[ad_1]

(Pic Sourced Here)

Traders may love volatility, but investor prayers for an end to the constant drama were seemingly answered late last week when the President announced a series of high-level phone calls with the Chinese leadership helped spark a low-volume rally to keep the S&P 500 from a monthly return comparable with the brutal August’s of 2013 and 2015. That desire for a return to normalcy, along with the fact we now know the President “misrepresented” the nature and importance of phone calls, might explain why our inboxes are blowing up with emails about how to find great dividend paying ideas. After all, if you can’t trust the man at the top to not engage in a little market manipulation, you can at least rely on stable and steady dividends to help you through some possibly lean years ahead.

Buying dividend payers for security is such a universally known strategy that it’s earned a spot in the MSCI Factor box, but the problem with that “bird in hand” approach to investing is that it ignores the distinct possibility that:

- We could soon be in a recession that would see inevitable cuts in dividend payouts

- That recession would cause even dividend paying stocks to see serious declines in their share prices

Fortunately, for investors, they have a wide variety ETP options to consider in their quest for dividends with over 75 “high dividend yield” in our database, and we have plenty of insights to share as we enter what’s traditionally the weakest month in the market calendar. Perhaps, the most surprising lesson of all is that if investors really want secure income and capital preservation, it might finally be time to get serious about investing overseas.

Three Lesson for Investors

We spend a lot of time talking about high dividend yield funds for our SA followers (FDL: Take A Dive Into This Dividend Fund), but if you wanted to know what the most important reason was, we’d have to say it’s because size does matter. Specifically, that those 75 funds in the space had $142 billion in assets at the end of August, making it one of the most widely used smart beta categories in the ETP universe. That alone demands we stay aware of what’s happening in the space, but the shift in interest rates is demanding investors take notice.

Buried underneath the latest G-7 shenanigans was that the 30-year Treasury yield briefly slipped beneath the dividend yield for the broad S&P 500, currently at 1.92% according to multpl.com versus 1.97% for the 30-year and 1.506% for the 10-year bond benchmark rate. The fact that some investors are willing to take on such a tremendous amount of interest rate risk for the opportunity to earn a rate of return below long-run inflation is almost absurd. Buying Treasuries at these low rates isn’t just about acquiring a risk-free asset, it suggests you’ve given up on any possibility for further economic growth or future inflation. No wonder the financial media is talking about opportunities with dividend paying stocks.

After all, a supposedly “safer” dividend paying equity fund has two return components. First, there’s the possibility of growth in the value of the company, eventually raising its share price over a long period of time. Then, there’s an income stream which is often significantly above that of the broader market thanks to the basic nature of high dividend funds. They focus on stocks in specific sectors such as utilities or consumer staples where lower growth prospects lead to investors pressuring management for higher payouts. Even better is the fact that those sectors are often natural defense plays with lower volatility than the broader market give investors a higher Sharpe ratio.

That’s the theory at any rate, but the ETFG Quant Model has some much more disturbing updates that should have you wondering if buying Treasuries isn’t the smarter play.

Observation #1: Nothing is Cheap

Breaking down the return stream is a smart way to analyze any investment, and investors who take their time to research before they buy will immediately notice that high dividend ETFs are trading at spectacularly high prices compared to their own histories.

Regular readers will know that our ETFG Quant Fundamental Model looks at a number of different price multiples and compares them to the historical values to tell you where the fund is trading relative to its own past. That helps you to avoid some of the potential missteps from strictly comparing the current multiple, say P/E, of a high dividend fund to the broader market. For example, financial ETPs, specifically bank stock and insurance funds, typically trade a discount to the broader market making any comparison between their price multiples somewhat spurious.

The largest ETF in the space is the Vanguard Dividend Appreciation ETF (VIG) with over $32 billion in AUM thanks to those retirement accounts that have shifted from more capital-gains oriented funds. In fact, VIG was a big winner last month with more than $300 million in new assets. A quick check would show that VIG has a trailing P/E ratio of 19.9x versus 21.7x for the S&P 500, giving the impression that VIG is a relative value compared to the broader market. VIG’s trailing P/E gives you an earnings yield of 5%, not terribly attractive for how the level of equity risk but still significantly higher than Treasury yields. But looking at the current P/E only tells you part of the story because when compared to where it has traded, VIG is certainly no value.

VIG and most of the other domestic ETPS that make up the largest high dividend funds are trading at peak valuations with their P/E, P/B, and P/CF multiple scores at 0.0, indicating they’re trading at the richest valuations in their history. Nor is that trait limited to just the largest funds in the space, there’s a strongly negative correlation between the size of ETFs in this category and their aggregate fundamental score which suggests that investors seeking safe havens have pushed valuations to their breaking point. Buying at these levels could leave you dangerously exposed to falling prices in the event of a market breakdown.

