[ad_1]

HHakim/E+ via Getty Images

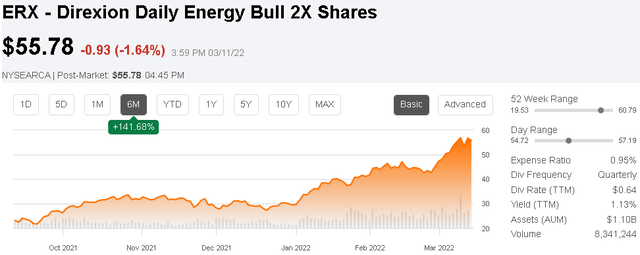

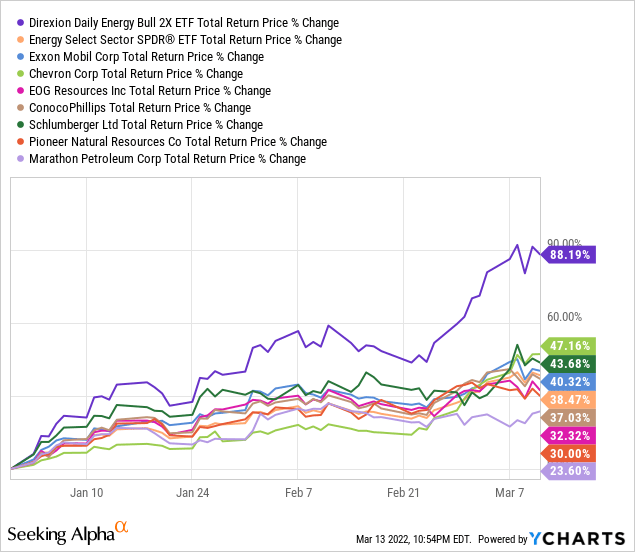

The Direxion Daily Energy Bull 2X Shares ETF (ERX) provides leveraged exposure to a basket of major oil and gas stocks. The fund has been a massive winner, up over 85% just this year amid the historic rally in energy. Indeed, the price of oil above $100 a barrel is a bonanza for producers translating directly into record cash flow and earnings. All this is in an environment where lingering pandemic-era supply-chain issues are now being stretched with the new Russia-Ukraine conflict uncertainties.

That said, we highlight a couple of reasons to take a more cautious approach towards ERX at the current level. There is a case to be made more structural bearish trends like an accelerated shift towards clean energy alternatives may end up overshadowing the near-term dynamics. The reality is that further upside in oil and energy stocks is far from certain. There is also a risk that softer demand into the volatile macro environment opens the door for a reversal of the current market sentiment. Overall, it’s been a great run, but don’t expect a repeat of gains going forward.

Seeking Alpha

What is the ERX ETF?

ERX is designed to generate 200% of the daily performance of the “Energy Select Sector Index” which is comprised of the energy sector constituents of the S&P 500 Index (SPY). The attraction of a 2x leveraged instrument is that it can potentially magnify gains, assuming investors are correct on the direction.

Trading ERX can also be useful by providing a certain level of risk exposure to the basket of energy stocks for effectively half the required capital outlay which can represent some portfolio management flexibility. On the other hand, it’s understood that ERX and other leveraged ETFs are high-risk simply because they face potentially wide swings of volatility that go beyond the underlying exposure.

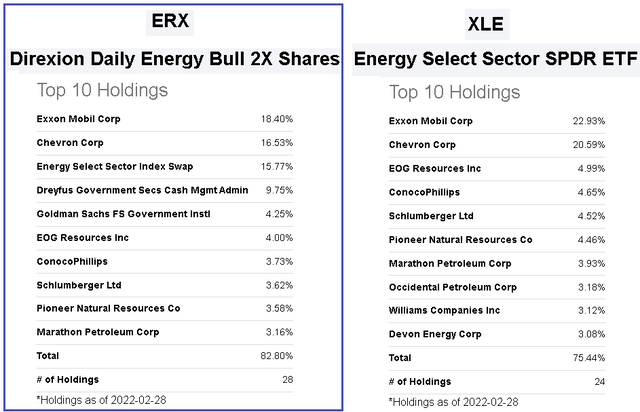

It’s helpful to look at ERX as the leveraged version of the Energy Select Sector SPDR ETF (XLE) as its benchmark. The fund technically holds a combination of the underlying stocks in XLE along with derivatives including index swaps to achieve the strategic objective.

