UnitedHealth Group (UNH), Johnson & Johnson (JNJ), Visa (V), Chevron (CVX), and McDonald’s (MCD). The fund has an expense ratio of .55%, which is very low for an actively managed ETF. Expense ratios are almost always lower in passive funds, but this expense ratio is very low for an actively managed fund. Dividends are also paid monthly since income comes from both selling calls and ordinary quarterly dividend payouts from the fund’s holdings. DIVO’s investment advisors are Amplify Investments LLC.

What is unique about this fund is the actively managed covered call strategy that this ETF has been successful with. The fund sells calls against specific holdings in the ETF, but unlike other income-generating investments, this fund does not sell covered calls against all of the fund’s holdings. DIVO’s covered call strategy has enabled the fund to have dividend growth of 41% over the last 3 years. The fund’s option selling approach also enables this ETF to pay monthly dividends as well.

The key to successfully using a covered call strategy is to have the right market conditions. Options traders selling the right to buy their underlying securities need enough volatility to make the call option they are selling have value, but investors don’t want so much volatility that selling calls caps the upside in the stock. When volatility levels are elevated but not at extreme levels, as we are currently seeing in the market, the covered call strategy that funds such as DIVO use can be very effective.

DIVO has been very consistent in paying stable monthly dividends in impressive amounts even though much of the monthly income comes from selling covered calls against the securities that the fund owns. The fund’s monthly payouts over the last 3 years have ranged from $.13 cents a share to $15.7 cents a share, and the fund paid out less than $.10 cents per share in monthly dividends only once since 2018. DIVO is up over 37% a year since the fund was listed in 2016 as well, showing that the fund’s covered call strategy has not limited capital gains for investors.

Today there continue to be signs of a wider slowdown in the labor markets with jobless claims rising to 8 month highs, and nearly 35% of small businesses are having problems paying their rent. With inflation rates still close to 40-year highs, the Fed’s actions have become very hard to predict as well. With economic data and monetary policy likely to be increasingly uncertain over the next year, volatility levels in the market should remain elevated for some time. This is why DIVO’s strategy of consistently selling calls where the fund managers see opportunity should be uniquely positioned to offer investors both solid income and capital gains for the extended future.

Markets have sold off hard over the last several months, but the US consumer remains strong with purchasing levels across the board still stable, and overall unemployment rates remain low even with jobless claims rising. Well, economic data indicates that the US economy is likely to slow, there are no signs of a deeper or wider recession in the world’s largest economy right now. With markets likely to remain range bound with at least somewhat elevated levels of volatility, funds such as DIVO should be able to deliver strong returns with the targeted covered call strategy this ETF uses.

[ad_2]

Source links Google News