[ad_1]

SARINYAPINNGAM/iStock via Getty Images

Thesis

Direxion Daily 20+ Year Treasury Bear 3x Shares ETF (NYSEARCA:TMV) is an exchange traded fund that aims to offer the inverse performance of the ICE U.S. Treasury 20+ Year Bond Index:

As per the fund’s literature

The Direxion Daily 20+ Year Treasury Bear 3X Shares seeks daily investment results, before fees and expenses 300% of the inverse (or opposite), of the performance of the ICE U.S. Treasury 20+ Year Bond Index.

The vehicle is a speculative investment tool, not a buy-and-hold investment. Any leveraged product should be viewed through the lens of a sophisticated investor and the holding period should be adjusted to reflect its speculative utilization. TMV is up more than +90% year to date, reflecting the violent move higher in long dated rates this year and the 3x embedded leverage in the product. Highlighting its speculative nature, on a 3-year basis TMV is still down more than -24%.

Long dated rates have rallied more than 200 bps year to date and are close to touching their 2018 highs. While the Fed has started a balance sheet driven quantitative tightening which will put further upward pressure on long end rates, many banks believe that the market has front-run most of the move and analytics show that quantitative tightening has less of a net impact on rates versus quantitative easing:

QT can be expected to reverse some of this impact, but we do not expect it to raise long-term rates by 100 bps. As noted above, the reduction in the balance sheet will be far smaller than the expansion that preceded it. The evidence so far suggests that there has been no persistent trend toward a higher term premium. And, in fact, during 4Q18 when investors appeared most concerned that QT was having an adverse impact on risk assets, the term premium fell.

Source: UBS

We therefore are of the opinion that most of the easy money has been made in TMV and would think about exiting any leveraged long rates positions.

Composition and Holdings

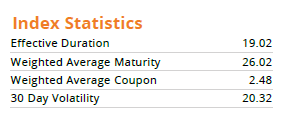

The Direxion fund TMV was started in 2009 and has a management fee of 1%. The fund replicates the index duration and maturity profile:

Index Statistics (Direxion Fact Sheet)

As we can observe the duration hovers around the 20-year mark with the weighted average maturity being higher at around 26 years. The fund holds bonds in different maturity buckets, evenly split in the 20-24 and 24-27 years bucket, whilst the highest concentration of securities reside in the 27-30-year bucket:

Bond Maturities (Direxion)

The fund achieves its desired leveraged exposure through swap contracts rather than holding any securities outright.

Performance & Interest Rates

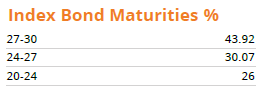

Year to date, 30-year rates have spiked more than 200bps:

30-Year Rates (The Fed)

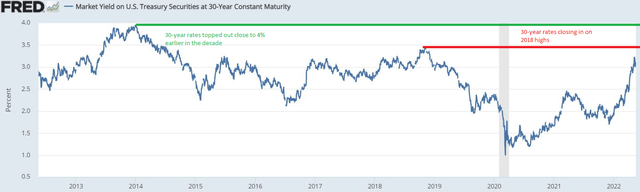

The move has been one of the most violent on record, on the back of spiking inflation readings. Earlier in the decade, long-dated rates topped out at 3.93%. We think we are going to revisit the 2018 levels but not the 2013 ones. Ultimately, the move in rates is driven by the Fed and their tightening of financial conditions in order to contain inflation. We feel the market has already done this, and as Goldman Sachs illustrates, financial conditions are well underway to reach constrained levels:

Financial Conditions (Goldman)

With leading indicators stagnating and an escalation of recessionary discussions for 2023, the Fed does not have a lot of maneuvering space. The move higher in rates in our opinion is closer to being over than the market anticipates. The Fed wanted mortgage rates to go higher to cool the housing market, and they have. Once they start unwinding the MBS balance sheet holdings, mortgage rates are going to continue to be constrained.

While corporate balance sheets are healthy, and the need to place long-term debt at these higher levels is going to be moderate for the next few years, higher long-term rates are going to take a toll on new capital projects and investments. It will take a few months for higher rates to percolate down to the real economy, but in our view anything above 4% is going to take a significant toll on the economy.

TMV is up more than 90% year to date on the back of the rates move:

Price Move 2022 (Seeking Alpha)

The fund is still down on a 3-year basis, highlighting the speculative nature of leveraged vehicles:

3 Year Move (Seeking Alpha)

Conclusion

TMV is a vehicle which offers sophisticated investors 3x the inverse performance of the ICE U.S. Treasury 20+ Year Bond Index. As long dated rates have risen in 2022 TMV has provided investors with a stellar return which clocks in above +90% year to date. While the Fed has started its balance sheet quantitative tightening actions, we feel most of the impact to rates has been priced in. We think long dated rates are going to revisit their 2018 highs but not move up significantly more. We therefore think the easy money has already been made in TMV and it would be prudent for retail investors to exit leveraged short treasuries trades.

[ad_2]

Source links Google News