All the mega-cap energy sector leaders are captured here including Exxon Mobil Corp. (XOM) and Chevron Corp. (CVX) as the two largest holdings. Overall, ERX includes leveraged exposure to 21 stocks that are generally recognized as category leaders and the largest U.S. energy companies.

Seeking Alpha

ERX Performance

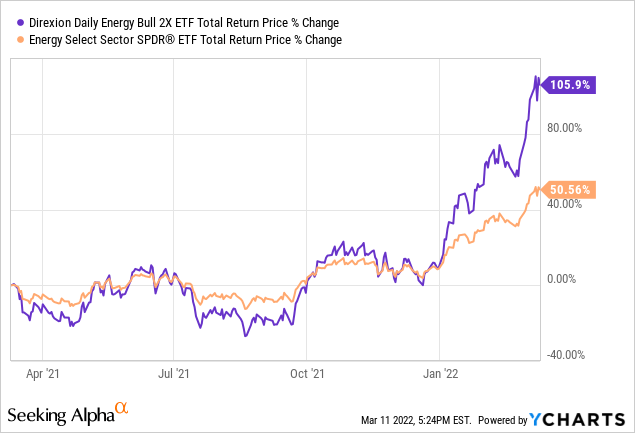

The data shows that the performance of ERX has worked as advertised, with ERX up 106% over the past year, a bit more than double the 51% total return of XLE over the period. In this case, XRE has benefited from the strong momentum in the sector which accelerated particularly since the start of 2022.

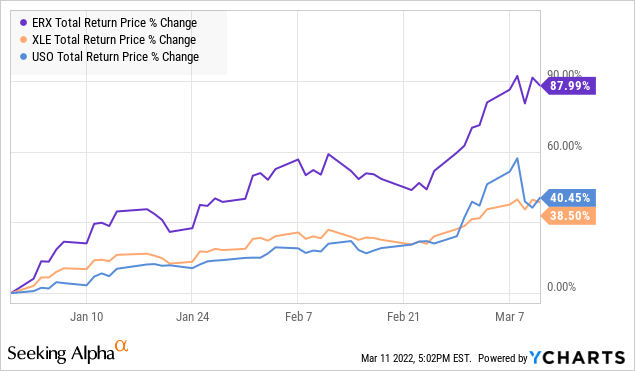

Indeed, ERX is up 88% YTD which is about 2.3x the 39% gain in XLE while the United States Oil Fund (USO), intended to track the price of WTI Crude Oil, has gained 40%. The price of oil has been trending higher over the past year, reflecting strong demand largely outpacing the supply growth that was disrupted during the early stages of the pandemic.

The latest geopolitical crisis in Eastern Europe over the past month has only added to the tight pricing conditions as the latest driver that has sent the price of oil to a near-decade high. For the underlying oil companies, the setup has been very bullish.

Russian Oil Ban Impact on Energy Sector

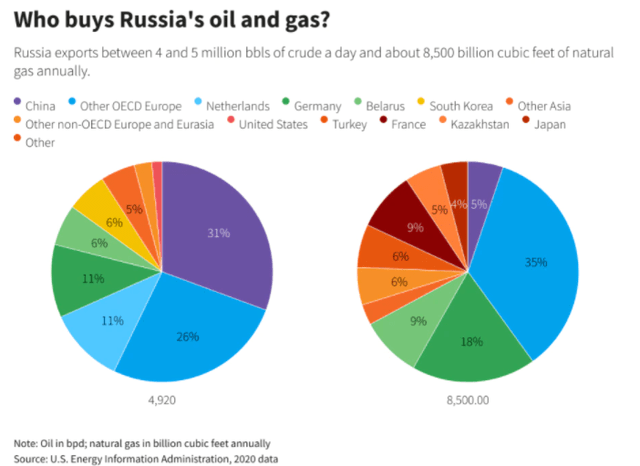

It’s a complex situation but the key headline over the past week is that the U.S. and other countries have moved to ban Russian oil imports as a retaliation to the invasion of Ukraine. For context, Russia accounts for approximately 10% of global oil production or 8% of exports with varying importance for each particular trade partner. The key point is that while the sanctions represent a disruption to the market, it’s relatively manageable in terms of volumes.

For example, in the U.S., Russia technically accounts for less than 3% of net imports. For crude oil, Russia’s largest trading in China representing approximately 31% of exports remains business as usual. The supply of natural gas is more critical to the European region although many countries are either planning to phase out Russian exports over an extended time, or still rejecting an outright ban.

