[ad_1]

S_Hoss/iStock via Getty Images

Emerging market equities are back on my radar, as I think the next two years will be a good time to begin building initial positions. There is no doubt that emerging markets are vulnerable this year due to Fed rate hikes, which could result in capital flight from other emerging markets. This is not to mention country-specific issues related to inflation, currency depreciation, and heightened geopolitical risks. 2021 has already produced several horror stories in markets such as Turkey and Russia, and 2022 will only likely be worse as food and energy inflation leads to increased political unrest and heightened economic risks. This article will cover the WisdomTree Emerging Markets SmallCap Dividend Fund (NYSEARCA:DGS) and explain how it is a solid alternative to other ETFs.

A Unique Product

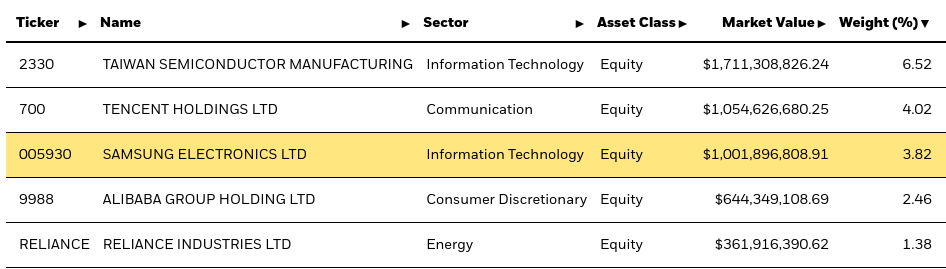

The WisdomTree Emerging Markets SmallCap Dividend ETF is a very intriguing alternative option for investors wishing to gain exposure to emerging market equities. Many emerging market ETFs have nearly all of the same top 5 holdings. These companies usually include Samsung (OTC:SSNLF), Taiwan Semiconductor (TSM), Tencent Holdings (OTCPK:TCEHY), and Alibaba (BABA). For example, the iShares MSCI Emerging Markets ETF (EEM) invests in the following companies listed below.

MSCI

Vanguard’s Emerging Market Stock Index Fund (VEMAX) has a similar setup.

Vanguard

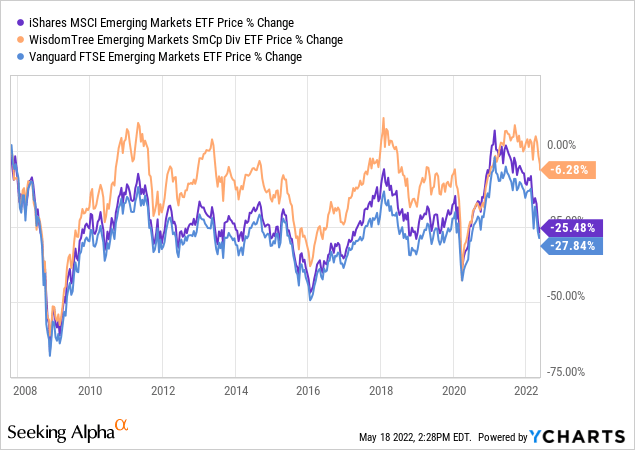

These ETFs have actually performed most in line with emerging markets, and would likely outperform during strong, large cap-driven bull markets. However, it is clear to see that the non-small cap-focused ETFs have recently experienced stronger drawdowns as global risks have increased. The bull market of the past decade has been largely driven by large-cap/tech stocks’ performance, and if capital flees emerging markets it is likely that some of these larger names would get hit the hardest. As seen below, the WisdomTree ETF was actually able to outperform both of these ETFs following 2008.

I will cover the industry/country weightings for this ETF later in the article, but this ETF is clearly a night and day difference, with completely different top 5 holdings and lower weightings for each of these companies. The end result is a more diversified emerging market bet, rather than a bet on popular large-cap emerging market stocks. Off the radar, small-cap stocks may be a safer bet in this environment in terms of long-term performance, although all emerging market equities would be vulnerable to pullbacks due to retail behavior. However, small-cap portfolios are still likely to outperform on a long-term basis, as they did last decade.

