[ad_1]

The Good Brigade

The Direxion Daily Real Estate Bull 3x Shares ETF (NYSEARCA:DRN) just doesn’t hit the right notes. There are reasons to want to invest in REITs. They have a lot of properties that make them favourable in the sort of economic environment we’re in. However, those reasons are primarily to do with solid and even growing FFOs that support yields that can sustain you and your investments. DRN doesn’t accomplish yield and is designed to hone in on real estate asset values as a leveraged speculative tool. We feel this is not the exposure that investors are actually looking for.

DRN Characteristics

The DRN is a 3x leveraged portfolio of some specialty REITs. The constituent pieces themselves are actually all fairly attractive in terms of their underlying economics and markets.

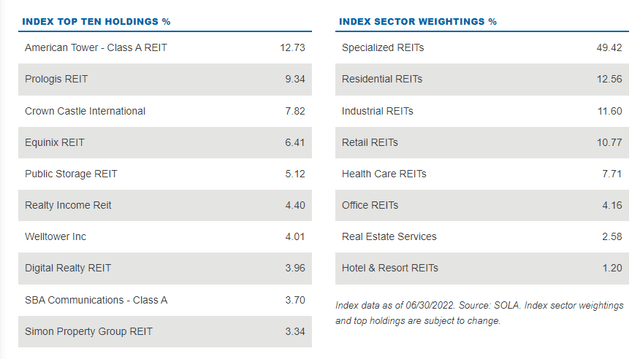

Top Holdings (direxion.com)

There’s a 50% exposure to specialty REITs which includes Prologis (PLD), a warehouse and logistics REIT, American Tower (AMT), which owns the telco towers that major telco companies like AT&T (T) operate, Crown Castle International (CCI) which is similar to AMT and Equinix (EQX) which has great demand side economics by being a builder and owner of IX facilities for networks to become data peers through and save on IP backbone transit costs for data. Other exposures are solid residential ones including elderly residences and staffed care facilities that benefit from favourable US demographics. Office REITs are only 4% of the portfolio, which we like to see since the idea of the office is undergoing change and risks permanent capital impairment.

At any rate, specialty REITs are at the top in terms of allocation.

The other thing is the yield. On a TTM basis we’re getting yield at 3.2%. The distributions are at the discretion of the fund, but it is a decent representation of the underlying yields. AMT yields 2.7%, and that’s one of the higher ones. EQIX is 2%. At 3x leverage, likely there’s more to be paid out, but interest is probably taking its toll in the leverage and conservatism by the managers.

Remarks

The characteristics of REITs, primarily their cash flow generation and built in rent hikes, make them interesting during recessions. The data shows they perform well both in the downcycle but also at the beginning of the next upcycle. While 3x leverage shouldn’t be an inherent problem, although we acknowledge that there is an element of interest rate risk with DRN because of rising interest expenses, we think that the lack of heavy yield from the ETF but also relatively low yields among its underlying exposures make it a pronounced asset value and not a yield play. Yield gets you head-started on returns where capital appreciation is anyway going to be difficult. And that’s the problem, capital appreciation, especially with real estate, is going to be difficult as rates rise and put a higher standard against assets of required returns. Plenty REITs without leverage could get you better and more solid yields, and if you really wanted to and were confident you might consider some leverage too. DRN and its distribution creates a situation where you make an acute bet on asset values over yields, where cash flows for reinvestment could be a good discipline to make the right decisions in a bear market.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Source links Google News