[ad_1]

undefined undefined/iStock via Getty Images

Investment thesis: the Fed’s shift to hawkishness has sent smaller and riskier stocks lower. Larger caps are relatively stable. Maintain your current position.

Introduction: ETFs now form the backbone of most portfolios. For example, a standard portfolio is composed some ratio of SPY (for the S&P 500) and TLT (for the long-end of the treasury market). In addition, due to low cost and high liquidity, an increasing number of investors and managers are now favoring ETFs that track broad averages over large mutual funds. Hence, an analysis of a large index-tracking ETF such as the (DIA) is warranted on Seeking Alpha as this is now a standard investment tool used by many investors.

Before jumping further into an analysis of the ETF, let’s first look at the macroeconomic backdrop to ensure that the economy is growing so that an equity investment is appropriate. This is my standard methodology when analyzing an ETF like the DIA.

I recently used the long-leading, leading, and coincidental methodology in this post. Let’s add a bit more color from two different sources: Markit Economic Manufacturing and Service PMIs and Federal Reserve Presidents.

The latest Markit Manufacturing Index was expansionary:

The seasonally adjusted IHS Markit US Manufacturing Purchasing Managers’ Index™ (PMI™) posted 55.5 in January, down from 57.7 in December, but higher than the earlier released ‘flash’ estimate of 55.0. The overall upturn was the slowest seen for 15 months and muted in the context of the substantial expansions seen in 2021.

Output rose only fractionally at the start of the year, following substantial increases through most of 2021. Weighing on the upturn was the impact of the Omicron COVID-19 variant, raw material and labor shortages, and a reluctance among some clients to place orders amid hikes in selling prices and longer lead times. The rise in production was the slowest in the current 19-month sequence of expansion.

The data is structured so that 50 separates expansion from contraction. The anecdotal information was soft. But it’s also likely that the virus surge is negatively impacting the results.

Service data was also expansionary:

The seasonally adjusted final IHS Markit US Services PMI Business Activity Index registered 51.2 at the start of the year, down notably from 57.6 in December, but up slightly on the earlier released ‘flash’ figure of 50.9. The upturn in business activity was muted in the context of marked expansions seen throughout 2021, as the spread of the Omicron variant of COVID-19 hampered business operations and demand conditions weakened. The rise in output was the slowest in the current sequence of growth which began in August 2020.

The specific mention of the virus again leads to the conclusion that, once it subsides, growth will return.

The overall economy is in good shape: employment is rising, people are spending, and earnings are strong. This was observed by Cleveland President Mester noted:

Despite the challenges, U.S. economic growth was very strong last year. Real GDP grew at a 5.5 percent pace, the highest annual pace since 1984. Firms added a record 6.7 million jobs to their payrolls and the unemployment rate moved down to about 4 percent, close to its pre-pandemic level. The economy’s strength reflected very robust demand by households and businesses. This demand was supported by extraordinary fiscal policy and monetary policy, as well as the deployment of vaccinations, which allowed the economy to reopen more fully.

She went on to note that inflation was a concern and that the Fed would have to adjust its policy accordingly.

Two Presidents have also noted that inflation is running very hot, which means the Fed should alter its interest rate policy. This was the position taken by Atlanta Fed President Bostic:

My staff and I have been vocal publicly and within the Federal Open Market Committee about our inflation concerns. We are not alone in that stance, of course. The Committee has moved to quickly end its large-scale asset purchases, and many members including myself have publicly expressed support for taking further measures soon to remove emergency policy accommodation. The economy is strong enough that emergency levels of accommodation are no longer warranted, and, if left in place, they could fuel already-high inflation. So, the primary goal of these latest policy actions is to ensure that longer-run inflation expectations do not become dangerously untethered, lest elevated inflation become cemented into our economy for years to come.

And now St. Louis President Bullard:

“I’d like to see 100 basis points in the bag by July 1,” Bullard, a voter on monetary policy this year, said in an interview with Bloomberg News on Thursday. “I was already more hawkish but I have pulled up dramatically what I think the committee should do.”