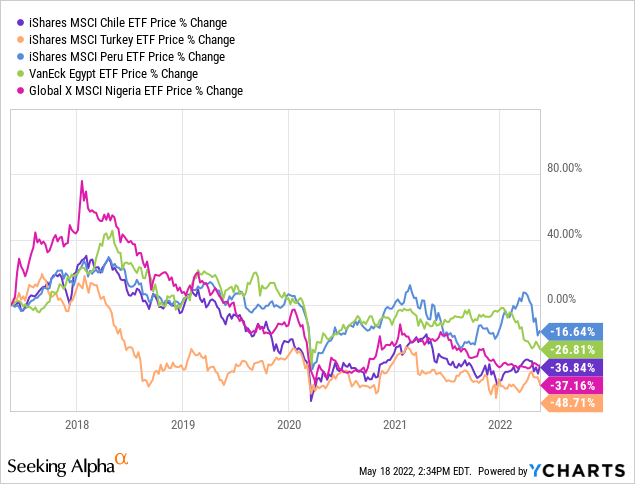

Emerging Market Sentiment

Emerging market sentiment is currently not at its best at the moment, even though the worst of COVID seems to be over now. Markets in Latin America, such as Chile (2019-2020 Chile protests and new constitution) and Peru, have been hit with massive political risks and relatively sluggish economic growth. Turkey and Argentina have faced massive inflation and currency devaluations, and other countries like Egypt, which is heavily reliant on agriculture imports from Russia and Ukraine, remain vulnerable as well. Inflation in emerging markets hit a record high not seen since 2008, and there are no recovery signals in sight. As seen below, some of these vulnerable markets mentioned have experienced massive drawdowns, and it is tempting to start bottom fishing.

Having said all of this, emerging market equities only trade at a 26% discount to MSCI ACWI on a P/E basis.

MSCI

This seems like an acceptable discount to hold or to accumulate if you are in it for the long run, but this is definitely not a screaming buy, especially since new macro and political risks are emerging this year and will not be resolved in the short term. The growth outlook for emerging markets does not look very appealing, and these numbers could potentially become worse during future reviews this year and next year.

|

Country |

Growth Projection |

|

India |

8.2% |

|

Saudi Arabia |

7.6% |

|

China |

4.4% |

|

Nigeria |

3.4% |

|

South Korea |

2.5% |

|

Mexico |

2.0% |

|

South Africa |

1.9% |

|

Brazil |

0.8% |

Source: CNBC/IMF

I’m taking these projections with a grain of salt, as a lot will definitely change this year, but it is clear to see that these growth trends are not desirable at all for emerging markets. Global growth is only projected at 3.6% this year, so it is ideal for an emerging market to be growing at 5-8% to justify the political/economic risk associated with some of these markets. Inflation is soaring in a lot of these markets, which has resulted in a plethora of rate hikes in many of these markets. Banking stocks are under pressure to implement more prudent lending due to higher interest rates and deteriorating economic conditions, and consumer/construction companies have to pass on rising costs to customers or take margin hits. Emerging markets are also burning through foreign exchange reserves rapidly. Nearly all of the countries in the above chart, with the exception of Saudi Arabia, have been depleting foreign exchange reserves this year. Sri Lanka and Turkey may likely be one of many countries where civil unrest follows due to poor economic conditions (namely food/energy inflation). The high levels of foreign emerging market debt are particularly concerning in an environment like this, as sovereign defaults could become an issue moving forward. The rise of Eurobonds in Africa, which were popular because of their high yield, is another major risk for countries with poor-performing currencies and lackluster growth that is below the 2018-2019 levels.

Country/Index/Company Breakdown

The ETF structure is pretty appealing and can provide US investors with access to stocks that are hard to access. I am looking at having this ETF account for 10-20% of my emerging market exposure. I plan on later adding some of my own country-specific bets (Pakistan/Korea/Egypt/Vietnam/Columbia/etc), sector bets (energy and banking), and management bets, as I monitor political/economic developments and stock price movements. There are plenty of large-cap stocks with solid management (Banco Bradesco is one of my favorites) that will likely be able to find new sources of growth and weather the economic turmoil ahead.