Observation #2: Where’s the Beef?

If you’re buying a high dividend fund because you actually want the income and not just for the defensive characteristics, you might be disappointed to learn that “high dividend” is a relative term. High dividend funds are strictly designed around an investment mandate to buy income producing stocks, but strong investor interest can make those stocks increasingly unattractive for income investors.

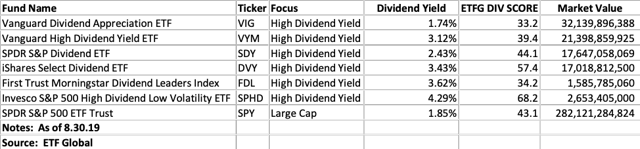

VIG, by virtue of being the largest and most well-known fund in the space, is a prime example of this trend with a trailing 12-month yield of just 1.74%, or only slightly more than the yield on a 10-year Treasury bond. While that’s not the lowest historical yield the fund has ever traded at (our fundamental model also uses dividend yield as component), it is in the lower third of VIG’s range and what’s worst is that it’s not alone.

As you can see in the table below, many of the largest funds in the space are sporting dividend yields that may be attractive relative to bond yields or the broader equity market but are low compared to not just their own history, but again to the amount of equity risk investors are assuming. The iShares Select Dividend ETF (DVY) may have a yield of over 3.4%, but that yield is just over 2x what investors could earn on a 10-year bond and requires buying a fund trading at close to historically high valuations with a P/E of 19.38x and an expense ratio of almost .4%. That’s a lot of risk to take on for a small income boost.

Observation #3: Concentration is King

Finally, investors need to remember that dividend income funds tend to concentrate themselves in certain stocks and sectors which can increase the likelihood of over-concentration in select stocks, a trend that might be getting stronger as investors seek out higher yields. That can leave you exposed to non-systematic risk (or stock specific risk) even in an otherwise diversified portfolio.

We’ve already covered the topic of dividend income fund construction in other detailed posts, but their tendency to buy larger stocks in a handful of industries and to use market-cap weighing means that income funds are increasing their ownership stakes in big names. Even with the increasing variety of funds in the space with names that include ‘low vol + high income’, ‘vol weighted’, ‘quality’, the basic fact is that they have to buy stocks with dividends and usually screened based on a constraint involving profitability or consistency. That cuts down the investment pool pretty quickly.

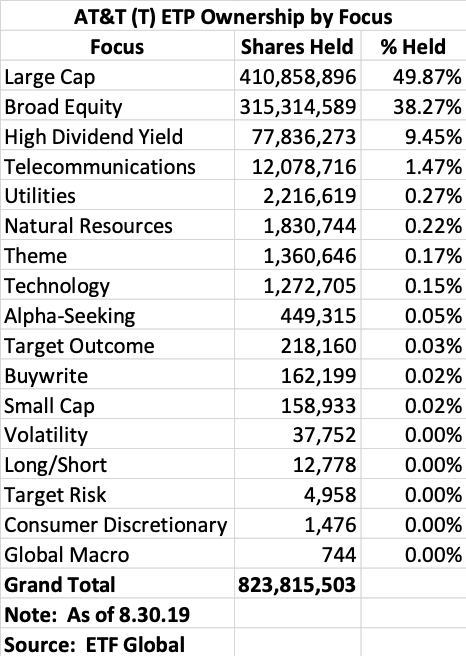

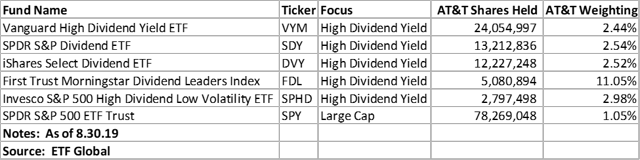

Case in point is AT&T (T), that telecom bellwether that still sports an attractive dividend despite the recent run-up in its share price with the stock now strongly outperforming the market over the last month. At least, some of that demand for ‘Ma Bell’ comes from increased buying by high dividend yield funds thanks to new share creations. As you can see in the table below, AT&T has over 820 million shares held by ETPs for more than 11% of its total shares outstanding with high dividend yield funds making up nearly 9.5% of that total.

That puts high dividend funds just behind broad index replicators as among the biggest owners of T and likely making those funds the more “active” component of AT&T’s ETP shareholder pool. And while a diverse group of funds make up the top 5 high dividend owners, AT&T remains a large holding with an outsized weighting compared to its allocation within the S&P 500. That can provide a certain momentum effect as new inflows to dividend funds push more money into stocks like AT&T, but it carries the same risks as any momentum strategy.

Traders might want to consider a strategy targeting high dividend purchases into widely held names while shorting stocks in those previously high-flying funds in the technology or communications sectors, but that trade isn’t without its risks. Namely that at some point, the trend will stop and you could run head first into a brick wall.