Russia Energy Exports

From the 5 million barrels of oil per day Russia typically exports, the actual strain on the market is likely under 2 million when the ban becomes in effect. On this point, it’s worth noting that the U.S. and member International Energy Agency countries are releasing a collective 60 million barrels of crude oil from strategic petroleum reserves that effectively cover a few months of lost Russian production. Considering the phased-out approach to the ban most countries are taking, the impact on market pricing goes both ways.

So while we’ve had a strong upside in the price of oil and gas on the Russia headlines since February, it’s telling that the market has already marked a deep pullback from the highs. BRENT crude futures briefly hit $139 per barrel on March 6th and has since corrected by over 20% highlighting the extreme volatility. To be clear, whether oil is at $110 barrel or even $90, the pricing environment remains positive for energy companies. Any calls for oil to hit +$200 barrel is far from a done deal.

source: finviz.com

A Long-Term Bearish Case for Oil

The way we are looking at oil is that getting past the near-term dynamics, we argue that the long-term outlook for oil pricing has never been more bearish. In our view, the fallout from the Russian-Ukraine conflict will help accelerate the urgency to shift towards clean energy. Beyond the environmental angle based on carbon-neutral and “net-zero” policies that were already being pursued by governments around the world, the incentive now is a recognition of the importance of energy independence.

While every oil producer is getting a windfall in profits and rushing to expand production as much as possible in the immediate term, the other side is a search for alternatives. Everything from wind, solar, and electric vehicles begins to look incrementally more attractive relative to higher energy prices. Reports are that consumers are already altering their travel habits based on high fuel prices which directly hits oil demand.

Any thought that the U.S. or global economy may spiral into a recession can also represent a bearish headwind against higher oil prices. For every consumer that was on the fence about getting an EV, gas prices above $4.00 a gallon on average in the United States make the proposition more interesting.

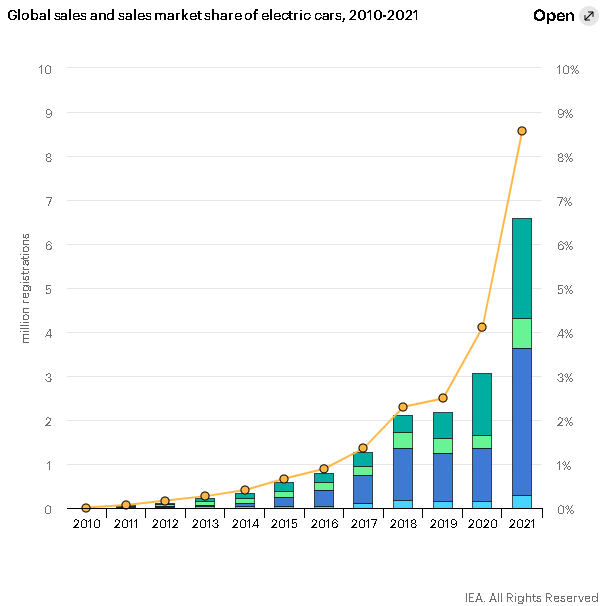

In 2021, the global share of electric cars sales approached 9%, more than doubling the 4.1% in 2020. This level is expected to approach 30% over the next decade. Furthermore, there is also a push into electric commercial vehicles and transit buses which is still in the early stages but will chip away the demand over time.

source: IEA.org

ERX Price Forecast

As it relates to energy stocks and the ERX ETF, the concept of peak oil demand may be approaching sooner rather than later. From there, the challenge is attempting to balance out what is objectively bullish near-term trends with a more concerning long-term outlook.

With the Russia-Ukraine situation still developing, there is also a consideration that “good news” like a ceasefire or resolution could pour some cold water on the energy rally. Beyond the positive fundamentals for energy stocks set to report a record quarter for earnings, a reversal in sentiment going forward could open the door for a correction in the sector that would be amplified by the fund’s leverage.

Seeking Alpha

The call we are making today is that it’s probably too late to get aggressively bullish on energy stocks with the ERX ETF. There may be some more upside over the next few weeks and months but we see the risks tilted to the downside looking out over the next year.

We rate the fund as a hold reflecting an otherwise neutral near-term view while seeing the risks. For investors already in the fund, it’s probably not a bad spot to take some exposure off the table by realizing gains. Selling covered calls is also a strategy that could work. The level between $50.00 and 47.50 appears to be an important area of support ERX will need to hold to maintain the positive momentum.

[ad_2]

Source links Google News