Luckily, the WisdomTree ETF is not taking heavy bets on smaller/troubled emerging markets, which is best at the moment. The ETF does have around 3% of its assets invested in Turkey and less than 1% in Chile. This ETF is taking a lot of interesting overweight bets relative to MSCI Emerging Markets and is also underweight China and South Korea.

|

Country |

Weighting |

MSCI EM Benchmark |

|

Taiwan |

26.7% |

Overweight |

|

South Korea |

11.71% |

Underweight |

|

China |

11.56% |

Underweight |

|

South Africa |

9.12% |

Overweight |

|

India |

7.56% |

Underweight |

|

Thailand |

7.51% |

Overweight |

|

Brazil |

7.32% |

Overweight |

Source: WisdomTree/MSCI

Taiwan: A near 27% Taiwan weighting, relative to MSCI’s 15.5%, is concerning, even if you are in the school of thought that it is very unlikely that China invades Taiwan. However, all emerging markets will likely experience a sharp drawdown, and selective shopping by country will not be that useful in the short term during any type of black swan event. Taiwan’s economy is still relatively healthy, and its GDP growth is projected to reach 4.42% this year, driven by strong tech exports.

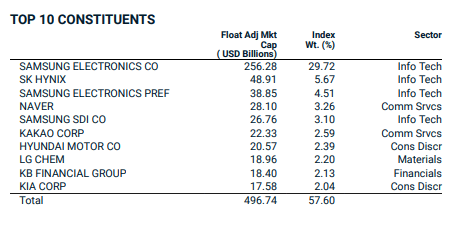

South Korea: One benefit of this ETF is that it directly invests in Korean equities, which are extremely difficult for US investors to access. South Korea, despite its classification, is not really anything like an emerging market, and equities are trading at very compelling valuations. South Korean equities currently trade at a forward P/E of 9.0 and P/B of 1.1. This is not to mention that the top 10 stocks are in solid industries, and include consumer, information technology, financials, and materials. So the lower valuation is not driven by the fact that it is heavily invested in themes like energy and utilities, instead of consumer stocks.

MSCI

Brazil: Brazil will do well if there is a long-term commodities bull market due to its export structure, so I think being overweight in Brazil is wise. Even though 7.3% is very high, I think that Brazil has the potential to be a more favored emerging market in the future and that this % is still a bit too low. I may increase my exposure to Brazil by adding banking, telecom, and consumer stocks.

Thailand: A 7.3% bet on Thailand is relatively uncommon. For example, Vanguard’s Emerging Market ETF only invests around 3% of its assets in Thailand. Thailand’s economy is poised to make a comeback this year as the economy reopens to foreign tourists. The ADB projects that Thailand’s GDP will grow by 3% this year.

Overall, the country breakdown seems reasonable, but I would prefer much less exposure to Taiwan and South Africa. However, this ETF does not have exposure to some of the following themes, which may be a large part of the next bull run that emerging market equities experience:

-

Commodities Boom: Certain Latin American markets, such as Colombia and Chile, could benefit from an increase in the price of copper and oil. This also holds true for countries in MENA. I am monitoring several ETFs that provide exposure to these countries.

-

Southeast Asian Equities: Other markets such as Vietnam in particular, and potentially even Malaysia could perform well this decade.

-

Other Smaller Emerging Markets: I also like following smaller emerging markets with frontier characteristics (some of which eventually are downgraded to frontier). Pakistan and Egypt are two unloved markets that are on my radar, and both are being ignored by a lot of emerging market investors.

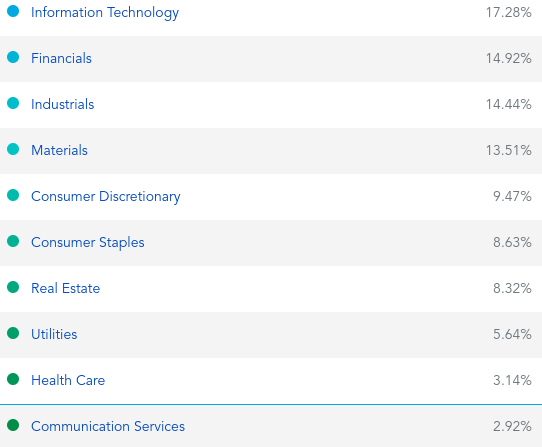

Industries

Below are the top 10 industries that the ETF invests in. The ETF only has 1.55% of its assets invested in energy, which is extremely low.