A Smarter Way to Buy High Income

The fact that high dividend ETPs are offering lower yields, over-concentrated and overbought doesn’t necessarily make them bad investments, but it does require you the investor to make a decision on the what your objectives are and on how much you’re willing to get behind it. If you want to ride that momentum factor, there are more concentrated funds, although even the best performers in the space were down in August. In the face of a true bear market, “safety” might mean just losing less. But if you want to commit to a high dividend fund with less concentration or non-systematic risk, you might be better off looking abroad.

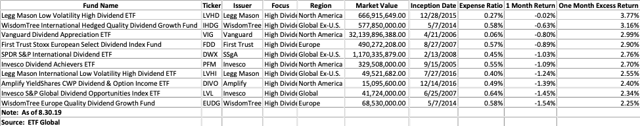

We were looking over the monthly returns by category and noticed a startling trend, or at least startling to anyone who’s been following international equities over the past few years. There was a clear trend of outperformance last month by funds we classify as either ‘European,’ ‘Global’ or ‘Global ex. U.S.’ with six funds in those regions making our list of top ten performers last month.

What’s to like about going with an international versus domestic fund? Let us begin with the fact that they largely avoid the issues plaguing domestic high dividend funds, namely being expensive and concentrated. Let’s take a look at one of the larger and stronger performers, the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG), which managed a strong August, losing only .63% compared to the average return of -3.79% for all high dividend funds. Being hedged against currency risk obviously helps, but IHDG has a long track record of success with its performance ranking in the top decile over the trailing three years.

How does it achieve that enviable track record? Certainly not with overconcentration in any one stock, sector, or even country. IHDG has close to 300 holdings spread out across the globe although like most funds in the space, it is heavily allocated within certain markets such as the United Kingdom, Japan, and Germany. Nor is the fund grossly misweighted in any particular sector with the current make-up largely in line with an international benchmark like the MSCI ACWI Ex. US Growth index. So, what’s in the secret sauce?

One wonderful part of ETP evolution has been how descriptive their names have become. For IHDG, quality is the word to focus on as it plays a key role in the benchmark construction process. After screening based on domicile, dividends paid and market capitalization, the investment universe is ranked using a formula that looks at both growth and quality. 50% of the ranking is determined by estimates of long-term earnings growth, 25% by the three-year average ROE and 25% by the three-year average ROA. Once the universe is ranked, the top 300 companies are selected for inclusion and weighted according to how much their dividend per share contributes to the total for the group with caps in place on the percentage of the portfolio in any one stock, sector or country. This combo gives investors in IDHG a combination of factors, both quality and dividends, to work with.

What else is there to like about IHDG? What about the fact it has enough growth stock exposure for Morningstar to classify it as a “foreign large growth” fund but with a substantially lower historical standard deviation, and with an attractive yield of over 3.8%? And with an expense ratio of .58%, you can own this fund for a price in line with what many domestic high dividend funds charge just to buy the S&P 500’s top dividend payers. Talk about a bargain.

Conclusion

There’s no denying that high dividend yield funds are an attractive space for investors, but they need to remember that its anything but monolithic. With 75 funds, the only limit for investors is imposed by their own biases, and we’d encourage you to consider looking beyond our own shores when it comes to adding some income to your portfolio.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Assumptions, opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. ETF Global LLC (“ETFG”) and its affiliates and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively ETFG Parties) do not guarantee the accuracy, completeness, adequacy or timeliness of any information, including ratings and rankings and are not responsible for errors and omissions or for the results obtained from the use of such information and ETFG Parties shall have no liability for any errors, omissions, or interruptions therein, regardless of the cause, or for the results obtained from the use of such information. ETFG PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall ETFG Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information contained in this document even if advised of the possibility of such damages.

ETFG ratings and rankings are statements of opinion as of the date they are expressed and not statements of fact or recommendations to purchase, hold, or sell any securities or to make any investment decisions. ETFG ratings and rankings should not be relied on when making any investment or other business decision. ETFG’s opinions and analyses do not address the suitability of any security. ETFG does not act as a fiduciary or an investment advisor. While ETFG has obtained information from sources they believe to be reliable, ETFG does not perform an audit or undertake any duty of due diligence or independent verification of any information it receives.

This material is not intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only correct as of the stated date of their issue. Prices, values, or income from any securities or investments mentioned in this report may fall against the interests of the investor and the investor may get back less than the amount invested. Where an investment is described as being likely to yield income, please note that the amount of income that the investor will receive from such an investment may fluctuate. Where an investment or security is denominated in a different currency to the investor’s currency of reference, changes in rates of exchange may have an adverse effect on the value, price or income of or from that investment to the investor

[ad_2]

Source link Google News