[ad_1]

The Global X Super Dividend U.S. ETF (DIV) is a nice idea but doesn’t seem to have much portfolio value in practice. The idea of a low-volatility stock portfolio that still generates substantial returns is somewhat of a Holy Grail amongst investors. Unfortunately, while the fund does indeed provide a low-volatility portfolio with a beta significantly below that of the stock market, it doesn’t succeed on the “generating a good investment return” part of the equation.

The Global X Super Dividend U.S. ETF Fund Overview

DIV tracks the Indxx SuperDividend U.S. Low Volatility Index and has an expense ratio of .45%. The index is composed of 50 of the highest-yielding low-volatility stocks, REITs, and MLPs in the US stock market with an equal weighting for each holding. There are also several rules that exclude smaller companies and stocks with low volume and low float.

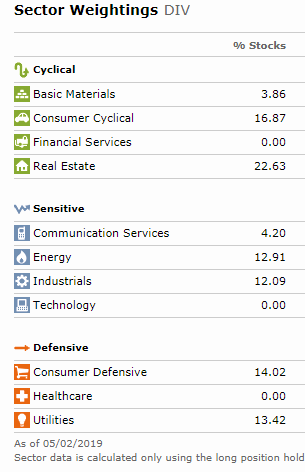

The result is a rather concentrated portfolio that is substantially overweight certain sectors and has virtually no exposure to other market sectors.

(Graphic source: Morningstar)

There are no healthcare, financial services, or technology stocks in the fund. On the other hand, the fund has substantial exposure to the utilities, energy, and real estate sectors.

The fund looks to have fulfilled its objective of low volatility. The beta is half that of the S&P 500 and only 20% that of emerging markets! Quite an accomplishment in today’s global economy.

(Graphic source: Fund website)

Additionally, the standard deviation of approximately 8% over the past year and 15% since the inception of the fund compares favorably with the S&P 500.

The issue with the fund is that while it may have low volatility, the returns of the fund appear lacking.

DIV’s Problem with Low Returns

For a fund with a beta of around .5 and a standard deviation that was about half that of the S&P 500 (at least over the shorter term), we would expect average annual returns to be about 50% of what the S&P 500 returned. Unfortunately, that does not appear to be the case. In fact, it appears investors are better off with the classic 60/40 stock and bond portfolio.

Over the last five calendar years, the fund returned an average of 6.03% with a standard deviation of about 12% (according to data from Morningstar). A portfolio that was invested 60% in the S&P 500 and 40% in ten-year treasury bonds would have returned an average of 10.78% over the past five years with a standard deviation of about 7%.

There does not appear to be any compelling reason for investors to pay .45% in fees for a fund to track a custom stock index when they could build a simple two-fund portfolio of stocks and bonds that would provide similar, if not substantially better, risk-adjusted returns.

There’s also something to consider that doesn’t necessarily show up in the return or volatility data. That is sector concentration risk. The 60/40 portfolio benefits from exposure to a much broader cross section of the economy by virtue of having stock holdings in every sector versus the extreme sector concentration in DIV. This is something that should be taken into strong consideration by investors. The holdings in DIV are selected based on past data. There’s nothing that guarantees that the same stocks or sectors will behave the same going forward. Presumably, the investors looking at DIV are risk-averse given their interest in a low-volatility fund, so the sector concentration issue could be a significant one.

Summary

Overall, we see no real role DIV would play in investors’ portfolios. Yes, the fund does live up to its name by investing in high-dividend, low-volatility stocks but there are better options for risk-averse investors. While the fund does generate substantial income from dividends, it’s of little consequence if the overall returns of the fund are lackluster.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News