The markets have taken this change in Fed policy to heart and have shifted from growth-oriented investing that favors small-cap indexes like the IWM and IWC, to larger caps, like the SPY and DIA. I discussed this topic here.

The Dow Jones Industrial Average is one of the oldest stock market indexes. For more information on it, please see this link from S&P Global.

The DIA is an ETF offered by State Street Global Investors. This following “Key Features” list is from the fund’s fact sheet, available here.

The SPDR® Dow Jones® Industrial AverageSM ETF Trust seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the Dow Jones Industrial AverageSM (the “Index”)• The Dow Jones Industrial AverageSM (DJIA) is composed of 30 “blue-chip” U.S. stocks• The DJIA is the oldest continuous barometer of the U.S. stock market, and the most widely quoted indicator of U.S. stock market activity• The DJIA is a price weighted index of 30 component common stocks

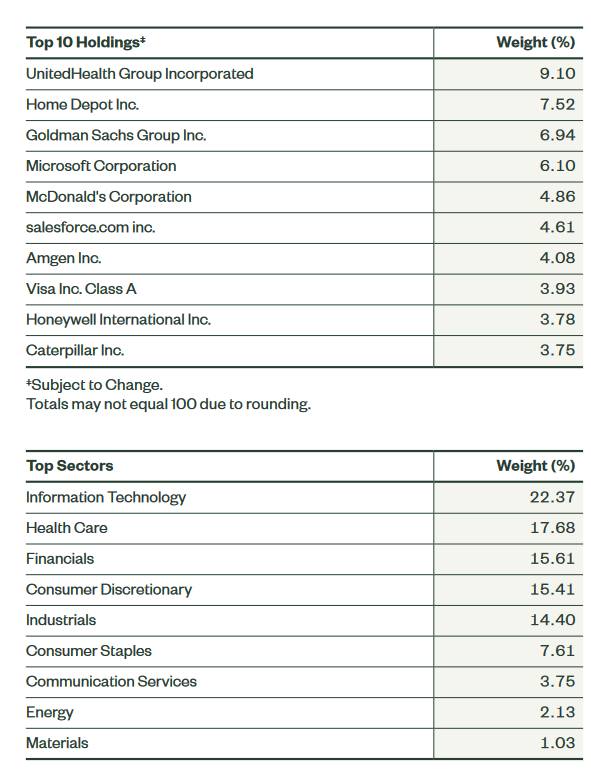

The following two tables which show the ETF’s 10 largest holdings and sector weightings are from the same fact sheet:

DIAs 10 largest holdings and sector weightings (State Street Global Investors)

Due to the DIA’s composition of larger, more established companies, it’s a great portfolio addition in the current market environment in which investors are shifting from smaller to larger companies.

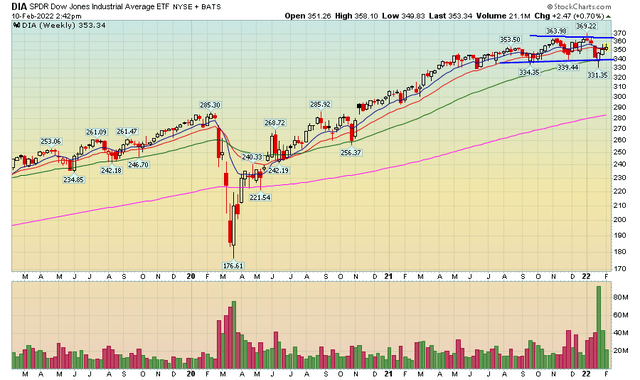

Now, let’s take a look at the weekly chart:

DIA Weekly (Stockcharts)

On the weekly chart, the index is consolidating gains. This is occurring when indexes composed of smaller or riskier companies are softening.

The DIA (NYSEARCA:DIA) is holding up well. Maintain your current position but don’t add to it.

[ad_2]

Source links Google News