Wisdomtree

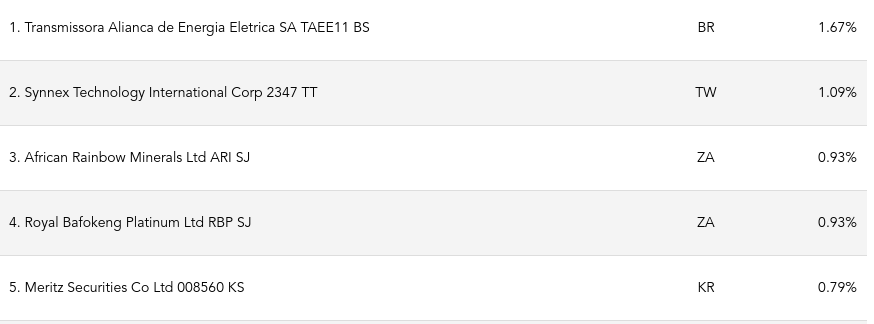

The top 10 holdings of the fund only represent around 9% of the ETF, and some of the top 5 holdings represent less than 1% of the total NAV. This eliminates the risk associated with one larger emerging market name, such as Alibaba or Tencent, selling off on news due to company/geopolitical specific risk. This ETF also invests directly on the exchanges of markets that are extremely hard for US investors to access, which makes this ETF ideal since it would be harder for a smaller retail investor to replicate the performance by individually investing in these stocks. The expense ratio of 0.58% is not terribly high considering the uniqueness of this product, although Vanguard funds certainly have lower fees.

Top 5 Holdings

Wisdomtree quarterly report

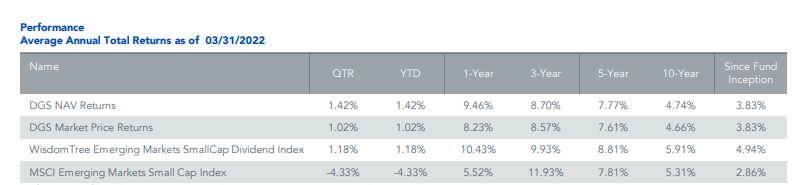

The performance of this ETF during the past decade has not been that stellar, but it has been able to consistently outperform the MSCI Emerging Markets Small Cap Index.

WisdomTree

Blending The ETF With Other Themes

It’s relatively easy to balance your exposure to investing more in energy and consumer staples by taking a look at global ADRs. Moreover, ADRs in countries that can benefit from commodities (Colombia, Saudi Arabia, etc.) can also be a solid addition to an emerging market portfolio.

I think that this ETF is an appropriate vehicle to help investors gain exposure to emerging markets. The extra fee (0.58%) relative to other ETFs is acceptable, given that the ETF constituents are unique enough to offer differentiated exposure to emerging markets. I am personally planning to rely on this ETF for 10-20% of my total emerging market exposure and to add other ETFs/ADRs, as seen below.

|

Description |

Countries/Companies |

% of total |

|

DGS |

Multiple |

10 |

|

Large-cap EM stocks |

Multiple |

10 |

|

South Korea ADRs |

Sk Telecom/Woori Bank/etc. |

15 |

|

Southeast Asia |

Vietnam/Thailand/Malaysia |

20 |

|

South Asia |

India/Pakistan |

10 |

|

MENA |

Kuwait/Saudi/Egypt/Oman/Qatar |

20 |

|

Brazil |

Various ADRs |

15 |

Conclusion

This ETF is certainly a superior and safer vehicle to access emerging market growth, as demonstrated by its ability to consistently outperform its benchmark. Emerging market sentiment is very poor right now, so it seems best to slowly accumulate during 2022-2023. I plan to start slowly with this ETF and start making more concentrated bets on other countries/companies in the coming years.

[ad_2]

Source links Google News